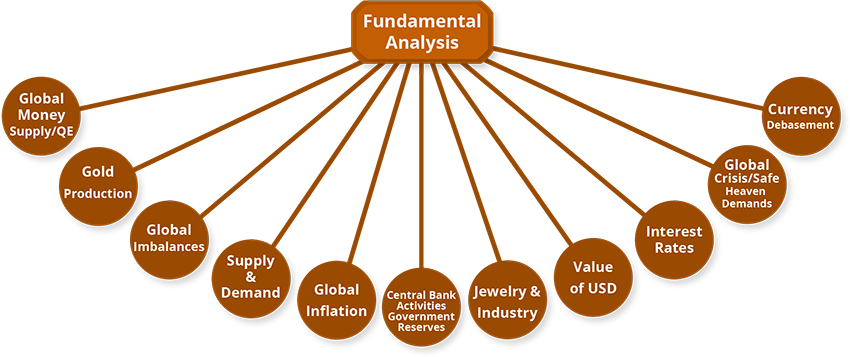

Fundamental Analysis

Fundamental analysis is a method of evaluating an investment vehicle in an attempt to measure its intrinsic value, by examining related economic, financial and other qualitative and quantitative factors. Gold and Silver market is affected by many fundamental factors, described below.

Global Money Supply /Quantitative Easing

Money supply is one of the important factor to consider for fundamental analysis of gold markets. Money supply is the entire stock of currency and other liquid instruments circulating in a country’s economy as of a particular time. Money supply includes safe assets, such as cash, coins, and balances held in checking and savings accounts that businesses and individuals can use to make payments or hold as short-term investments.

An increase in the supply of money typically lowers interest rates, which in turns generates more investment and puts more money in the hands of consumers, thereby stimulating spending. Businesses respond by ordering more raw materials and increasing production. The increased business activity raises the demand for labor. The opposite can occur if the money supply falls or when its growth rate decline.(Gold Fundamental)

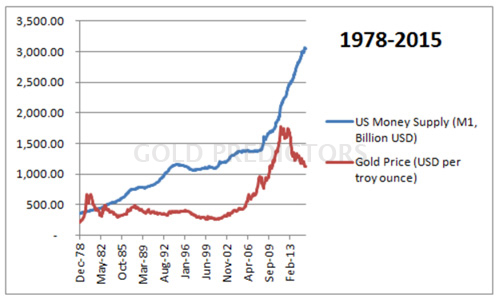

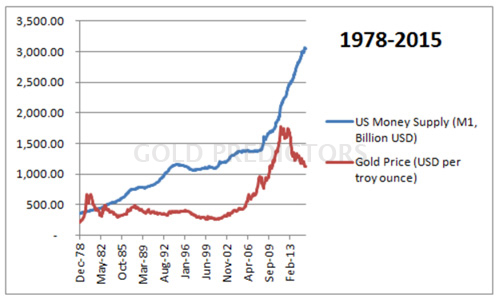

The figure shows US money supply M1 and relation to gold prices from 1978 to 2015. As shown in the graph, the money supply is correlated, with gold price except the year 2011 when gold prices crashed while the Fed has pumped money into the economy at one of the fastest pace ever observed in history.(Gold Fundamental)

Quantitative easing (QE), refers to a central bank strategy of buying securities to increase the money supply. By flooding financial institutions with money, a central bank, like the Federal Reserve, hopes to encourage banks to loan more money and increase the amount of money. A larger money supply pushes interest rates down, which could help investors to buy gold because of the lower opportunity cost. When overdone, this tactic can trigger inflation, another signal of a rising price of gold.

Global Imbalances

For fundamental analysis, one crucial factor in the outlook for the gold price is the number of significant trade imbalances in the global economy. The US has massive trade deficits with China, the Eurozone, and Japan. Germany has one of the largest current account surpluses (GDP-adjusted) in the world, and significant trade surpluses with the southern half of the Eurozone. These imbalances suggest that many currencies are severely misaligned, a major factor behind the ‘secular stagnation’ of many economies. The situation cannot continue indefinitely. Eventually, there must be a correction. Protectionism is on the rise, but at some stage, significant exchange rate realignments will be required, and these will have a positive impact on the price of gold.(Gold Fundamental)

Central Bank Activities/Government Reserves

Bank failures, irregular economic policies and Gold Buying by central banks in emerging markets make gold seem like a haven investment. Once again, people flock to gold when the current paper money system experiences uncertainty. Some investors prefer the physical and tangible security of holding gold when central banks are going through deficits as a protection of wealth. In turn, an increased demand drives up the value of gold even more.

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. Last year they collectively added 483 tons, the second largest annual total since the end of the gold standard, with Russia and China accounting for most of the activity. The second half of 2015 saw the most robust purchasing on record, according to the World Gold Council (WGC). The Bank of Canada has liquidated close to all of its gold, mainly in coin sales, while Venezuela is in the process of doing the same to pay off its debts, but most of the world’s central banks right now are accumulating, holding and repatriating the precious metal.

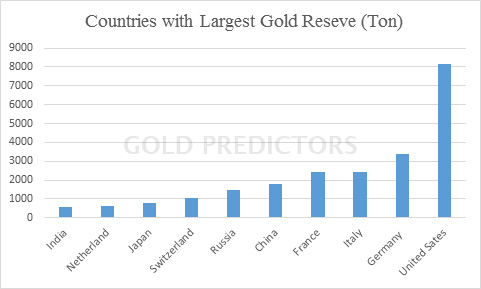

Central banks hold both gold and paper currency in reserve. In fact, the United States and several European countries hold the bulk of their reserves in gold, and they have been buying more gold for these reserves recently. Other countries that hold gold include France, Germany, and Italy. When these central banks start to buy gold in greater quantities than they sell, it drives gold prices up because the supply of currency increases and free gold becomes more scarce. The graph shows the world’s top 10 countries with largest gold reserves. These all factors are important for fundamental analysis of gold market.

Interest Rates

Gold does not pay interest like treasury bonds or savings accounts, but current gold prices often reflect increases and declines in interest rates. As interest rates rise, gold prices may soften as people sell gold to free up funds for other investment opportunities. As interest rates decrease, the gold price may increase again because there is a lower opportunity cost to holding gold when compared to other investments. Low-interest rates equate with a greater attraction to gold.

However, rising interest rates are not negative for gold while looking at longer term basis. Historical Record shows that rising interest rates are positive for gold. The most recent example we have of higher interest rates is when the Fed increased interest rates in the 2003 to 2006 period. In June 2003, the Fed funds rate was at 1%, and by June 2006, it had been increased, to over 5.5%. Even if the Fed increases rates, interest rates remain close to zero not just in the U.S but most major economies. Thus, there is no opportunity cost to owning the non-yielding gold. Indeed, there remains significant counterparty and systemic risk in keeping one’s savings in a bank and government bonds look like a bubble that is being supported, by money printing and debt monetization. We believe the fact that Higher interest rates are not negative for gold on a longer term basis and ply an important role for fundamental analysis of gold market.

Currency Debasement

One of the most popular reasons to own gold is as a hedge against inflation. When a paper currency loses value, gold will retain its purchasing power, making it a safe place to preserve one’s wealth. Gold is the inverse of US dollar according to historical data. A stronger dollar makes dollar-backed commodities like gold more expensive to buy in other currencies, which weakens demand. Times of real market panic have altered the dollar/gold inverse relationship as both are purchased as safe havens, an alternative to stocks and “riskier” currencies like the euro. During currency debasement, investors’ lack faith in paper money which shine a light on gold’s appeal as a haven asset. To consider the gold’s appeal as a safe heaven is most important factor for fundamental analysis of gold

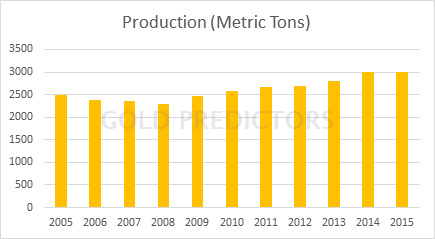

Gold Production

On Average, about 2,500 metric tons of gold get produced each year, compared to an estimated 165,000 metric tons of the entire world’s gold supply. Global mine production of gold steadily rose after the 2008 economic crisis. The production of gold was increased, from 2280 metric tons to 3000 metric tons, the U.S. production value of gold has also increased along with the gold production. China is currently leading global gold mining production at 490 metric tons in 2015, while Australia is second, producing about 300 metric tons the same year. There are different processes of mining of Gold which include placer mining, panning, sluicing, and dredging. Panning is a manual technique that uses a shallow pan filled with sand and gravel, that may also contain gold, to sort through the material.

Even though new production might seem modest compared to the total supply, production costs can influence the price of all gold in the world. When production costs rise, miners sell gold for more money to preserve their profits, and those higher costs also get reflected when it comes time to sell coins if they were mined, from gold mined yesterday or thousands of years ago.

Supply and Demand

The supply and demand factor is pivotal in determining the price of gold and has big effect in the fundamental analysis of gold market. We argue there isn’t enough gold being produced to satisfy the rising demand.

According to The World Gold Council, the total annual supply of gold has averaged around 4,000t over the last ten years. While many will be aware that gold is sourced, from the earth through mining, this is not the only way in which gold is supplied, to the market. Total mine supply – which is the sum of mine production and net producer hedging – accounts for two-thirds of total supply. Recycled gold accounts for the remaining third. The sources of mine production have now become as geographically diverse as gold demand. China was the largest producer in the world in 2015, accounting for around 14 percent of total output. Asia as a whole produce 23 percent of all newly-mined gold. Central and South America provide around 17 percent of the total, with North America supplying around 16 per cent. Around 19 percent of production comes from Africa and 14 percent from the CIS region. There are times when gold producers will want to lock in a future price for their gold so that they can ensure a return appropriate to their current production costs. The gold sold into the market adds to supply in the short term. It brings metal onto the active market – and allows mining companies to sell metal ahead of their production schedules. Because gold is virtually indestructible, all the gold ever mined still exists, apart from a small amount lost. At the end of 2015, there were 186,700 tons of stocks in existence above ground. It is recoverable from most of its users and capable of being melted down, re-refined and reused. Recycled gold, therefore, plays an important part in the dynamics of the gold market. While gold mine production is relatively inelastic, the gold recycling industry provides an easily-traded supply of gold when it is needed, thereby helping to stabilize the gold price.

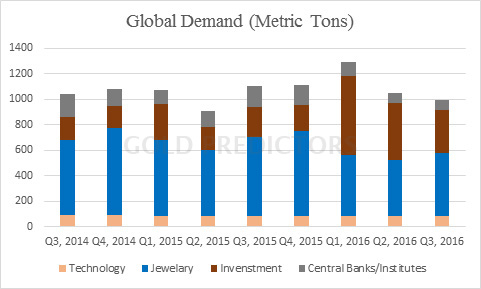

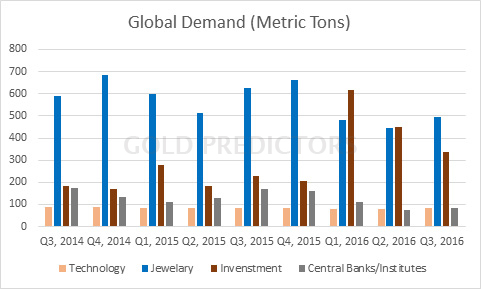

World Gold Council shows the demand for Gold in graphs which illustrates that how the desire for gold by investments is increasing.

We believe that people have been mining and coveting gold for at least 1000 years, and this precious metal is likely to remain valuable even if the price falls. The price of Gold and Silver is impacted, by production costs, money supply, Global Crisis and Inflation, Safe Heaven & Industrial Demands, and Central banks decisions, and these factors are important for fundamental analysis of gold. We can conclude that gold is a finite resource and when global economic conditions make gold more attractive, investors shift their heads towards gold investment, making the price of gold rising, but the actual value of gold remains relatively stable in the long run, and the price could just reflect temporary uncertainty.

Jewelry and Industry

Gold is not just valuable as a hedge fund and a safe-haven investment; But also in jewelry and industry. Over half of gold demand is from jewelry, and China, India, and the United States are three countries with the biggest demand. In some parts of India, gold is still regarded, as a type of currency, a display of wealth, an extraordinary gift, and a hedge against bad times. This demand drives the price of gold in India up. Gold, both the color and the precious metal, is a symbol of opulence in China, and a booming Chinese economy means that more people have money to spend on China gold which affect the gold fundamental value.

Besides jewelry, another twelve percent of gold demand is generated, from industrial applications. Manufacturers use gold in all sorts of electronic devices, from computers to GPS systems, and medical devices like heart stents. The Picture shows the global demand is carried mostly by jewelry. These must be considered as important factor for fundamental analysis

Value of US Dollar

The U.S. dollar is the world’s dominant reserve currency, making it one of the main currencies that different countries hold for international trades. When it comes to commodity prices, a high dollar is a depressive factor. There is a long-term inverse relationship between the dollar and raw material prices. That does not mean that a high dollar will always weaken gold. Multiple factors drive gold. And there are sometimes when US Dollar and Gold can move higher together. Fundamental analysis also performed by using technical analysis of US dollar.

Global Crisis & Safe Heavens Demands

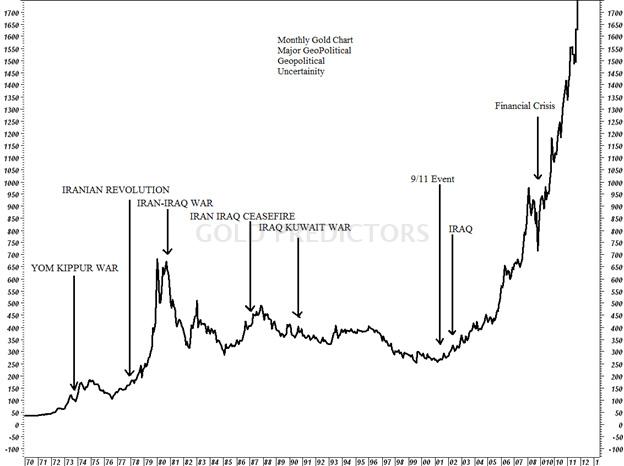

Gold Prices tends to rise during financial uncertainty or geopolitical risk because people lack confidence in governments or capital markets and flee to its relative safety during world tensions. It is often called “Crisis Commodity.”

World events often have an impact on the price of gold because gold is viewed, as a source of safety amid the economic or geopolitical tumult. When Gold become safe heaven during economic turmoil, more people start to jump into gold due to safe-haven demand and buying pressure increases, causing gold to increase volatility and shoot unpredictability.

The chart above point out major events that has happened in the past and the reaction to gold prices. Long-term investors should not make a decision based only on geopolitical events, which often strengthen gold support only in the short-term, but always look at the fundamentals.

Long term chart well illustrates the importance of the geopolitical concerns. Unless investors believe that the world is on the edge of the next Cold War or even the Third World War, or live in the region affected by the conflict, they should be guided by the fundamentals and not by the geopolitical concerns that are popular in the media at a given point in time. Crises should be regarded rather as a possible bonus or premium factors contributing to the rise in the price of gold.

Global Inflation

There are two main causes of inflation. The first cause is classified, as “cost-push inflation.” This type of inflation causes the dollar to lose value because companies have to pay more for things, so they pass those costs onto consumers, thus making products more expensive. The second type of inflation is known as “demand-pull inflation.” Demand-pull inflation happens when manufacturers reach the maximum amount of production of goods and services in spite of exploding demand.

The first effect has to do with inflation itself. When more fiat currency gets created, it lowers the value of every other dollar in circulation. Gold and other commodities that are priced internationally in US dollars automatically cost more because you’ll need more of the newly-devalued dollars to purchase the same amount of gold.

The second effect that inflation has on gold prices involves market sentiment and speculation. News are probably aware that each time the Federal Reserve mentions interest rate hikes, gold prices jump. If there is speculation that certain central banks or governments are stockpiling gold to combat inflation, gold prices will almost inevitably increase. If you’re an inflation “hawk,” then you are well aware how important inflation and inflation-related news is to gold prices.

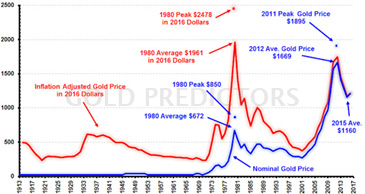

See that in the graph the nominal price of Gold from 1913-1931 is flat, but the inflation adjusted price is not flat. That is because the government fixed the price of gold. Once gold was allowed to float freely in the 1970’s, and if Gold correctly hedged inflation, the inflation-adjusted price of gold would be flat.

Gold Predictors offers technical analysis for the spot gold and spot silver markets, along with short-term and medium-term trading signals. These are delivered via email and WhatsApp. To become a premium member and receive these insights, please subscribe here.