Dollar Strength Persist

Dollar strength persist as we predicted in last week’s report. GBPAUD and GBPNZD were mostly bullish, and USDJPY is meeting its oscillation’s objectives at the triangle. GBPUSD was paused as we illustrated in the report, due to dollar strength and key reversal on weekly charts. But GBP and USD were strongest currencies last week as per our expectations, GBPJPY on other hands shoots higher.

Highlights

- The decision by OPEC not to raise output next month, combined with Fed Chair Powell’s apparent lack of concern about long-term rates, surged the dollar. Oil is up, yields are up, equity markets are down.

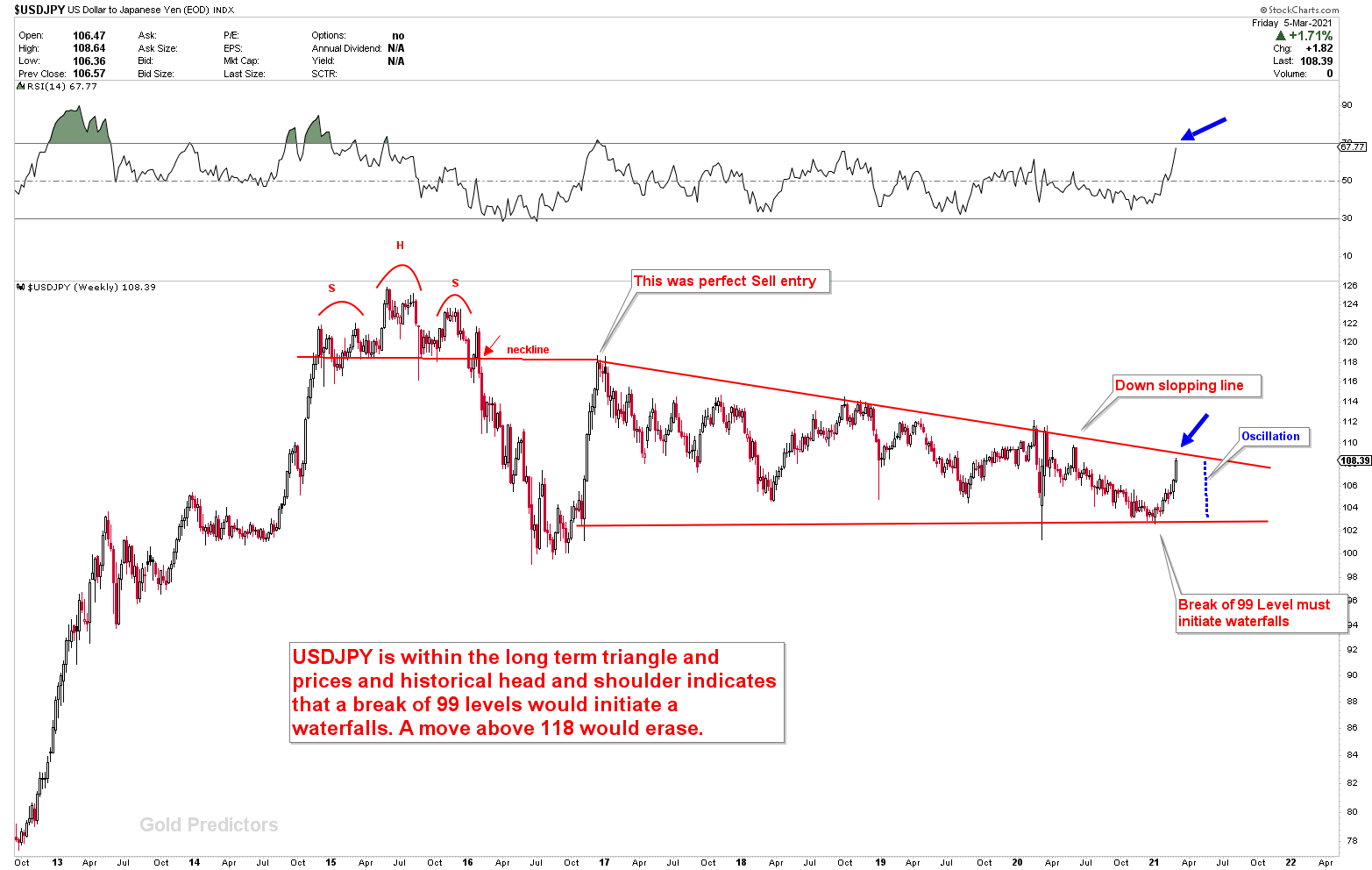

- The dollar’s rally against the yen is still going strong, and the greenback is teasing with the JPY108.50 level, which it hasn’t seen since June. It was expected in last reports as per the part of oscillation, USDJPY has to hit the triangle resistance soon. The time for that comes in March 2021.

Weakest currency: CHF, NZD

Strongest Currency: USD, GBP

Best Instruments to Focus:

LONG GBPCHF

LONG GBPNZD

Weakes and strongest currencies remain same as last week

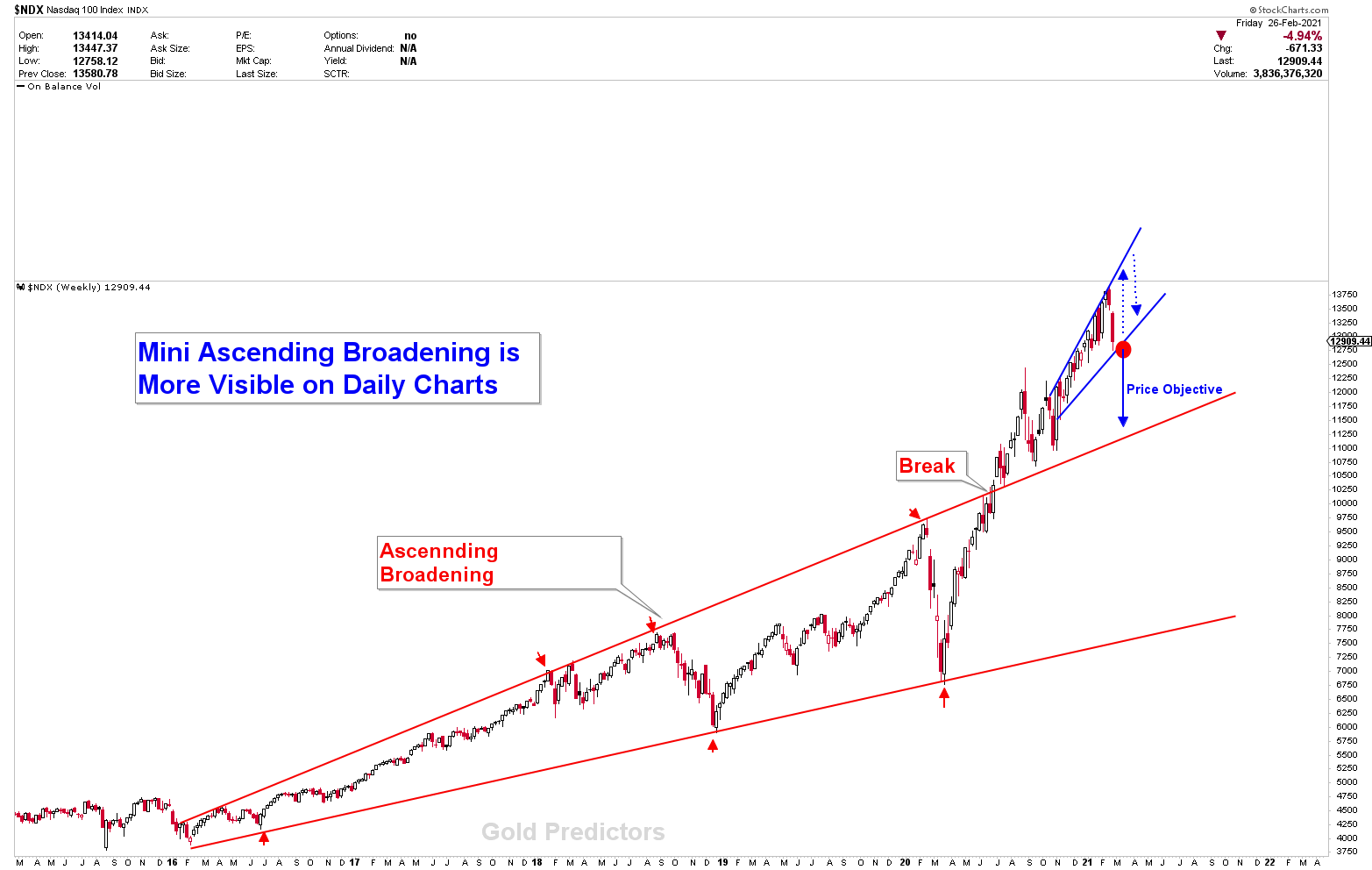

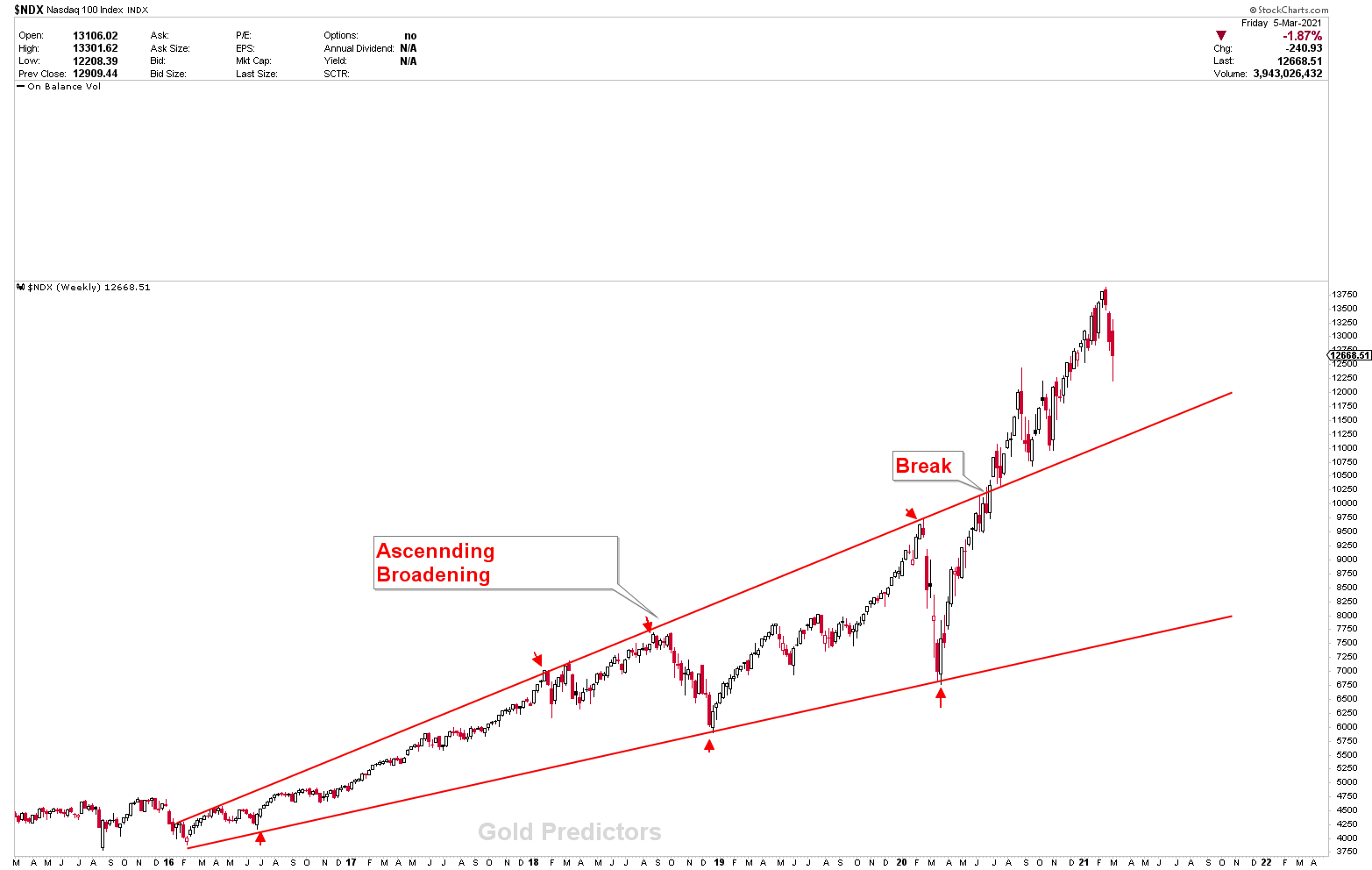

Only Gold Predictors premium members are aware of what we forecasted in NASDAQ while discussing the gold market’s state in premium article’s section. Last week, we demonstrates the NASDAQ chart as below.

Nasdaq dropped sharply, and the chart now looks like this.

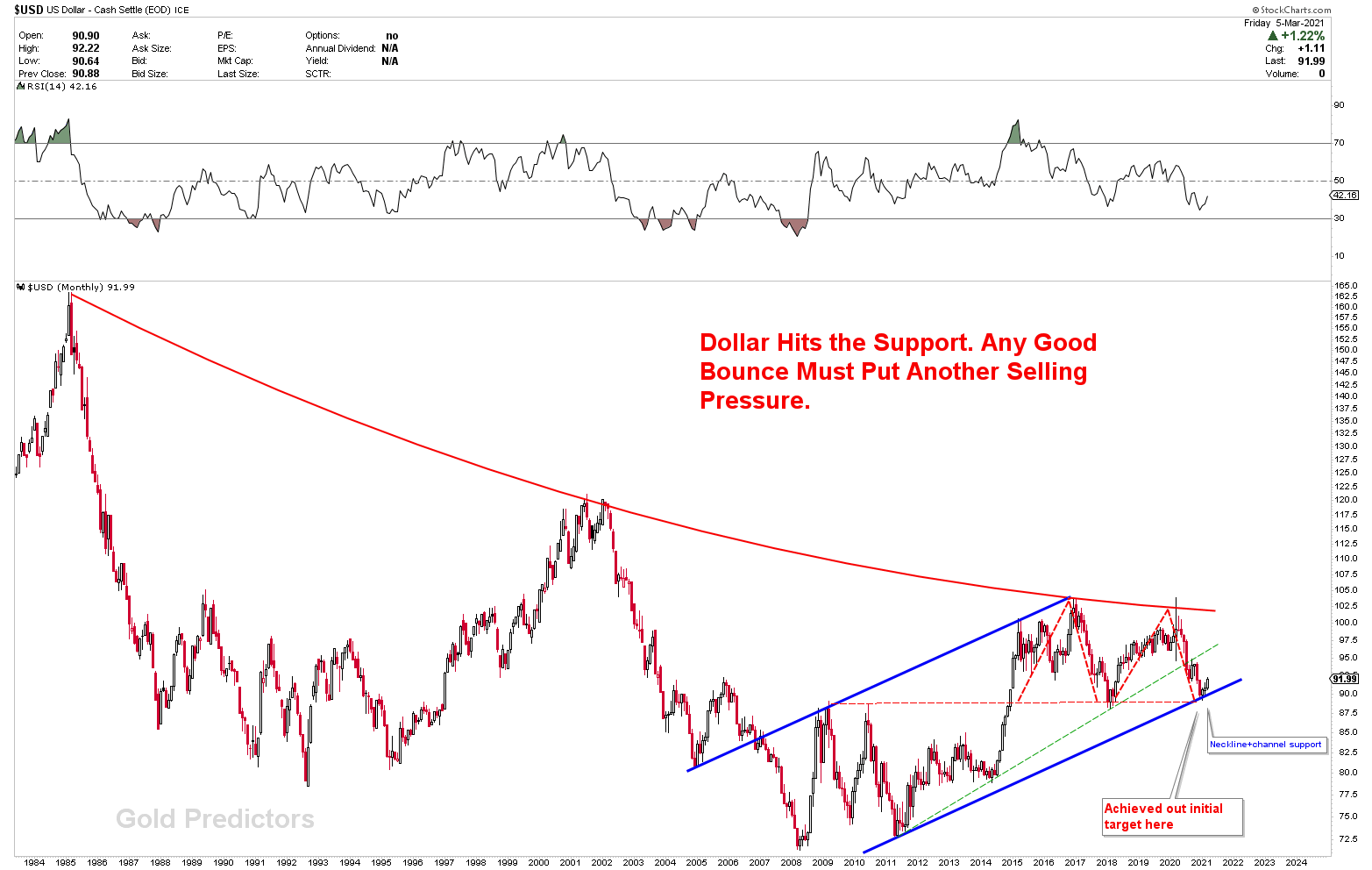

Let’s have a look at the dollar monthly chart. The chart below has been updated from the previous article, so no further explanation is required. The dollar has risen sharply, as expected. After last week’s move, the dollar strength persist on Monday.

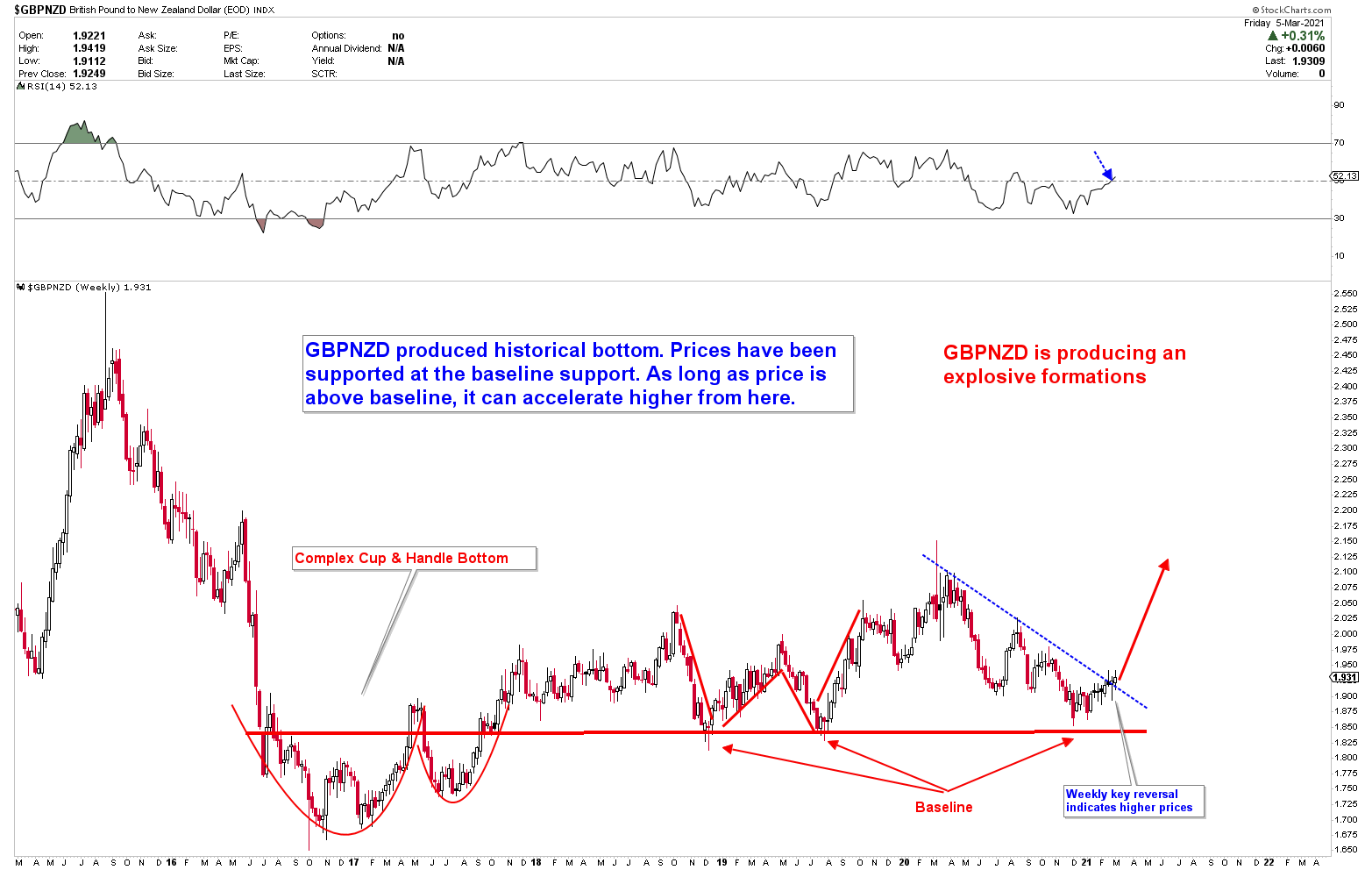

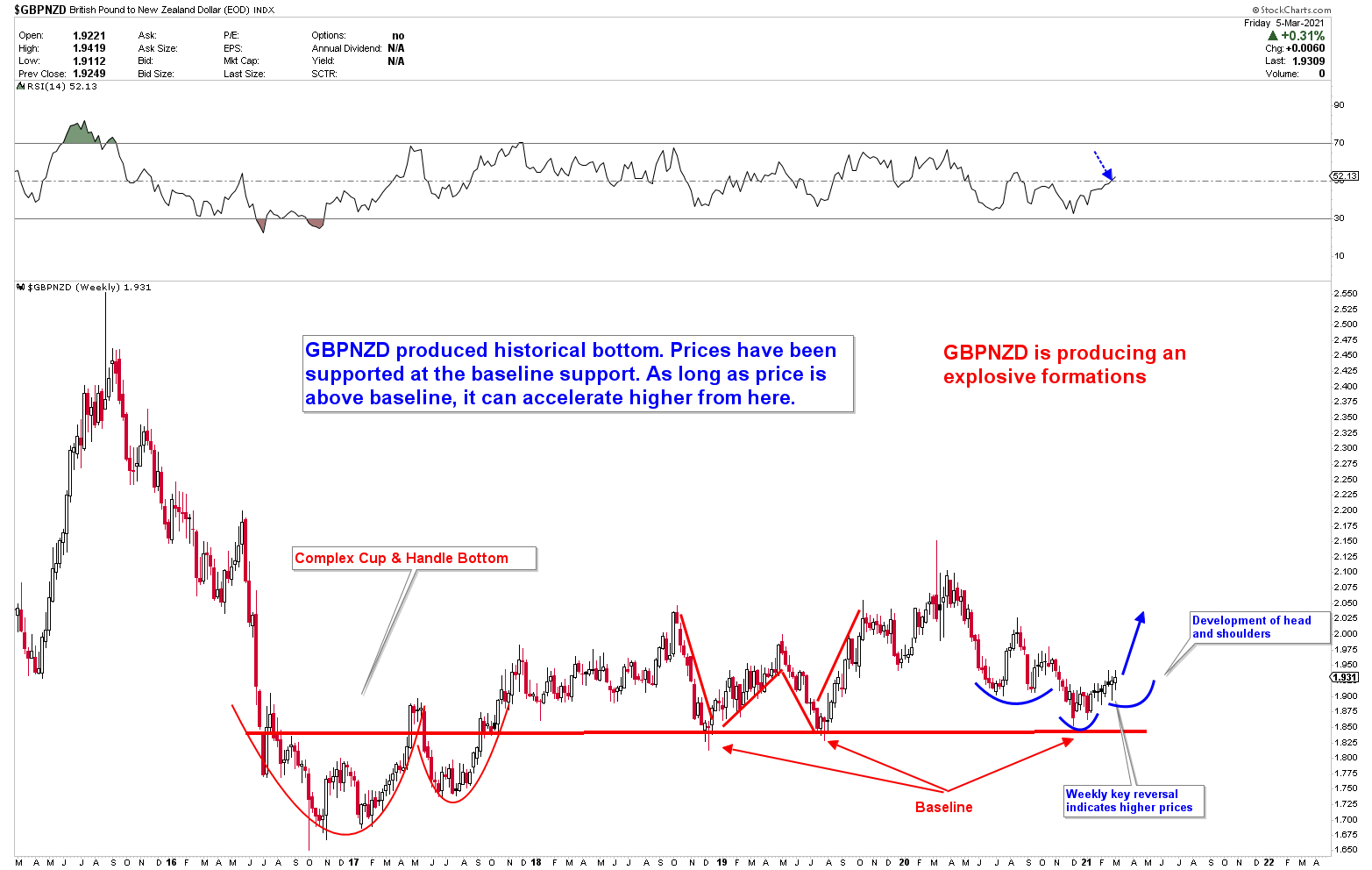

The patterns on the GBPNZD appear to be very strong, and as we have been addressing this instrument for the past two weeks to describe the bullish bias in the instrument, GBPNZD rose more than 300 pips last week, and looks to explode in the months ahead following the Red arrow. GBPNZD remain in explosive condition until the baseline support holds.

The new development in the GBPNZD chart is like an inverted head and shoulder pattern, which must be developed next, indicating that the instrument’s next path will be upward. However break of baseline support would negate the scenario.

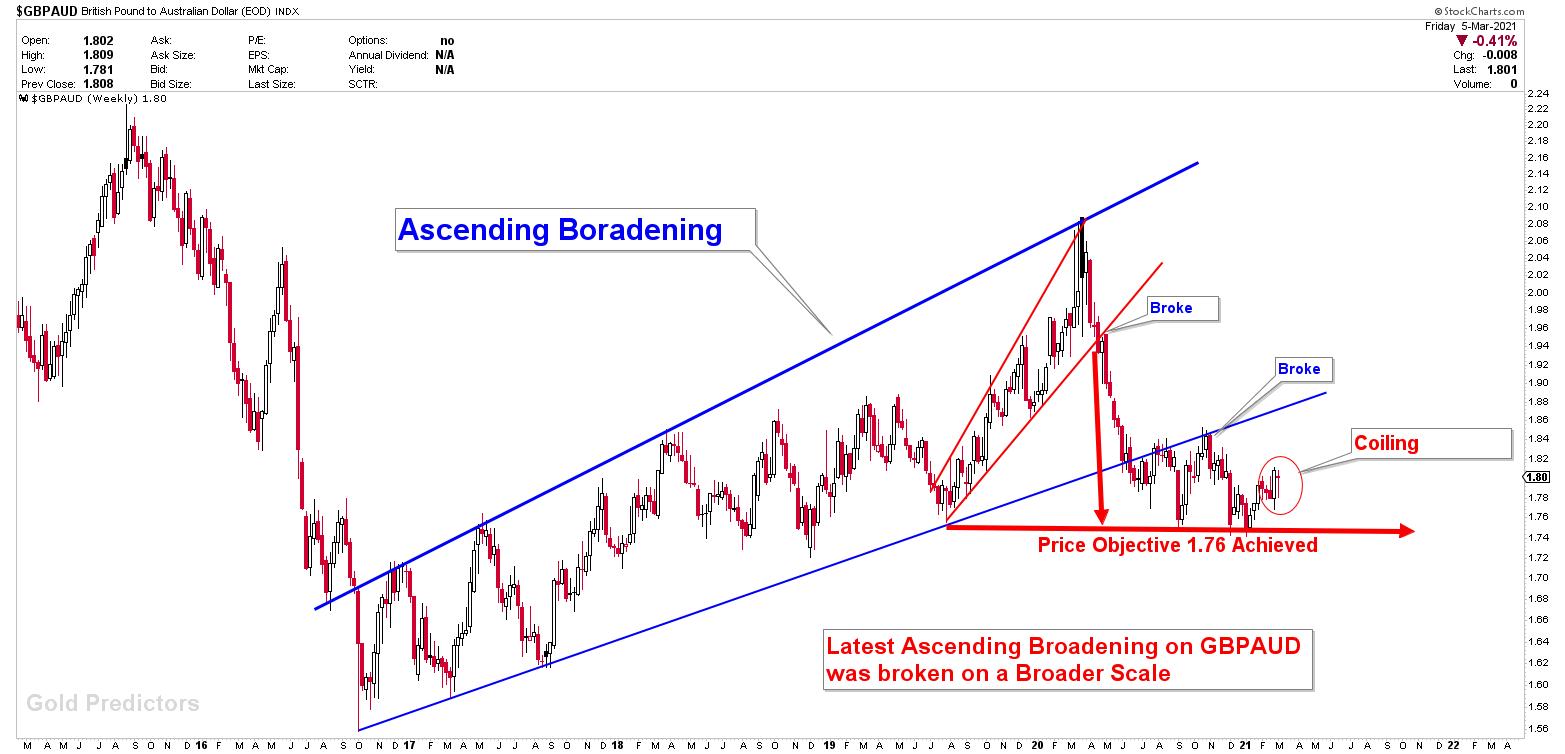

Last week, GBPAUD formed an inside week bar, implying that a break above the previous week’s highs would be a powerful move upward. Looking at the dollar strength, the AUDUSD appears to be on the verge of finding support at lower levels. It will be difficult for GBPAUD to find much support for a healthy rise, if AUDUSD rises. In that case, the instrument’s ability to rise would be limited to pound strength alone.

Trading this instrument should be done with caution. But Expect a positive direction. 1.8090-1.8110 must be breached first.

As a result of the dollar strength and the JPY’s weakness, the USDJPY has soared and is now approaching the triangle on our last chart. We are still not executing any long trades in JPY pairs following the significant levels, as we mentioned previously about the weakness of the JPY and the strength of the GBP.

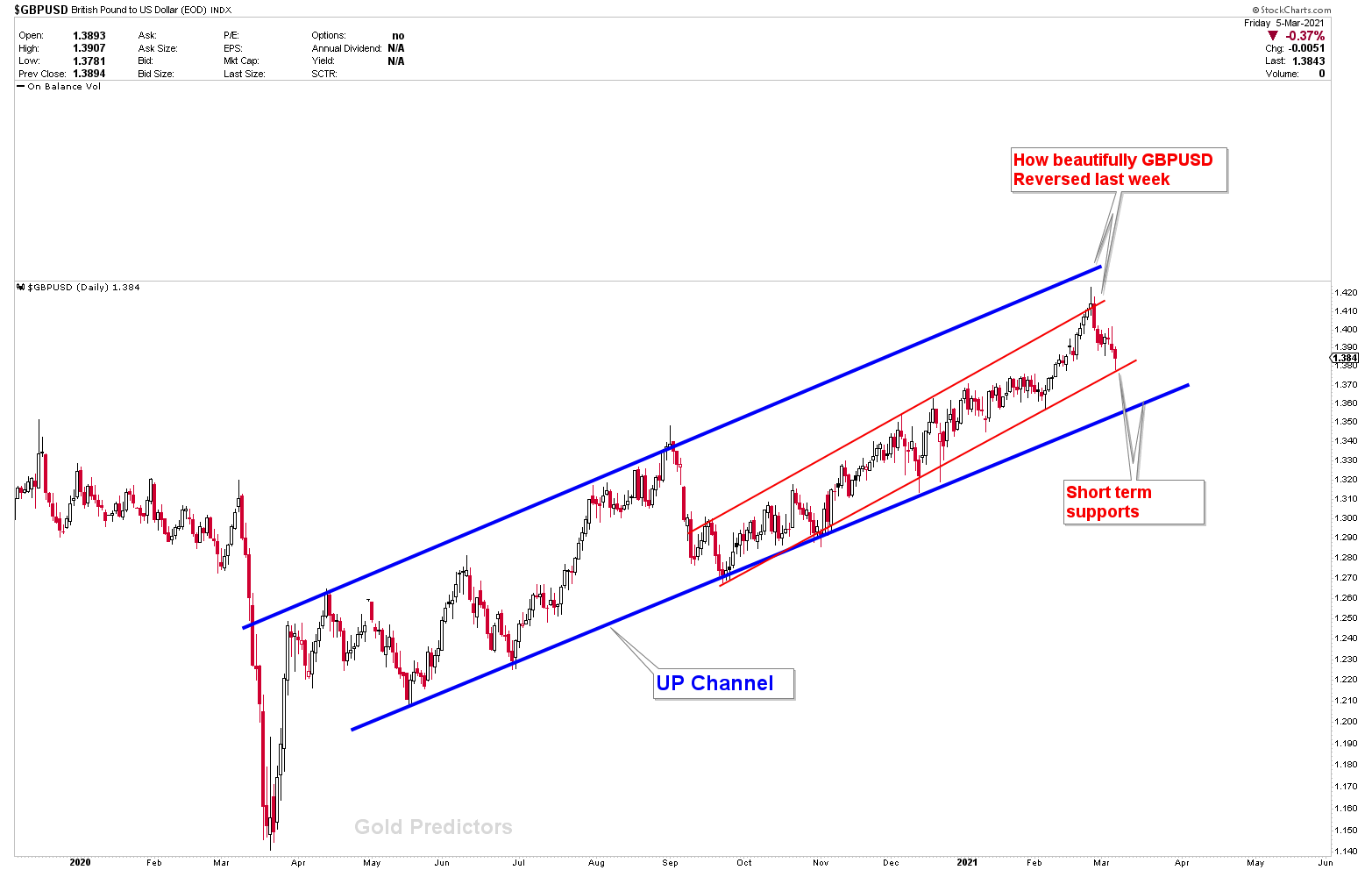

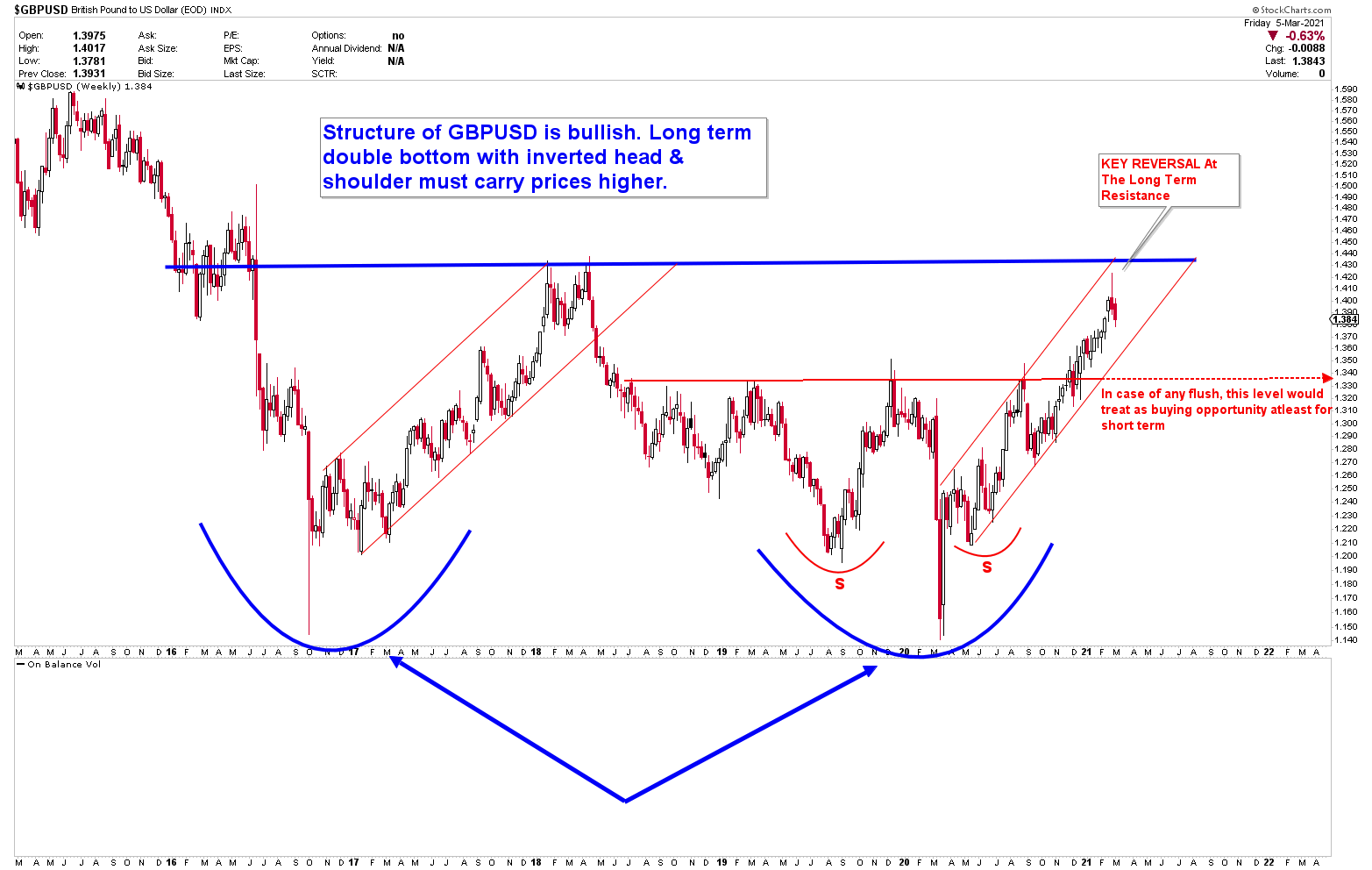

GBPUSD spent the entire week within the red channel, eventually finding support at the red channel’s lower line on Friday. If this support is broken, the blue channel line will be the next level to watch. Although we expect the GBP to remain strong, the dollar strength makes this instrument unsuitable for trading. This is same words from out last update.

This is update of weekly chart from last article.

The strongest currencies on the board are the US dollar (USD) and the British pound (GBP), while the weakest currencies are the New Zealand dollar (NZD) and the Swiss franc (CHF). There is still no sign of a dollar rollback, and it appears that the dollar will strengthen on Monday’s opening, influencing Gold’s ability to achieve its objectives. We’ll cover gold and silver in the Premium section as a special articles. At 109-109.80, the USDJPY has strong resistance. The red and then blue channel lines provide support for the GBPUSD. Finally, final support is situated at the weekly chart’s Bottom arrow (GBPUSD); if in case, that level is reached in GBPUSD, the dollar will reverse by following a bottom in AUDUSD, commodities, precious metals, and EUR.

To receive the free trading alerts, signals and articles please subscribe as a Free member to the link below.

Note: The subject highlights the ideas and thoughts of the writer for educational support that can be used to enable the reader to become an independent thinker and decision maker.