Forex Markets On Wide Ranges

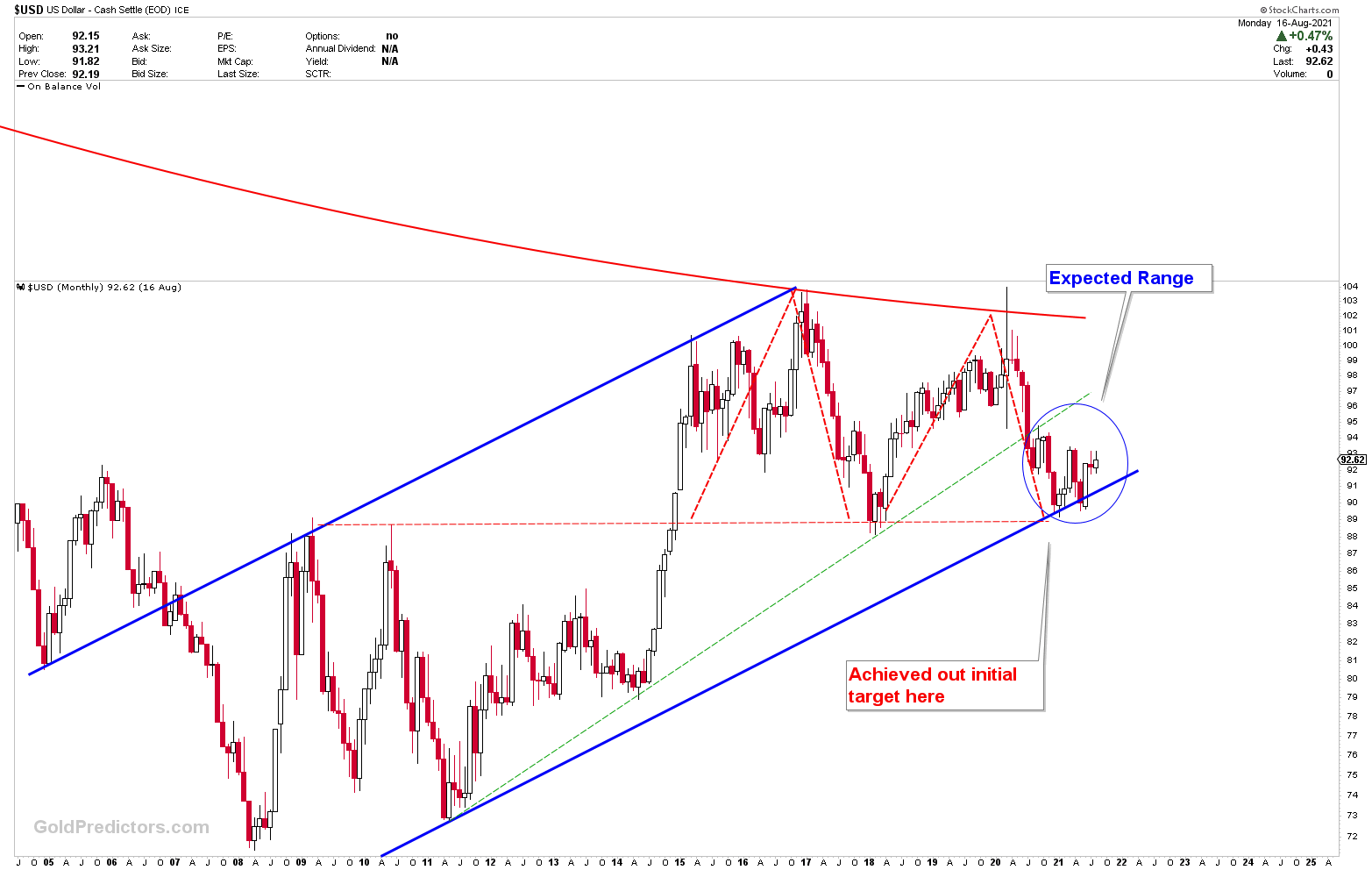

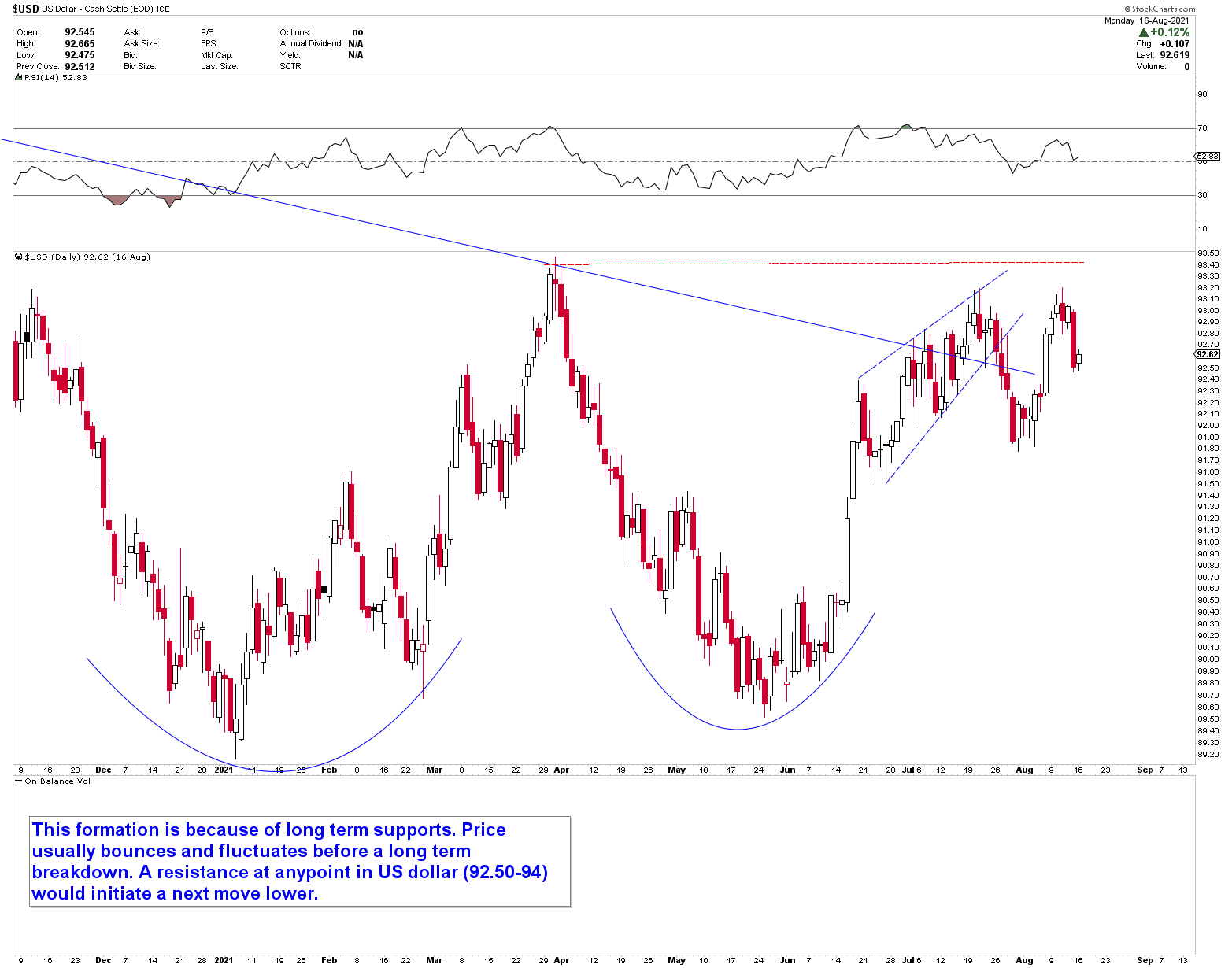

US dollar has been forming long term bearish patterns and we have never been bullish in US dollar. Every bounce from long term supports are expected to put another selling pressure. However, short term bounce to the resistance and wide sideways ranges might fake out the point of view of many investors. But these ranges are unlikely to change the bearish view of US dollar index. All other major instrument in the forex markets are trading in wide ranges.

Highlights

- US dollar is expected to remain sideways to bearish.

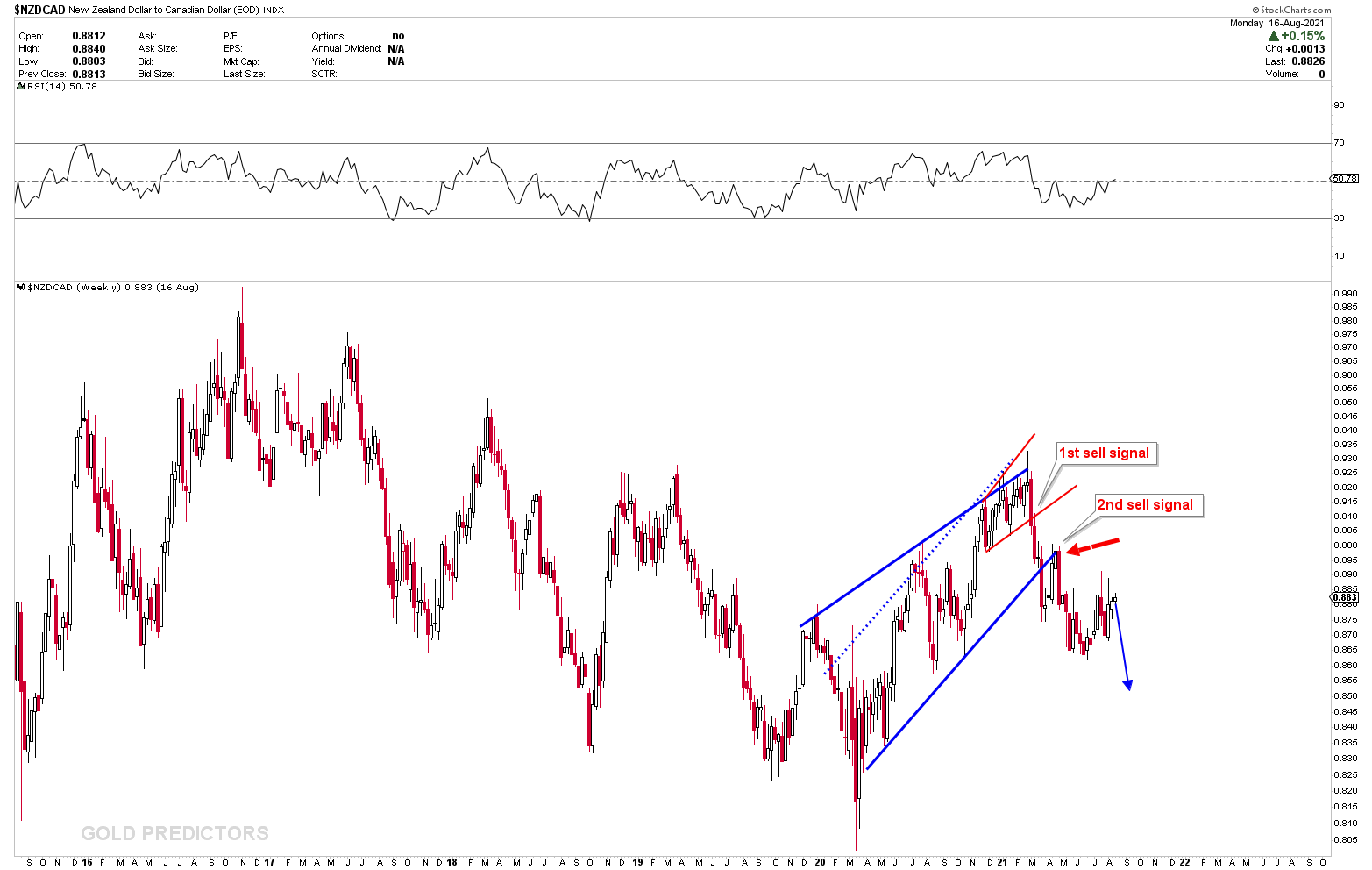

- NZD is likely to remain week with NZDCAD as the bearish pair and GBPNZD as the bullish pair. Current wide ranges in both pairs are likely to remain for short period of time. Risk in all markets are high so we are away from the forex minors and majors.

- EURUSD is likely to put support at long term support juncture. Where wide ranges in the instrument may fake out the point of view of the investors. While the instrument looks to trade higher on long term basis (strong point of decision).

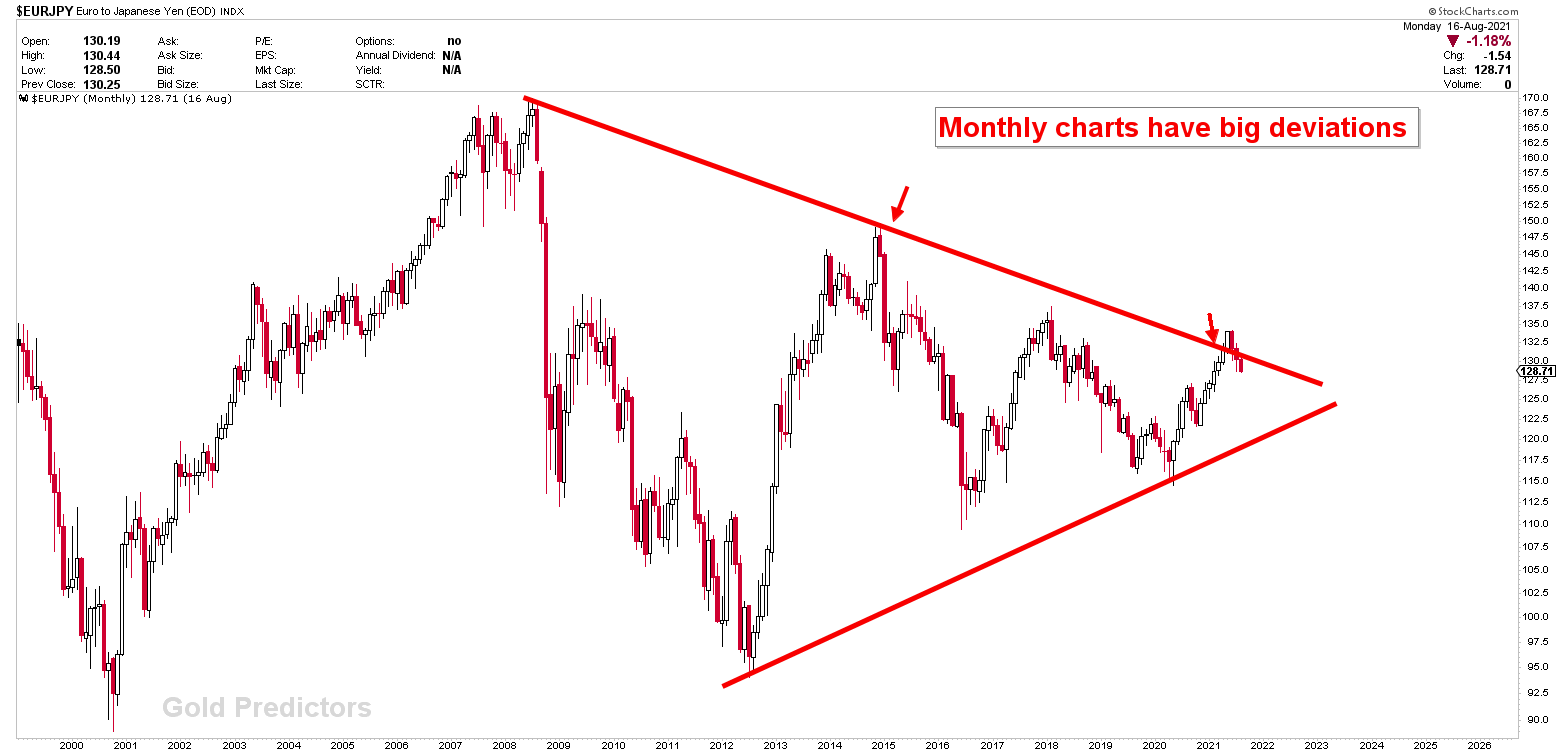

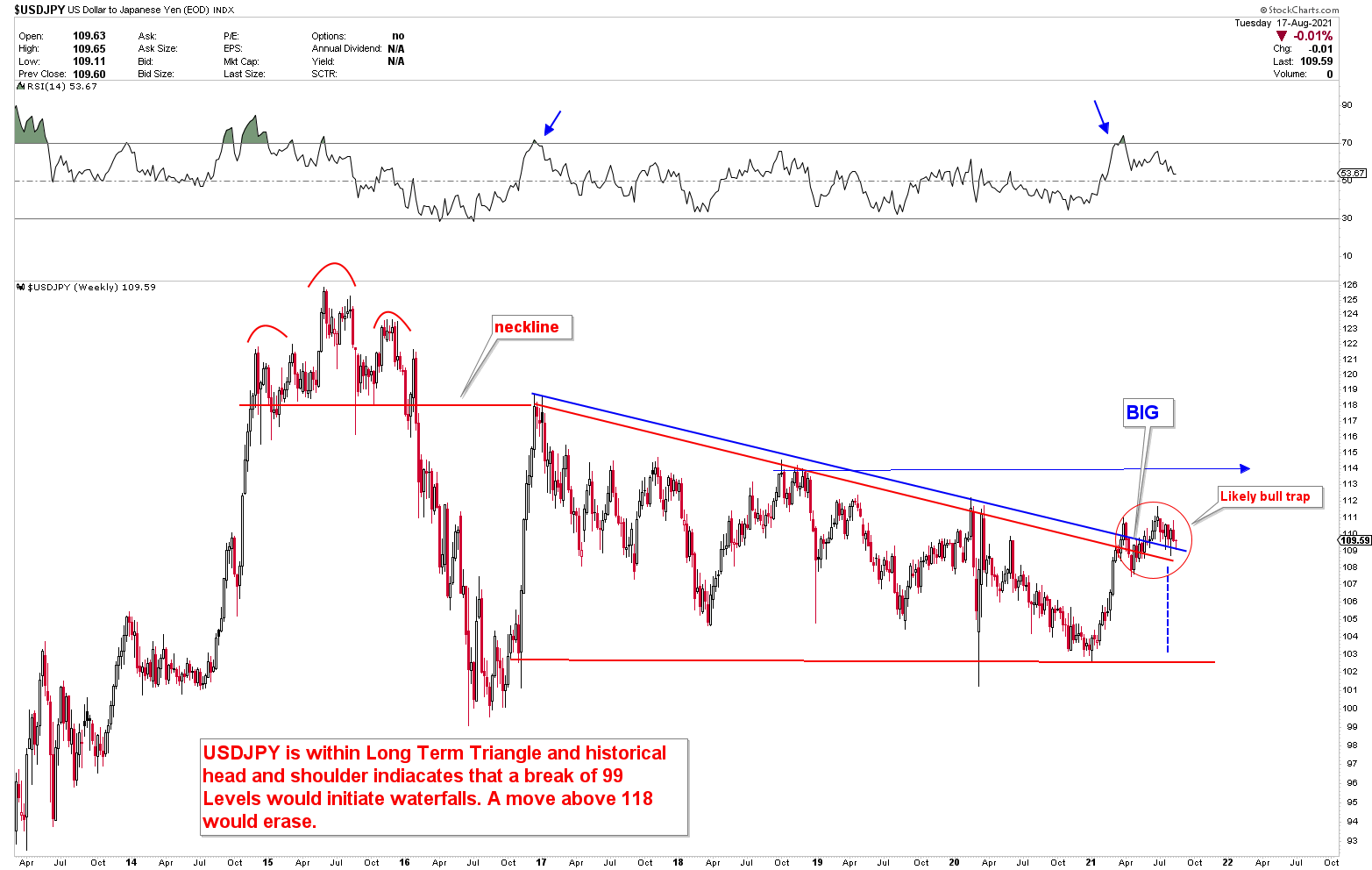

- EURJPY and USDJPY are likely to drop following the long term inflection points. The wide ranges in both pairs indicates selling only at higher levels.

Weakest Currency: USD

Strongest Currency: GBP, JPY

Best Instruments to Focus:

US dollar Index Bearish View

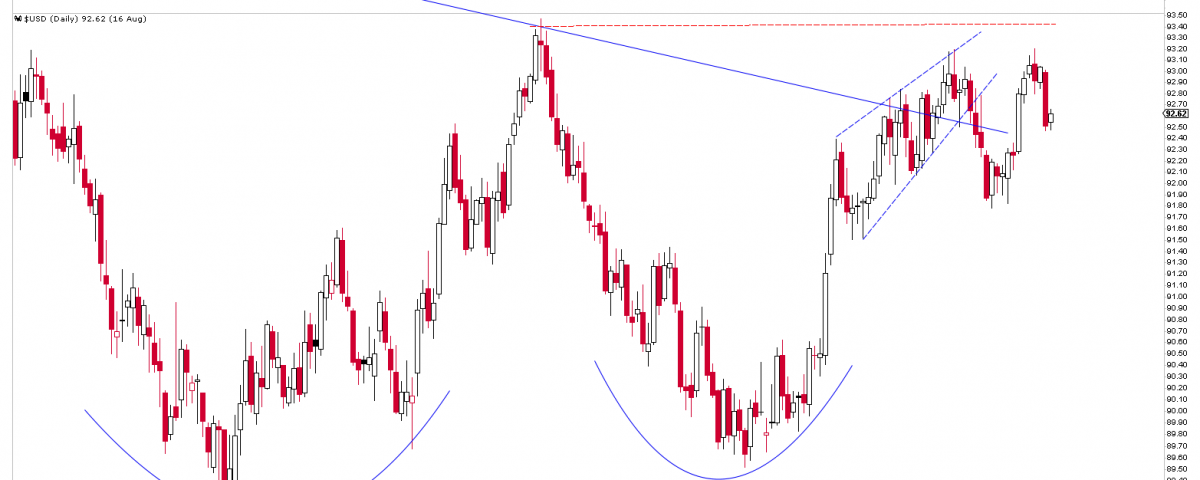

The monthly chart of UD dollar shows that prices are bouncing from the long term blue channel and the bounce has been week. The index is likely to trade sideways to bearish.

The daily chart was presented few weeks ago and the red dotted line was pointed as the strong level to capture for the index. The US dollar index is likely to trade sideways to lower below the red dotted line. However any punch above the red dotted line is likely to be captured for lower value.

Japanese Yen Remain Strongest Forex Currency

We have been following this chart for few months and we have been very bearish on the Japanese Yen pairs. EURJPY is trying to break lower following the break of support. A symmetrical triangle in EURJPY is on long term basis and it is likely that the pair will trade lower after going through some sideways ranges. Our view for EURJPY to trade lower remain same for last few months.

While USDJPY is also trading at the resistance area. While the resistance line was broken few weeks ago but we still favor lower prices in this instrument. USDJPY is trying to turn lower from here while on very short term there might be some more sideways before it drop to much lower levels.

New Zealand Markets Remains Weaker

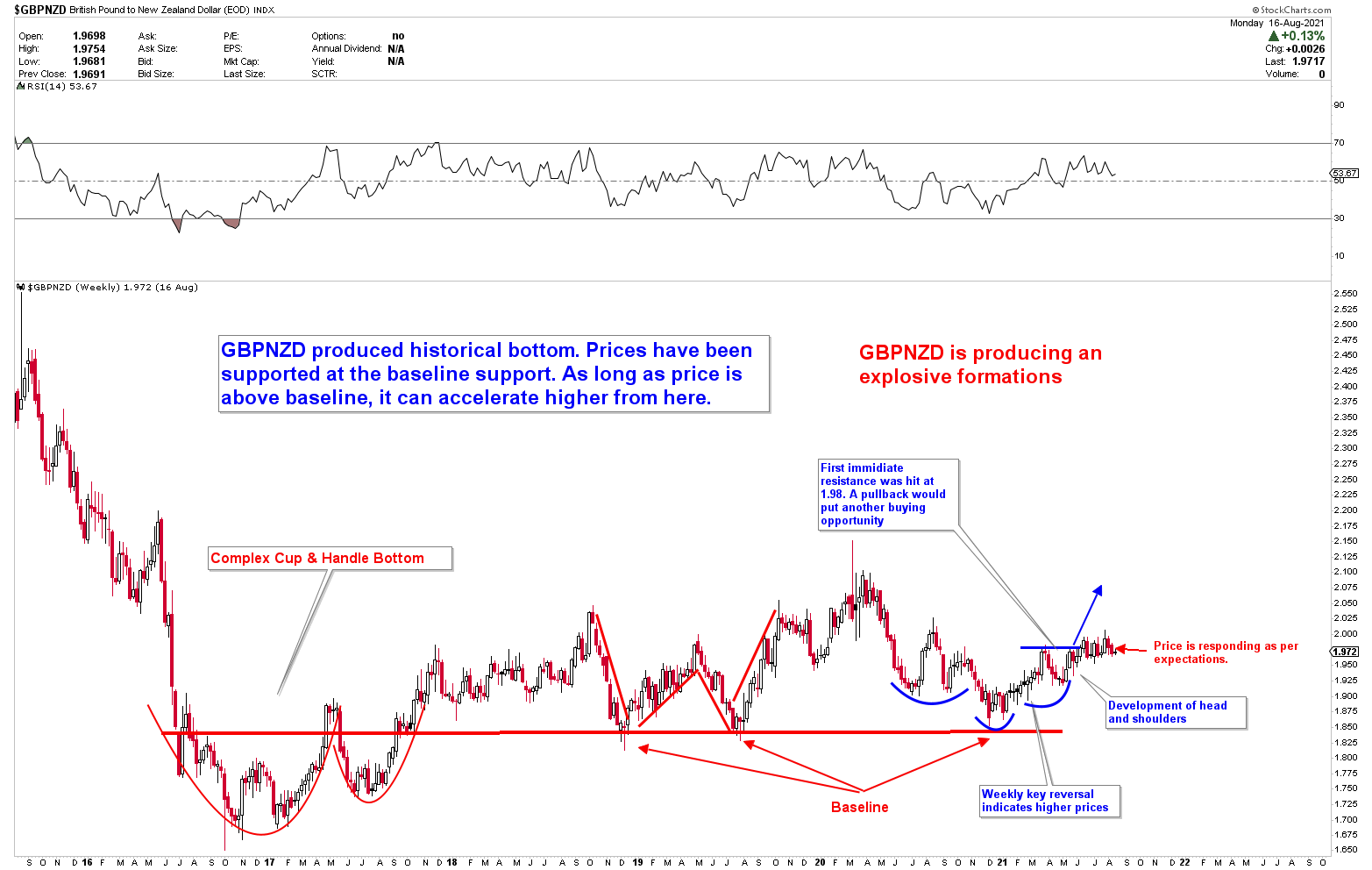

We remain bearish on the New Zealand dollar, and due to its weakness, we expect the GBPNZD to skyrocket higher. However, the market’s current sideways movement allows us to remain cautious for a pullback. However, there is a lot more room for this instrument to go once it breaks higher.

We have been tracking the GBPNZD for several months and it has gained approximately 1000 pips since our forecast, and we anticipate that the development of this instrument will have much more to gain in the future. However short term trading is extremely risky.

NZDCAD, on the other hand, has been bearish across the board. All pairs are currently in broad ranges, and if this range gives way, they are likely to move significantly. Short term trading in all instrument is risky due to heavy ranges.

Forex markets have been exhibiting wide ranges in recent weeks, raising the prospect of a larger-scale development in risk. It appears that the US dollar will trade sideways to lower, with the New Zealand dollar remaining weaker on the board. At the moment, the Japanese yen is the most powerful currency.