New Zealand Dollar To Sands

Last week, the pound and the dollar were both very strong. And these currencies show no signs of turning around. The Japanese Yen is at a crossroads, and a breakout would result in a paradigm shift in Long-term bear market. New Zealand Dollar remains the weakest currency on the board.

Highlights

- Last week’s report highlighted the weakest currencies as NZD, CHF, and EUR. Last week, these currencies traded to the sands, with the GBP staying the strongest.

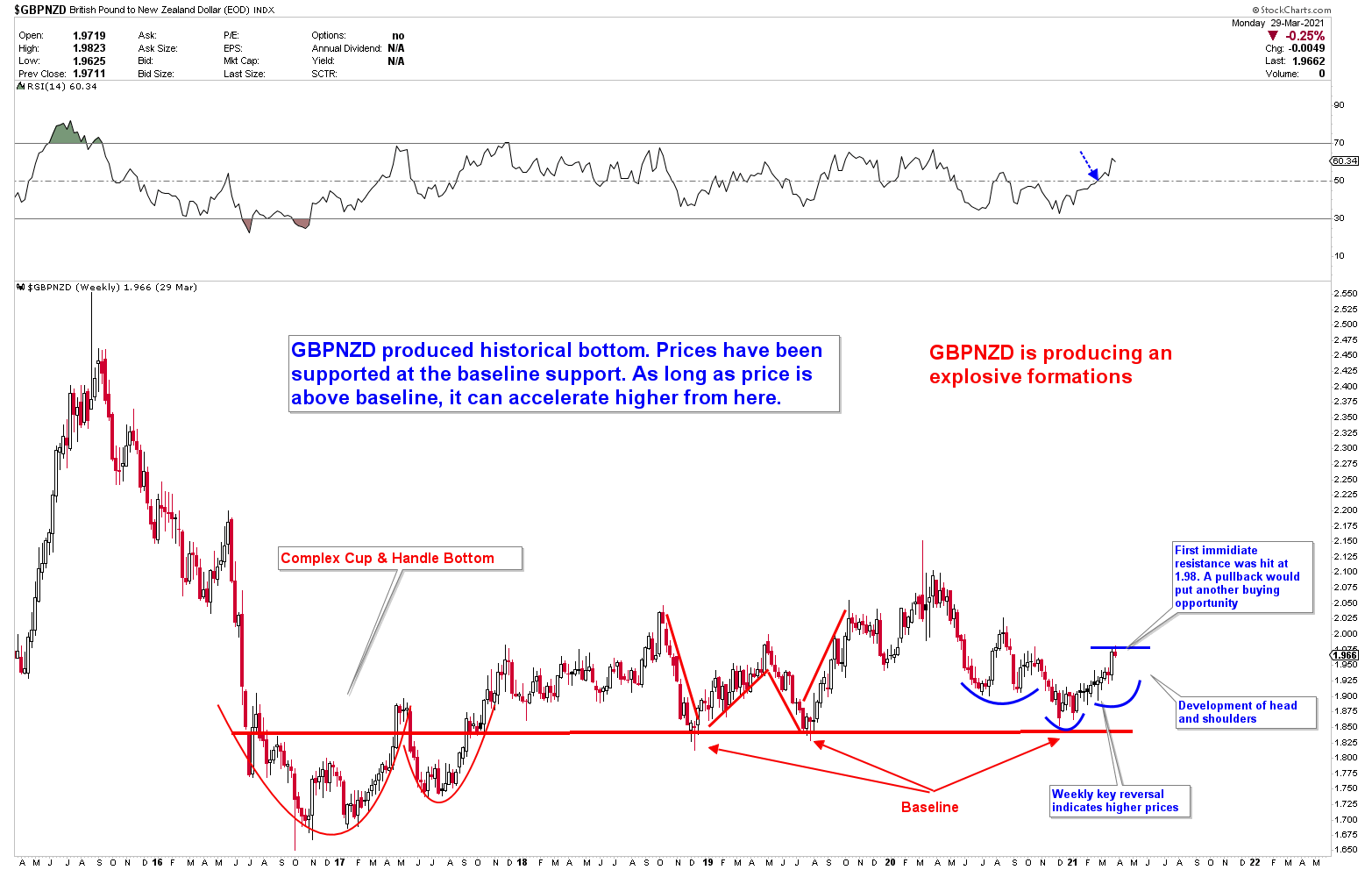

- For the past three weeks, we’ve been discussing the JPY’s inflection point. Above the inflection point from last week, we see a small breakout. However, because these are long-term patterns, there are some price deviations. Last week, we advised everyone to stay away from dollar-related pairs. While discussing the sell in USDJPY, we made it clear in the citation that this instrument must exhibit some weakness; otherwise, be cautious when trading this pair. GBPNZD, on the other hand, is surging higher in line with our expectations. The initial target was set at 1.98, and the price reversed from this level at 1.9819.

Weakest currency: EUR, CHF, NZD, JPY

Strongest Currency: GBP, CAD

Best Instruments to Focus:

LONG GBPNZD

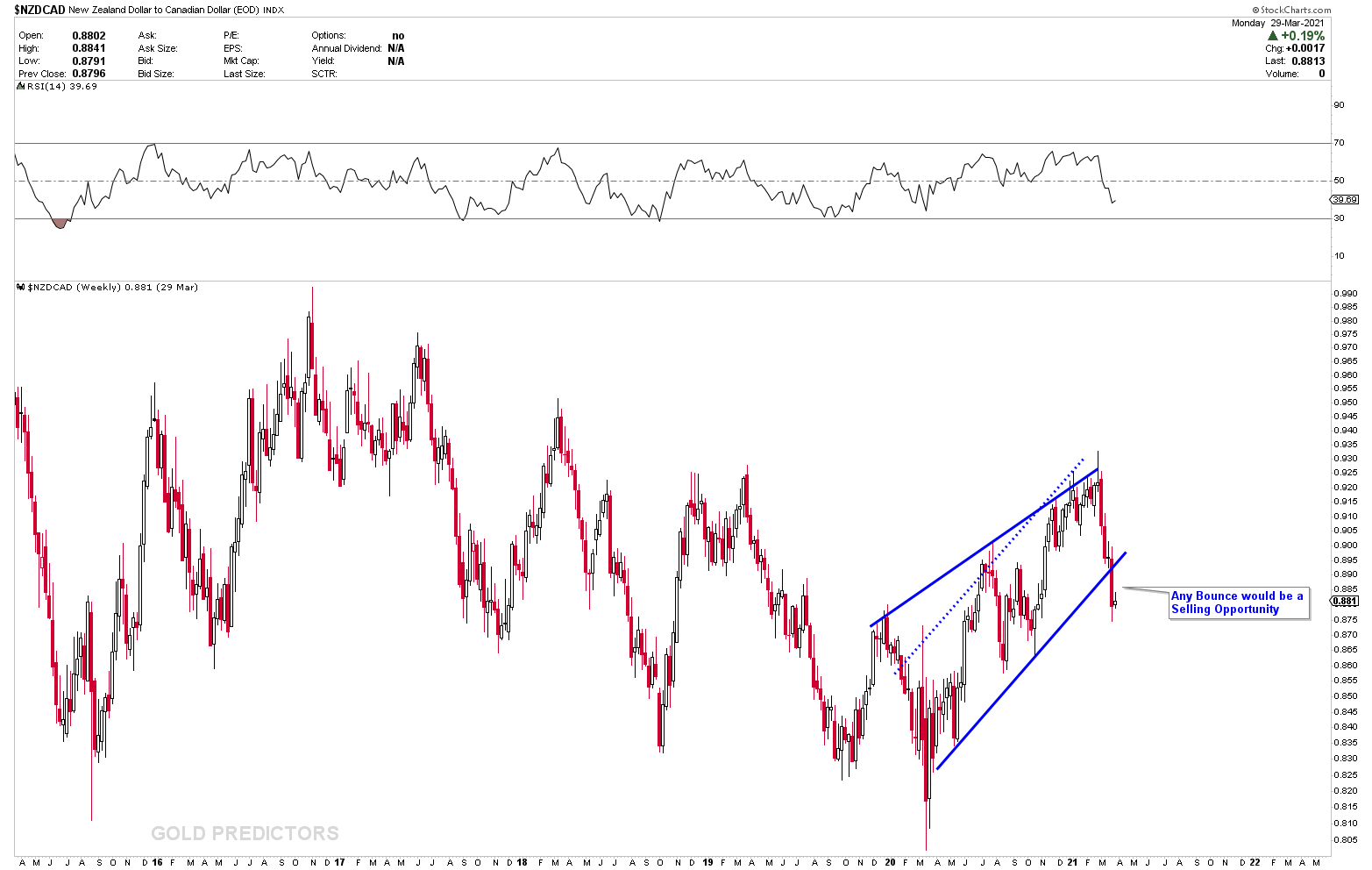

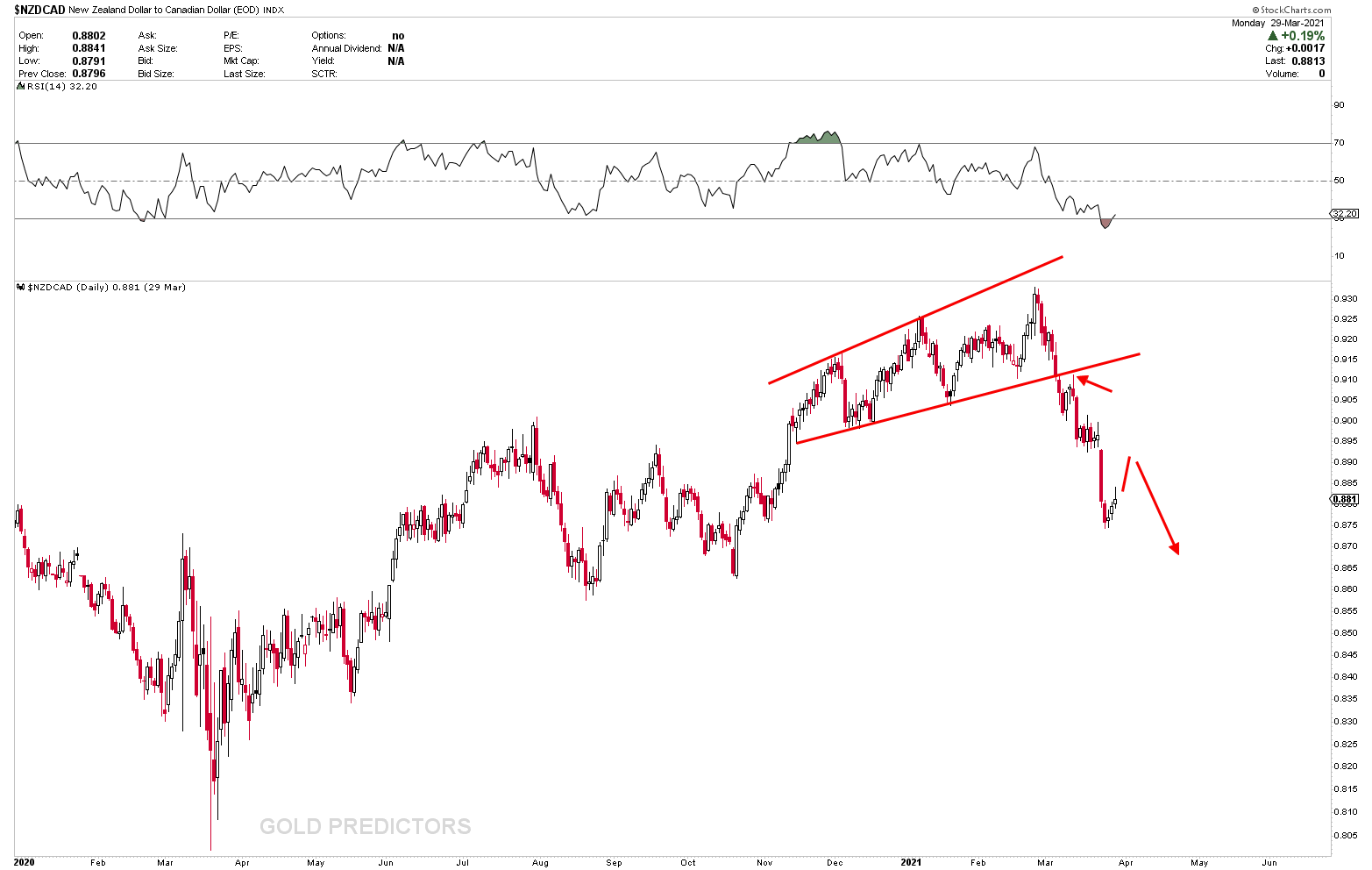

SHORT NZDCAD

Dollar Flight to Safety & Paradigm Shift in Japanese Yen

The highlight of the economic reports will be the US jobs survey, which will be published on Good Friday. It’s the first big report of the month, and it sets the tone for the high-frequency data that follows. On Wednesday in Pittsburgh, the Biden administration will unveil its infrastructure plan, which will be a major political event. It had been prominently featured in the advertisement. In addition to the cost (estimated at $3 trillion), the planned tax hikes would attract scrutiny. Biden has called for increasing the corporate tax rate to 28% (from 21%) and imposing a minimum corporate tax of 15% on major businesses. He also supports raising the personal income tax rate for those making more than $400,000.

After all of this, the dollar remains strong, along with the pound, the most powerful currency. We expect the dollar to lose its strength soon, but in the meantime, we must pay attention to what the market is offering. Dollar strength has caused a paradigm shift in the long-term bear market for major Japanese pairs. We’ve been talking about how important inflection points are in major Japanese pairs. Yes, EURJPY and GBPJPY have corrected lower, but they are now following the main path as expected after hitting the first basic support. For several weeks, we’ve been debating the strength of the pound. And the pound has shown a lot of power. If the Japanese yen breaks through the inflection point, GBPJPY will be the severely affected by the pound’s strength.

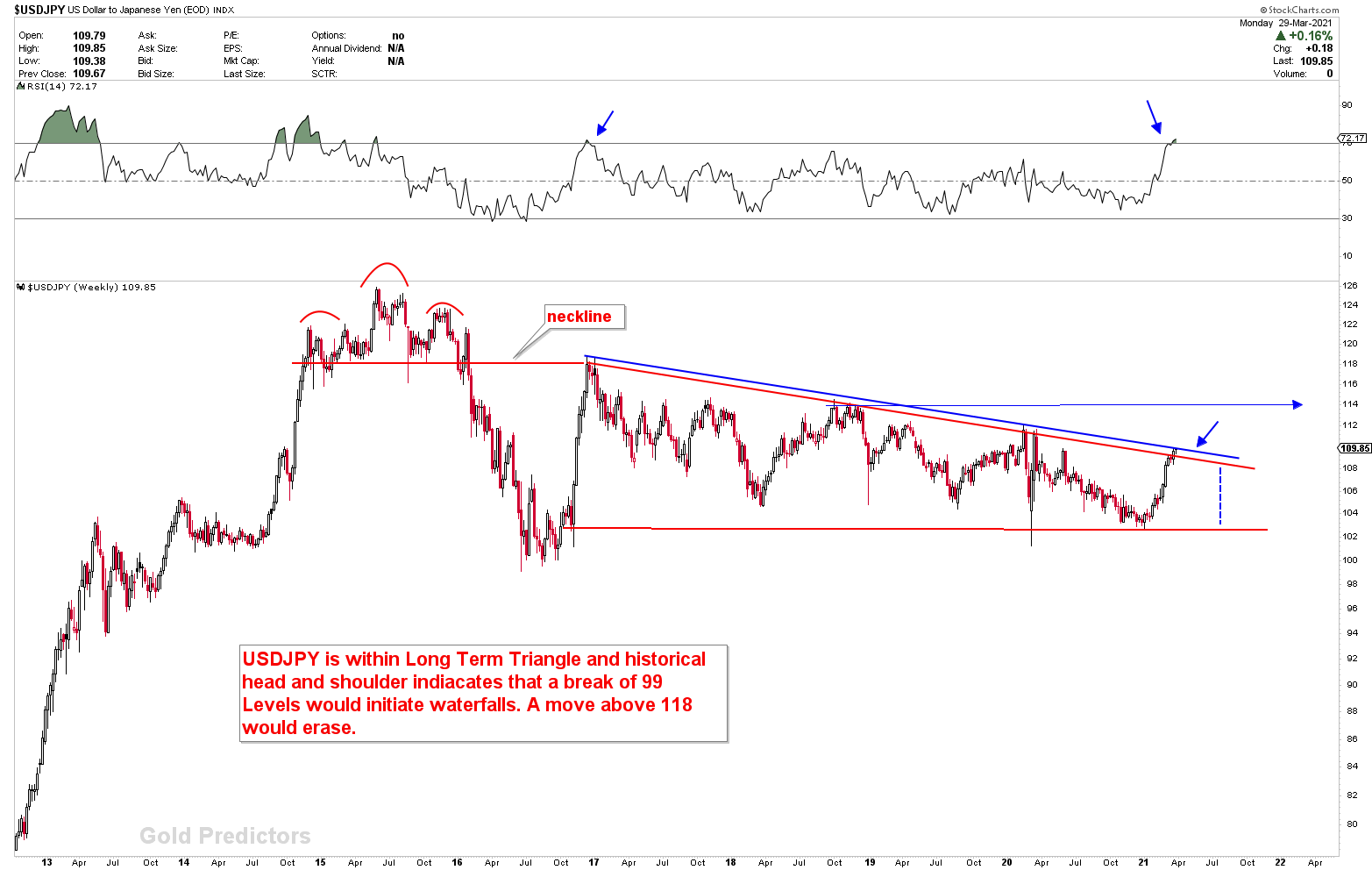

The USDJPY hit the triangle resistance, but the price broke the first red line after two weeks of consolidation. It is, however, still below the blue line. The jobs report on Friday will also determine the next move in this pair. The price of the USDJPY is trading at long-term inflection points, according to monthly charts. Because the chart is long-term, the numbers have a lot of deviation. Price may break higher in one month and then reverse in the following month, creating a fake breakout, until then it is strongly bullish.

New Zealand Dollar To Sands

For several weeks, the New Zealand dollar has been the weakest currency. For the past few weeks, GBPNZD has been the best trading instrument due to the strength of the pound and the weakness of the New Zealand dollar. The target of 1.98 was reached, but we expect the price to rise much higher, so any pullback in the pair must present a buying opportunity.

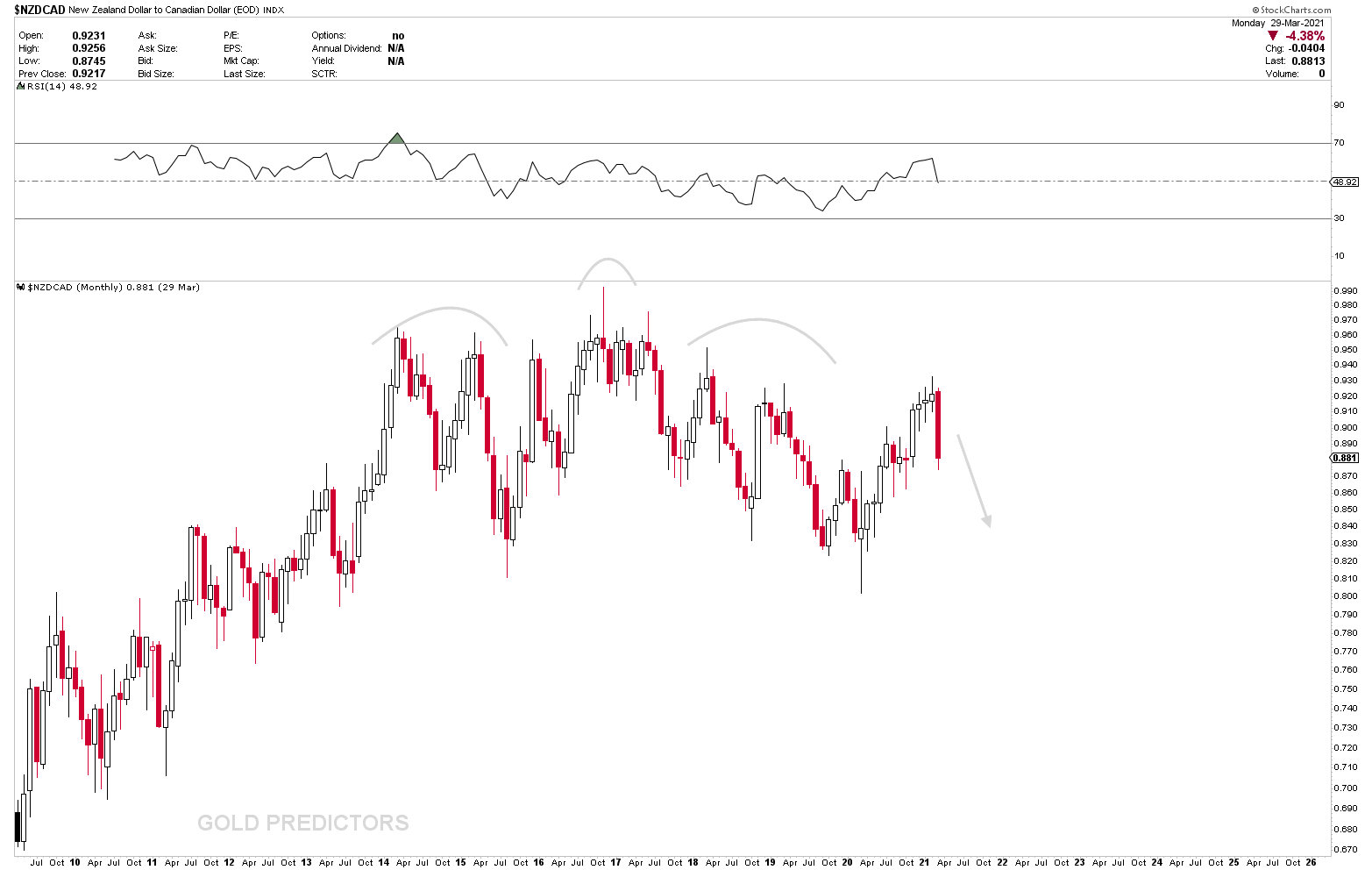

NZDCAD, on the other hand, has been producing a selling opportunity as a result of NZD weakness. Price has been consolidating in large ranges, as seen in the monthly chart. The bearish side of these large ranges is summarized in the monthly chart below. The real sell signal appeared on daily charts when price broke the wedge (as seen in the daily chart). Price broke the rising wedge and rising channel on the weekly chart, implying that selling pressure will develop in the NZDCAD in the coming days.

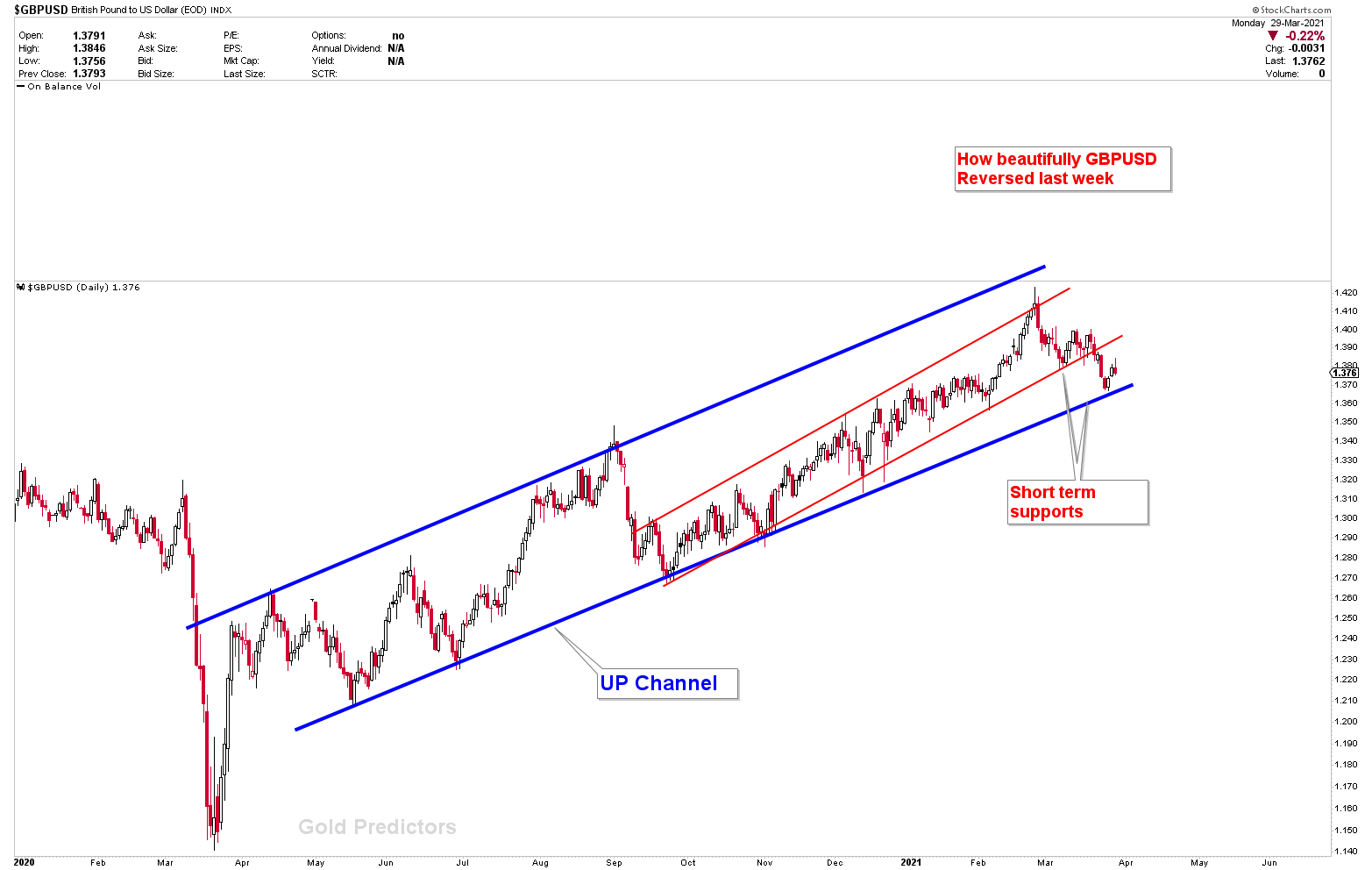

As we have been discussing for the past three weeks, the GBPUSD has reached the second support level. The pound’s strength is undeniable, but the dollar’s strength has prevented the pair from rising. To trade pound strength, go long on the GBPNZD and GBPJPY pairs. The Japanese Yen, on the other hand, is at a crossroads, and until the dust settles, the price may be vulnerable to risks.

The Japanese Yen is at an inflection point, and any breakout would signal a shift in the long-term bear market. The strongest currencies remain the dollar and the pound, while the weakest currencies are the New Zealand dollar, Swiss franc, and Japanese yen.

To receive the free trading alerts, signals and articles please subscribe as a Free member to the link below.

Note: The subject highlights the ideas and thoughts of the writer for educational support that can be used to enable the reader to become an independent thinker and decision maker.