Gold Follow Through the Strong Bottom

Jerome Powell’s dovish actions at the Jackson Hole meeting of central bankers regarding the upcoming taper and instead discussing why inflation is transitory caused everything to roar except the $US and US yields. Equities, cryptocurrency, energy, and even the battered gold and silver rallied hard into Friday’s close.

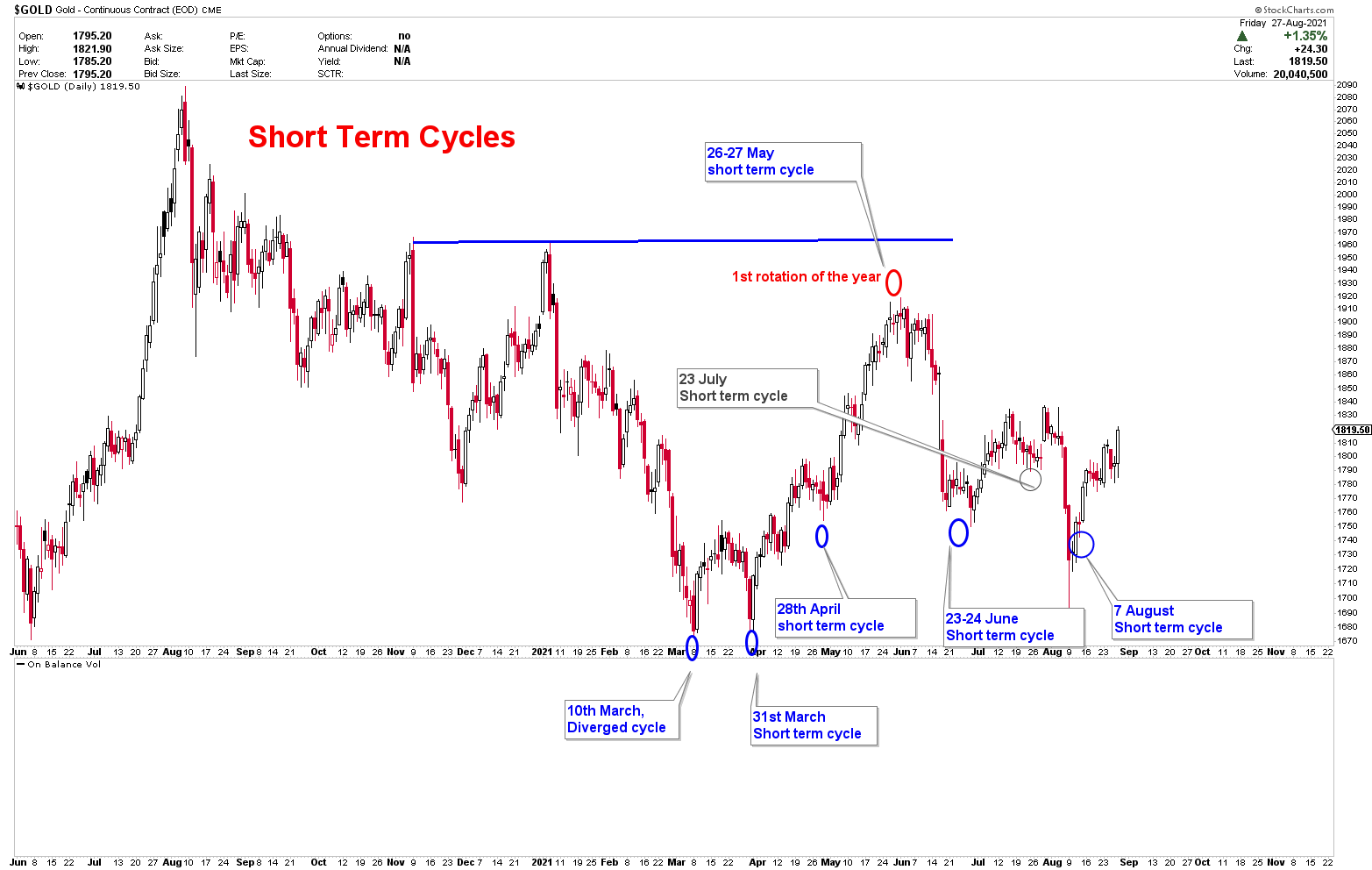

On the 7th of August, gold prices produced a bottom on our defined short term cycles and reversed higher from the inflection point of 1680. We’ve been talking about important levels like 1680, 1725, and 1765 for the last few months. These levels have proven to be powerful magnets in the gold market and still remain the major supports. A quick reversal from the 1680 inflection point means a lot of things, which we’ll go over in today’s report.

Our Thoughts Remain Unchanged

Despite the fact that the US dollar market was showing bullish momentum, we have been bearish in US dollars. We haven’t changed our minds about the US dollar and remain very bearish in the medium to long term. However, we anticipate the US dollar churning at strong long-term support before the next leg south. This is what is happening in US dollars for the last few weeks, and the index is simply producing a broad sideways range. We continue to believe that the US dollar’s wide ranges and high volatility will resolve to the downside in the near future. The huge volatility in US dollar has effected the forex market which shows that summer doldrums are in. Once US dollar resolve its primary trend to downside, forex markets will likely follow the course.

We anticipated two major supports in spot silver. The first is 23.01, and the second is 20.80. Last week, silver prices reached 23.01 several times and moved higher. We presented a bullish structure to premium members last week, and said that the closing level to watch is 24.07. Silver prices shoot higher on Friday, failing to close above 24.07. However, there are a number of market factors that have emerged, which we will discuss in today’s premium report. Please login to read the report.

To receive Free Updated Please Register as Free Member