Gold Prices & Russia-Ukraine Conflict

Russia launched an invasion of Ukraine, establishing three front lines in the north, south, and east. Apparently, the entire Ukrainian Air Force was bombed down within three hours of the invasion. Massive cyberattacks are also taking place, although with varying degrees of success. Electricity, internet, government networks, and all communications between the Ukrainian army, fleet, and air force, as well as with the government, may be cut off within the next few hours.

It appears that heavy armed forces are moving from the north and out of Belarus to target Kiev, which is only about 250-300 kilometres from the Belarus border, and it is possible that the majority of Putin’s war objectives could be achieved in as little as one or two days if Kiev is occupied with a tank blitz, possibly as early as tomorrow morning, and the Ukrainian government is deposed, arrested, or escapes. If that scenario of a quick invasion of Ukraine comes true and it is split in half by tomorrow, the stock markets may plummet during this crisis.

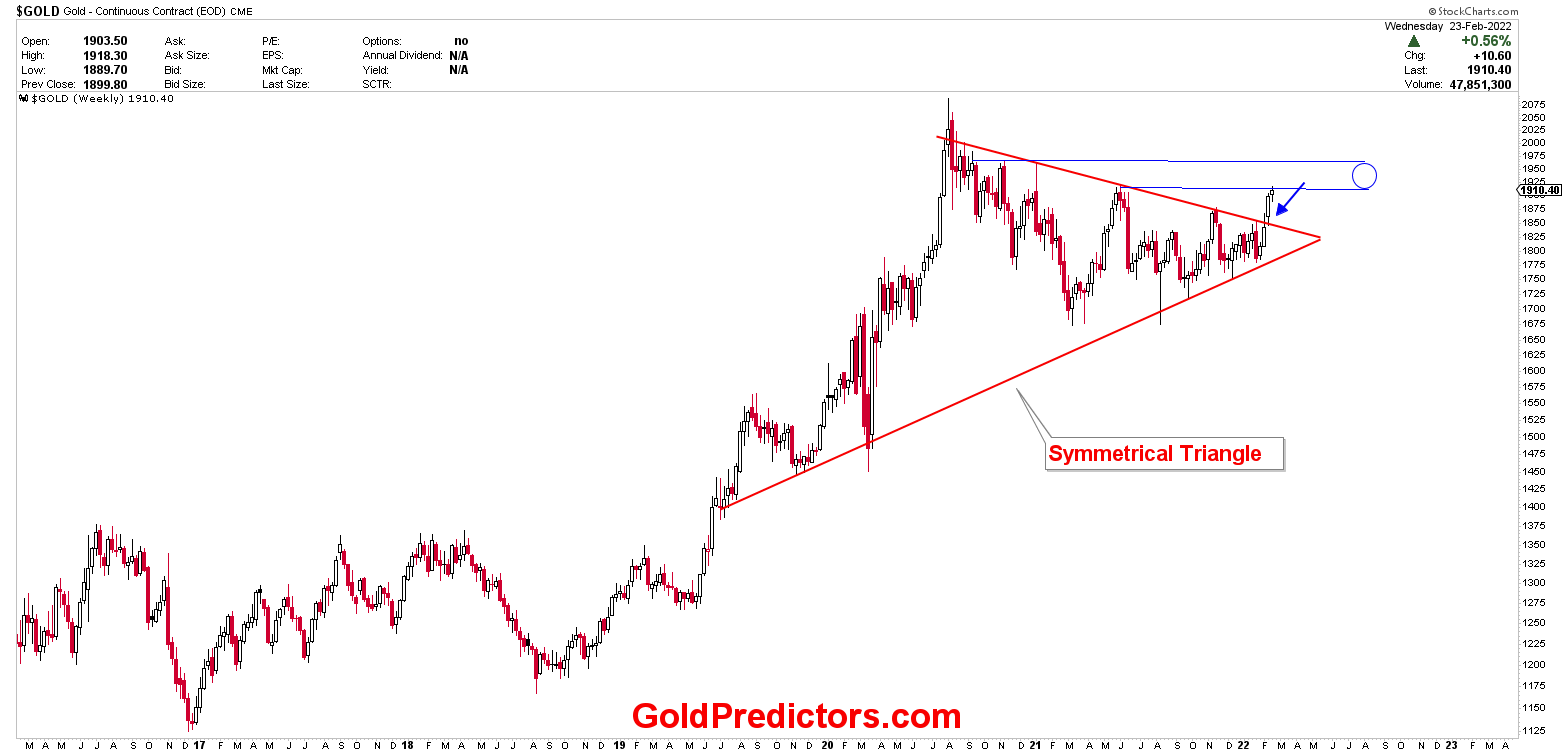

As discussed in the weekly letter, the gold market shoots higher from its symmetrical triangle support to reach the upper level of resistance of $1,975. The strong resistance zone of $1,920 to $1,975 was identified and the high so far is $1,975. The resistance of $1,975 is also a yearly pivot, indicating the significance of this level. A short-term surge in metal markets has exhausted the precious metals market, and it appears that a short-term top has formed. Silver also reaches the pivot level of $25.75, which has been discussed in previous reports. Silver appears to be preparing to consolidate its gains as well. Markets are extremely risky right now, and it appears that even more risk is on the way. Before making any trading decisions, it is best to keep an eye on the market dynamics.

Please login to read full article!

Please subscribe to the link below to receive free updates.