Gold Price Surge Continues: Will $3,350 Resistance Break or Trigger Pullback?

The announcement of up to 245% tariffs on Chinese imports significantly escalates trade tensions and injects fresh uncertainty into global markets. This sharp move triggers fear across financial markets and increases safe-haven demand. Gold benefits from such geopolitical and economic instability. As investor sentiment turns risk-averse, capital flows into gold, increasing its price.

China’s restrictions on critical materials add another layer of concern. These elements are essential to global supply chains, especially defence, technology, and manufacturing. Disruptions in these sectors could heighten fears of a prolonged economic conflict. As a result, gold could see strong buying interest as a hedge against trade disruption, inflation, and broader market volatility. The overall impact of gold is bullish in the short to medium term.

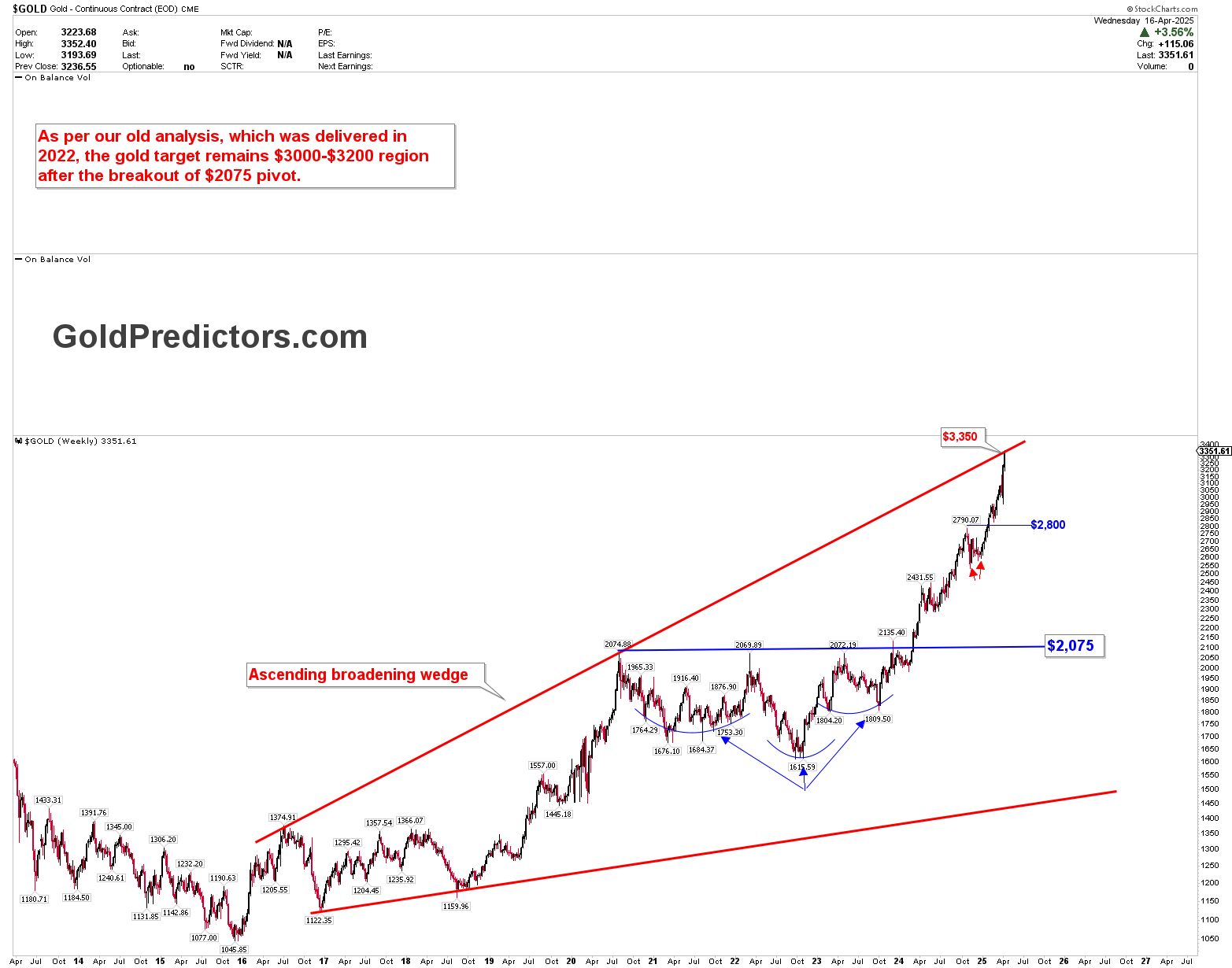

Gold Price Reaches Wedge Resistance as Tariff Fears Intensify

The chart below confirms that gold has reached the $3,350 level, aligning perfectly with the upper boundary of the ascending broadening wedge. This target was projected in the 2022 analysis, which identified the breakout above the $2,075 pivot as the key trigger for a move into the $3,000–$3,200 range. With gold testing, the upper wedge resistance, this area becomes a critical inflection point. Rising tensions from the 245% U.S. tariff on China and rare earth supply concerns fueled this rally.

While gold remains supported by global risk aversion and strong liquidity, the $3,350 level may prompt some profit-taking. Historically, this technical wedge pattern can lead to a strong breakout or a corrective pullback. The bullish momentum may extend further if the price holds above $3,200. However, failing to break the wedge resistance could trigger a short-term correction. The following 72 hours will be crucial as market reactions to trade tensions and geopolitical shifts play out.

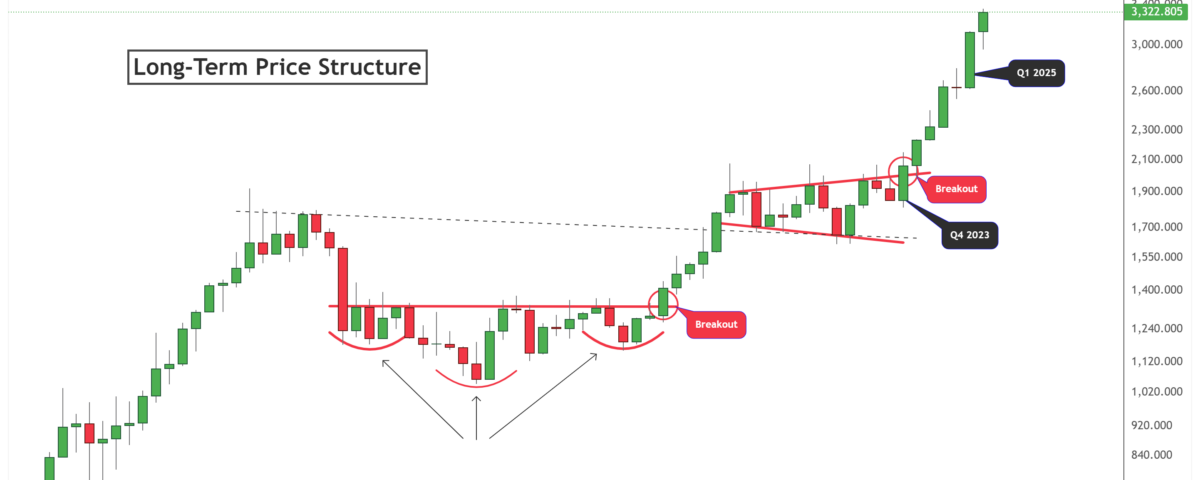

Long-Term Price Structure Supports the Gold Supercycle

The long-term chart below confirms that gold’s breakout in Q4 2023 began a structural shift. This breakout followed years of accumulation and pattern formation, including a multi-year cup and handle between 2013 and 2019. Gold steadily climbed once the price cleared the neckline and the upper trendline, pushing it above $3,300 in Q2 2025. This breakout validated the long-term bullish thesis during the $2,075 pivot breakout discussed in the previous section.

The move aligns with the ascending broadening wedge shown earlier and reinforces the potential for a continued supercycle. The current price action shows acceleration after the Q4 2023 breakout, with strong bullish candles indicating momentum. This pattern signals that gold is in a long-term parabolic phase, driven by global liquidity, trade tensions, and geopolitical uncertainty. As long as the price holds above former resistance zones, significantly in the $2,800 and $3,000 regions, the structure remains intact, and the bullish trend will likely continue.

Bottom Line

Gold benefits from rising global uncertainty, aggressive trade policies, and strong technical momentum. The breakout above key resistance levels, including the $2,075 pivot and the Q4 2023 structure, confirms a long-term bullish trend. With the price now testing the $3,350 level, gold remains well-positioned within a broader supercycle. As long as global trade tensions and liquidity pressures persist, gold will likely attract strong safe-haven demand and maintain upward momentum. If the gold price continues to correct from the $3,350 resistance, it may offer a strong buying opportunity for traders ahead of the next upward wave.