Gold Targets $4,000 After Healthy Correction From $3,500 Resistance

Gold has long been viewed as a safe-haven investment during times of uncertainty. In recent months, its price has shown strong momentum and significant upward movement. Investors and traders are closely monitoring gold’s performance to gauge its next direction. According to the latest technical analysis, gold has broken above $3,350 and reached the key resistance at $3,500. A sharp correction has followed from this level, and the market is now seeking its next move. This article explores recent gold price trends to provide insight into where the market may head next.

Gold Breakout Above $3,500 Signals Potential Rally to $4,000

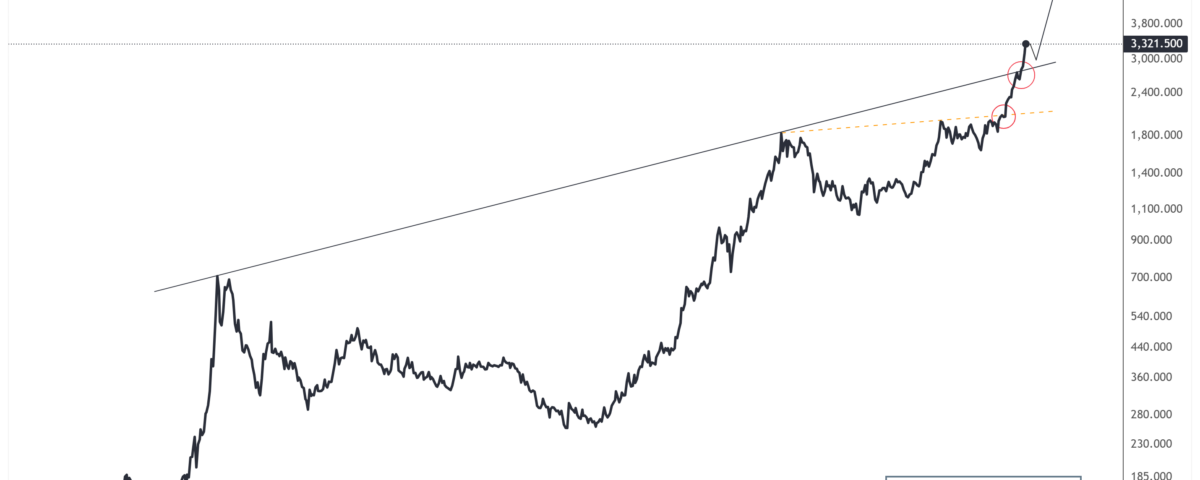

The monthly gold chart shows long-term price trends from 1970 to 2025. Historically, gold has moved in strong upward waves during times of inflation, currency devaluation, and geopolitical tension. In the 1970s, gold rose sharply and formed its first major peak. After a long correction, gold started another bullish phase in the early 2000s, reaching around $1,900 by 2011.

From 2011 to 2019, gold moved sideways. But since 2020, the price has gained momentum again. The chart clearly shows that gold broke a key horizontal resistance level marked with an orange dashed line near $1,900-$2000. This breakout led to a rapid price increase. Recently, gold has also broken above a major long-term trend line that acted as resistance for the past 40 years. This breakout was highlighted with red circles on the chart.

Currently, gold is trading at a strong price point. A price correction from this zone may set the stage for another surge in the gold market, potentially targeting the $4,000 and $6,000 levels. The black arrow on the chart shows a possible future path with a short-term correction followed by continued bullish momentum. This long-term breakout is very important. It suggests that gold may enter a super bullish cycle in the coming years if it holds above the breakout level.

Gold Price Holds Above Key Support as Uptrend Remains Intact

The weekly chart for gold shows a strong and steady upward trend. Gold has been moving inside a parallel ascending channel for over a year. Each dip has been followed by a recovery, which indicates strong buyer interest.

Recently, gold reached the upper red trend line resistance at $3,500. This price level has been marked with a pink arrow and a yellow circle. The price touched this resistance and slightly pulled back, now trading around $3,315. This small pullback is natural in any strong uptrend. The immediate support for this correction is at $3,280, while the overall pattern remains bullish as long as the price holds above the $3,000 level. If gold maintains this zone, it may build enough strength to break above the $3,500 mark.

Moreover, the trend within the channel is consistent and strong. Traders and analysts will be watching closely to see if gold can break above $3,500 in the next few weeks. If it does, the next targets could be $4,000.

Final Words

In conclusion, gold remains in a strong uptrend despite the recent pullback from $3,500. The price continues to hold above key support levels, suggesting that bullish momentum is intact. If gold maintains the $3,000–$3,280 zone, it could soon attempt another breakout. A move above $3,500 may open the path toward $4,000 and beyond, confirming a long-term bullish cycle.