Gold Hits Initial Target of 1835 from 1750, What’s Next?

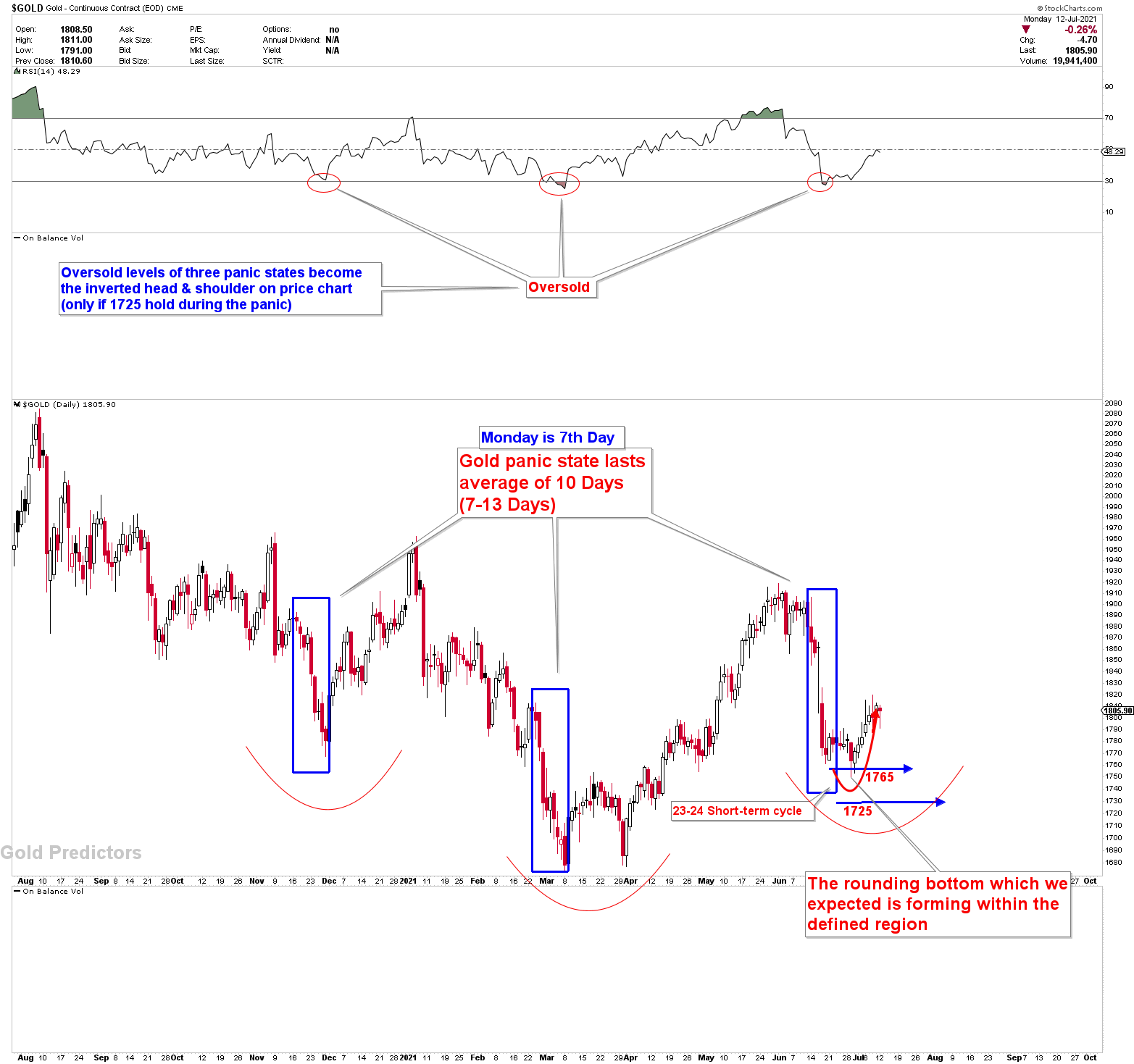

We discussed the strong resistance of 1825-1835 with an absolute number in the 1830 region last week. The support was mentioned as 1792. In spot gold, the week’s low was 1791.45 and the high was 1834.20. As the strong resistance was hit, gold prices were toying with the above-mentioned figures. The first arrow pointing from the 1765-1750 support was hit in 1835. This arrow has completed its journey, and the next gold path will be determined after the transition week. The transition week is the one when prices come to a halt for a few days. The next move in precious metals is determined by the development of short and medium-term historical patterns. However, the correlated markets also play a role in anticipating the next move.

Treasury yields, as discussed in the long-term trends in 10-year Treasury yields, are pointing lower. According to the most recent newsletter, the USD index is attacking the resistance line. The USD attacks and the bond markets implies a short-term risk in the major forex and commodities markets. In today’s report, we’ll discuss the Treasury yield, the impact of the US dollar on gold, and the transition week, as well as how to use it in trading.

To receive free updates, please register as free member.