Upcoming Gold Overshoot Above $2,000

Gold remains the most sensitive asset to changes in risk mood during the Ukraine-Russia conflict. The developments of crisis in Ukraine are likely to reflect in the gold market over the next days and weeks. Investors will likely jump in the gold market and further upside potential in gold persists. The price has risen to $2,000 for the first time since August 2020 as the safe-haven assets are set to continue to find demand due to Russia-Ukraine concerns. In Ukraine, the situation is getting worse each day. Russian President Vladimir Putin said at the weekend that Western economic sanctions were a declaration of war. Gold will likely remain a safe haven for investors in the face of this uncertainty. Although it was reported on Friday that the US labour market remained strong and many new jobs were created in February. No attention was paid to US labour market data. The US Federal Reserve is expected to raise interest rates next week as the labour market tightens, which raises inflationary pressures.

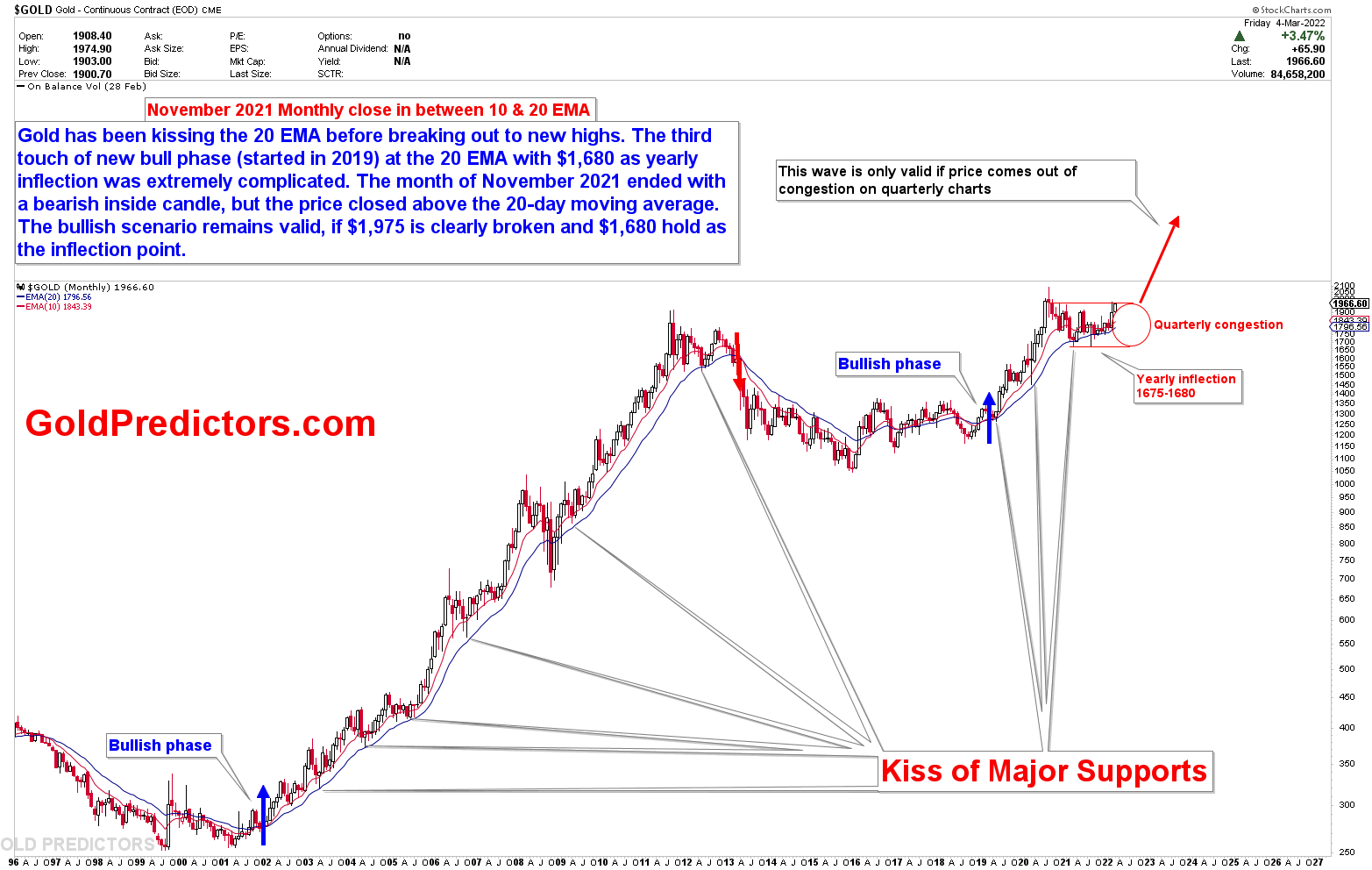

The chart below was presented a few months ago. It has been declared that $1,680 is the inflection point for 2021, and any move to this level will result in an upside shape move and huge buying opportunity. The low for spot gold was $1,674 in 2021. The chart shows that any move to the 20-EMA results in a bounce that takes gold much higher. Gold hit the EMA for the third time in the current bull phase, and prices are continuing to rise. The levels of $1,975 and $2,000 have been strong resistances, and any break will set off fireworks in the gold market.

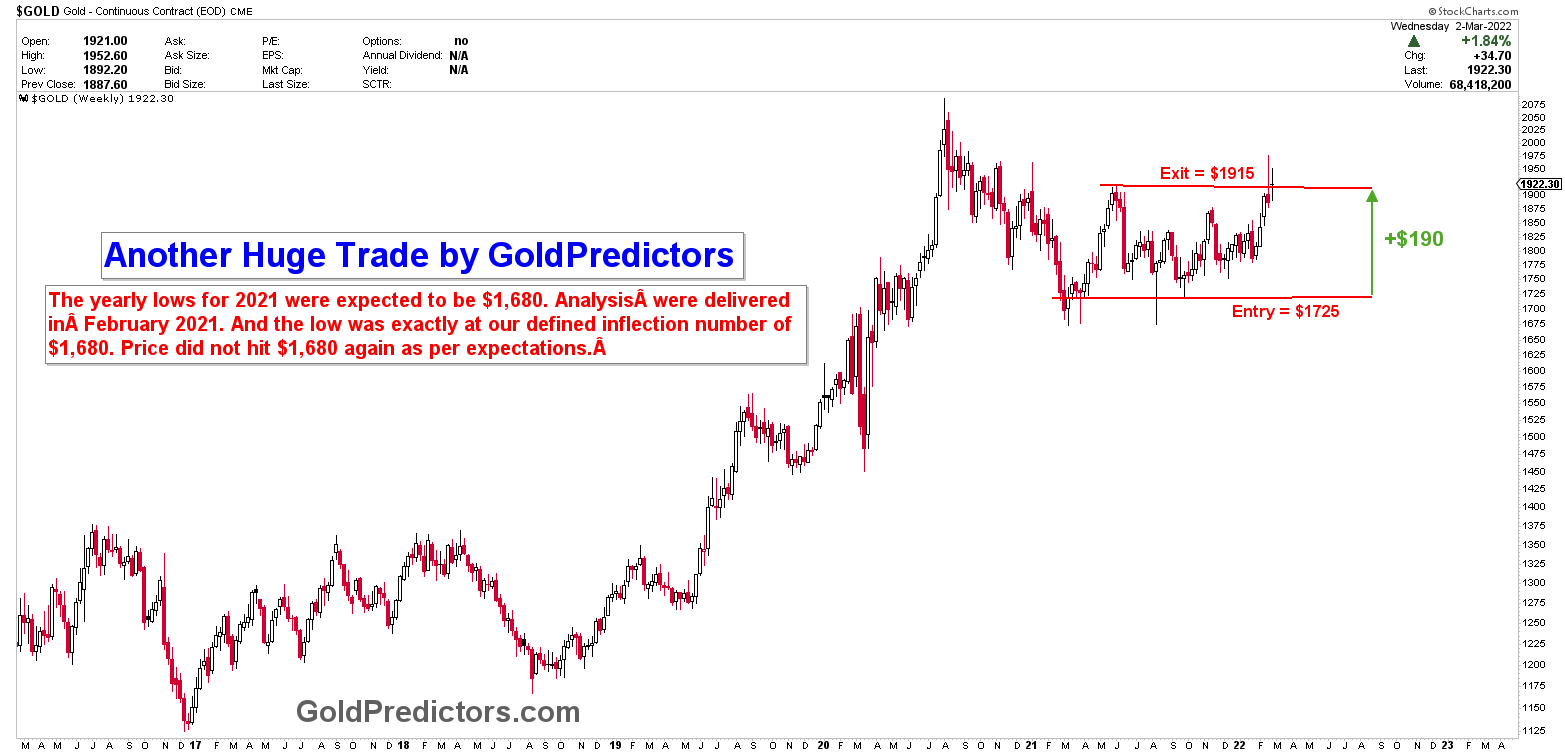

Due to high volatility and uncertainty, it has been extremely difficult for gold traders to make profits. The major levels in spot gold were identified for 2021 as $1,680, $1,725, $1,765, and $1,835. These levels provided significant support for the year 2021, and with an inflection number of $1,680, the price is now breaking above the $2,000 level. One of the best gold trades was to enter in $1,725 and exit in $1,919, with a profit of $190/ounce. The trade was delivered using WhatsApp. The current political situation is deteriorating, and gold volatility will likely increase further over time, making gold trading extremely difficult. The environment will benefit gamblers, but if traders control risk effectively, this environment could be extremely beneficial for gold and silver traders.

Please login to read full article!

Please subscribe to the link below to receive free updates.