Gold Is Preparing for a Seasonal Bottom

Gold prices show a certain level of seasonality. Various factors, including geopolitical events, economic indicators, and cultural phenomena, influence this seasonal fluctuation. Most prominently, the demand for gold typically increases during certain months due to cultural and financial trends, thereby impacting its price. The recent drop in gold prices during the past two weeks indicates that gold is preparing for a seasonal bottom.

Impact of Seasonal Events on Gold Prices

Throughout the year, several events significantly influence the prices of gold. Traditional festivals like Diwali in India and the Chinese New Year see a surge in gold purchases as gold is a popular gift. These cultural events lead to a temporary boost in demand, pushing prices up. Conversely, during summer and year-end months, the trading volumes can decrease as traders and investors take holidays. This leads to a less volatile market.

On the other hand, economic policies and decisions by major central banks also play a crucial role. The announcements regarding interest rates or economic stimuli often cause market reactions that can affect gold prices due to its status as a safe-haven asset.

Gold Recent Trends and Seasonal Bottom

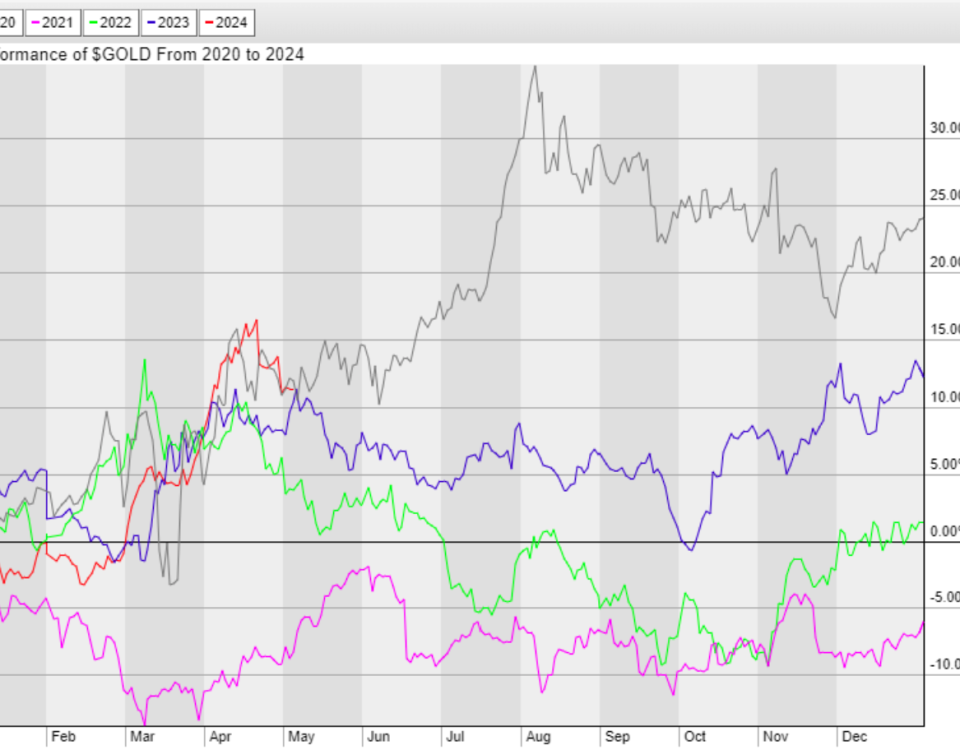

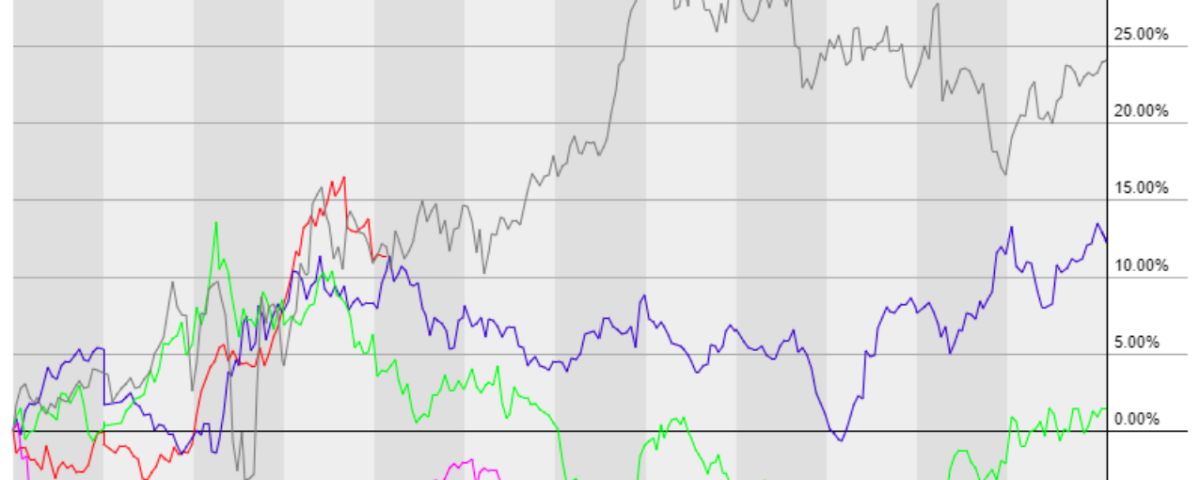

Over the past five years, the data shows distinct patterns in the seasonality of gold prices. August and September have consistently been weak, with prices often closing lower than they opened. This trend suggests a decrease in market confidence or a shift in investment focus. This is due to the end of summer vacations and the resumption of complete market activities, which might include adjustments in investment portfolios.

Similarly, July and December have painted a different picture. These months have a higher probability of gold prices closing above their opening marks. The end-of-the-year boost is due to increased buying during the holiday season. As investors adjust their portfolios for year-end financial reporting. This seasonality chart shows only the five-year data. However, 20-year data indicates a correction in May and June and strong prices in December and January.

The price trend chart below shows the gold price behavior over the past five years. This indicates that May and June are the correction months. During the past five years, COVID-19 crisis in 2020 and 2021 disrupted typical market behaviors, but by 2022 and 2023, these months again showed weakness in gold prices, conforming to the longer-term seasonal trend.

Current Market Dynamics and Investor Outlook

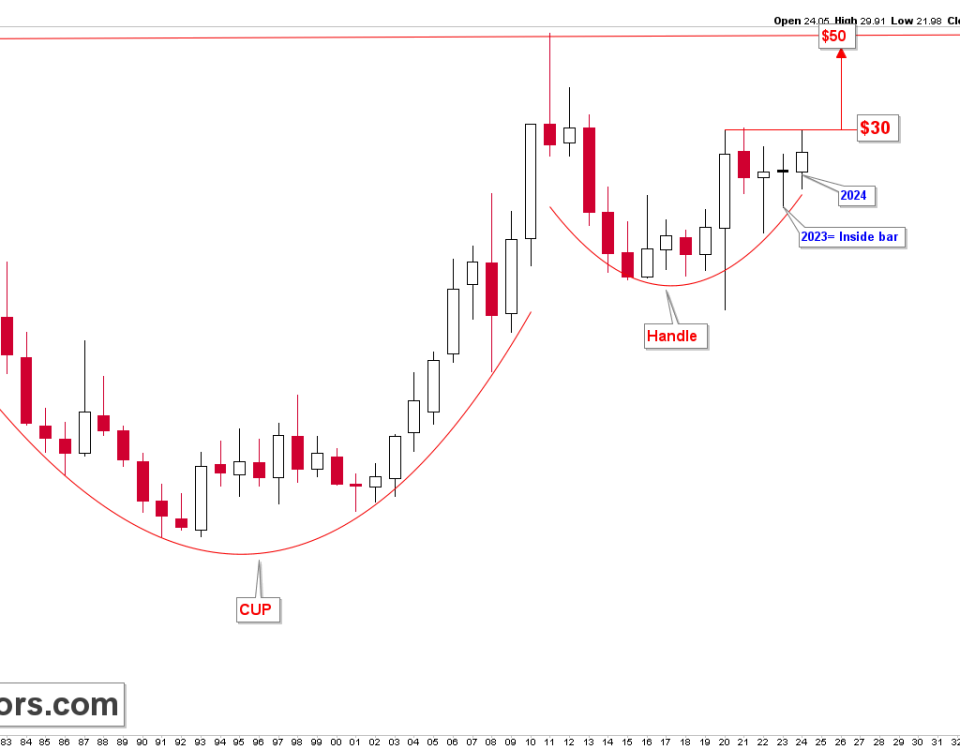

The gold market has recently experienced a shift, breaking through a long-term pivotal area and maintaining a strong bullish trend. Despite this strength, there has been a noticeable correction with prices peaking in April 2024 and declining. Based on the recent breakout in the gold market, this correction may not be deeper and limited. Instead of making deeper corrections, the gold prices may consolidate within the ranges and continue higher.

This consolidation phase is critical as it potentially sets the stage for forming a seasonal bottom, preparing the market for a subsequent strong rally. Investors looking forward should be aware of this pattern and prepare for the possibility of investing near these seasonal lows to capitalize on the upward trend that typically follows.

Conclusion

Investors must stay informed about the broader market dynamics and the specific seasonal trends of gold to make investment decisions. Understanding these patterns, especially in recent market developments, is crucial in expecting changes and strategically timing market entry or exit. The ability to predict and react to these seasonal bottoms can significantly impact the profitability and success of gold investments.

This analysis highlights the importance of recognizing market trends and underscores the necessity of adaptability in response to evolving market conditions. By doing so, investors can enhance their strategies to align with both traditional seasonal cycles and contemporary market shifts. The gold is preparing for a seasonal bottom based on the recent price correction and offers a strategic buying opportunity to look for long positions in May and June 2024.

Please subscribe to the link below to receive the gold and silver trading signals and premium updates.