Gold Breaks Multi-Decade Resistance as Gold/Silver Ratio Nears Historic Turning Point

The long-term price action for gold shows a significant breakout that could shape the market’s direction for years to come. The gold-to-silver ratio provides a clearer understanding of the unfolding dynamics within the gold market. Observations suggest that gold remains in a long-term bullish phase, where any correction is viewed as a buying opportunity.

Gold Breaks Multi-Decade Resistance: Is $4,000 the Next Target?

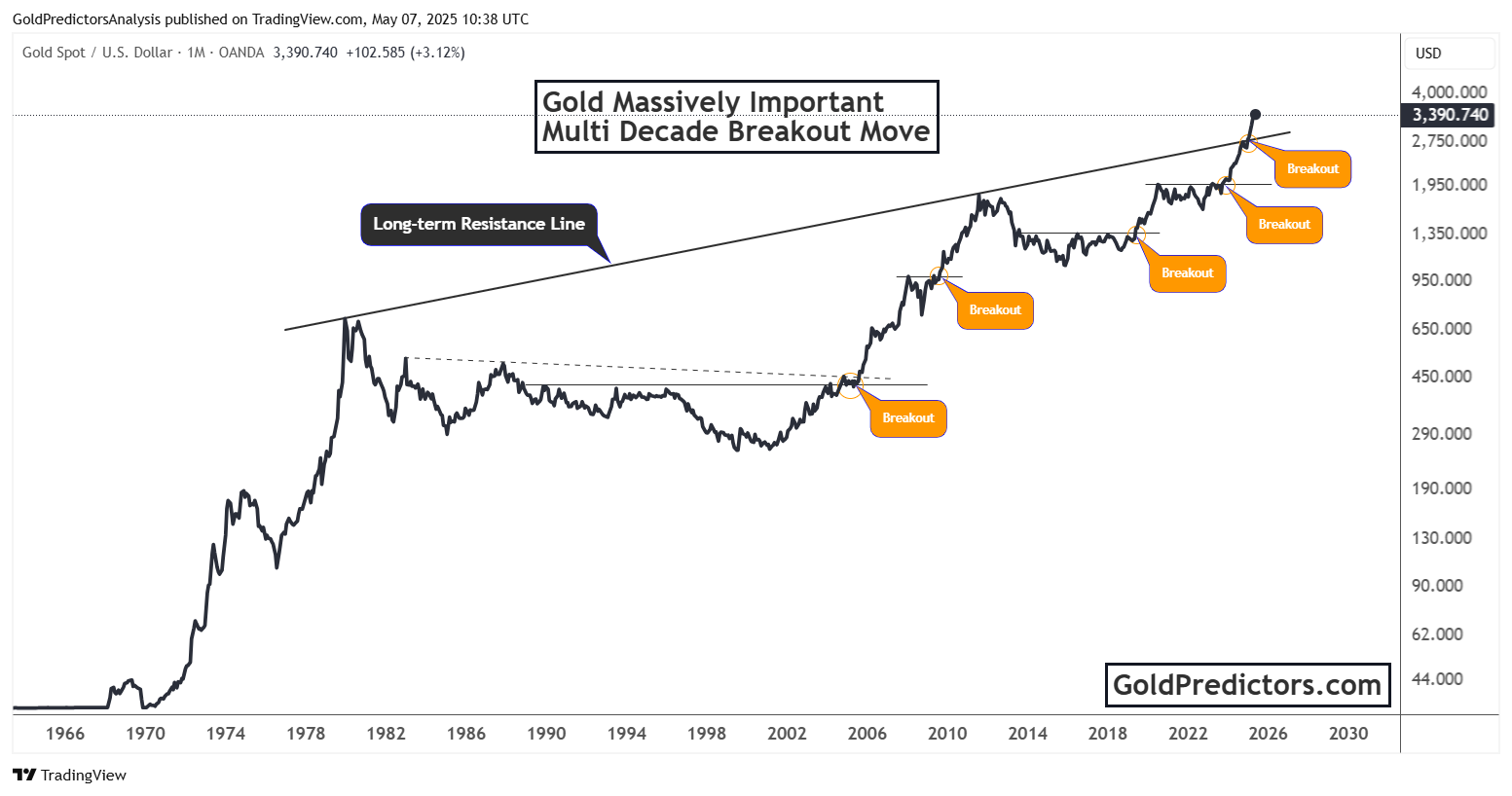

The gold chart below shows a decisive breakout above a long-term resistance line that has capped gold prices for several decades. The resistance line began forming in the late 1970s and held firm during the peaks of 1980, 2011, and again in the early 2020s. These previous highs marked a top in gold prices, followed by long consolidation periods.

However, the most recent move has changed that pattern. In 2024, gold broke out convincingly above this resistance line. The breakout has taken the gold price to a record level of $3,500 per ounce, which signals that this move is not a false breakout but a structural shift in the market. The chart identifies key breakout points throughout the past few decades, notably 2005, 2009, 2019, and 2024–2025.

Each breakout in the past has led to significant price rallies. For instance, after the 2005 breakout, gold surged over 300% within a few years. The 2009 breakout initiated a move that nearly doubled gold prices within two years. History suggests the current breakout could drive prices even higher, potentially towards $4,000. The chart shows gold floats above previous resistance levels with no central ceiling.

Gold-to-Silver Ratio Breakout Could Signal Next Big Move in Gold Prices

The chart below shows the gold-to-silver ratio, another critical indicator of gold and silver market direction. Historically, a high ratio means gold outperforms silver, typically during financial stress or uncertainty. Conversely, a falling ratio suggests silver is catching up or outperforming gold, often during inflationary booms or when industrial demand for silver increases.

The chart shows that the gold/silver ratio is approaching the key resistance zone between 105 and 120. This level has acted as a ceiling since the 1990s. The ratio is currently at 101.235, moving closer to this historical resistance. Over the decades, this ratio has repeatedly bounced lower after reaching this zone. However, the current setup looks bullish for gold dominance. However, as the ratio approaches a key level, it indicates that the gold rally may pause, and a silver rally could begin.

Conclusion: What Gold’s 2025 Breakout Means for the Future

The breakout in gold prices marks a historic moment for investors. This isn’t a typical rally. It’s a breakout from a multi-decade resistance that has shaped gold’s price for nearly 50 years. The current price above $3,000 reflects strong momentum and growing investor confidence in gold as a hedge against inflation, currency devaluation, and global instability.

In addition, the gold/silver ratio shows continued strength in gold. If the ratio breaks above the 105–120 resistance zone, it could fuel further gains in gold prices while silver lags. Both charts indicate a strong, sustained bullish trend in the precious metals market, with gold leading the way. However, short-term trends show a risk of exhaustion as the price has rallied continuously over the past few months. A short-term correction may present a good opportunity for investors to accumulate.

Gold Predictors Premium Membership

Get exclusive short-term and swing trade ideas with precise entry levels, stop-loss, and target prices, including justification and analysis — all delivered directly via WhatsApp.

Our premium service includes deep technical analysis on gold and silver markets. We cover cycle analysis, price forecasting, and key timing levels.

Members also receive a weekly market letter with detailed analysis, commentary from our Chief Analyst, including actionable insights, trade timing, and direction forecasts for gold and silver.

Stay ahead of the market — join our premium community today.