Bitcoin Evaporation to $400,000

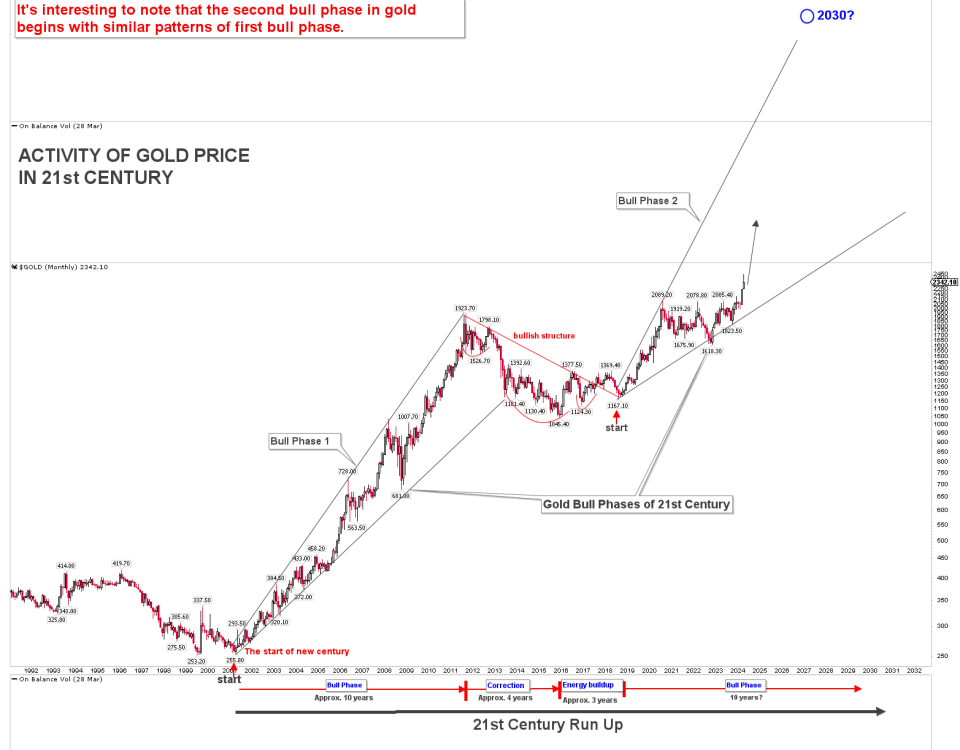

Since the launch of bitcoin, prices have been rising in four phases. The first phase was the phase of recognition, where most individuals were aware of the bitcoin and the blockchain’s significance. Once many entities were aware of exchange and its importance, they produced a high of $29.58 and collapsed back to lows to encourage new buyers. The second phase was the heatup phase, where bitcoin was not that attractive and it was not acquired as a trusted investment by many individuals and investment firms. Prices suddenly produced a $1132 top in December 2013 and crashed back to lows above $100. As prices move in parabolic contexts, the pullbacks are extreme. Bitcoin was already hot in the third phase and the price melted to $19,666 as a result of the financial bubble in 2017. Prices crashed back to $3232.93 right after the top was formed at $19,666. The phenomena of shooting prices to $19,666 was shocking for many traders, investors, institutions and investment firms which attracted their attention to add bitcoin as investment vehicle to their portfolios. At this time, the importance of bitcoin was known to almost all investors and intuitional players, since there are only 21,000,000 bitcoins, the jump of big institutional players into blockchain shoots the price upwards and the top is unseen based on recent history. It is observed clearly, that bitcoin produced a spike of around 12000% in each of the phase. In that case, if history repeats, the bottom was $3232.93, then prices would shoot up to $400,000 where bitcoin could disintegrate to 100% of the supply in circulation. The chart below illustrates all the parameters on which prices can be projected. (Bitcoin Evaporation)

Acknowledge Phase

When its implementation was released as open-source software, Bitcoin began to be used in 2009. Other cryptocurrencies have started to emerge based on open-source bitcoins. The period from 2009 to 2011 is known as the acknowledgement period where the bitcoin was known to many. A non-profit group, the Electronic Frontier Foundation (EFT), began accepting bitcoins in January 2011, then stopped accepting them in June 2011, citing concerns about a lack of legal precedent for new currency systems. When EFT started accepting bitcoin, prices shot to 11,732% and when they stopped accepting, prices collapsed by producing a top that is referred to as the Acknowledgment phase top. The Acknowledge phase has received two peaks, one was at $7-$8 and second was at $29.58. The main peak of this phase was $29.58.

Bitcoin HeatUp Phase

In the year 2013, there were many events that caused 2 peaks in bitcoin prices. In April, there was one peak at $259, and December was the second peak at $1132. The bitcoin-based payment processor Coinbase reported selling bitcoins worth US$1 million in a single month at more than $22 per bitcoin in February 2013. The Internet Archive announced that it was prepared to accept donations as bitcoins and that it intends to give the option of receiving portions of its salaries in bitcoin currency to employees. On 17 May 2013, the ETF decision was reversed and the acceptance of bitcoins was resumed. During that time, Bitcoin shot up to $259. On 15 May 2013, the US authorities confiscated accounts linked to Mt. Gox after discovering that it had not registered with FinCEN in the US as a money transmitter. On 17 May 2013, BitInstant was reported to have processed approximately 30% of the money going into and out of bitcoin and facilitated 30,000 transactions in April alone.

In October 2013, during the arrest of alleged proprietor Ross William Ulbricht, the FBI seized about 26,000 BTC from the Silk Road website. On 29 October 2013, two companies, Robocoin and Bitcoiniacs, launched the world’s first Bitcoin ATM in Vancouver, BC, Canada, allowing customers to sell or buy Bitcoin currency at a coffee shop in the downtown area. Prices began to rocket higher right after that and peaked at $1132 in December 2013. Baidu, the Chinese internet giant, had allowed the website security service customers to pay with bitcoins. The Japan-based Mt. Gox and the Europe-based Bitstamp were overtaken by the China-based bitcoin exchange BTC China in November 2013 to become the largest bitcoin trade exchange by trade volume. Overstock.com announced plans in December 2013 to accept bitcoin in the second half of 2014. The People’s Bank of China banned Chinese financial institutions from using Bitcoins on 5 December 2013. After the announcement, the value of bitcoins produced a $1132 top and dropped significantly, marking it with 12694% of value gains in the heatUp phase.

Development of MeltUp Phase

As bitcoin was already hot, it continue to rise for months and when the software marketplace Steam announced that it would no longer accept bitcoin as payment for its products, citing slow transaction speeds, price volatility, and high transaction fees, Bitcoin established a peak on 6 December 2017 marking it as peak for meltUp phase at $19,666. The peak was marked with 12,804% gain in prices in meltUp phase. The bottom was then created at $3232.93 in December 2018 after the meltUp phase.

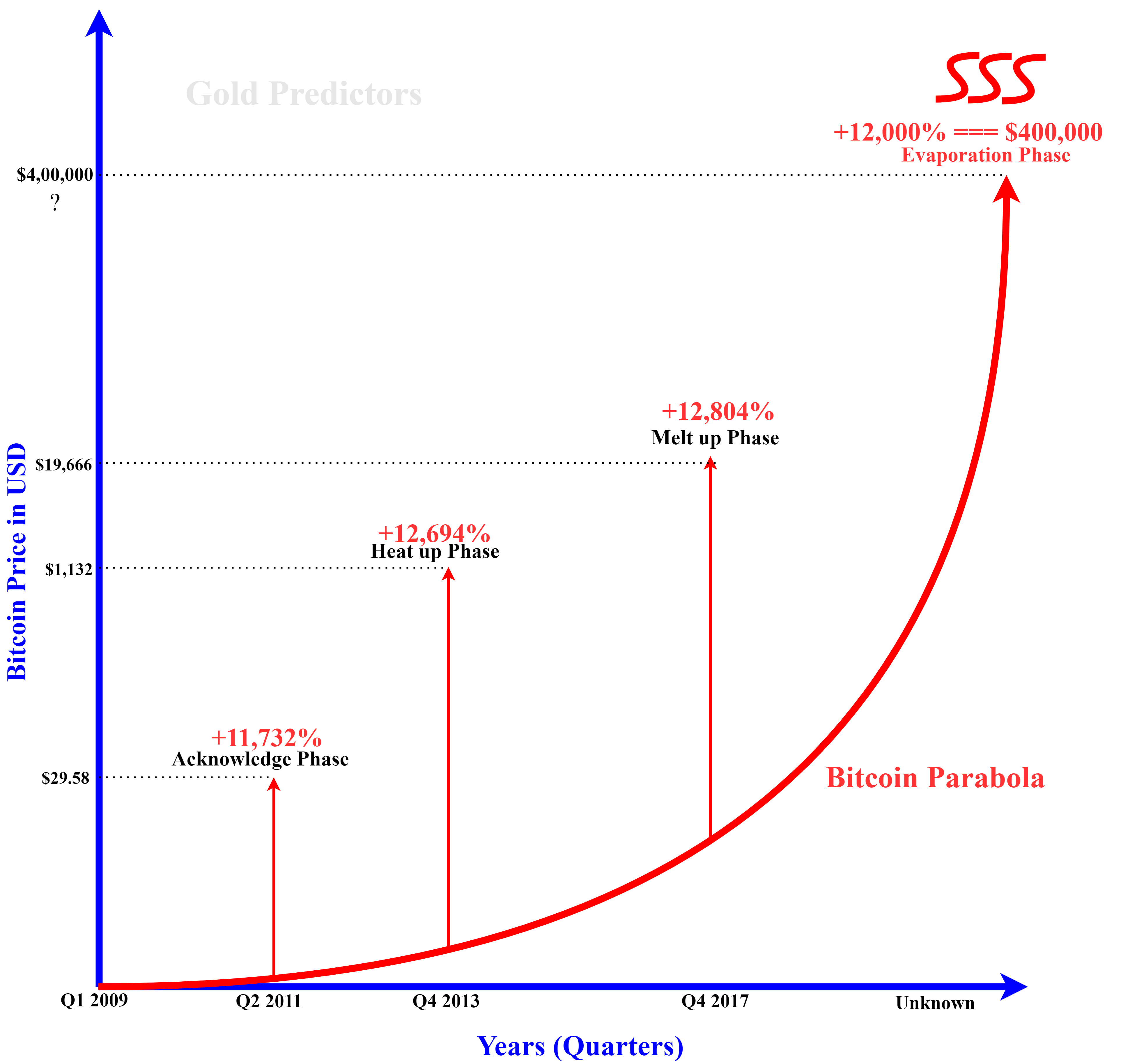

Evolution of Evaporation Phase

As the bottom was formed after the meltup phase, prices began to improve for further explosions. As a result of the COVID-19 pandemic, during the week of 11 March 2020, cryptocurrency exchange Kraken experienced an 83 % increase in the number of account sign-ups over the week of the price collapse of bitcoin, as a result of buyers looking to capitalize on the low price. During a broad COVID-19 pandemic related market selloff, bitcoin fell to below $4000 on 13 March 2020, after trading above $19,000 in February 2020.

FURTHER DEVELOPMENTS: MicroStrategy invested $250 million in Bitcoin as a treasury reserve asset in August 2020. Square, Inc. placed about 1 % of its total assets ($50 million) in bitcoin in October 2020. In November 2020, PayPal announced that bitcoin could be bought, held, or sold by all users in the US. Bitcoin hit a new all-time high of $19,860 on 30 November 2020, topping the previous December 2017 highs. Massachusetts Mutual Life Insurance Company announced, it had acquired $100 million in bitcoin on December 2020. On 19 January 2021, Elon Musk tweeted “In retrospect, it was inevitable” in his Twitter profile, placing #Bitcoin, which caused the price to rise briefly to $37,299 per hour from about $5000. Microstrategy announced on 25 January 2021 that it was continuing to buy bitcoin and had holdings of $2.38 billion worth. Tesla’s announcement on 8 February 2021 that it had bought $1.5 billion in bitcoin and planned to begin accepting bitcoin as a payment for vehicles pushed the price of bitcoin to an all-time high of $44,141. Elon Musk said on 18 February 2021 that “owning bitcoin was only a little better than holding conventional cash, but that the slight difference made it a better asset to hold” In September 2020, it was announced that the Canton of Zug (in Switzerland) would start accepting Bitcoin tax payments from February 2021.

From above studies, it is clear that how bitcoin become an investment vehicle. The demand for bitcoin and huge investments from large institutions carried the prices to all time highs and it is estimated that the sky is unseen at the moment by looking at the Bitcoin parabola and when this kind of jump of huge investment comes into any investment vehicle, it is completely unpredictable that where the head is formed. Although it is very clear that the current cryptocurrency demand is not like 2017, which was a kind of financial bubble. It is possible that we will see consolidation for a longer period of time once the head is formed. As the price moved in the evaporation phase, from $3232.92, it is likely to make about 12,000% of the gain, which is around $400,000. Yes! Yes! For many, it seems unbelievable, but was it believable to accept the $60,000 level when bitcoin was trading at $1000 just a few years ago?

On technical charts, the development of the evaporation phase was very surprising. It was a huge, inverted blue head and shoulder triangle breakout that was confirmed. This breakout confirmed bitcoin’s nearest target of $100,000, but the long-term goal of $400,000 remains valid as each phase produces a gain of about 12,000%, so who know who is buying bitcoin at the back and carrying the prices higher?

The Facts to Keep in Mind While Bitcoin Evaporating

Since the crisis of Covid-19 began, Bitcoin has been very attractive to investors. During the escalation of the crisis, a talk on the implementation of paperless money boosted demand for bitcoin and other crypto assets. Bitcoin rocketed to over $50,000 from $4000. It is clear from our bitcoin research that there is a lot of room for bitcoin prices to boost, but bitcoin is still not an alternative to the dollar yet.

A lack of faith in government currencies is the main reason for people to rush to bitcoin. To pay for Covid relief measures and to stimulate damaged economies, central banks have crushed interest rates and are printing unimaginable amounts of money. Bitcoin and other cryptocurrencies are therefore now regarded as a respectable investment class, and bitcoin is being added to their portfolios by financial institutions.

Whatever happens, “Bitcoin Is Not A Money” is the truth. For instance, to purchase products and services, we use dollars. But are you going to be able to purchase products and services with bitcoin? if YES, then how you can, while the price of bitcoin was $40,000 yesterday and $50,000 today, While there are companies willing to accept bitcoin, until the value is stable there will be discoveries to find a solution. A stable value of any instrument is not the overshooting of prices to 1000% in few months and correction back to 600%. When it has stable value, money only works best. If bitcoin is used as money to buy a mortgage house, buy insurance or leasing a car, then what happens if you sign a contract in 2018 when bitcoin was $1000 and now it is $50,000? In value, Bitcoin is more than 20k% from that level. Fixed supply is the other problem with bitcoin. In order to meet the needs of a growing economy, the money supply must be capable of expanding. In 1990, as a need for a growing economy, the dollar supply increased 160-fold.

Money can be created excessively out of thin air to finance the massive pandemic coronavirus, but because of its arbitrary supply limit, bitcoin can not be created. But in order to get the advantage, it can only be manipulated to raise prices to several thousand percent. Yes There might be a possibility But still need to do some work before bitcoin is considered as MONEY. WHAT if FED is Buying a bitcoin to get the advantage of higher prices? What will happen if they all sold off to get advantage of higher prices, then prices will sink in the toilet.

For Bitcoins to be used as money, crypto must have a stable value.

The Next Stage In Bitcoin

Bitcoin has gone through all fours stages when prices start to heat up and then evaporates. Once bitcoin evaporate, one possibility is that price would collapse and second is, price would become stable at higher levels. If there is no solution sorted out for the bitcoin to be used as Money, the big players would start selling to get advantage of higher prices. That would be time for Bitcoin Collapse. The other possibility is prices become stable at higher level after the evaporation stage. At the time of writing, the research suggests that both cases are valid until we see some changes in the bitcoin system or economies rules.

The above research states that Bitcoin is in evaporation phase and prices are looking to evaporate to $400,000 as the target of this bull phase. But on other hands, some technical confirms that there might be a pause at $100,000 and which might be also the target for starters. In any case, the skyrocketing prices of bitcoin are not similar to the last financial bubble, which suggest that prices might be stable at higher levels. What will happen next will be seen in future development and it will be clear in few months.

The article was presented to private investors a few months ago. The article is now updated and presented today to our free and premium members and posted to Gold Predictors.

To receive Free gold, silver, crypto and forex articles and trading signals, please subscribe as a free member as below.