Silver Prices Surge with Strong Fundamentals and Technical Buying in 2024

Silver prices have surged significantly in 2024 due to strong fundamentals and technicals. Currently, prices are trading in the $26 range. This uptick is primarily driven by technical buying, underpinned by a positive shift in long-term fundamentals. The precious metal is renowned for its industrial applications and status as a store of value. It has benefited from favorable economic data and a brightening global outlook.

Silver Surge Amid Strong Fundamentals

The recent uplift in silver prices is directly linked to the latest US Industrial Production data, which exceeded expectations. In February, production rose by 0.1%, surpassing economists’ predictions of flat growth. This figure marks a recovery from the previous month’s decline of 0.5%. Released by the US Federal Reserve, this data suggests resilience in industrial activity. This bodes well for silver, given its extensive industrial use.

Moreover, silver’s appeal stretches beyond mere industrial use. Analysts, including Marcus Garvey from Macquarie, have expressed optimism about the metal’s prospects due to increasing global demand. Its crucial role in manufacturing solar panels, various electronic devices, and jewelry drives this demand. Furthermore, higher-than-expected US inflation data suggest potential delays in interest rate cuts by the Federal Reserve. However, the silver’s allure as an investment remains strong. Typically, higher interest rates benefit yield-bearing assets and diminish the attractiveness of non-yielding investments like silver. However, the current economic environment has seen silver maintain its investment appeal.

The Silver Institute also projects that demand for silver will reach 1.2 billion ounces in 2024. This makes it the second-best year on record for the metal. This forecast underscores the strong demand for silver. This demand plays a pivotal role in technological advancements and as a hedge against inflation.

Silver Prices Surge & Technical Understanding

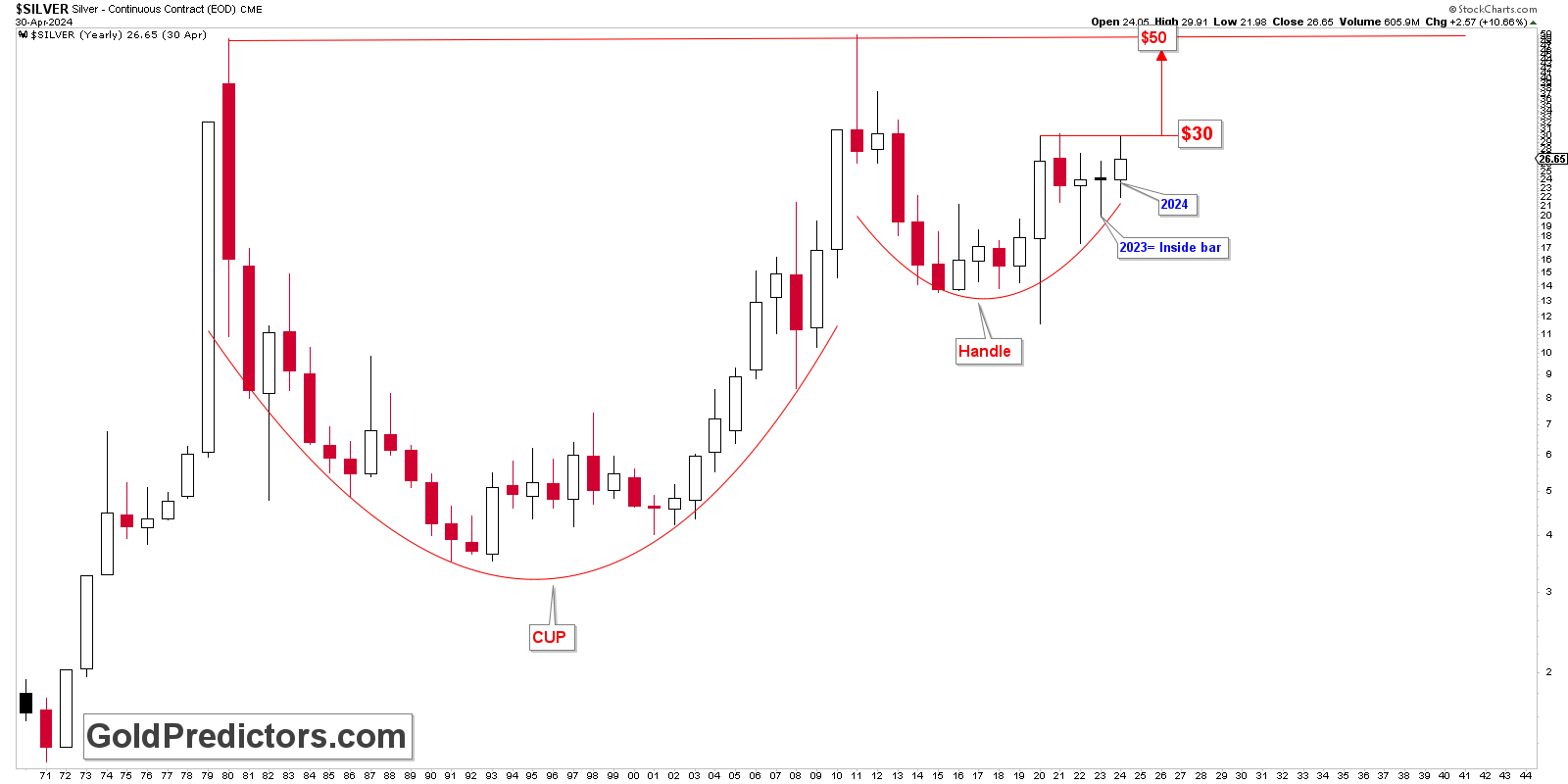

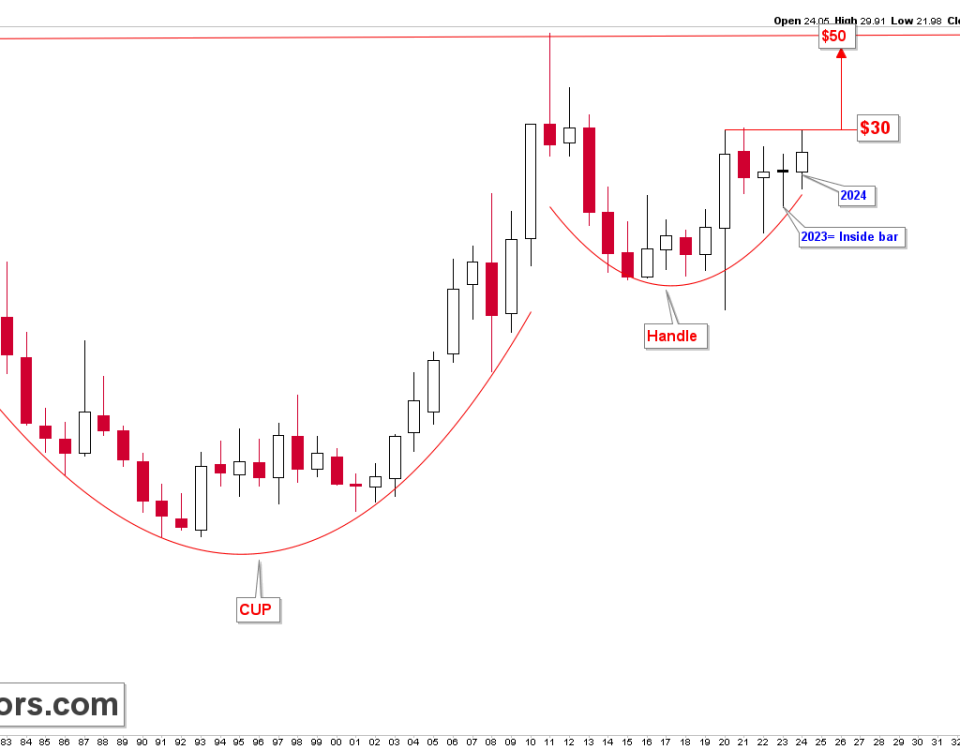

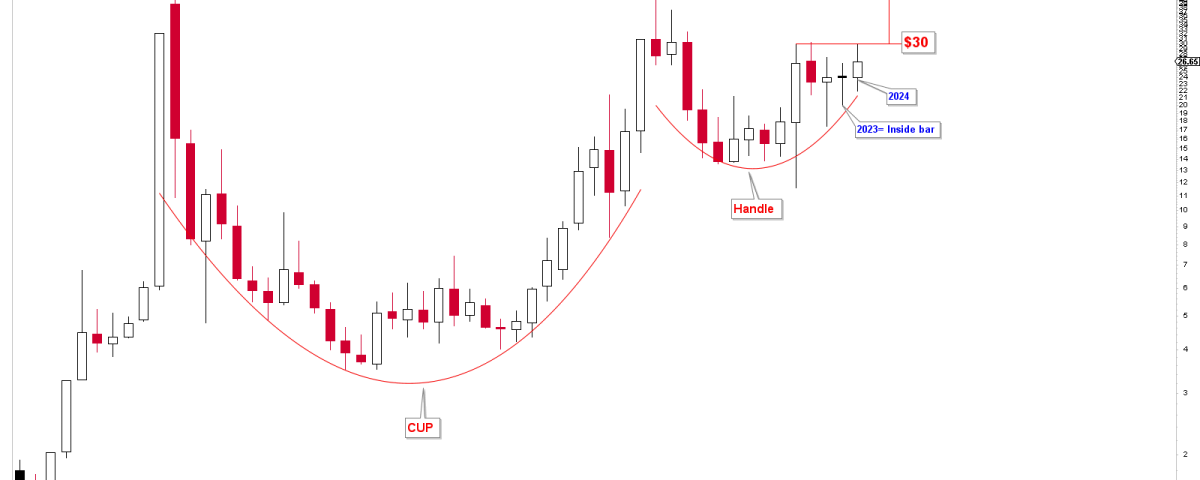

The technical perspective of the silver market is distinctly bullish. Although the price of silver has not broken the $50 mark in the past 40 years, forming a strong ‘cup and handle’ pattern on the long-term chart suggests a potential breakout above this level. Such a move could signify a more significant upward trajectory for silver than the gold market over the same period.

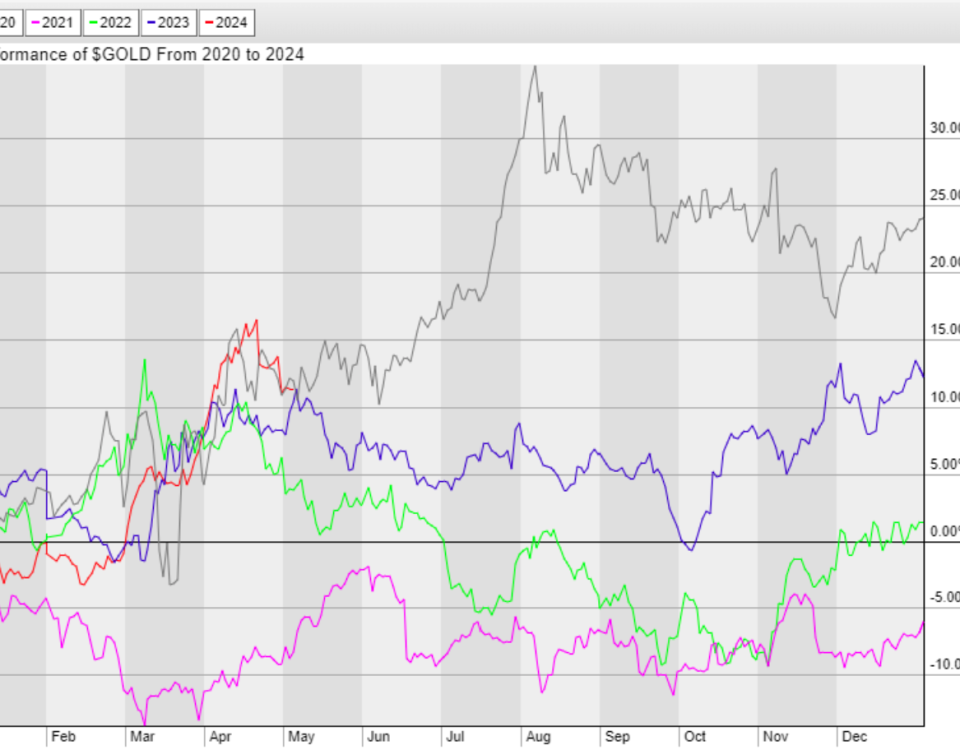

Silver prices have consolidated in recent years, with the prices from 2021 to 2023 consolidating in tight ranges. Notably, 2023 acted as an inside bar, where trading was confined within the price range of the previous year. This pattern indicates price compression, which typically precedes a strong breakout. Recently, silver tested the $30 resistance level, and a correction is underway. A sustained break above this level could swiftly carry the price toward $50.

Conclusion

Silver prices have surged due to positive industrial production data, a favorable global economic outlook, and sustained investor interest despite challenging broader economic conditions. The technical indicators further support the bullish sentiment, with patterns suggesting a strong potential for significant price movements soon.

Investors and market watchers would do well to monitor these developments. A break above critical resistance levels at $30 will be a quick move to $50. Moreover, a break above $50 could open up new avenues for growth in the silver market. The growth above $50 potentially outpaces gold and other precious metals. However, the breakout above $50 might be a long process. Silver continues to shine as a valuable industrial commodity and a prudent investment choice as the landscape evolves.