Gold & Silver Consolidation at First Target of Bounce

Gold has rebounded strongly from the $1,680 inflection point to retest the red trend line of the ascending broadening patterns. In previous updates, we discussed a strong bounce from the $1,680 level to the red trend line, where the decision will be made. The pivot numbers were $1,772 and $1,833, and a weekly close above $1,833 was required. After the bounce, the red trendline in spot gold charts is now approaching $1833. The two cases discussed in the previous premium update remain valid in the gold market. Based on the gold market recent structure, the price still requires some breakout from the key levels.

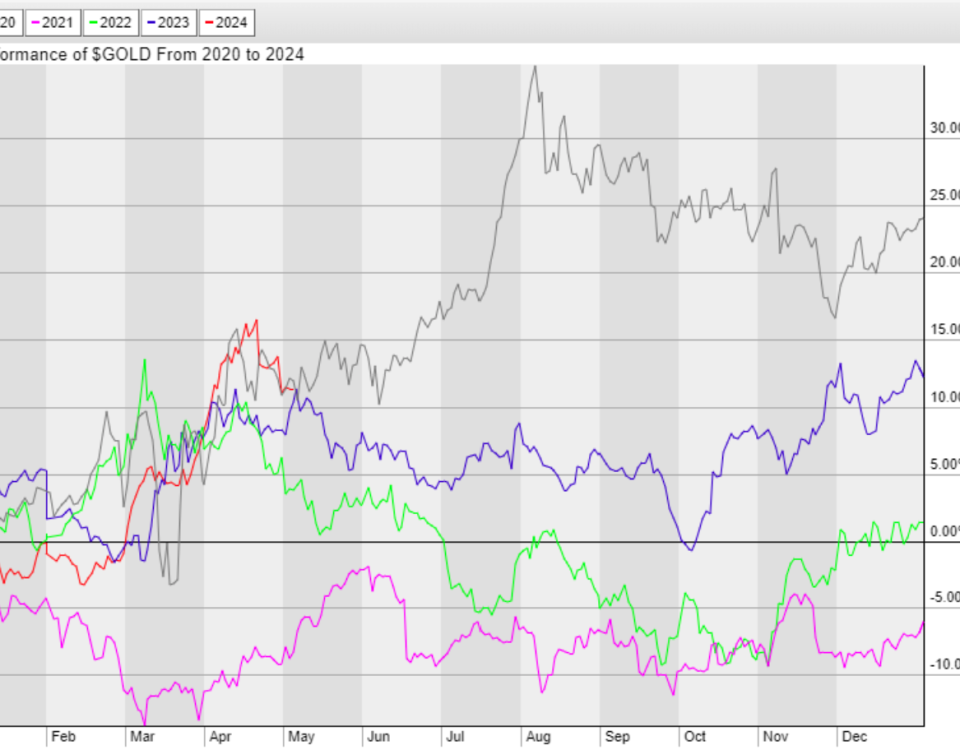

Silver Market Outlook

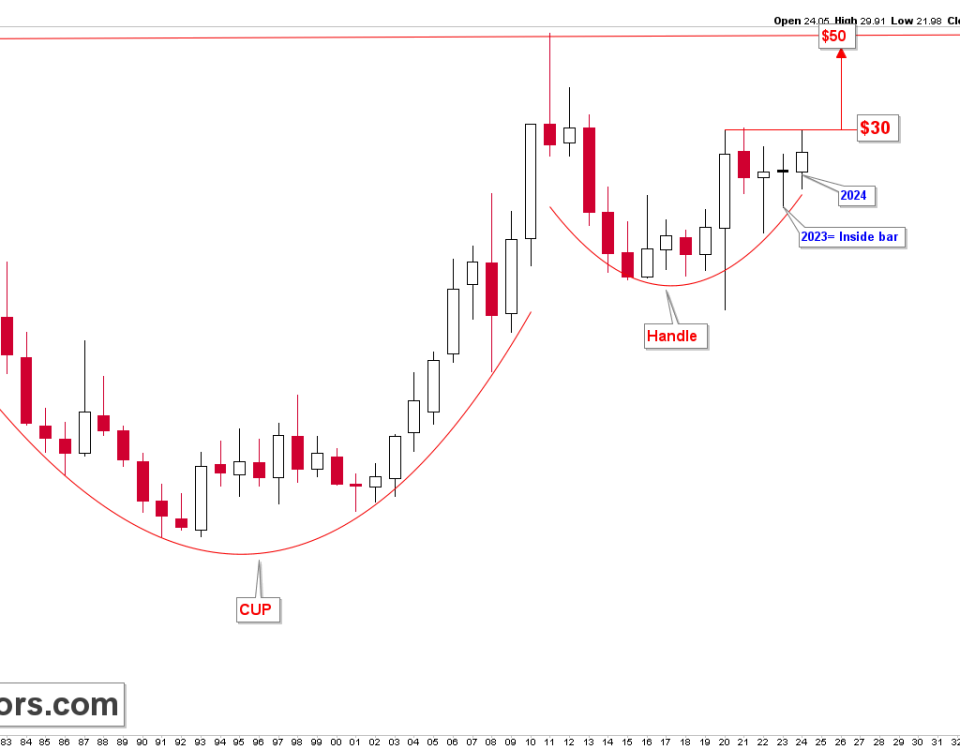

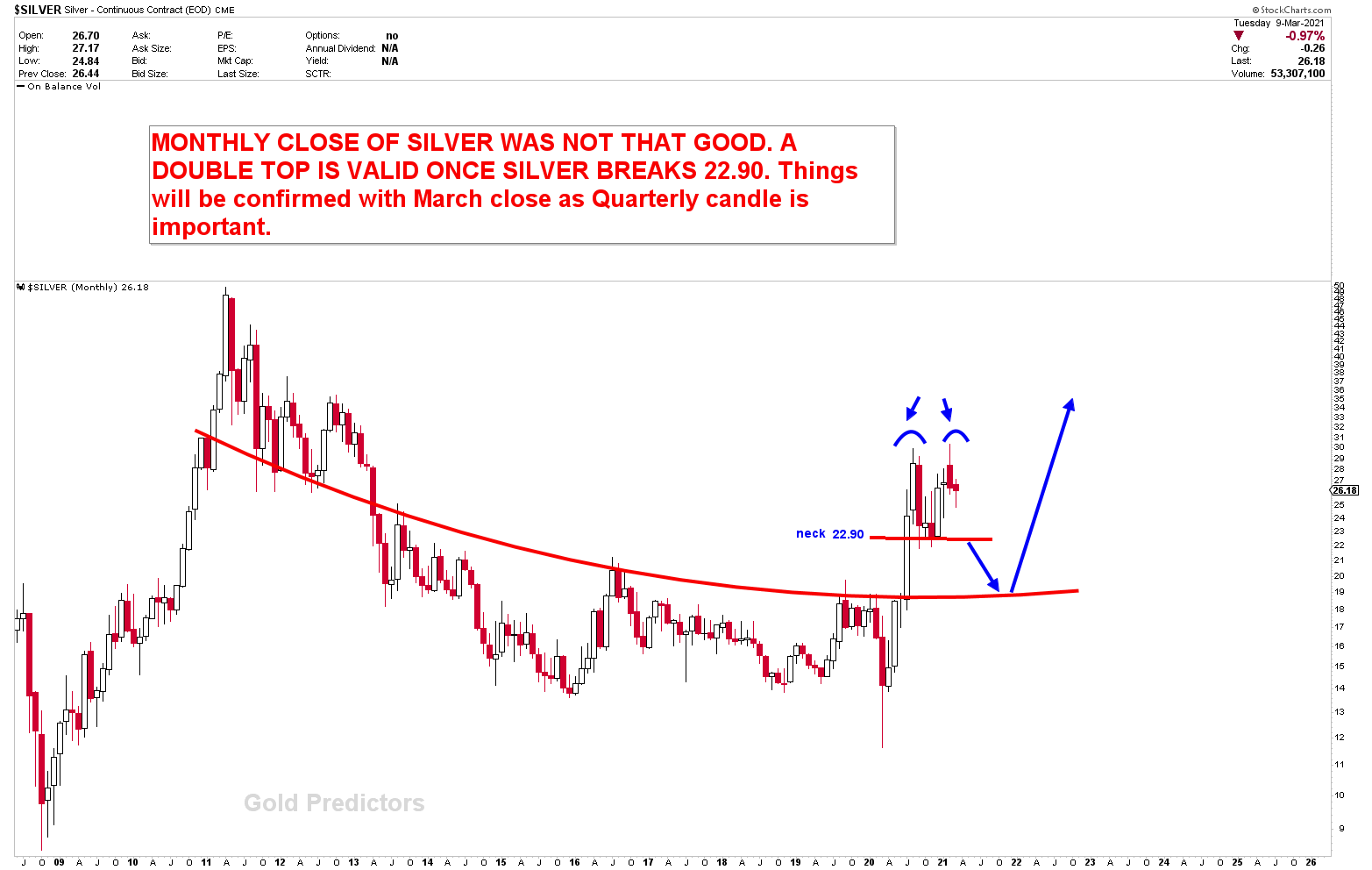

We expected silver to fall from $25.75 to $18.70, where it would likely act as a strong support for the year and spark a strong rally. So far, no weekly close has been below $18.70, and the price has risen to the first resistance level of $20.80. Until silver breaks the weekly $20.80-$21.20 level, the rally in the silver market may be halted for some time, resulting in consolidation with wide ranges. A break below $18 is unlikely, but it would result in a significant drop in the silver market.

The chart from March 9th, 2021, which was presented to premium members, has acted, and the price has dropped as a result of the double top towards 18.70. With the monthly bullish key reversal that is more visible in spot charts, a drop to $18.70 generated a buying opportunity. The recent rally, however, is due to the massive support at $18.70, and a weekly close above the mentioned pivots is required to see the major rally to $35 levels. In the silver market, major levels to watch are $23.01 and $25.65. These levels have been discussed with premiums for last few months.

How to Trade the Gold & Silver Markets?

The gold and silver markets are approaching key inflection points for the year, ensuring some excellent trading opportunities in both markets. One of those opportunities was to buy gold at $1,680 levels, where the risk of loss was very low and the reward was high, with a high probability of success. The trade was entered, and gold prices immediately rose to the target of the trade, where profits of $80/ounce were booked. Gold is currently trading at the first target levels, where the decision is due. These gold levels are extremely risky, and patience is required for short-term traders.

The silver market, on the other hand, provided an excellent buying opportunity at $18.75. After entering the trade at $18.75, the silver market surged higher, confirming a monthly bullish key reversal on spot silver charts.

What’s Next?

The gold and silver markets have reached the bounce target of $1800-$1833 in spot gold and $20.80-$21.20 in spot silver. To confirm a trend reversal, a weekly close above these levels is required. Aside from these levels, metals must put in a lot of effort to overcome these resistances. A short-term pullback is possible, but a weekly breakout will increase demand in both markets. Further discussion of these markets will be provided in following sections.

Please login to read full article!

Please subscribe to the link below to receive free updates.