EURUSD bearish channel

The EURUSD concluded Friday’s session around 0.9960s, with only 0.02% gain. The US Dollar strengthened owing to additional Fed action necessary; as its preferred index of inflation, core Personal Consumption Expenditure (PCE) surged beyond August levels, a headwind for the EUR. Nonetheless, the Shared currency gained strength versus the USD. The US Department of Commerce reported that US core PCE spending increased by 0.5% in September, as per expectations. On the other hand, YoY numbers increased by 5.1%, below expectations but higher than 4.9%. According to another data released by the US Labor Department, the Employment Cost Index (ECI) for the third quarter increased by 1.2%, in accordance with Bloomberg’s expectations, and was 1.4% lower than the second quarter.

Technical Outlook for EURUSD

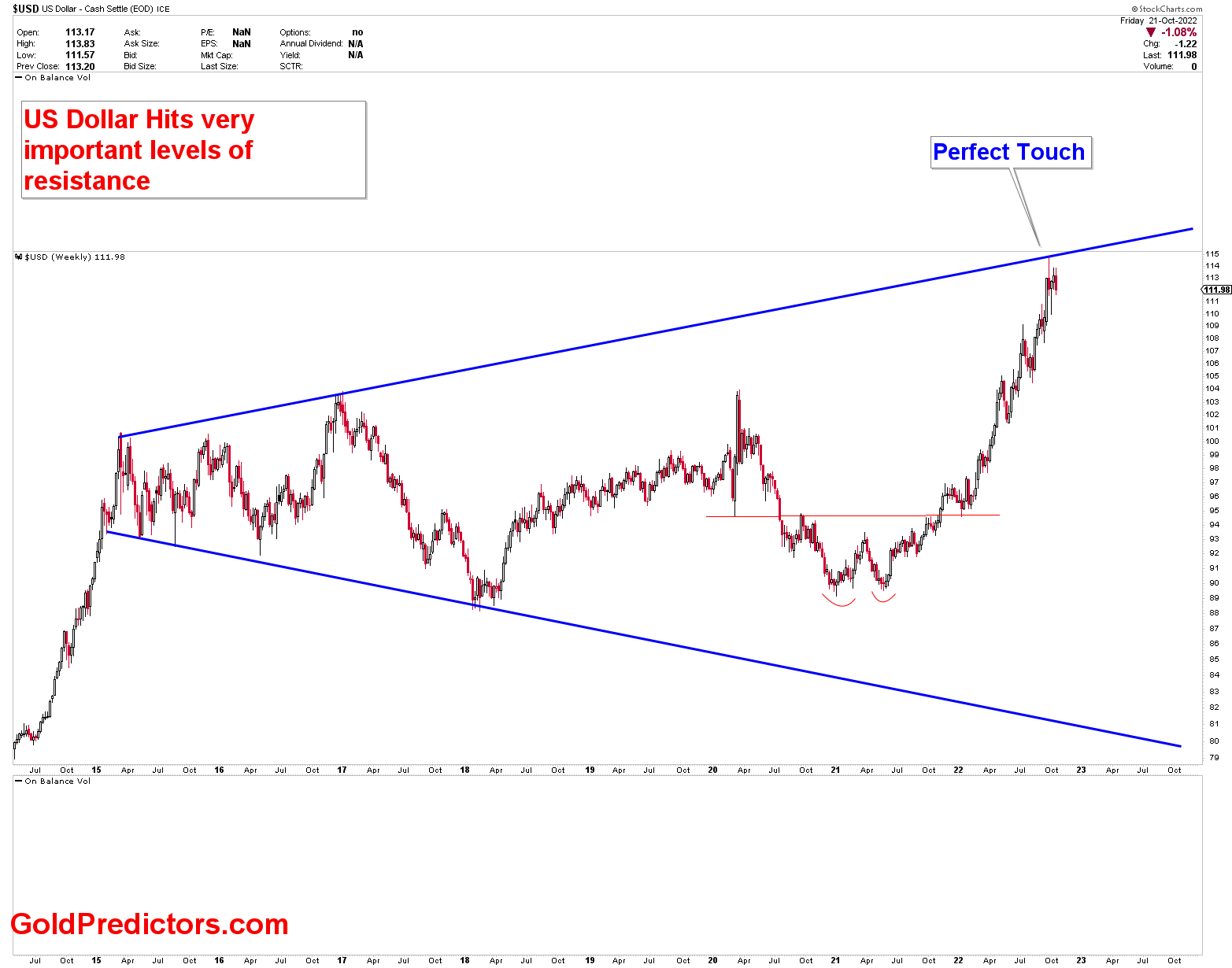

Technically, the US dollar index has been very strong in recent months, and we expected it to hit a very strong resistance level from which a breakout would send the US index much higher. Since, EUR is inversely proportional to the US dollar index, the EURUSD has been extremely bearish, declining in recent months. The chart below depicts the technical outlook for the US dollar index, indicating that the recent pullback is within our expectations. This drop in the US dollar index should be interpreted as a bounce for the EURUSD, which is trading at the month’s support levels.

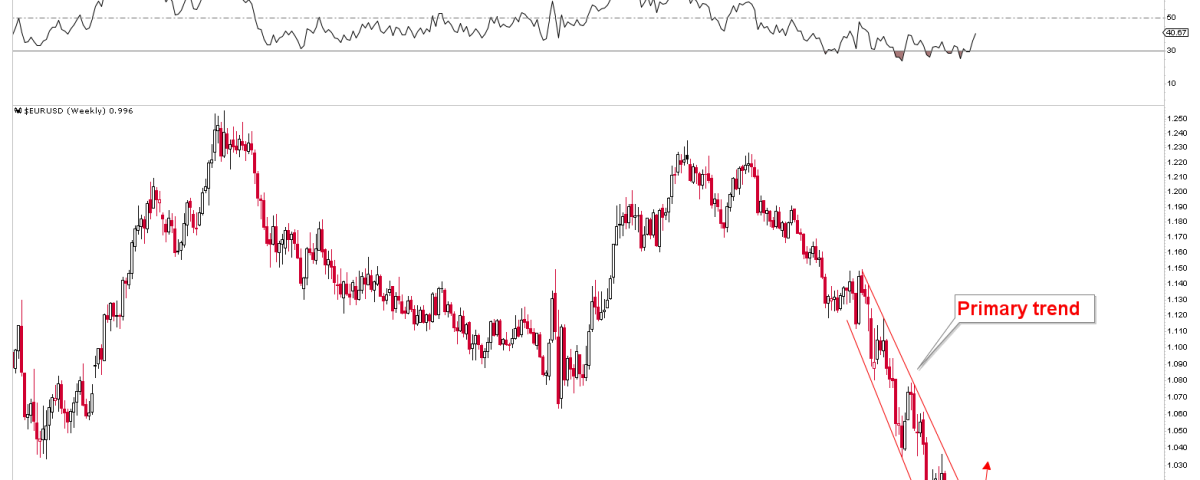

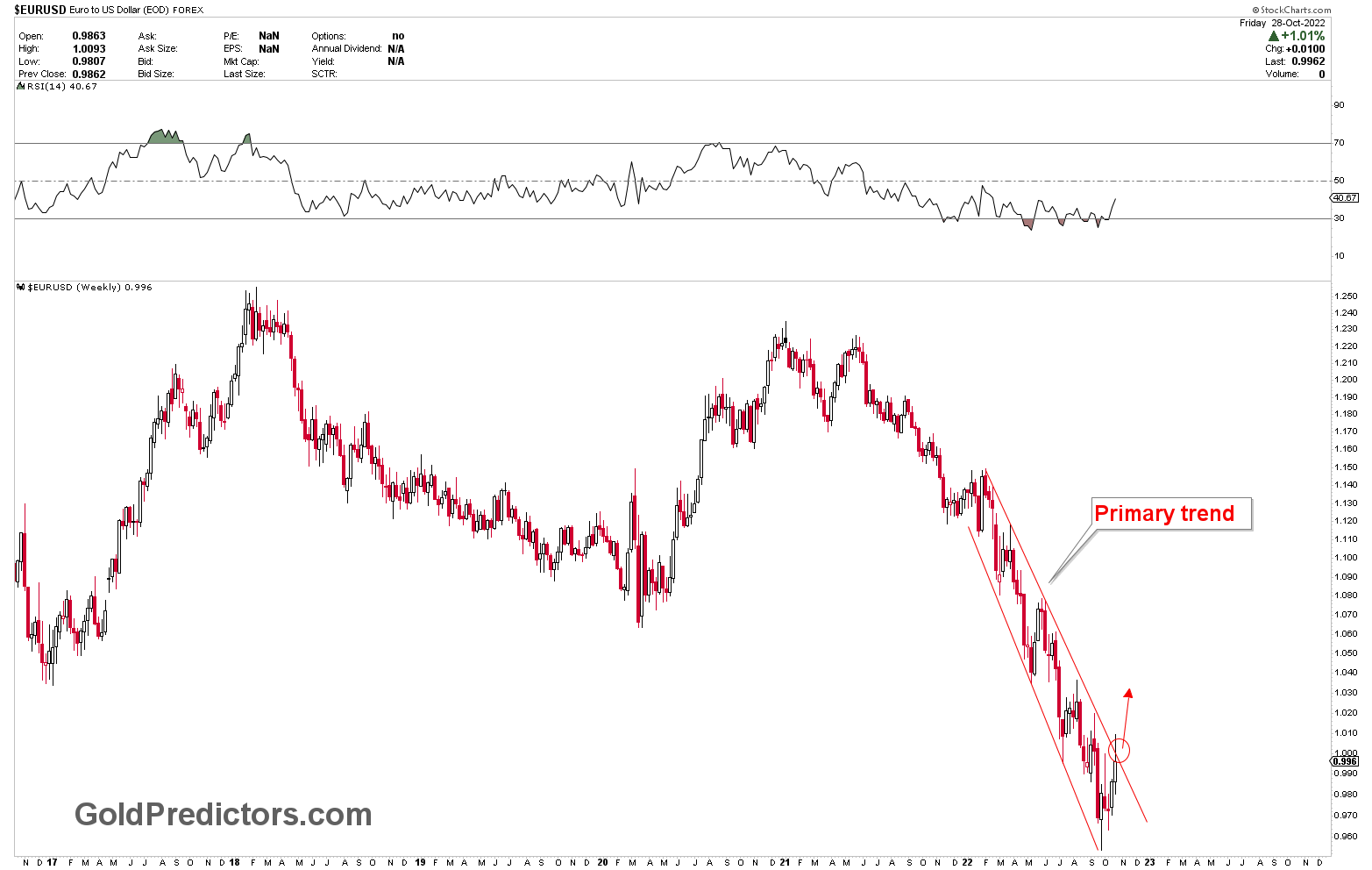

The weekly chart for the EURUSD shows that the instrument is trading in a bearish channel. If there is a strong bounce in the instrument as a result of the pullback from the USD, it will hit channel resistance. If this channel is broken, the instrument will be able to advance to higher levels. There are currently no confirmations for this bounce. Traders should closely monitor the scenarios based on the development of patterns on hourly timeframes in EURUSD.

The above chart illustrates the current scenario for EURUSD whereby the strong resistance was hit. If EURUSD breaks from the red circle, it will initiate a strong bounce followed by pullback in US dollar index.