New Zealand dollar to weaken

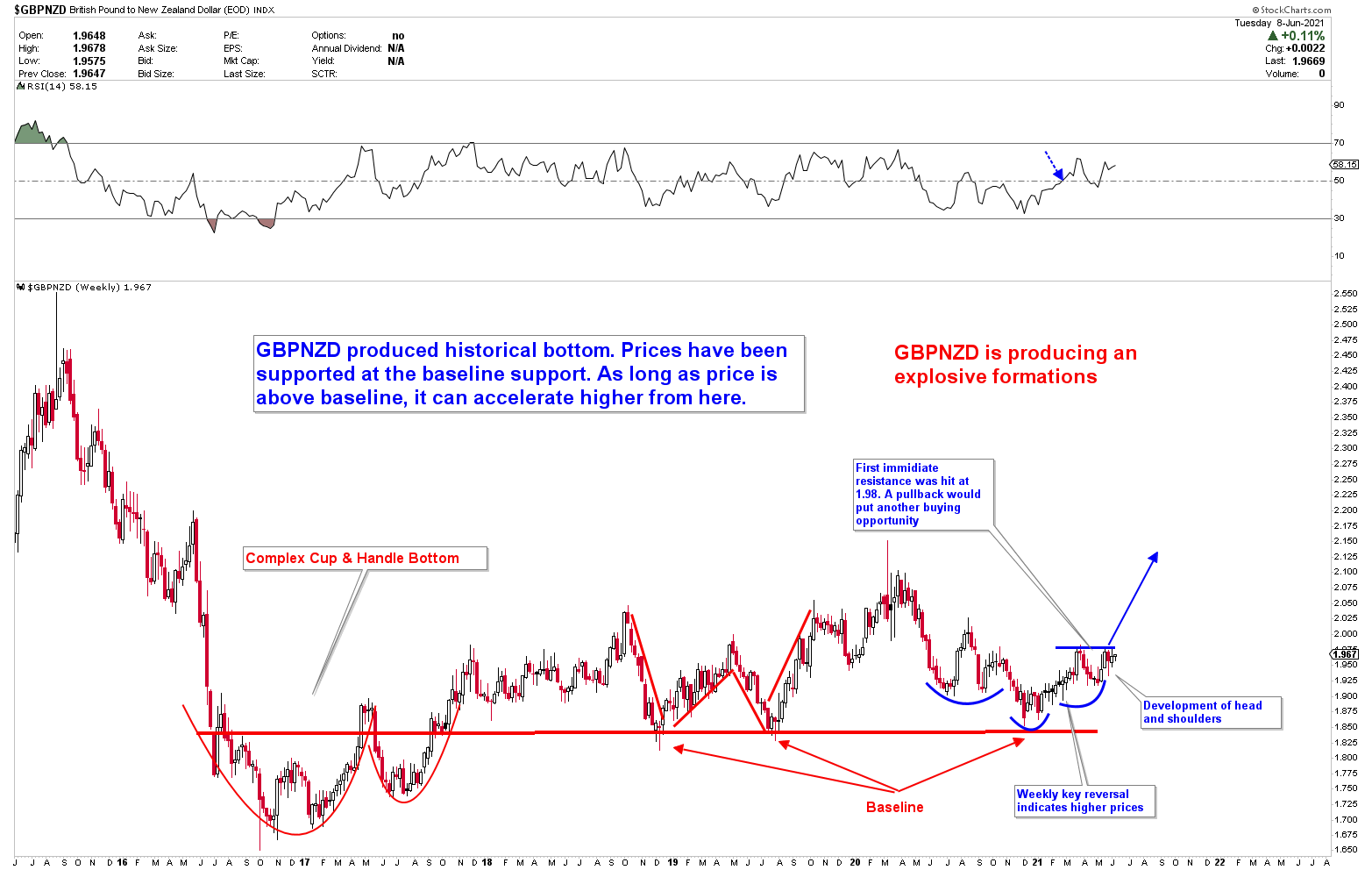

The US dollar is still under pressure, but prices are trading near significant long-term supports. We expect the US dollar to fall to lower levels, the possibility of churning at these levels cannot be ignored. The forex and commodity markets are still trading sideways, consolidating their recent gains in order to run to next levels. The price developments indicates that New Zealand dollar has to weaken. Based on the weakness of the New Zealand dollar and the strength of the Pound, the best instrument to trade is GBPNZD.

Highlights

- The US dollar has been under pressure and is now trading at important long-term levels. While we expect the US dollar to fall to lower levels, the current churning cannot be overlooked.

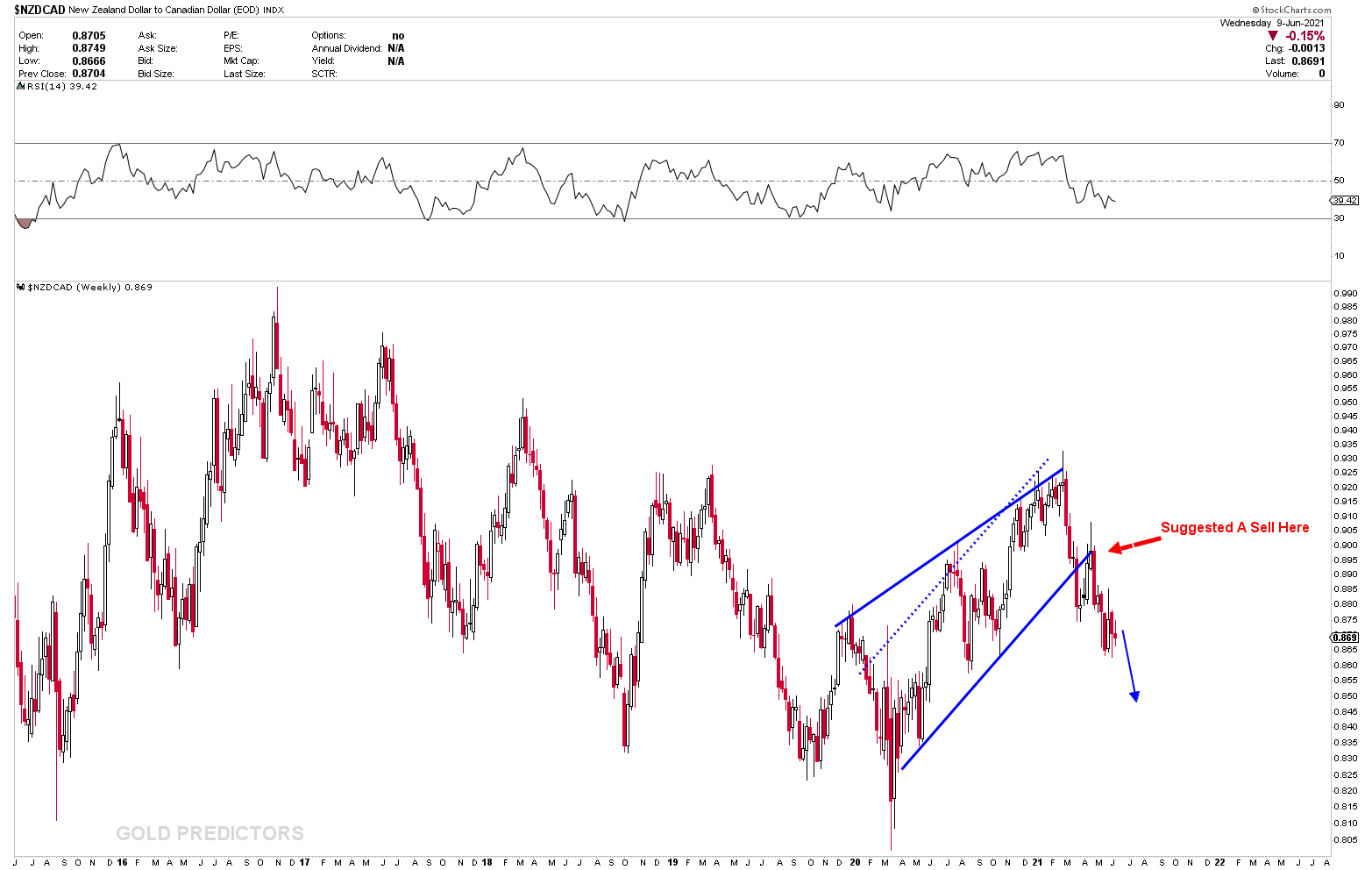

- The weakest currency is now the New Zealand dollar, and the best instruments to profit from it are NZDCAD and GBPNZD.

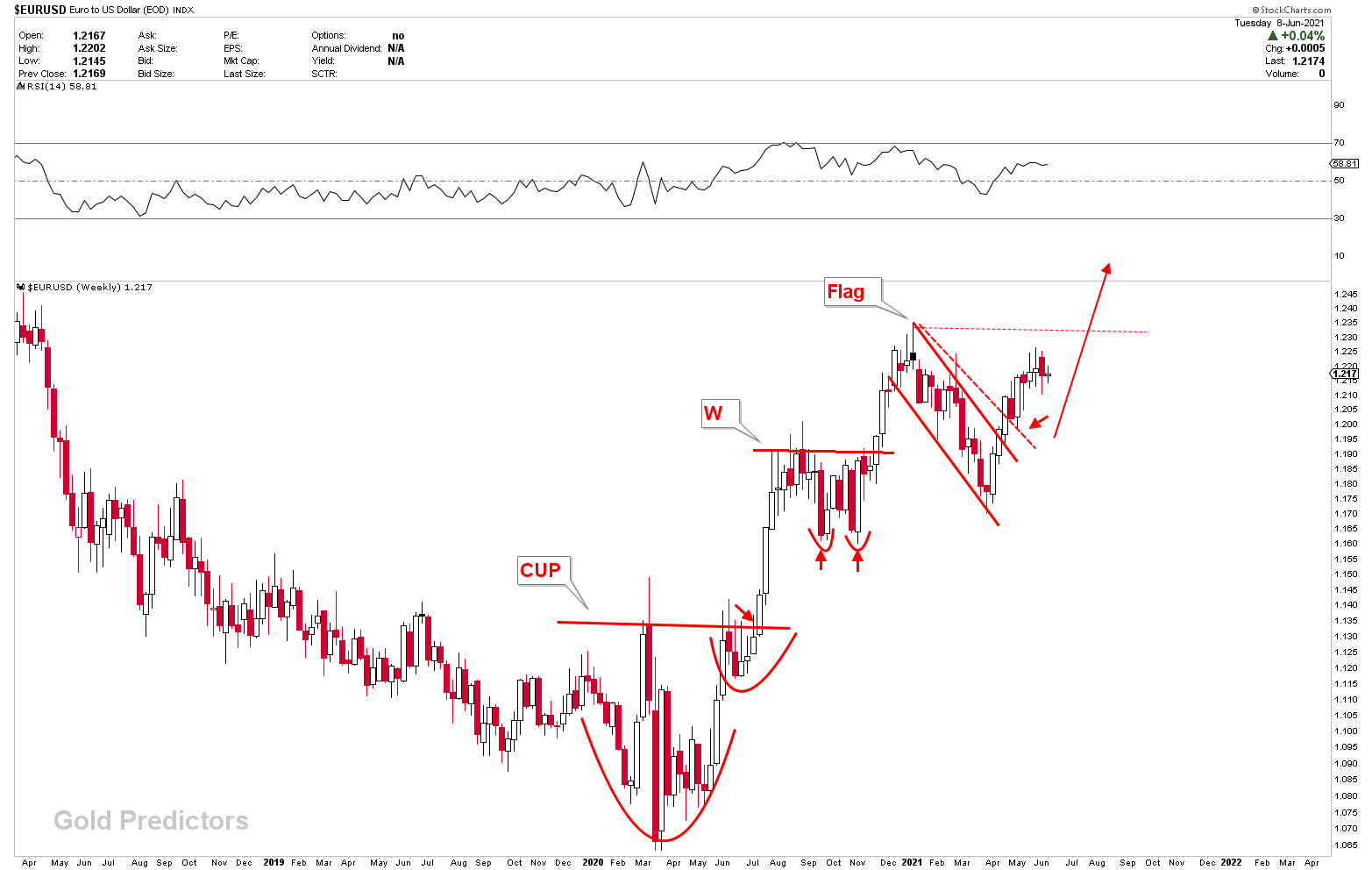

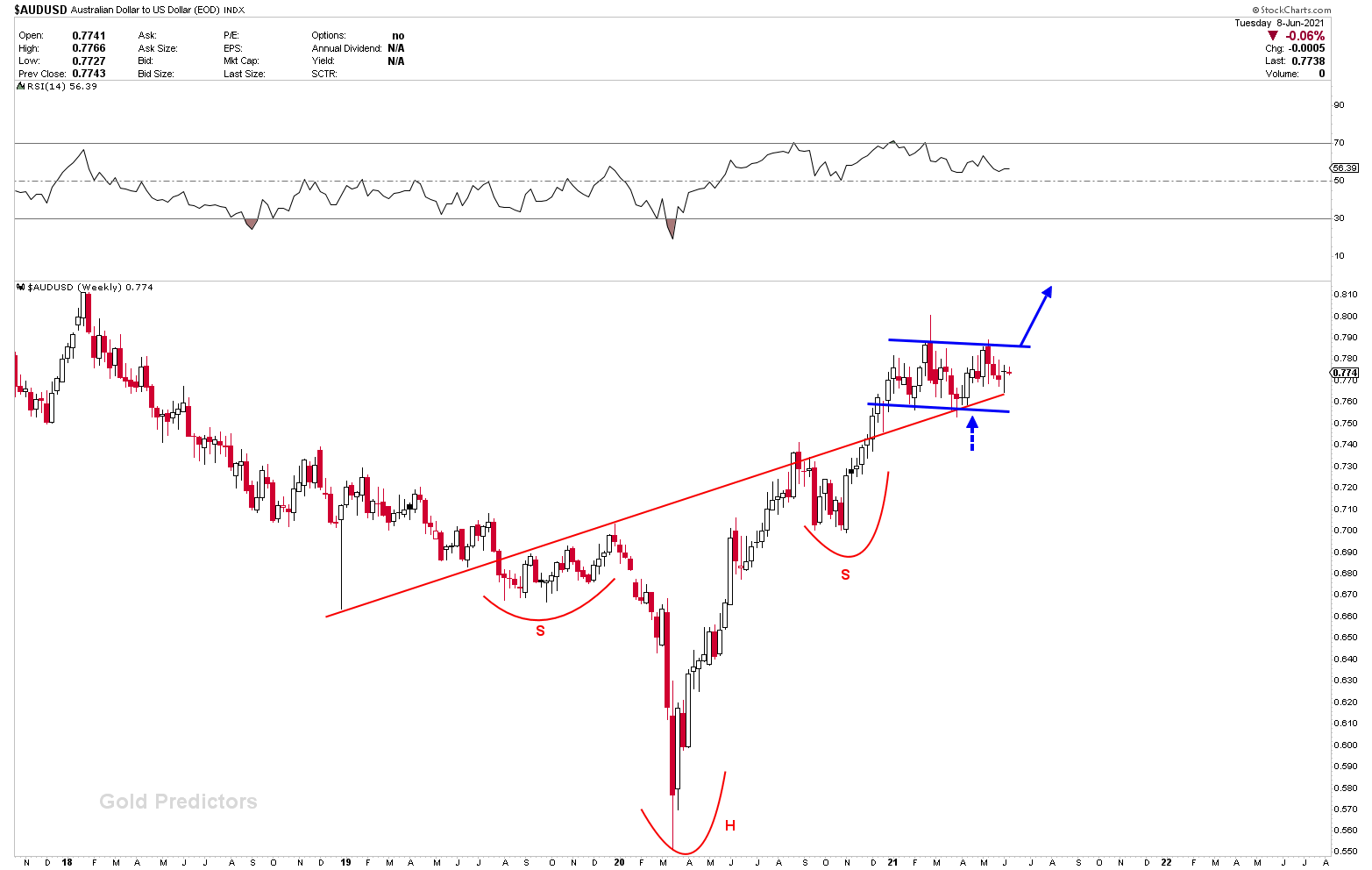

- The EUR, CAD, and AUD continue to be the most powerful currencies. If the US dollar falls to its toes, the EURUSD will rally strongly to the upside.

Weakest Currency: NZD

Strongest Currency: EUR, AUD

Best Instruments to Focus:

Long AUDUSD

Short NZDCAD

Long EURUSD

Long GBPNZD

New Zealand dollar to weaken

Across the board, the New Zealand dollar is the most inefficient currency. A few weeks ago, we demonstrates you the GBPNZD chart. The historical development of complex CUP and HANDLE formations above the baseline support suggests that this instrument must go thousands of pips higher. As long as the basline support holds, we expect the instrument to rise in the short, medium, and long term.

We presented the 1.98 resistance and proposed that any pullback would reveal the instrument with another strong buying opportunity. The resistance was hit a few weeks ago, and the subsequent strong pullback pushed the price back towards 1.98. If the 1.98 level gives way, a trading opportunity will emerge, with the initial target of 2.0250, which is around 500 pips away.

While GBPNZD is one instrument, NZDCAD is the other. Because the Canadian dollar is the strongest currency, NZDCAD would take advantage of the NZD’s weakness. We recommended selling a few weeks ago, but the instrument is still expected to decline.

US dollar significant levels

Because the US dollar is the weakest currency on the board, AUDUSD and EURUSD are forecast to expand. The AUDUSD chart was illustrated months ago and is still executing well. The newly formed bull flag supports the neckline of the inverted head and shoulder. While the US dollar waits for a breakout, the AUDUSD appears to be on the verge of exploding. Because the Australian dollar is a commodity currency, it will benefit greatly from the US dollar’s weakness.

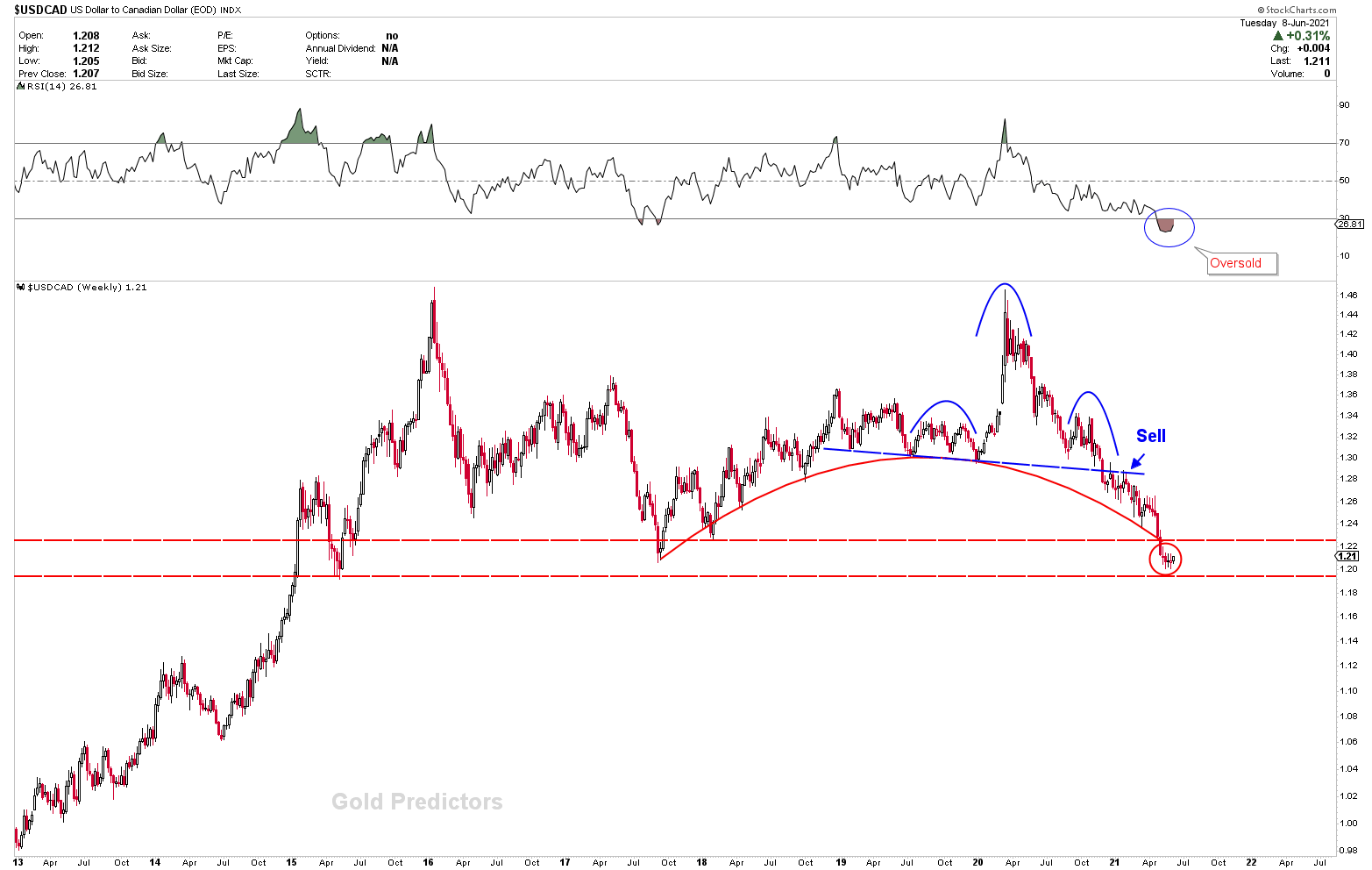

The chart below shows the strength of the Canadian dollar in relation to the US dollar weakness. Because the dollar index is trading near long-term inflection points, the USDCAD is also trading near long-term supports. The price is extremely oversold, and a bounce from this level will present the market with another selling opportunity. The development of patterns in USDCAD over the long term suggest that the instrument is headed lower. However, selling on a bounce would be a good bet to take advantage of this opportunity.

The chart below, which shows a similar scenario of bullish price patterns, was developed a few weeks ago. In EURUSD, the flag was broken, indicating a strong rally if new highs in the pair are broken.