Gold Fluctuations Around $1,680 Inflection

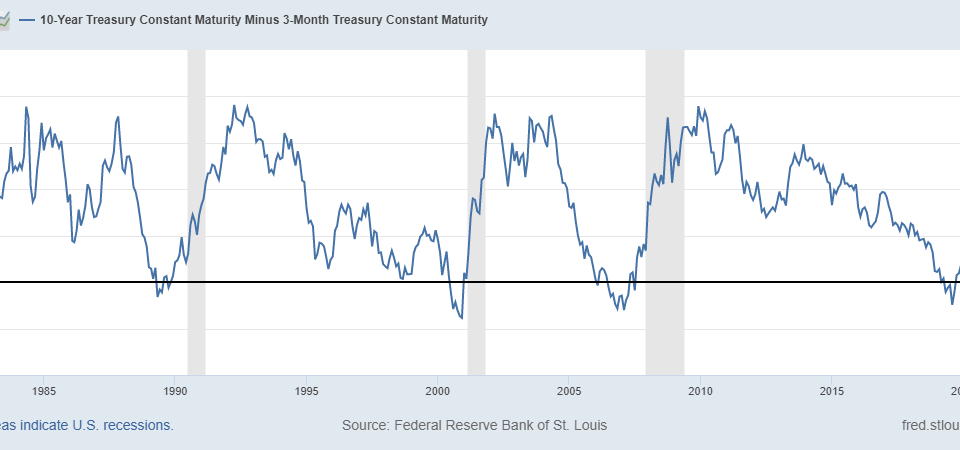

Due to a huge breakout from the $1680 inflection point, gold fluctuates in broad ranges with substantial market uncertainty. The market falls below $1,650, eroding some of Friday’s positive bounce from the $1680 inflection point. The US dollar, on the other hand, makes a strong return and quickly recovers from a two-week low, which is considered a crucial factor placing downward pressure on the gold market. Despite rumors’ that some Fed officials are becoming more concerned about excessive rate rises, investors seem to be confident that the US central bank will continue its aggressive policy tightening cycle. This, in turn, supports rising US Treasury bond yields and aids the greenback’s recovery.

Moreover, in upcoming future policy meetings, the European Central Bank and the Bank of England are likely to deliver a big rate rise. Another mechanism forcing flows away from the yellow metal. Aside from that, a minor improvement in risk sentiment, as seen by a bullish tone in equities markets, is weighing on the safe-haven gold. However, rising recession worries may assist to minimize the metal’s losses. Investors are worried about the economic headwinds caused by fast-increasing borrowing prices and the extended Russia-Ukraine conflict. This, along with China’s rigorous COVID policy, has fuelled fears of a more severe global economic crisis. The mixed underlying background necessitates considerable caution before initiating strong negative wagers on gold and preparing for any additional decline. Traders are now looking for some encouragement from the flash US PMI prints.

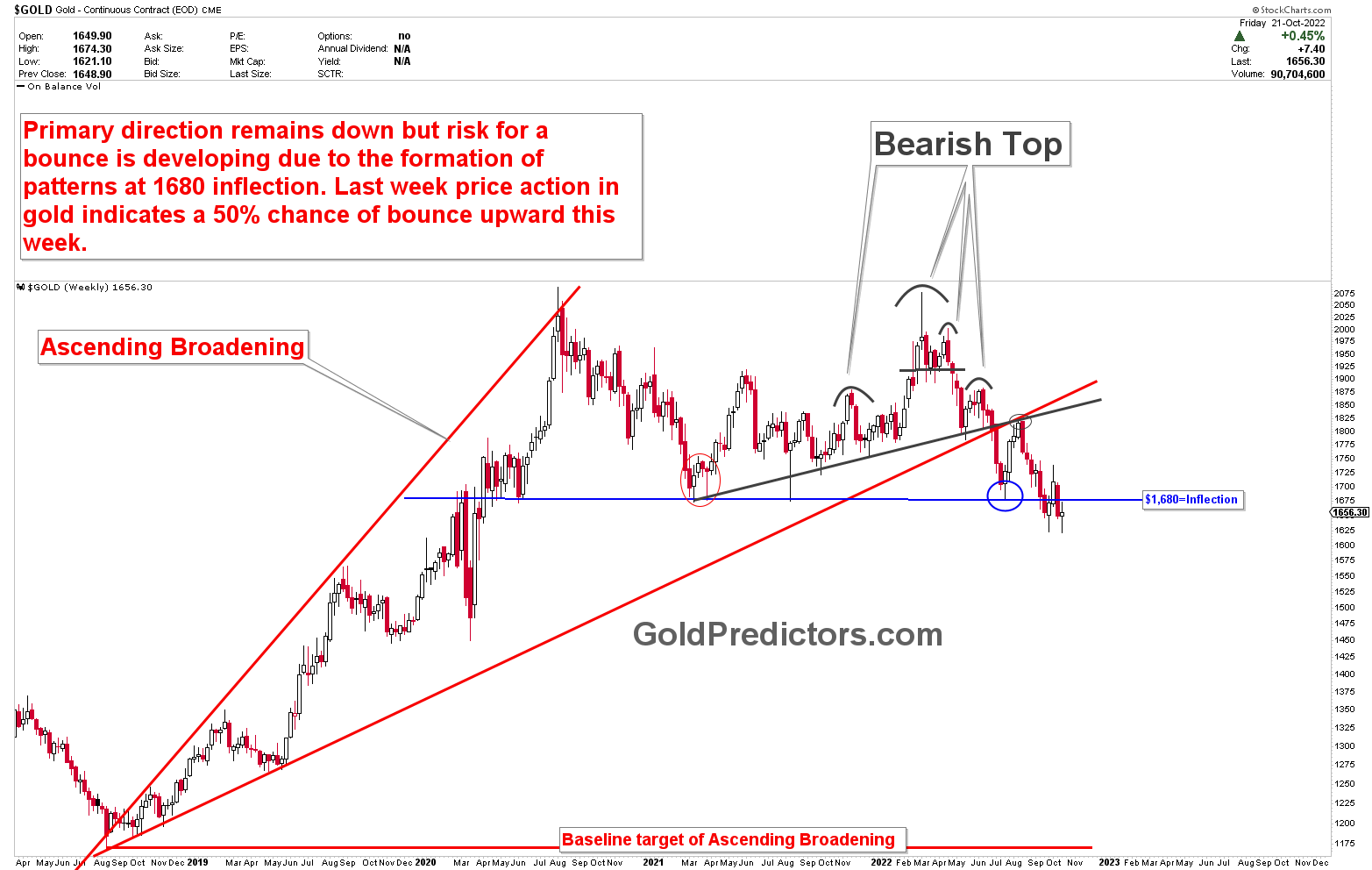

The chart which we have been discussing with members from last 12 months was broken few weeks ago with the broken ascending broadening patterns. The breakage of ascending broadening resulted in the slide towards the inflection of $1,680. Then next breakout from 1680 produced another slide whereby, we expected a strong bounce 3 weeks ago. The bounce was completed, but due to the emerging patterns in US dollar and other correlated markets, gold is producing another chance of another bounce before the next decline. The primary outlook has not been changed as shown in the chart below.

The above chart speaks itself and tells the story of gold maket. The bearish top including the double top and head and shoulders remains the primary concern and any bounce from current levels must not change the scenarios.

Please login to read full article!

Please subscribe to the link below to receive free updates.