Gold And Higher Inflation

Producer prices (PPI) increased by more than 22% in the last 12 months, approaching the high from 1974 (23.3%). In recent years, consumer prices have diverged from PPI, but such a sharp rise in PPI remains a threat to the economy. The consumer price index (CPI) rose 6.2% in past 12 months, while the core CPI rose 4.6%. The CPI index for shelter, which accounts for nearly one-third of the total index, remains low at 3.5%. Wage and producer price increases have been warning higher number of CPI and a threat to higher inflation. The subject of higher inflation has been discussed several times. Inflation is on the way, despite the Fed’s reluctance to raise interest rates. Prices for iron and steel have increased up to 100% year on year (YoY), which will likely result to price increases for automobiles and consumer durables. Other notable increases in key inputs include construction materials, industrial chemicals, copper and aluminum.

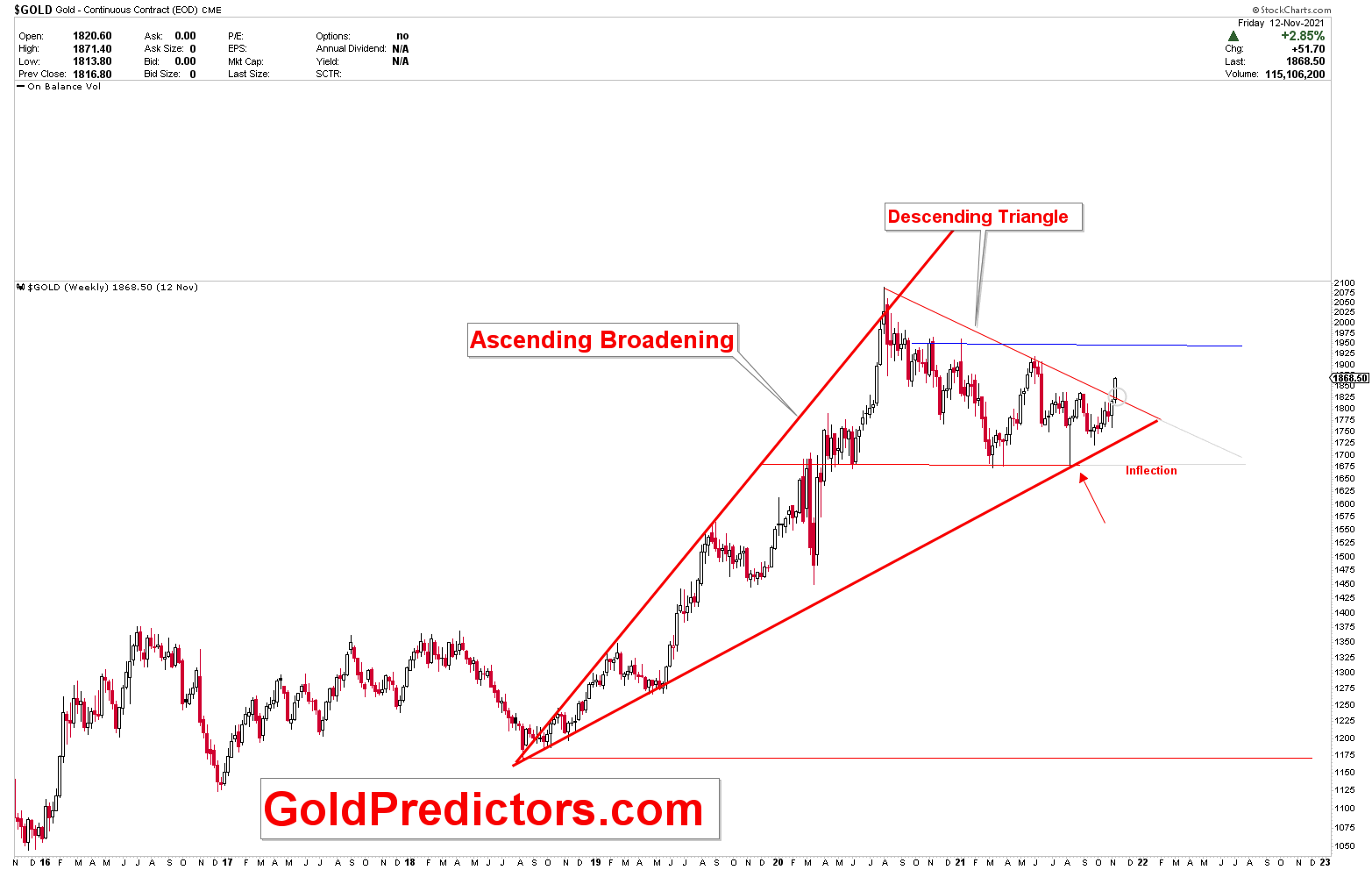

A thread of higher inflation propels precious metals to massive gains. Gold jumped more than $50 in a short period of time after the release of CPI figures. It was discussed with premium members last week that a breakout from $1,835 is expected, so a trade was executed using WhatsApp trading alert, to buy spot gold at $1,822 that was covered with profits of $37.5 at $1,860. The chart below depicts the medium-term outlook for gold, which has been discussed several times and is expected to stay within the ascending broadening formation. The expected low of $1,680 on the diverged cycle of March 10th, 2021, must raise gold prices. Last week, gold broke a massive descending triangle formation, indicating that gold is heading to the $1,923.70 region, with $1,931 as the major inflection point. The inflection point of $1,931 was calculated several months ago, when gold started to pullback from $2070 (All Time Highs).

Last week, gold resistance was identified between $1,850-$1,870, and the high was established in $1,868. The support level was defined at $1,810-$1,813, and the low was developed at $1,812.70. This report will provide a detailed analysis of the short and medium term outlook for gold using short term cycles, as well as personal opinions from the chief analyst, trading comments, market overview discussion, silver, and important levels.

To receive premium updates and trading signals, please subscribe to the link below.