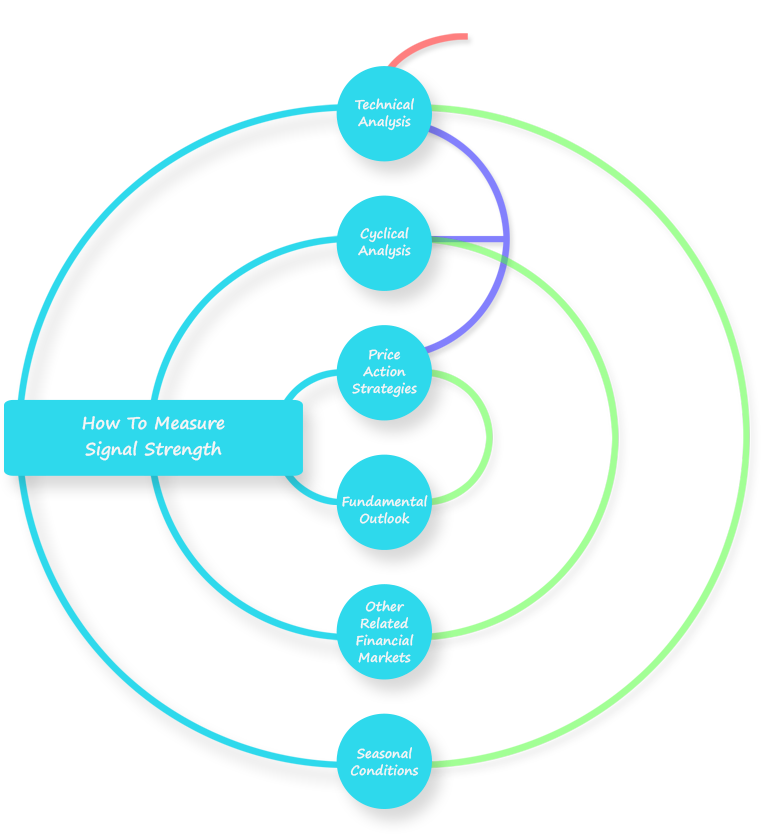

This section explains how we determine the strength of a signal for gold and silver trades. We have divided the trading signal into three categories for the convenience of our private investors, followers, and premium members. It’s possible that the signal is weak, strong, or confirmed.

Signal Strength Measurement

The technical analysis of an instrument is the first step, we perform for our trading signal strength measurement. We prefer to execute trades if technical analysis generates a signal that is justified by our risk reward scenarios. If other factors, such as price action analysis or other types of analysis, contradict technical analysis, the signal is rated as Weak. We execute the signal with lower risk than average risk once the signal strength is classified as weak. For example, if one take a 4% risk per trade, then it is recommended only a risk of 2% per trade for weak signal.

If Technical analysis, price action analysis, and cyclical analysis all produce the same signal, but the signal is not confirmed by the other correlated market research, the signal is ranked as a Strong Signal. We like a strong signal because it confirms the strength of future direction and makes us feel very comfortable trading with reasonable risks. If all of the analysis depicted in the chart, as well as other market conditions, point to the same direction as the technical and price action analysis, we classify this signal as Confirmed Signal and increase our investment portfolio’s to maximum acceptable risk.

Please be aware of the trading rules, as there are no guarantees in markets, only odds, and we must adhere to the rules that are appropriate for the investment. A confirmed signal may fail at any time, and a weak signal may provide us with a tangible payoff. It all depends on the state of the market.

Note: We stopped rating signal strength because of huge volatility due to Covid-19 crisis.

Weak Signal

Weak signals are trading signals that are only executed based on technical analysis and are not verified by other analysis. These types of signals must be executed with a low level of risk. Depending on the level of uncertainty and market volatility, the signal’s stop loss may be higher. Accepting weak signals at a rate of more than 2% risk is not recommended.

Strong Signal

Strong Signals are activated when a price action strategy generates the same signal as technical and cyclical analysis. Trades involving Strong Signals should be conducted with a moderate level of risk. Please don’t put more than 6% of your trading capital at risk in a single trade. We use short-term and medium-term cycles to determine the best time and date for top and bottom. There are times when inflections occurs between short and medium term cycles. And these inflections turn periods provide the best top or bottom in the market. We are successful in calling tops and bottoms with 80 % of the time. Trading should be avoided during times of uncertainty, such as Brexit and presidential elections because of huge volatility.

Confirmed Signal

Confirmed signals are trading alerts that are executed if there are strong signals that can be justified using the other correlated market analysis. If gold’s seasonality, fundamentals, and other correlated markets all confirm, we consider it a confirmed signal. According to the calculated statistics, these trading signals have a high win rate and a large reward. However, nothing is guaranteed in the financial markets. Traders should plan their risk criteria based on the amount of money they plan to invest.

To receive premium gold and silver trading signals via email and WhatsApp, please subscribe using the link below.