Canadian Dollar Strengths

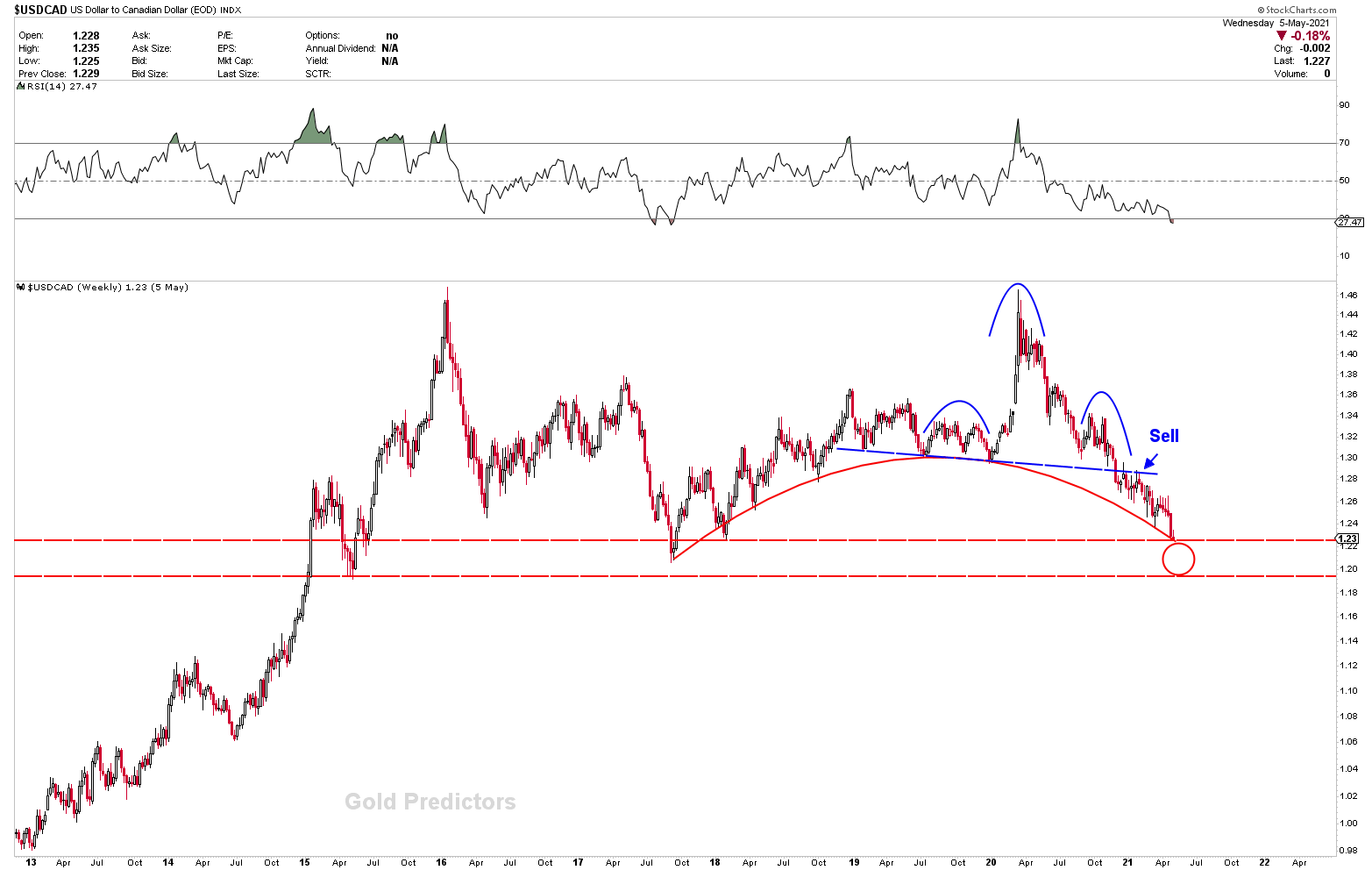

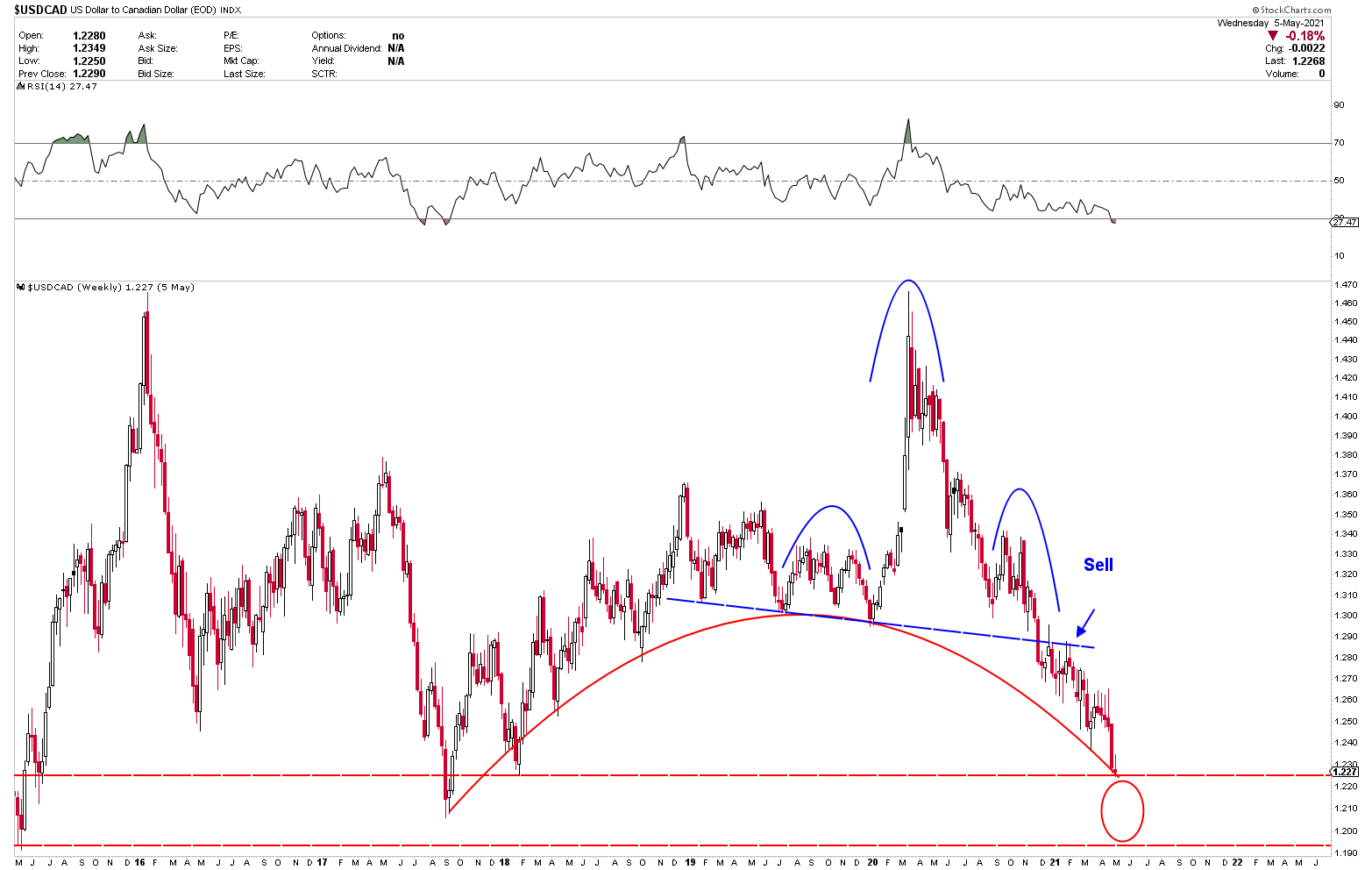

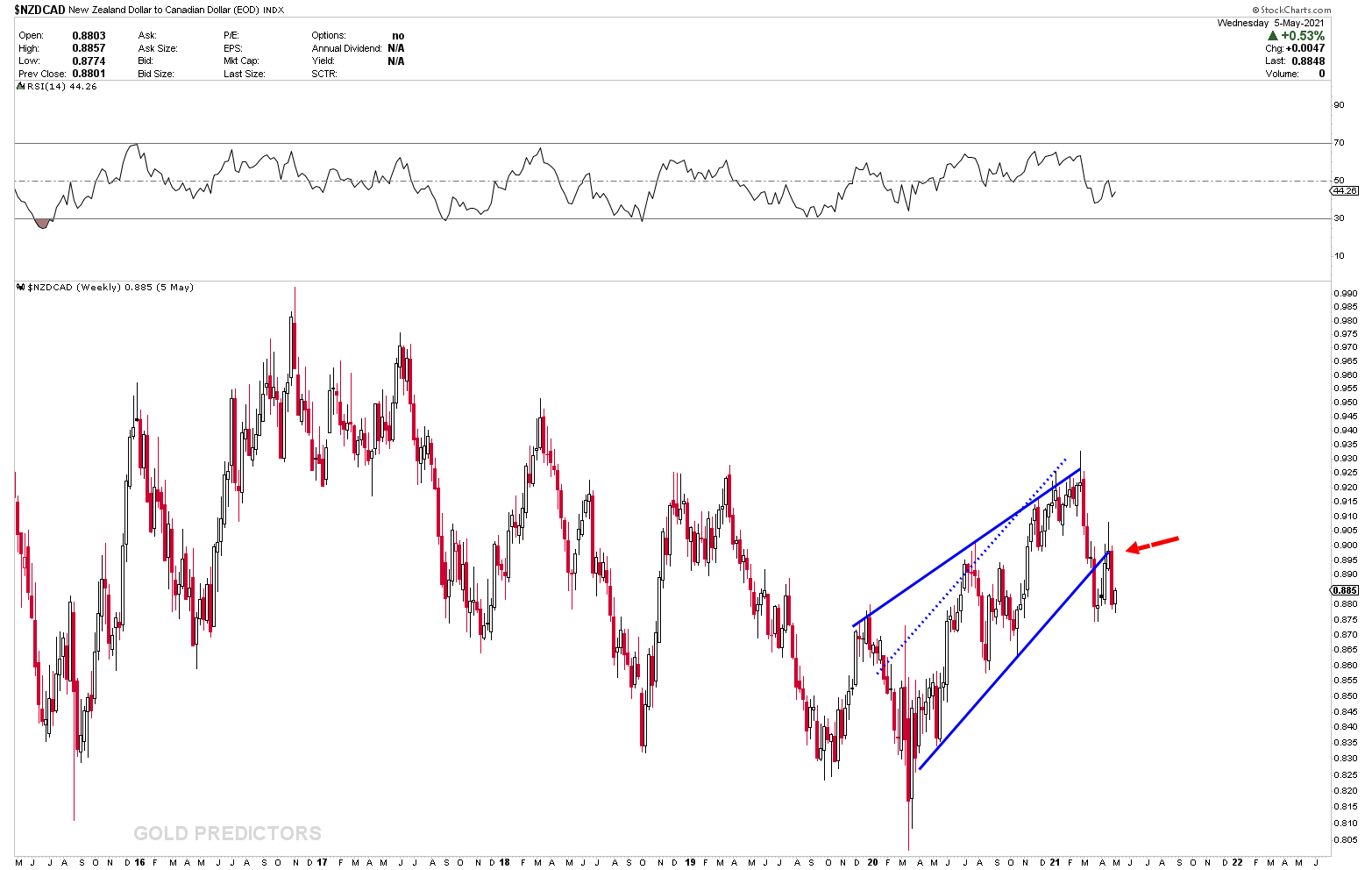

We discussed the Canadian dollar as the strongest currency to explode in the previous report. On the other hand, we have been discussing the possibility of a significant drop in the value of the US dollar. On major currency pairs, the Canadian dollar is exploding through its barriers and is now approaching the initial targets. NZDCAD and USDCAD looks the best pairs to benefit from Canadian dollar strength.

Highlights

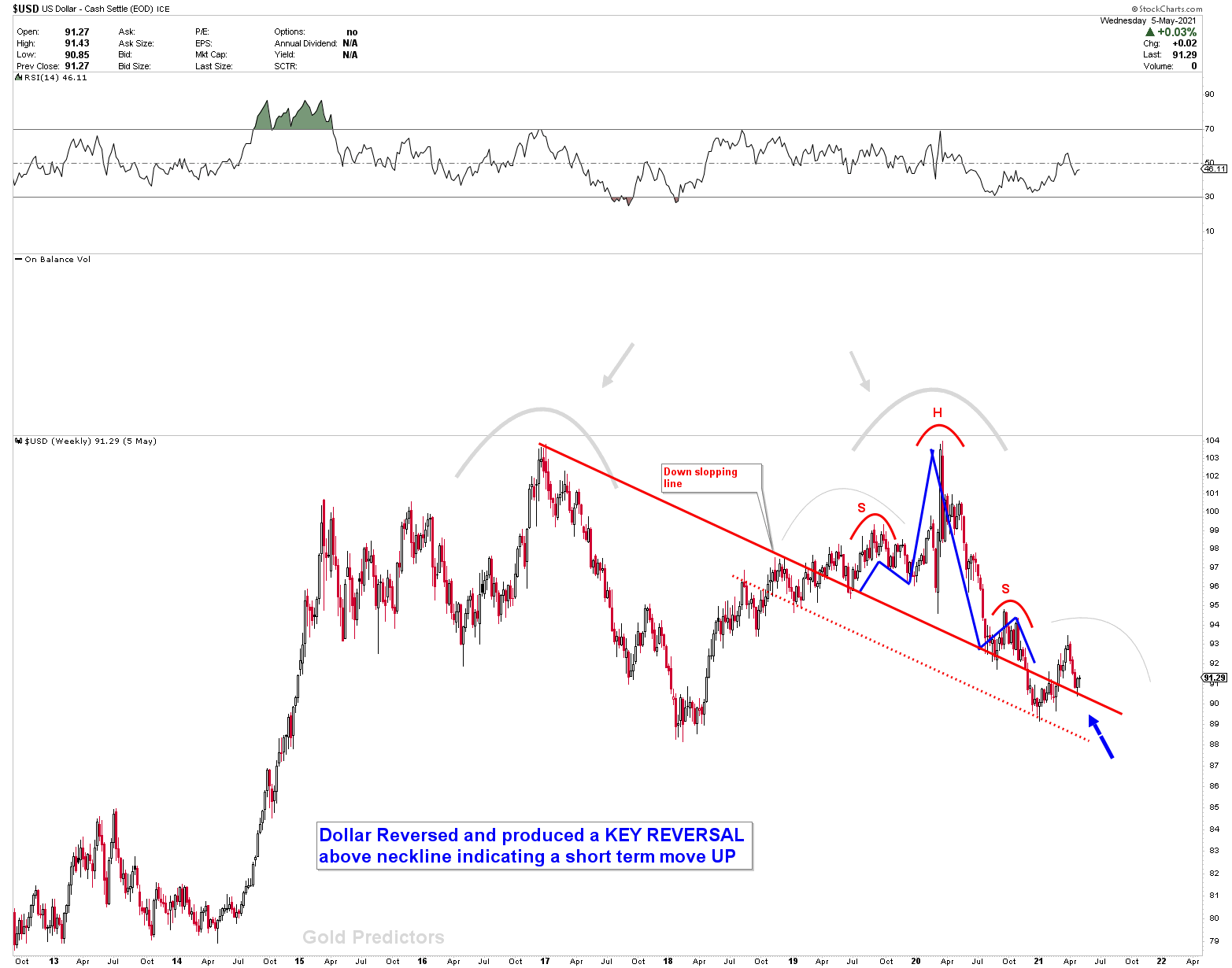

- EURUSD initially found support after rolling back from strong resistance, with the dollar trading on significant supports.

- NZDCAD hit the sell signal at rising wedge breakout and reversed sharply to hit lower levels

- US Dollar bounced off the neckline on weekly charts, producing a hammer.

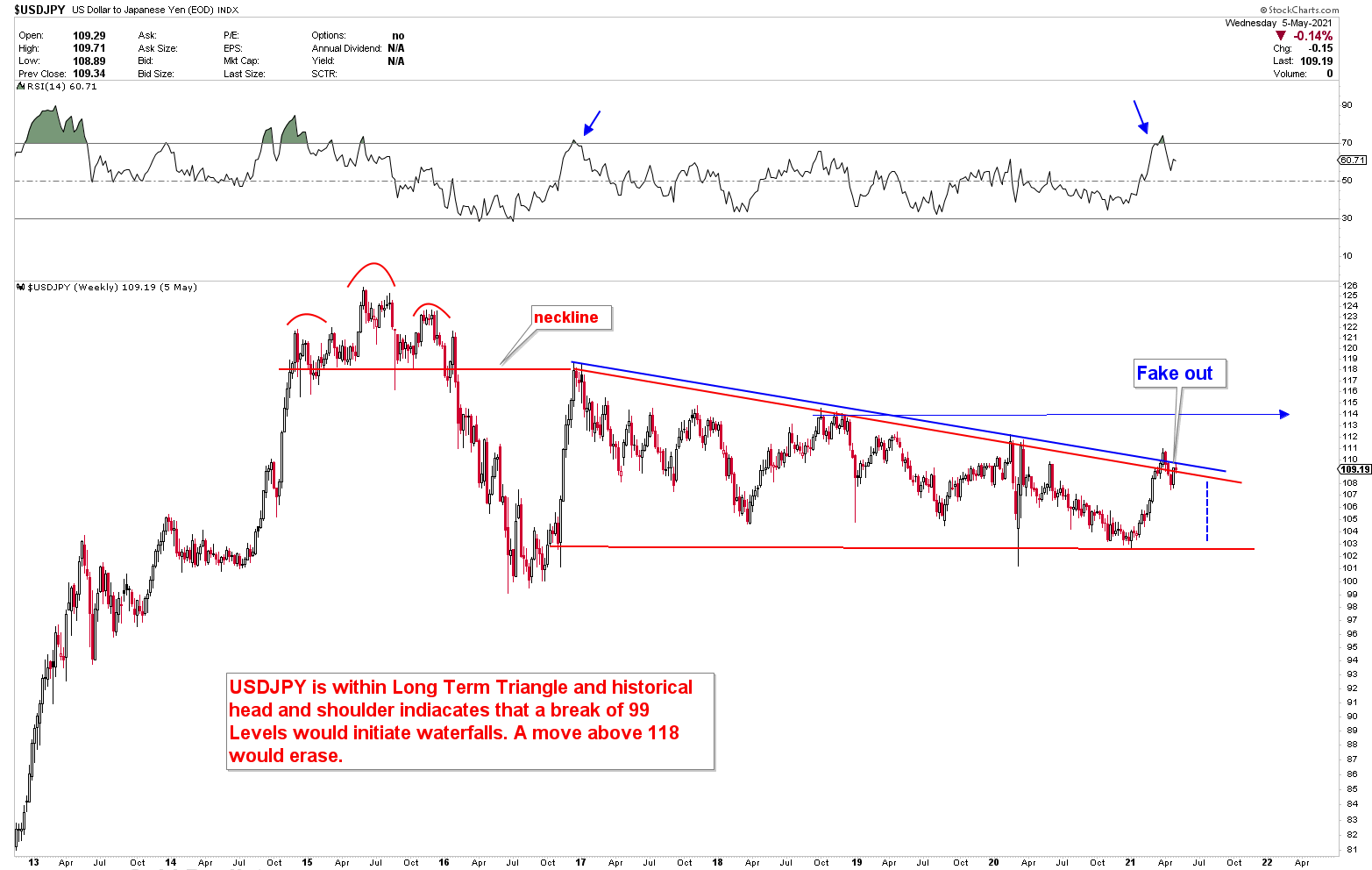

- The USDJPY has retested the triangle resistance, and daily charts are pointing to more resistance at these levels.

- USDCHF has crashed since we started a coil three weeks ago and is poised to fall even further, though dollar supports may halt the downward trend in the short term.

Weakest currency: Null

Strongest Currency: CAD

Best Instruments to Focus:

Short NZDCAD

Short USDCAD

Long AUDUSD

Canadian Dollar Explosion

The Canadian dollar continues to be the strongest currency on the board. The chart patterns are very prominent as the head and shoulders were formed few weeks ago. The perfect sell signal on this chart was developed when price hit the neckline after a breakout, as seen in the chart below. The instrument is poised to go much lower, but the weekly charts show significant support. If prices bounce from the circle, it will be a powerful selling opportunity. There is, however, no bounce signal at this time.

The chart analysis few weeks ago which demonstrated that any rebound in NZDCAD towards rising wedge must act as a selling opportunity, has been perfectly hit and prices have sold off the rising wedge resistance. In anticipation of the strength of the Canadian Dollar, prices will fall considerably lower.

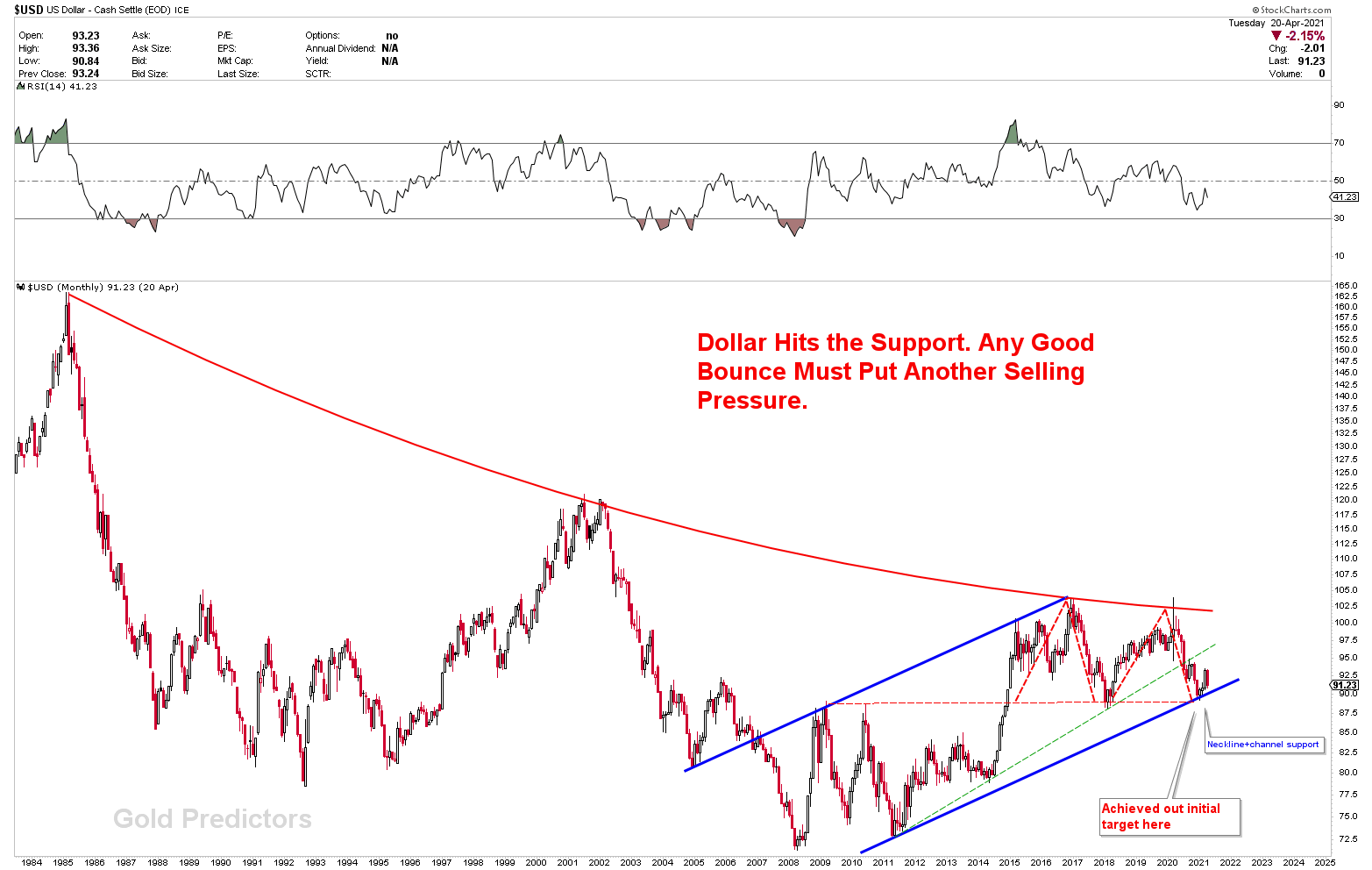

US Dollar Trading On Significant Level

We have been bearish in US dollars and the charts have become bearish week by week. However, last week there was a bullish Hammer on a neckline. That is a bullish US Dollar signal usually in the short run. This bounce scenario would be erased if the USD dropped below last week and closes the week below the red down slopping line as shown in the chart below. It would attract sellers again if USD chose to bounce one more time from this region. There might be sideways actions in the USD index and EURUSD in the short term before any meaningful trade has been taken. We recommend being cautious on dollar related pairs.

The significance of these levels in dollars can be seen in monthly dollar charts. A monthly breakdown under this rising channel would as M top and act as a predicted dollar collapse.

The blue trend line and triangle patterns are being tested once more by the USDJPY. As previously stated, this pair is highly volatile, and there may be zigzags. The key now is to figure out whether the instrument will break higher or crash lower. The area in USDJPY is significant because it serves as an inflection point for the pair.

To receive the free trading alerts, signals and articles please subscribe as a Free member to the link below.