Dollar Poised to Go Lower

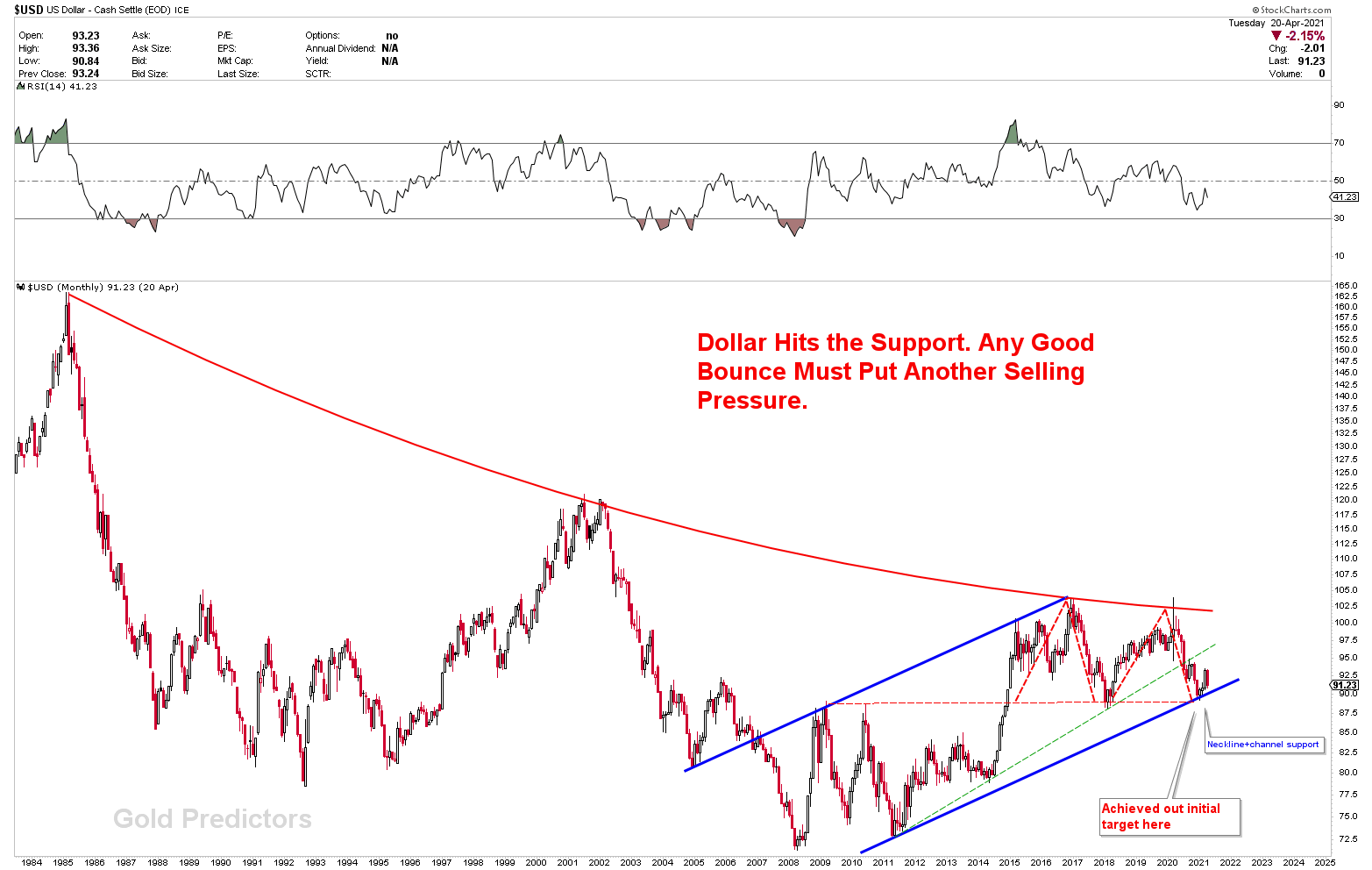

On a broader scale, we’ve been discussing dollar weakness. Price has now approached some critical levels, where a breakout could crash dollar. In simple words, dollar is poised to go lower.

Highlights

We didn’t recommend any trading instruments last week. The dollar was expected to fall sharply. The dollar is about to crash in line with our expectations.

Weakest currency: USD

Strongest Currency: EUR, CAD

Best Instruments to Focus:

Long EURUSD

Short USDJPY

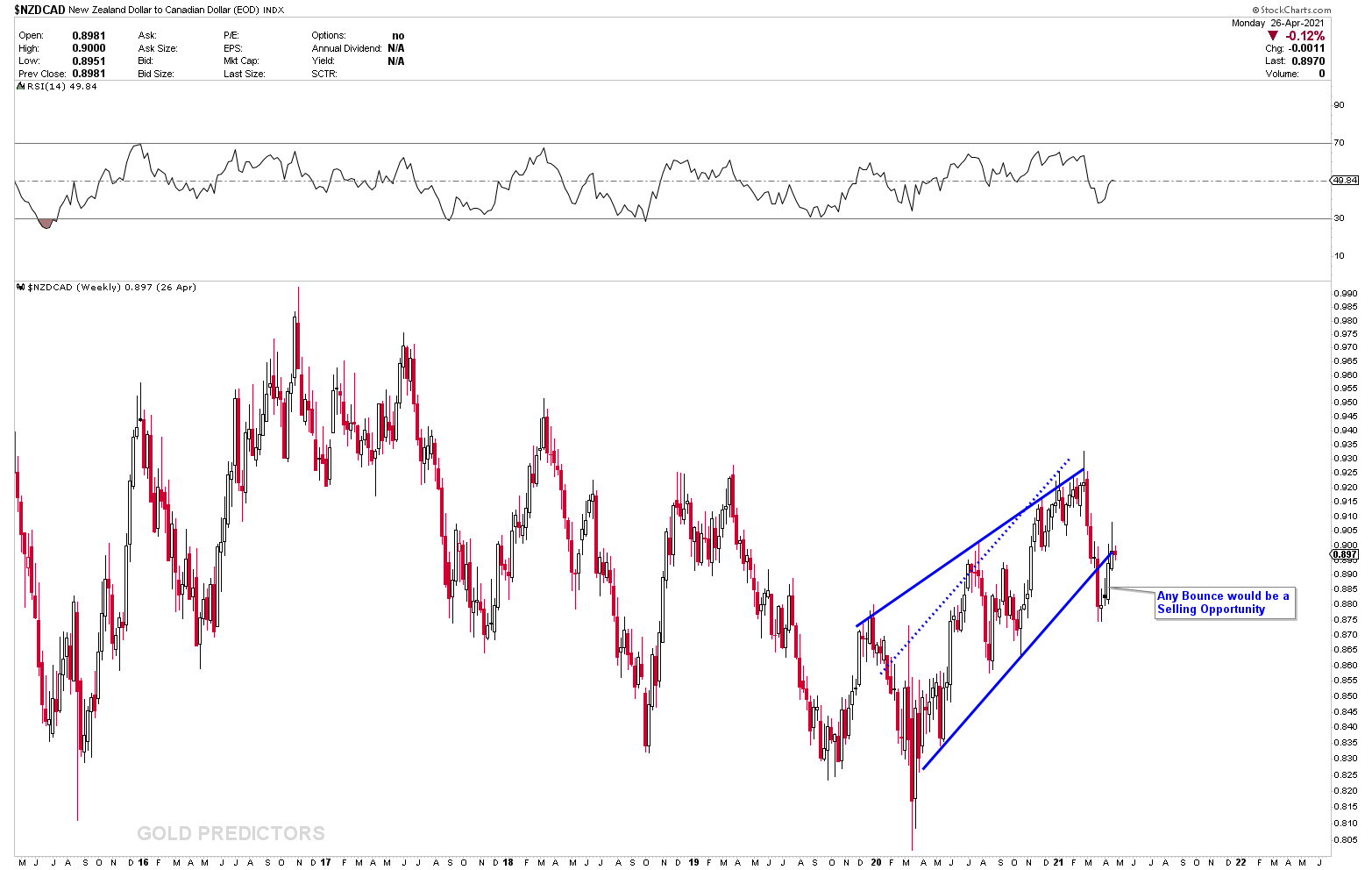

Short NZDCAD

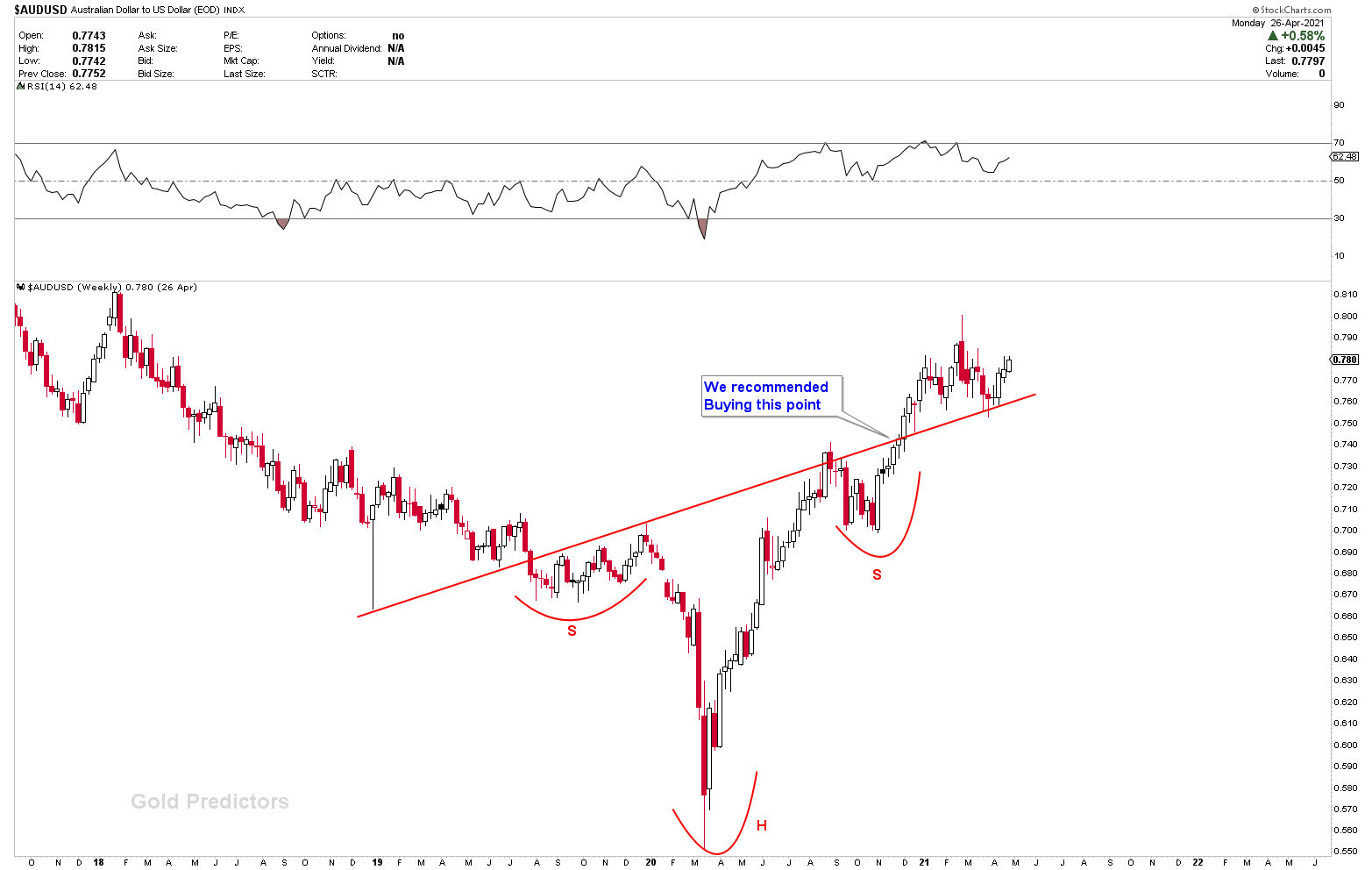

Long AUDUSD

Short USDCAD

Short USDCHF

Dollar is Poised to Go Lower

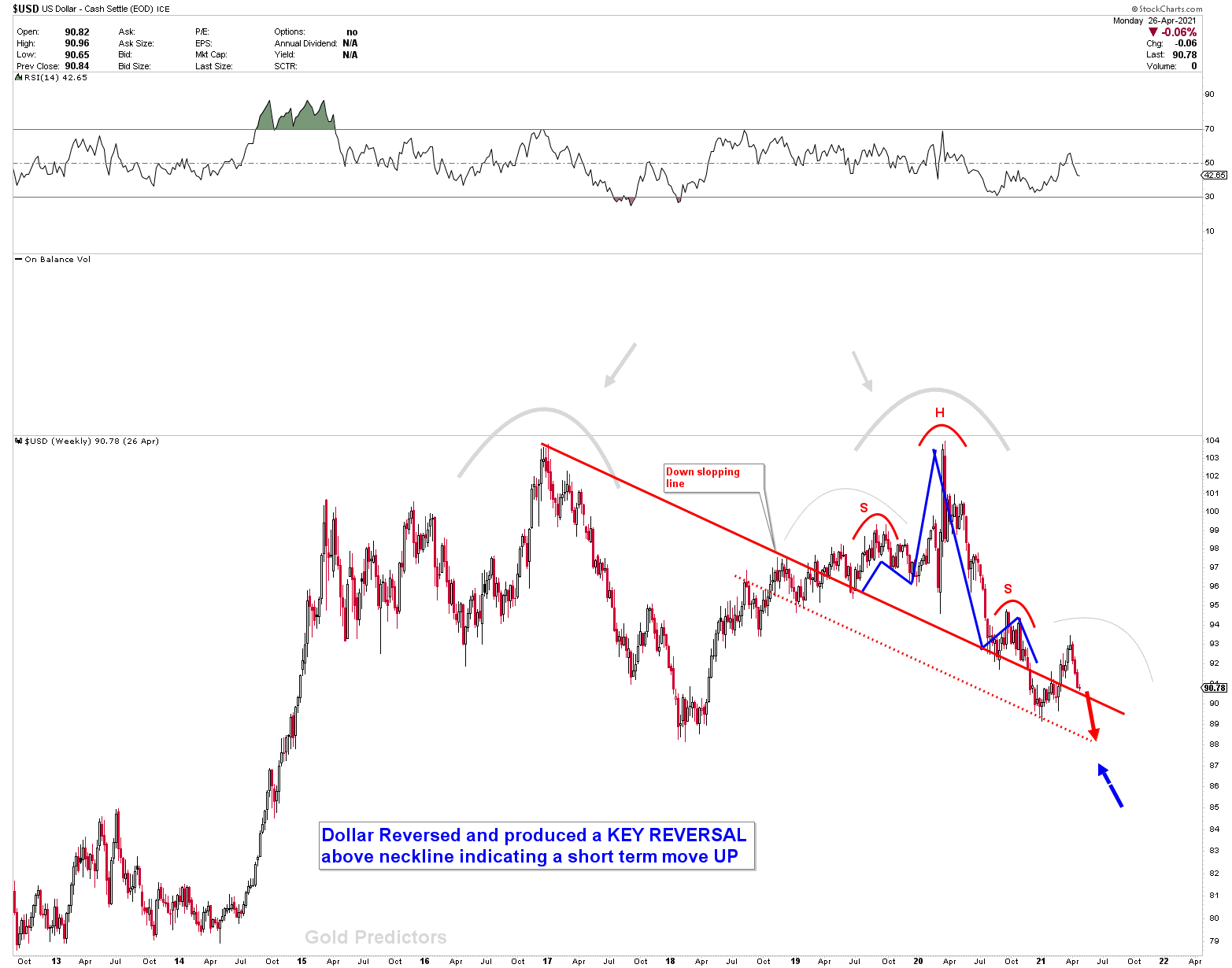

The USD is poised to go lower. A bounce from key levels is quite common, and it has no effect on the dollar’s tone. If a bounce occurs, it must be viewed as a selling opportunity. On monthly chart prices are approaching at long term inflection and long term development of patterns suggest that dollar is poised to go lower.

The EUR and AUD are the best currencies to be used to profit from the dollar’s weakness. The AUDUSD has tested the rising inverted head and shoulder neckline, and a quick bounce from the neckline indicates that the pair will continue to advance. Any pullbacks in the instrument should be viewed as a buying opportunity.

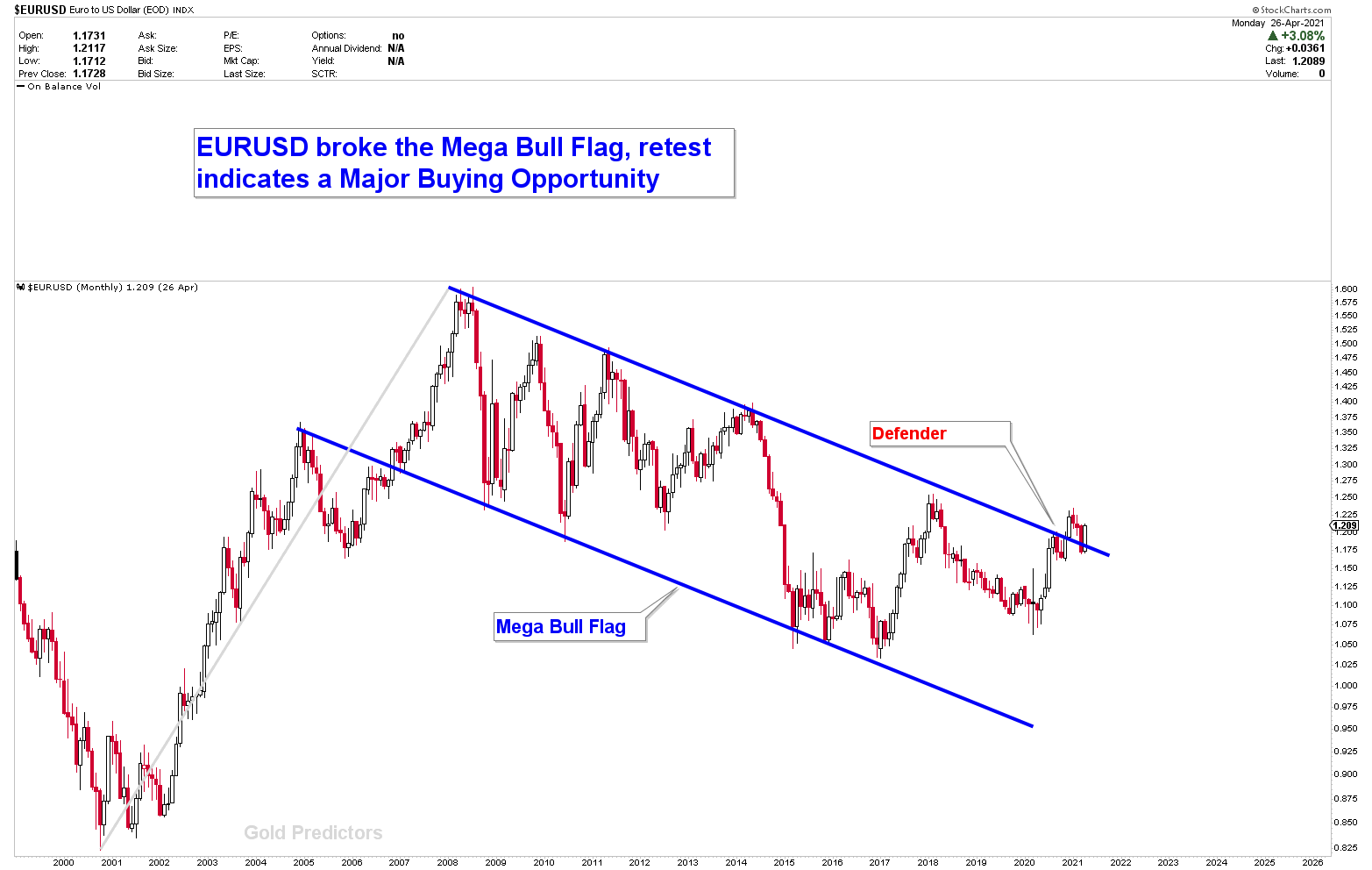

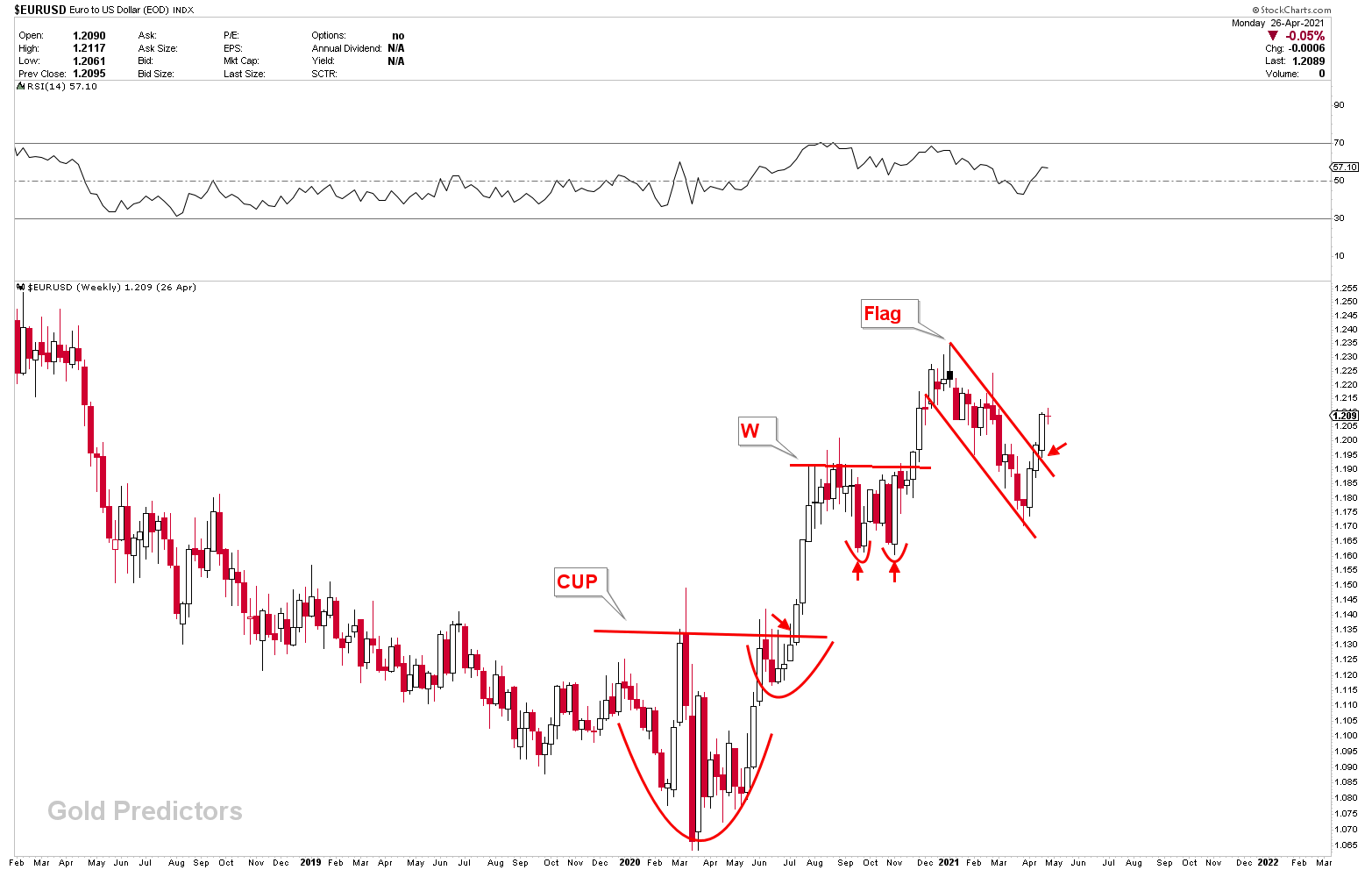

EURUSD is another currency pair that has benefited from the weakening of the US dollar. A quick reversal from the broken flag in the month of April appears to be very strong, and prices are expected to rise from the region, according to a monthly chart, posted a few weeks ago. Any weakness should be viewed as an excellent buying opportunity. On the weekly chart, a flag breakout over the historical complex CUP & Handle with a double bottom W pattern indicates a strong move to the upside in the pair.

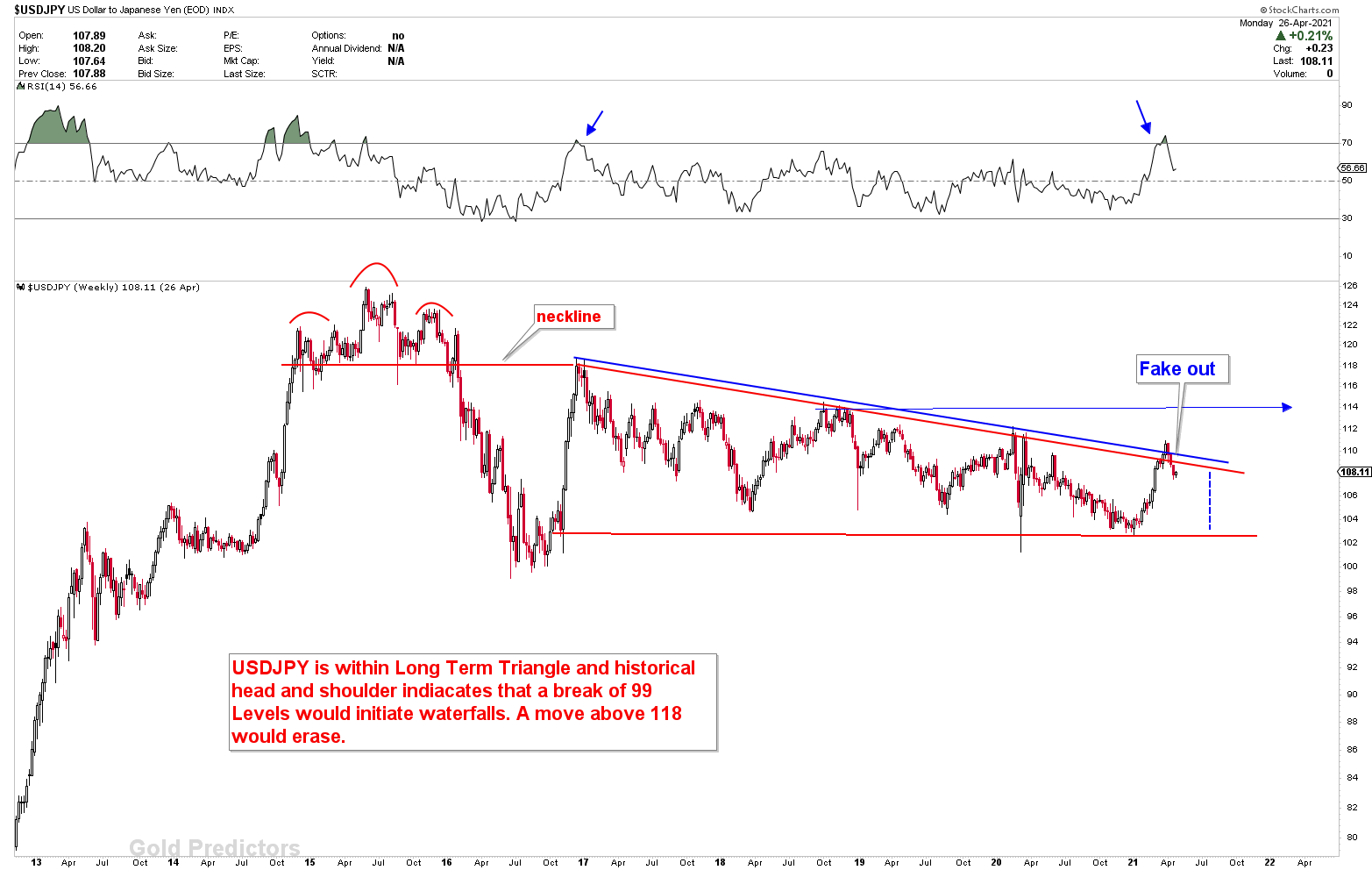

USDJPY is expected to fall as it retraces from a strong yearly inflection. However, because this instrument is so volatile, any significant move to upside should be viewed as a strong selling opportunity for the pair. Any strong bounce in the direction of the red line would act as a magnet to sell. However, the instrument is more than likely to be dropped sooner rather than later.

Canadian Dollar Strength

The chart was first shown a few weeks ago. A bounce to the blue breakout must be treated as a selling point, as we previously stated. It was a test last week, and the price was sold off. The pair is likely to fall as the Canadian dollar strengthens, but the New Zealand dollar is regaining some of its strength. When the New Zealand dollar’s recovery is complete, the pair must resume its downward trend. The best instrument to focus for the weeks ahead is USDCAD due to the weakness of USD and strength of CAD the pair is poised to crash.