Gold dance below $1,975

The value of precious metals is declining as a result of the current risk-on market environment. Following a drop in the US Treasuries yields from a three-year high, the US Dollar Index retraced from 101.04 to 100.28, indicating the greenback’s vulnerability. Treasury Inflation-Protected Securities (TIPS) 10-year rates reverted to negative territory after a four-basis-point increase. These factors kept gold prices from falling lower, and technical charts also supported the bullish stance.

While all of this was going on, the Federal Reserve was still speaking on Wednesday. Inflation will not return to 2% until 2023, according to Fed President Charles Evans. In addition to his comments on Tuesday, he rejected a 75 basis point increase recommended by St. Louis Fed President Bullard. Aside from that, the conflict between Russia and Ukraine continues to dominate the headlines. While NATO countries, led by the United States, continue to transfer weapons to Ukraine.

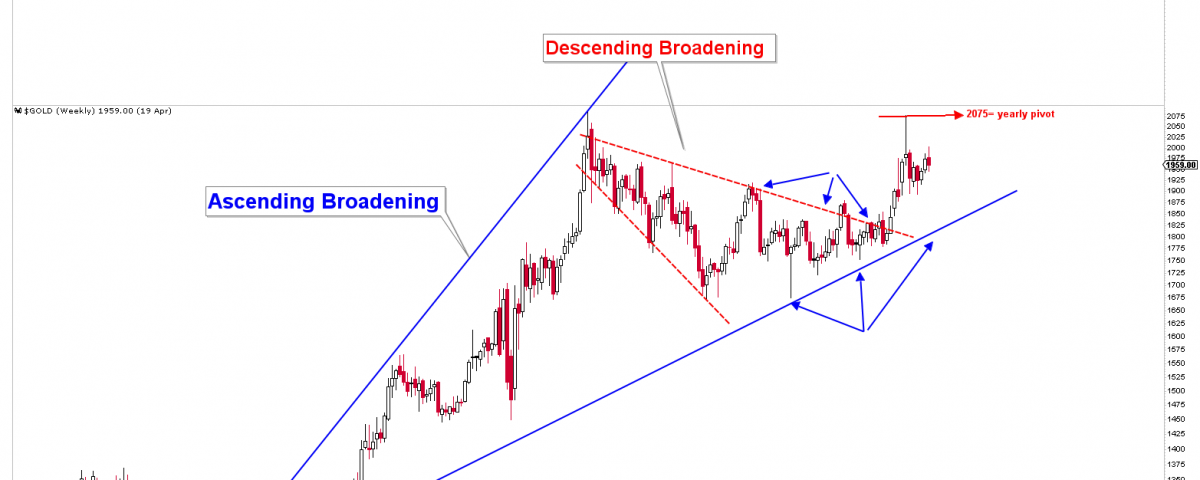

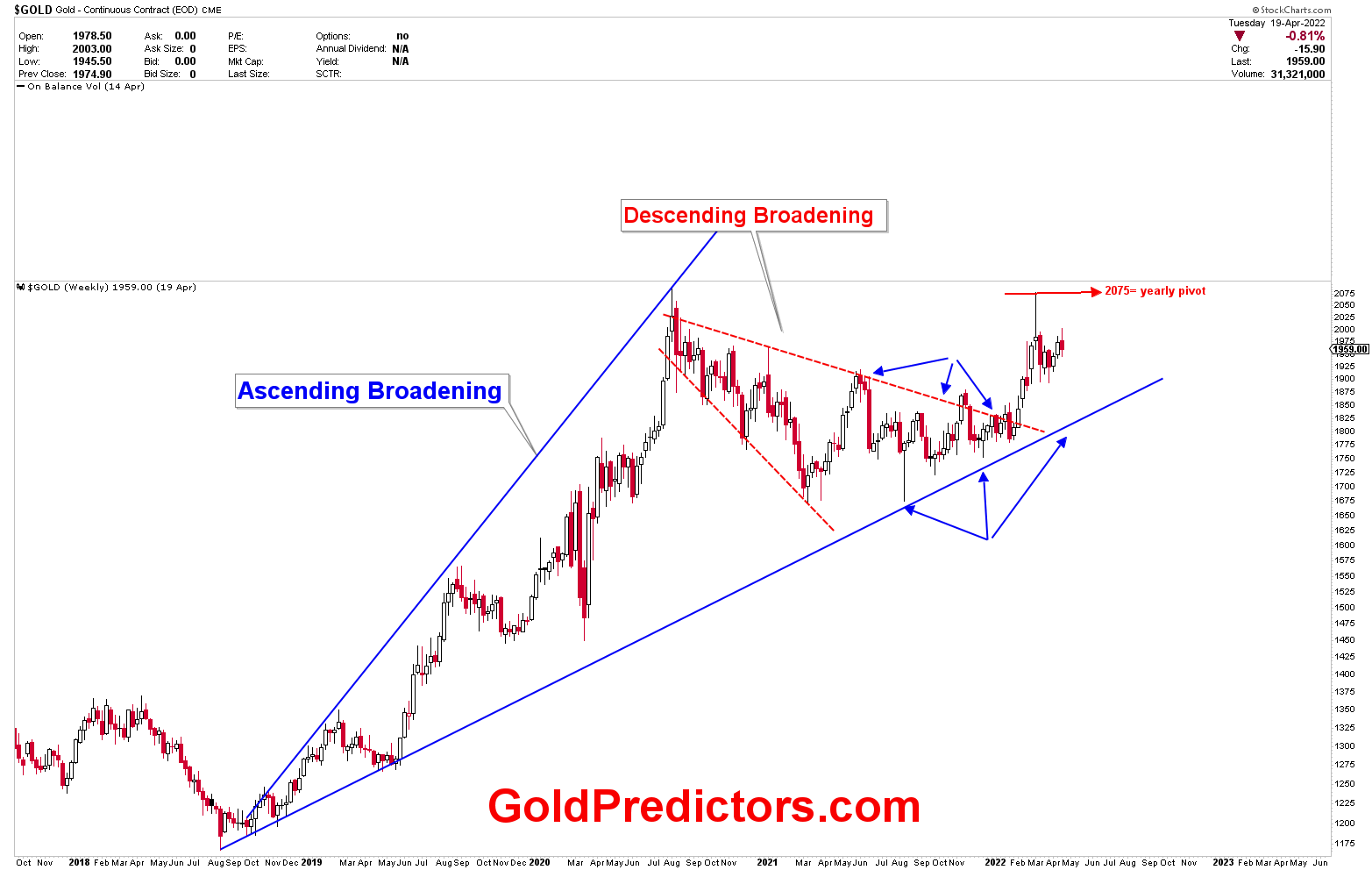

Gold prices are supported by ascending broadening patterns and are expected to rise to the $2,075 yearly pivot. Prices fell below $1,920 as a result of the strong yearly resistance, and the price has fluctuated below the $1,975 resistance. The patterns indicate the formation of descending broadening, which is usually a bullish pattern, and a breakout indicates that gold must continue to trade higher. However, to accelerate to the next level, the strong pivot of $2,075 must be broken on a monthly closing basis. As previously discussed, prices are likely to be in a wide range between $2,075 and $1,920. On the other hand, our mentioned strong level of $25.75 was a fake-out, and silver is now back below this level, causing silver to consolidate gains. The precious metals consolidations will ignite the next big rally. If gold breaks the highs, the next rally might be very strong.

Please login to read full article!

Please subscribe to the link below to receive free updates.