Understanding The Gold Bounce

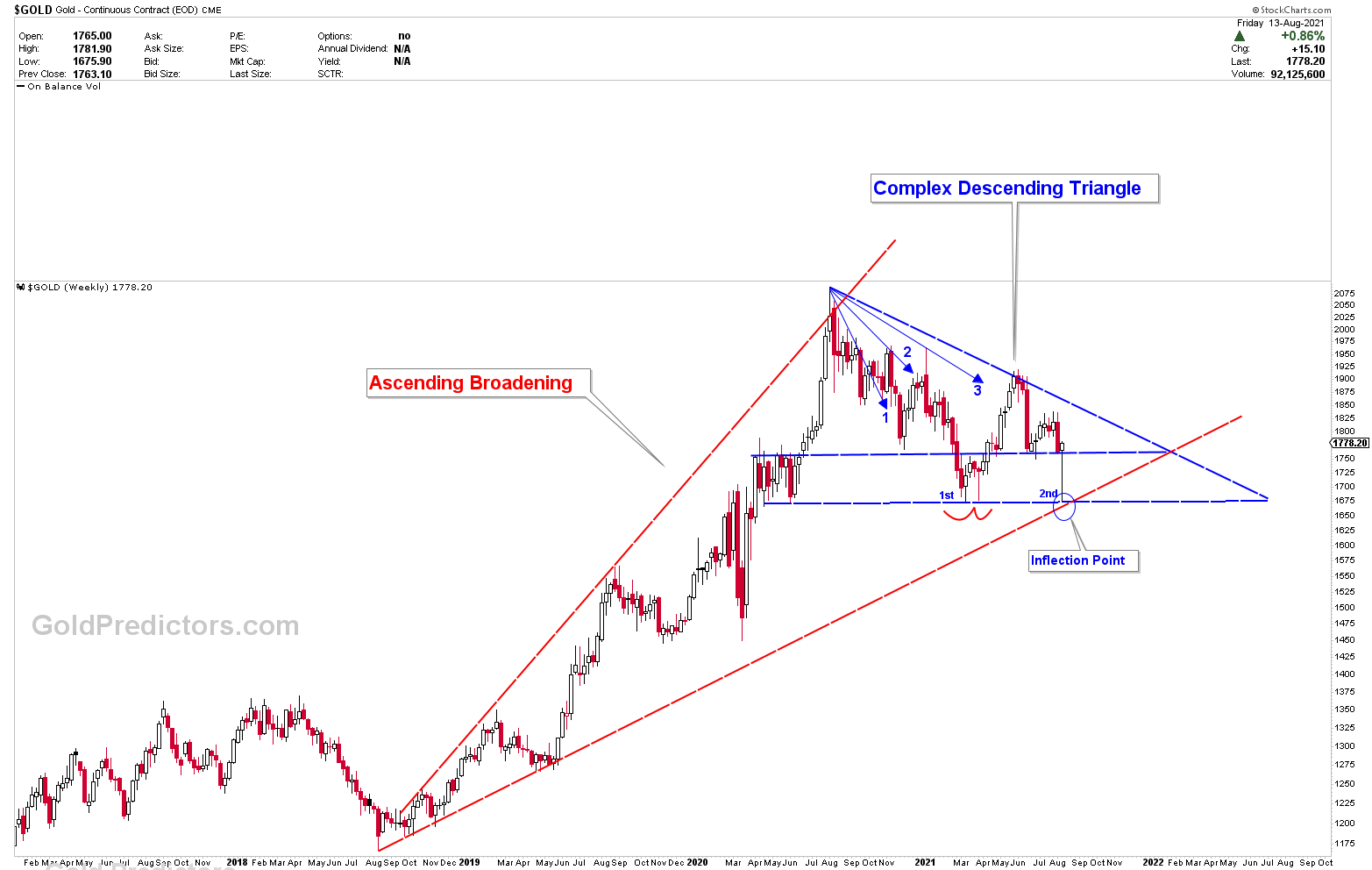

The gold bounce was forecasted. As discussed in the previous premium report, the drop below 1725 to 1680 was a bear trap. Prices were expected to rise after reaching the inflection point of 1680. They rose last week and broke through the resistance of 1760-1765 on a weekly basis. The dramatic move to the upside resulted in a strong weekly key reversal, which is one of gold’s historical weakly key reversals. While the candle is very strong, the candle’s development with the formation of patterns is not as strong. Price moves in large ranges, especially in June, July, and August, clearing stops on both sides. Therefore, the caution is still be used for traders.

The 7th of August was discussed as the short term cycle date where the bottom is expected to shape. Because August 7th was a Saturday, markets were closed. Prices fell significantly lower on Monday, August 9th, to 1680, forming the bottom of the 7th August (short term cycle). A quick reversal from the inflection point indicates that short term cycles have kicked in, and prices may not fall below 1680 until the next short term cycle begins. That was the primary reason for executing a Long Trade in spot gold in 1741. Many investors and traders have been frustrated by the large sideways movement between 1700 and 1900. Despite the fact that all market participants went bullish in US dollar during the last bounce, we have been bearish on the US dollar. We continue to expect the US dollar to trade sideways to lower in the coming weeks and months. The weakening of the US dollar, higher inflation, and lower treasury yields all indicate higher gold and silver prices in future.

The chart below, which was featured in a free article, has now closed above the 1760 mark (blue line). As previously discussed in the premium section, there has been no weekly close below 1760 levels. This premium article will discuss the charts and patterns that are used to forecast the next move in gold and silver prices. The article focuses on short-term cycles, monthly and weekly charts, and key levels for forecasting the next move.

To receive free updates, please register as free member.