US dollar to Produce Wide Ranges

The US dollar hits the resistance last week and consolidating its gains. In the short term, a break above this resistance may unlock some bullish forces. The US dollar’s medium to long-term trends remain bearish, and any short-term rally must be capped by some strong resistance. GBP is showing some strength against the NZD and AUD. The strongest bulls on the streets continue to be the GBPAUD. On the other hand, the Japanese Yen remains the strongest forex currency.

Highlights

- The US dollar is trading at resistance and any upwards momentum is likely to be capped. The medium term outlook remains negative. Any bounce could be limited to 95.

- GBP and JPY continue to be the strongest forex currencies.

- The AUD is still the weakest currency.

- USDJPY and EURJPY are likely to roll over to the downside.

Weakest Currency: AUD

Strongest Currency: GBP, JPY

Best Instruments to Focus:

Short EURJPY

Long GBPAUD

US Dollar Overview

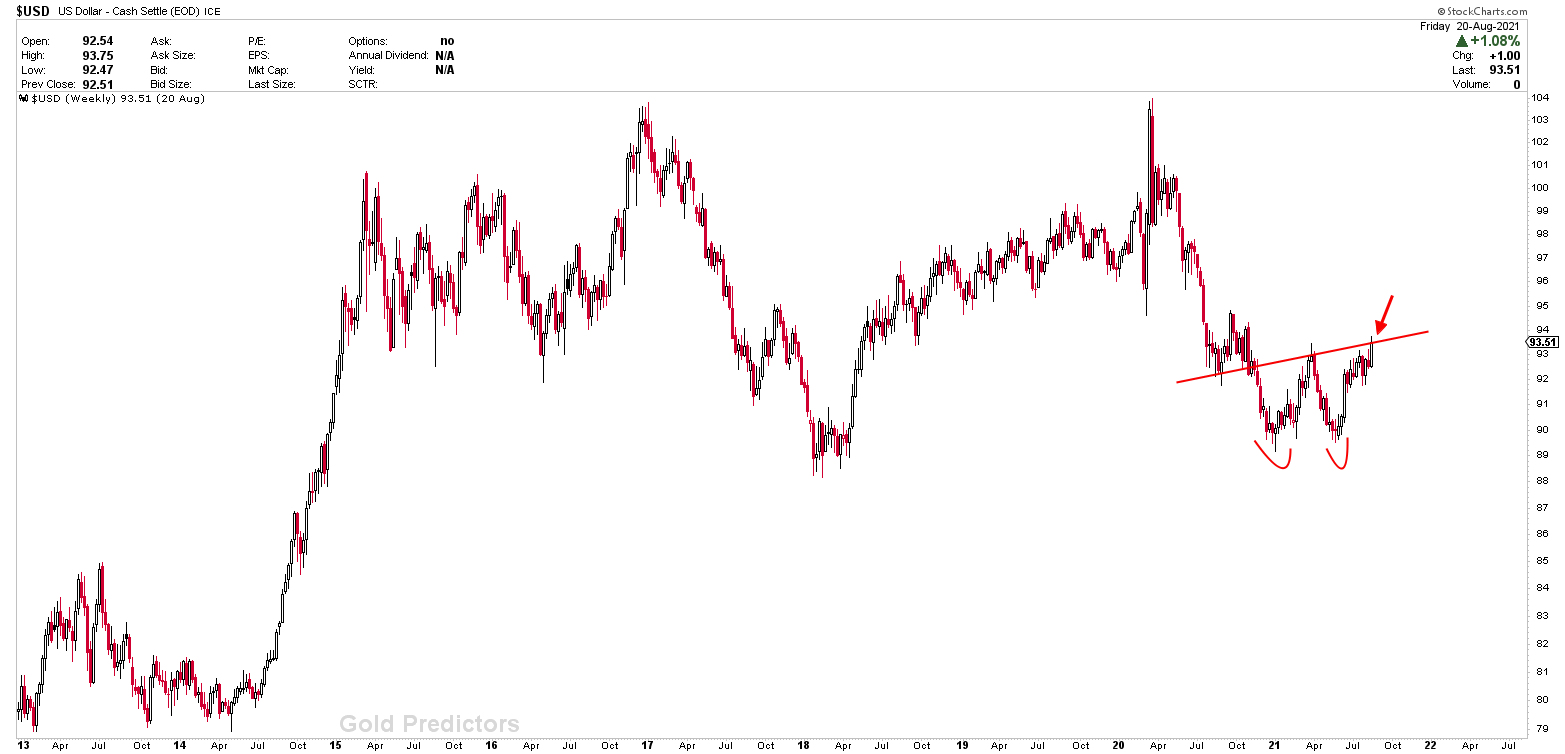

The chart below depicts the outlook for the US dollar index. As we have discussed the US dollar’s double bottom and the short-term bounce from long-term supports, the US dollar hit the resistance and is likely to remain sideways to bearish on the short term. The double bottom’s red neckline is only valid once the US dollar closes above it on a weekly basis. Similarly, the EURUSD, which is inversely proportional to the US dollar, is trading near a strong support level. Despite the fact that the EURUSD price action indicates further downside, the patterns are highly unreliable in the months of June-August. US dollar is likely to remain with big sideways movements. However the next move in US dollar is likely to continue lower. Any short term bounce must remain below 95 levels.

GBPNZD and GBPAUD – The Gainers

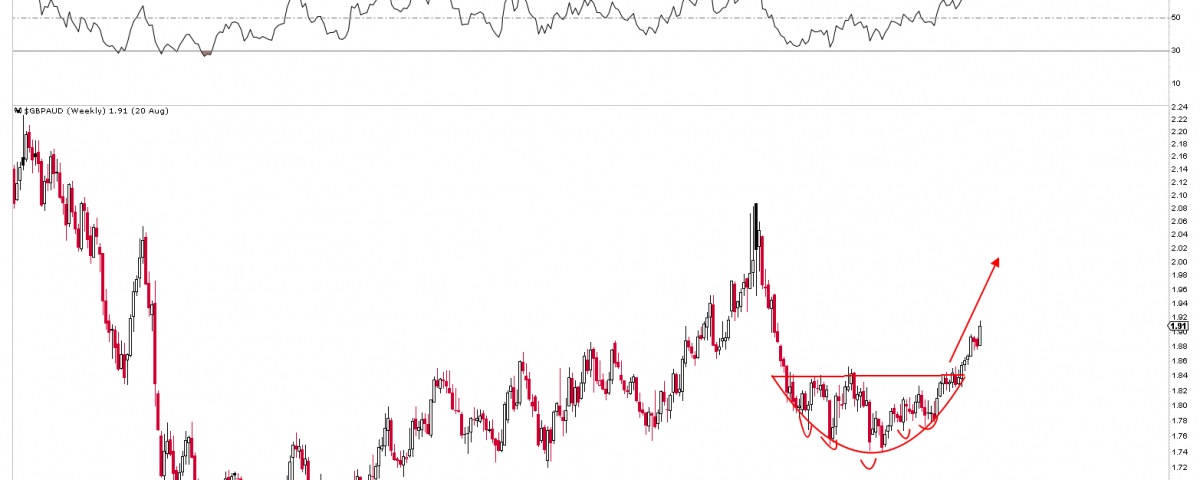

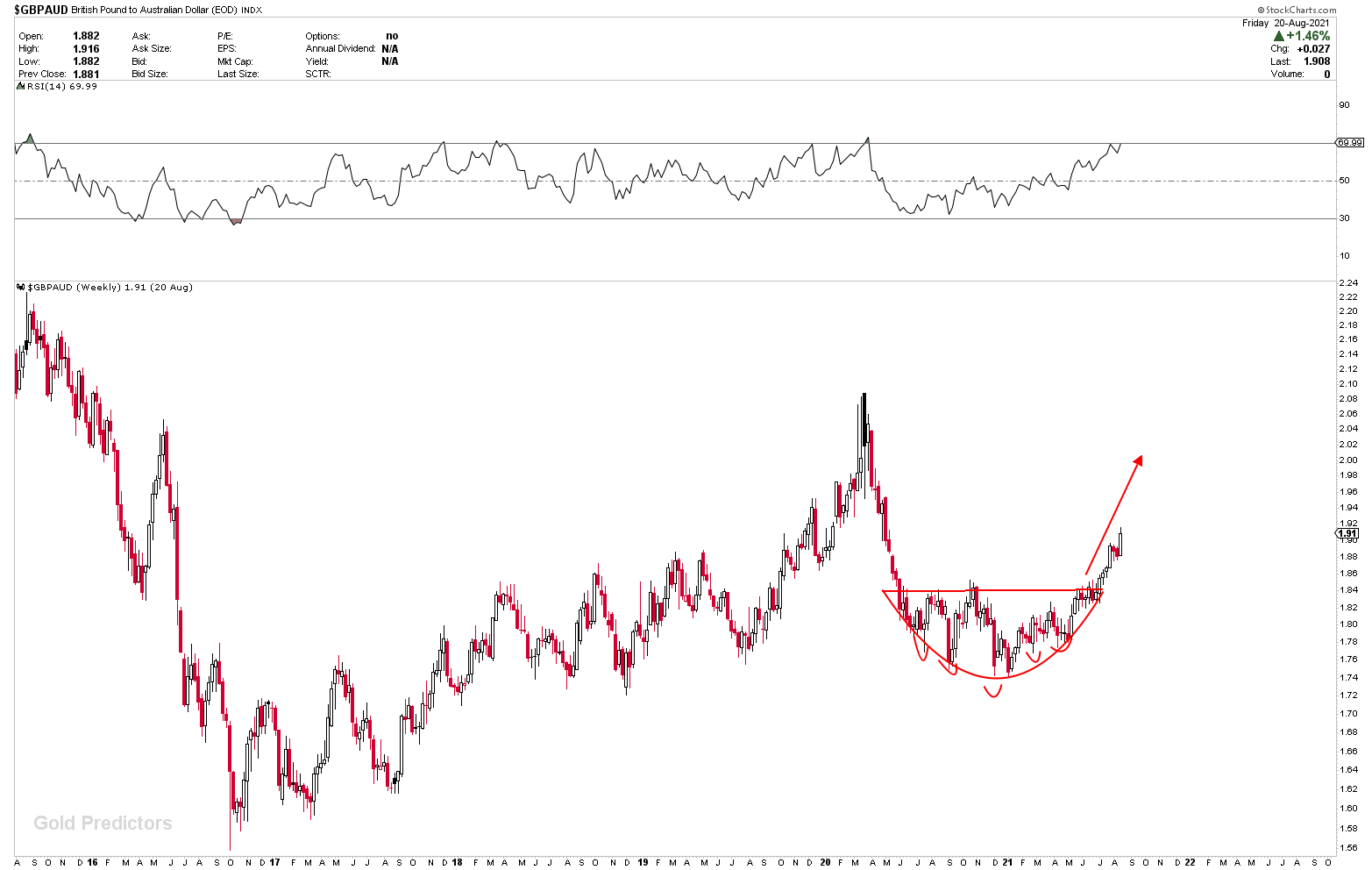

The GBPAUD weekly outlook is depicted in the chart below. The breakout from the rounding bottom in the GBPAUD chart could push prices much higher. Strong resistance was met last week. Any pullback must be viewed as a buying opportunity. The GBPAUD and GBPNZD are extremely volatile, with wide ranges possible. The bullish signal appears only at 1.9165. Any positions taken below this level in anticipation of higher prices may increase the portfolio’s risk. The GBPAUD and GBPNZD scenarios will be discussed in separate updates.

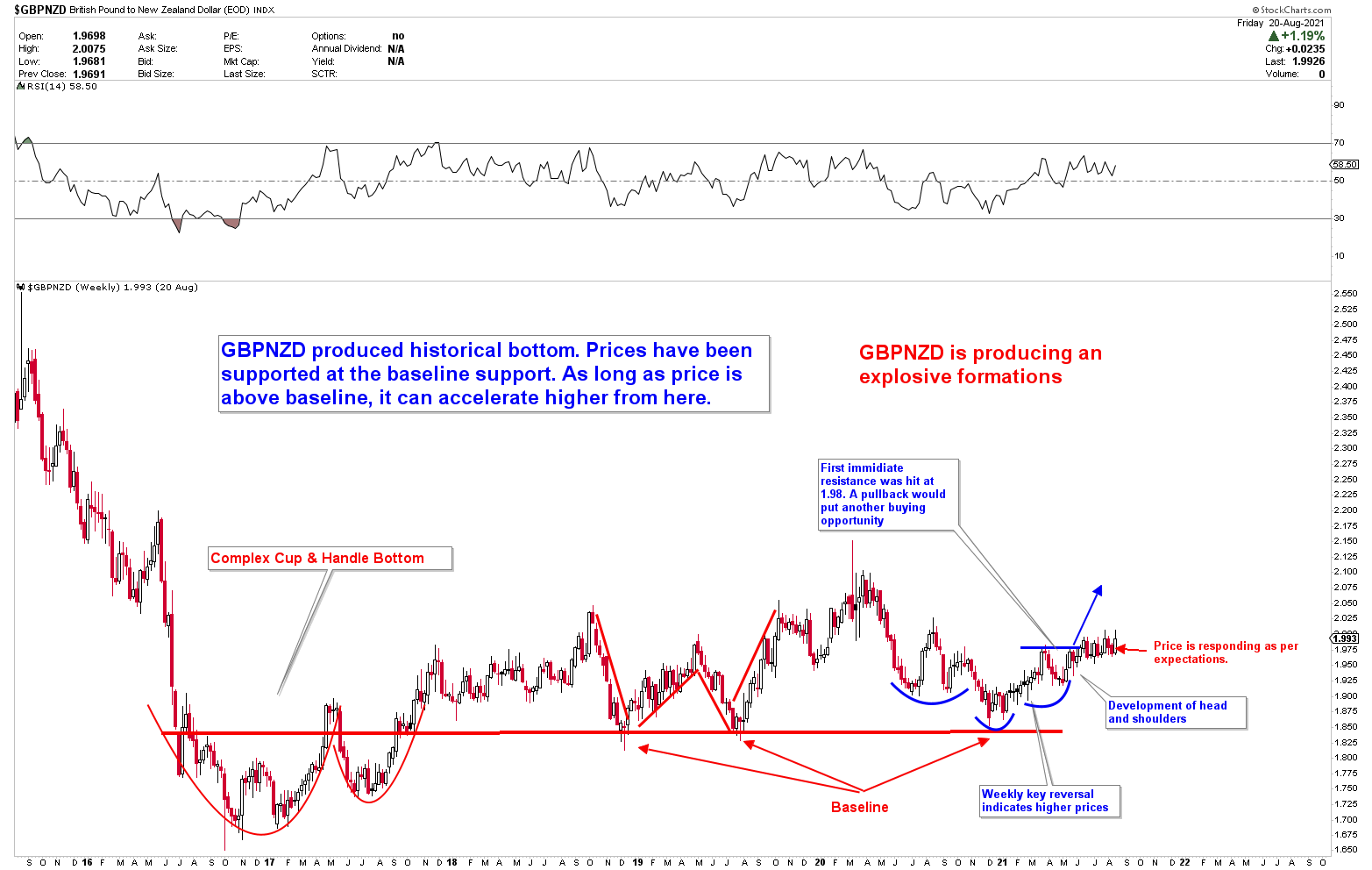

The GBPNZD is bullish in the long term. The wide ranges in the short term are increasing the risk in investor portfolios. The recent 500-pip range is expected to complete soon. The bullish signal appears only at 2.008. Based on the long-term price action, it appears that this instrument must rise in the medium to long term.

To receive free updates, please register as a free member.