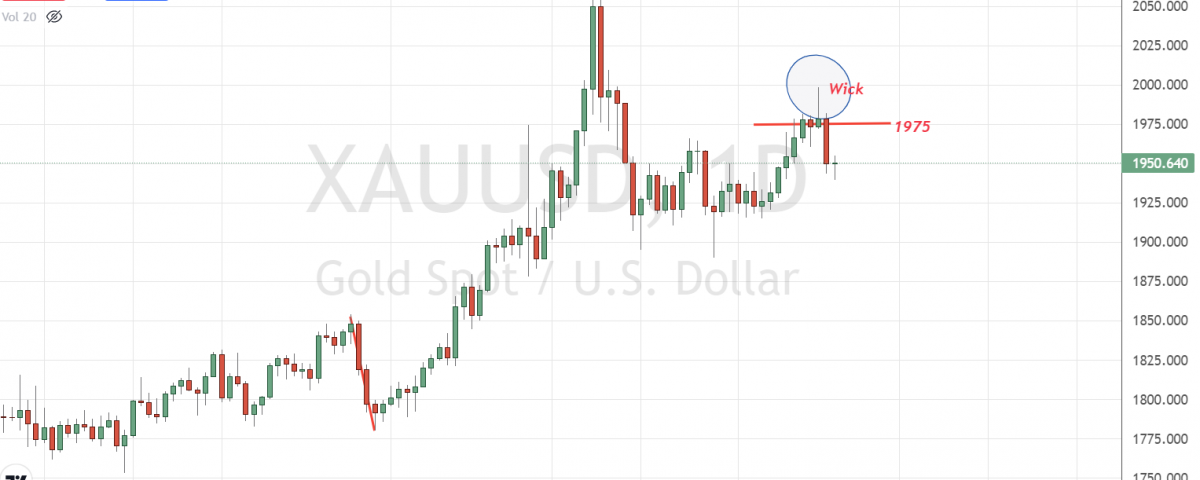

Gold Resists at $1,975

The markets have been roiled by a mix of risk-off themes in the aftermath of China’s lockdowns and Russia-Ukraine conflicts. The equities are in red and Wall Street had a “sell-off”. According to new data, consumer confidence in the United States fell in April. Furthermore, on April 19, the Atlanta Fed’s nowcast forecast for first-quarter GDP growth was reduced from 1.3% to 0.4%. The Bureau of Economic Analysis will release its preliminary reading of Q1 GDP on Wednesday, followed by the final estimate on Thursday.

Concerns over China’s coronavirus epidemic keep markets on edge. Lockdowns in Shanghai, as well as rumors that the virus has moved to several Beijing districts, threaten to trigger another round of inflation caused by supply-side disruptions. Meanwhile, the People’s Bank of China (PBoC) continues to inject stimulus into the Chinese economy to contain an economic slowdown. Meanwhile, the Russian-Ukrainian squabbles have recently taken a back seat. However, comments by Russian Foreign Minister Lavrov that the possibilities of nuclear war are “severe” summed up the already gloomy market atmosphere. Rising concerns about the economic effect of China’s COVID-19 lockdowns would likely support the dollar’s safe-haven appeal, while aggressive US interest rate rise expectations will keep US Treasury rates up. In addition to the dollar and yield dynamics, attention may be drawn to a pair of top-tier US economic announcements in the form of Durable Goods Orders and CB Consumer Confidence data. This week is a blackout period for Fed speakers; thus, incoming US macro data and rate rise expectations will continue to influence dollar values and, as a result, Gold Price.

Technical Outlook

Gold prices were expected to rise until $1,975 from the base of $1,920. The highlighted resistance of $1,975 was carefully monitored to forecast the next level, which is the yearly pivot of $2,075. Prices rise in line with expectations, surpassing the $1,975 resistance. However, there was no clear breakout from $1,975 because there was no clear daily close above this region, as shown in the chart below. The daily candle on April 18th produced a clear and shape wick, indicating that gold prices would fall further below $1,920. A break below $1,920 was another bearish signal to target lower levels. Huge volatility in precious metals increases the risk for short-term traders.

Please login to read full article!

Please subscribe to the link below to receive free updates.