Australian Dollar Remains King Currency

This Week’s report we will focus on AUDUSD, AUDCHF, GBPUSD, GBPNZD, GBPAUD and EURUSD. It looks like Australian dollar remains the king currency of all at the moment while CHF and USD remains weakest currencies.

Highlights:

- We have presented USD and JPY as weakest currencies and the strongest currencies such as AUD and GBP from the last update. AUD and GBP pairs shoots higher

- We have suggested to go Long in AUDUSD, GBPNZD and GBPJPY. The pairs gained a lot. While GBPNZD reversed after shooting higher.

Weakest currency: CHF, USD

Strongest Currency: AUD, GBP

Best Instruments to Focus:

Long AUDUSD

LONG AUDCHF

LONG NZDUSD

Long GBPCHF

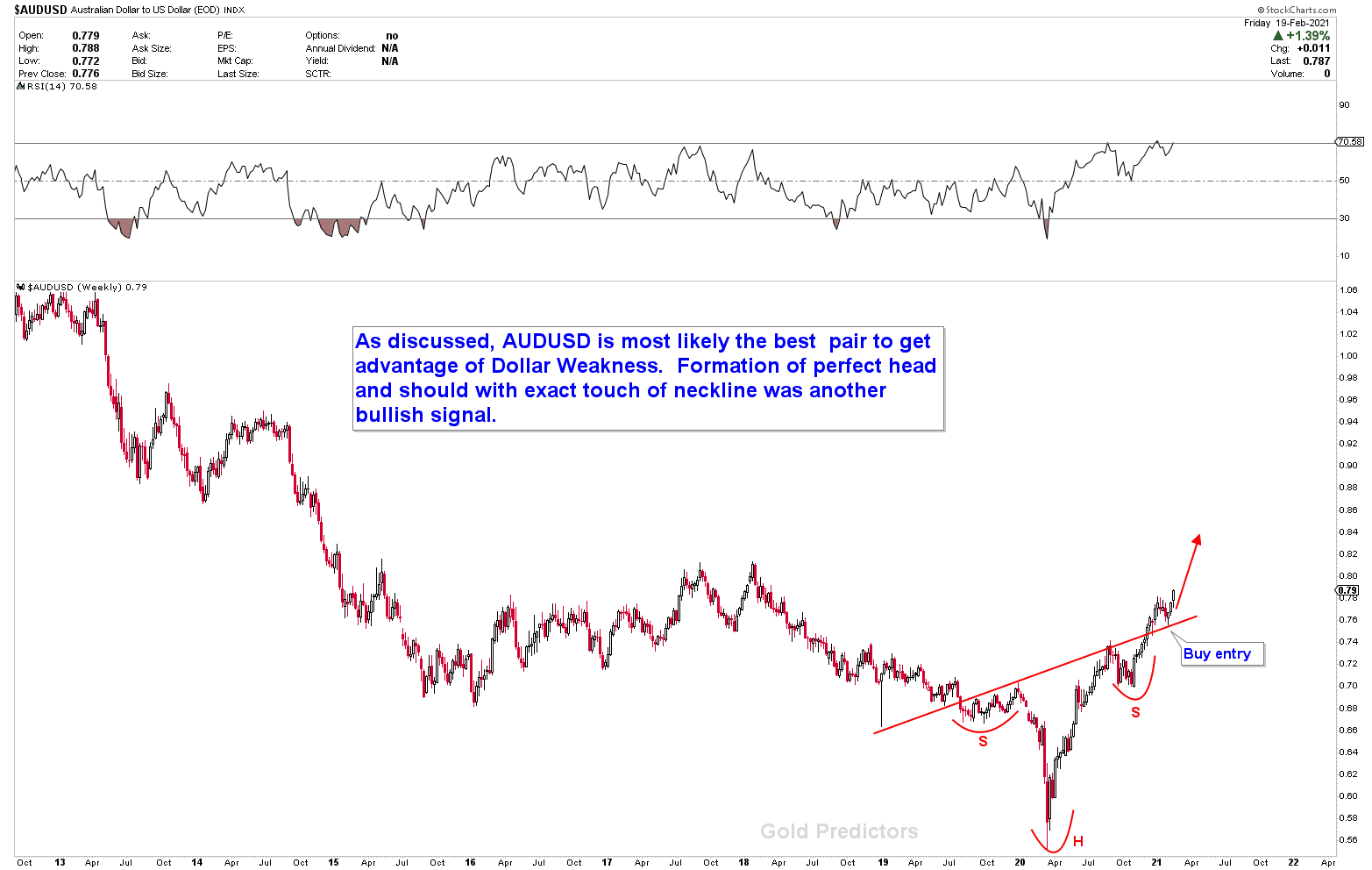

The Australian dollar is still very bullish, and prices look higher. As both the weakest currencies are the CHF and Dollar, the outlook developed in AUDUSD and AUDCHF is super bullish. Let’s have a look at the chart for AUDUSD. The perfectly inverted head and shoulder formations would throw AUDUSD to levels of 0.80 to 0.81 soon.

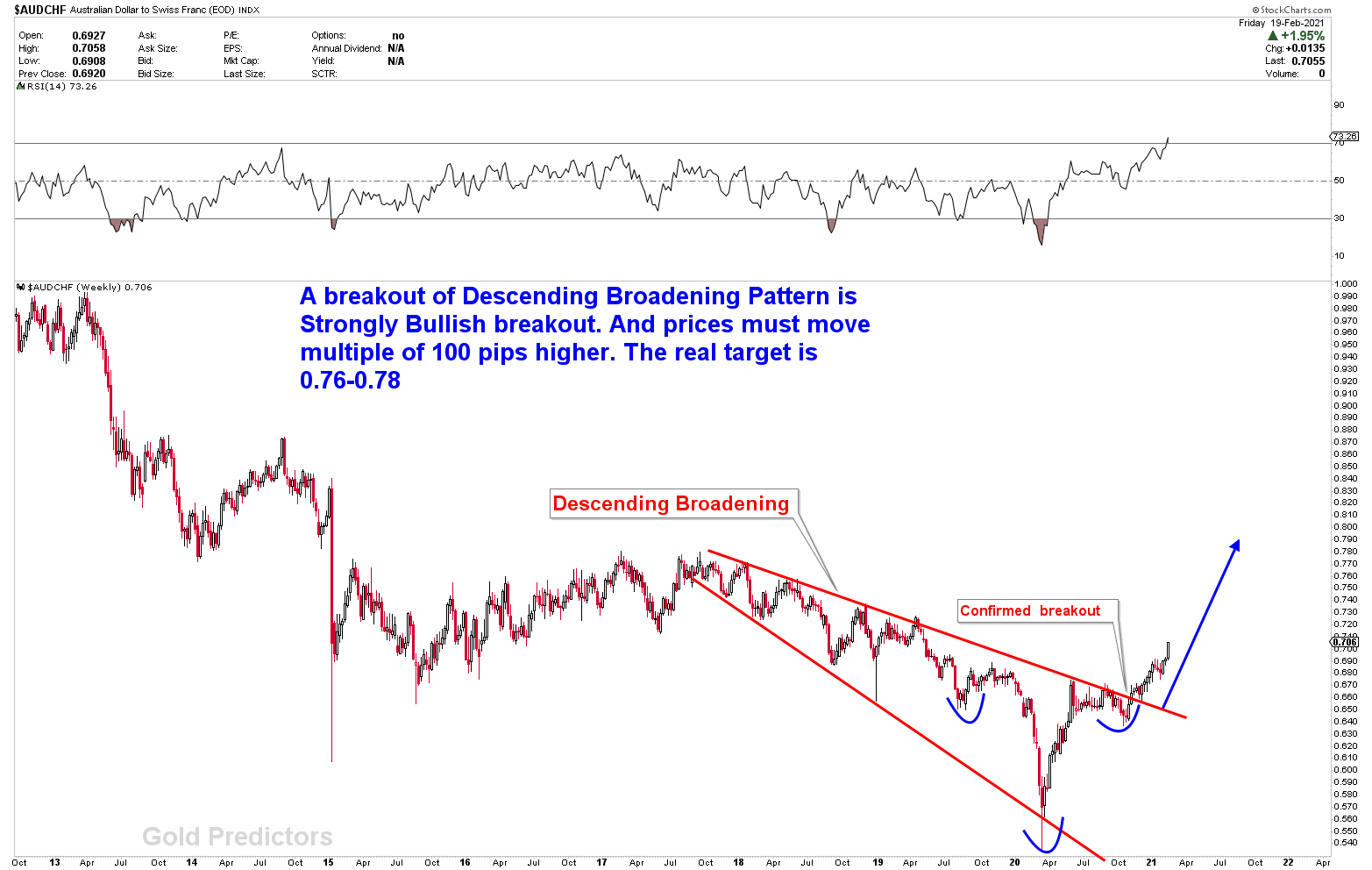

By having AUD strength and CHF weakness, AUDCHF is also strongly bullish. The Descending Broadening wedge is strongly bullish patterns and shoots higher if prices are broken. This wedge’s target is 0.76-0.78 minimum. The inverted BLUE head and shoulder support the wedge, which would also support prices in the near term.

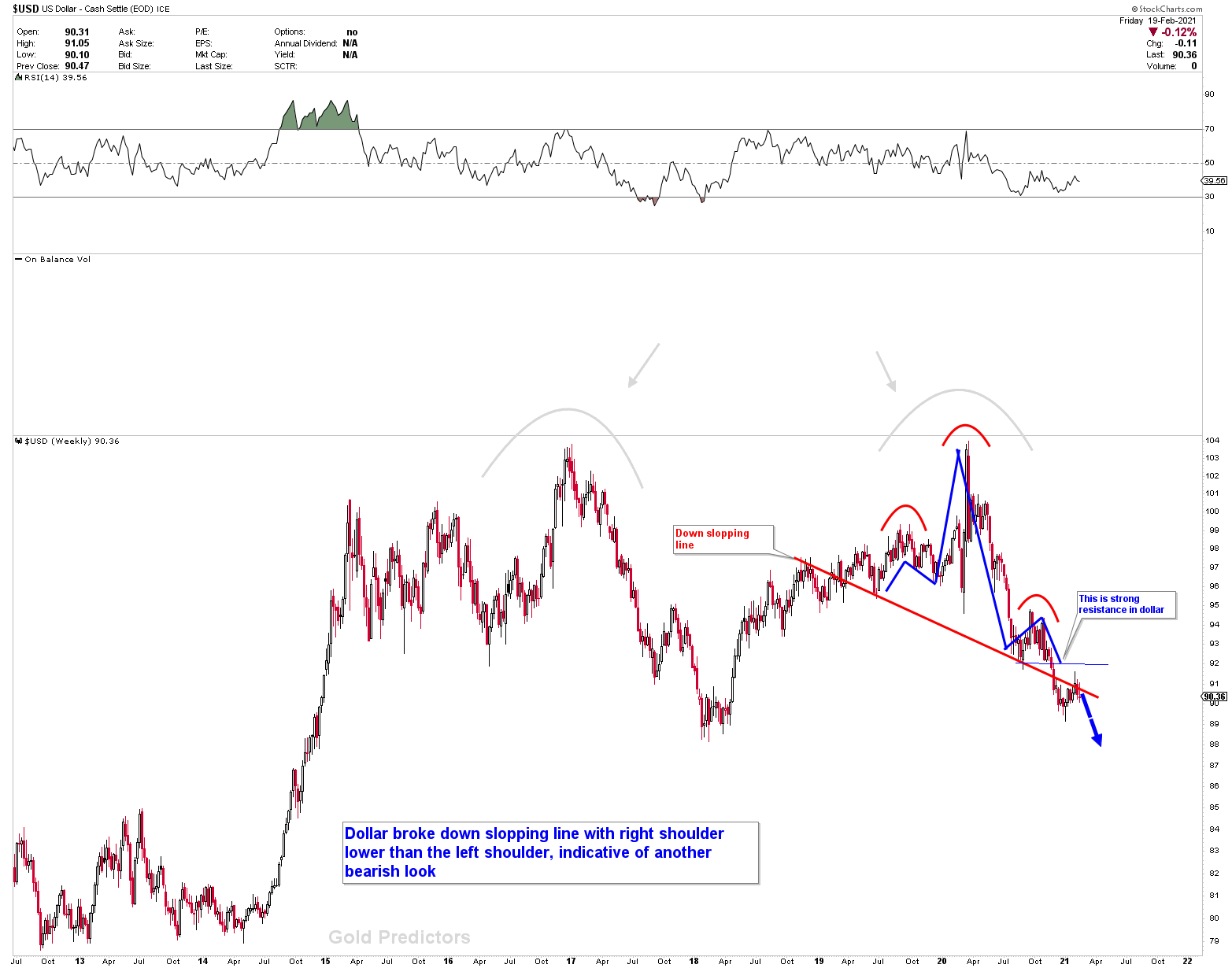

On weekly charts, the dollar closed the week below the blue neckline, prices show extreme pressure, and it appears that prices would accelerate lower, which would be good for AUDUSD, EURUSD and GBPUSD.

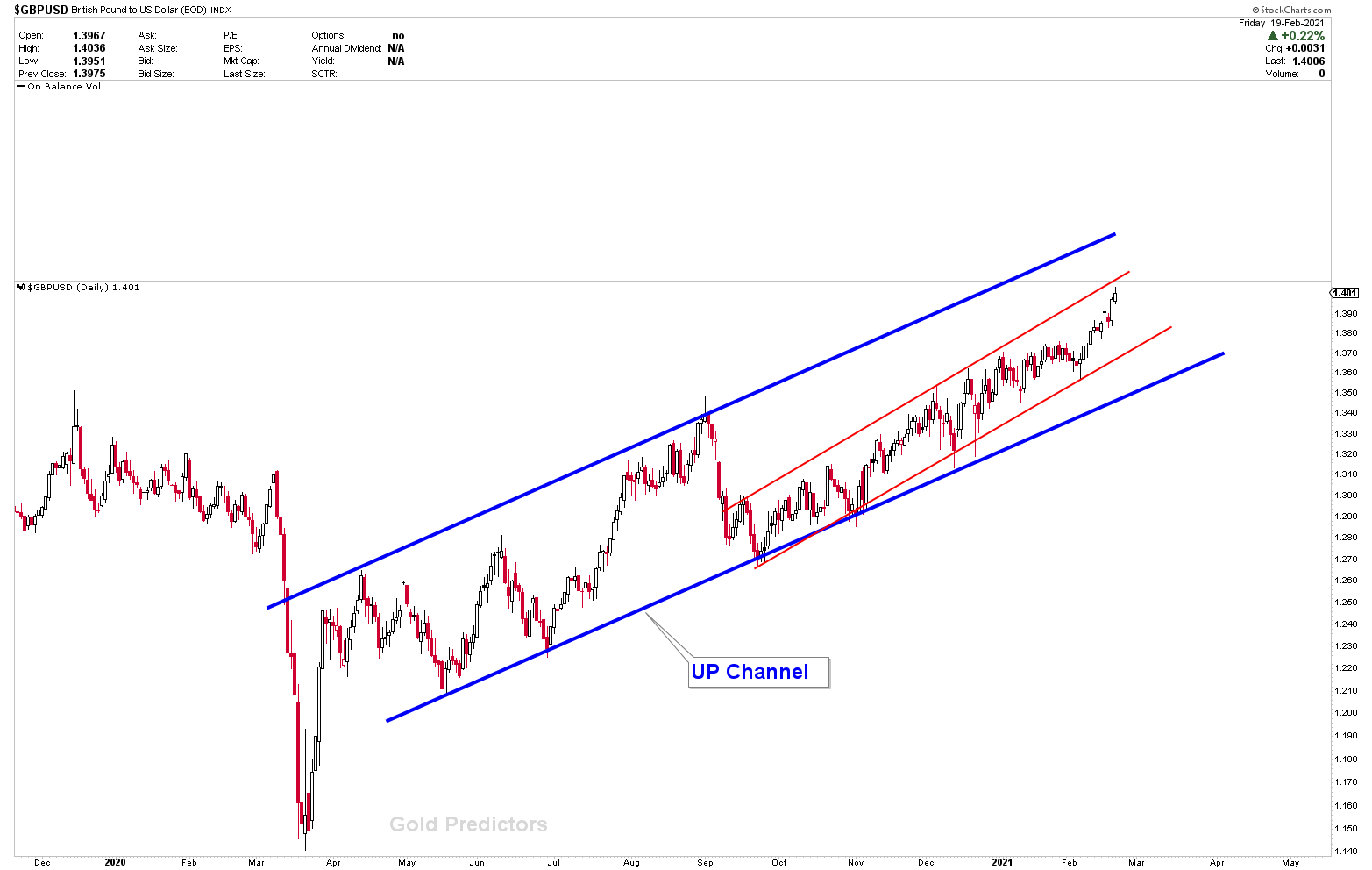

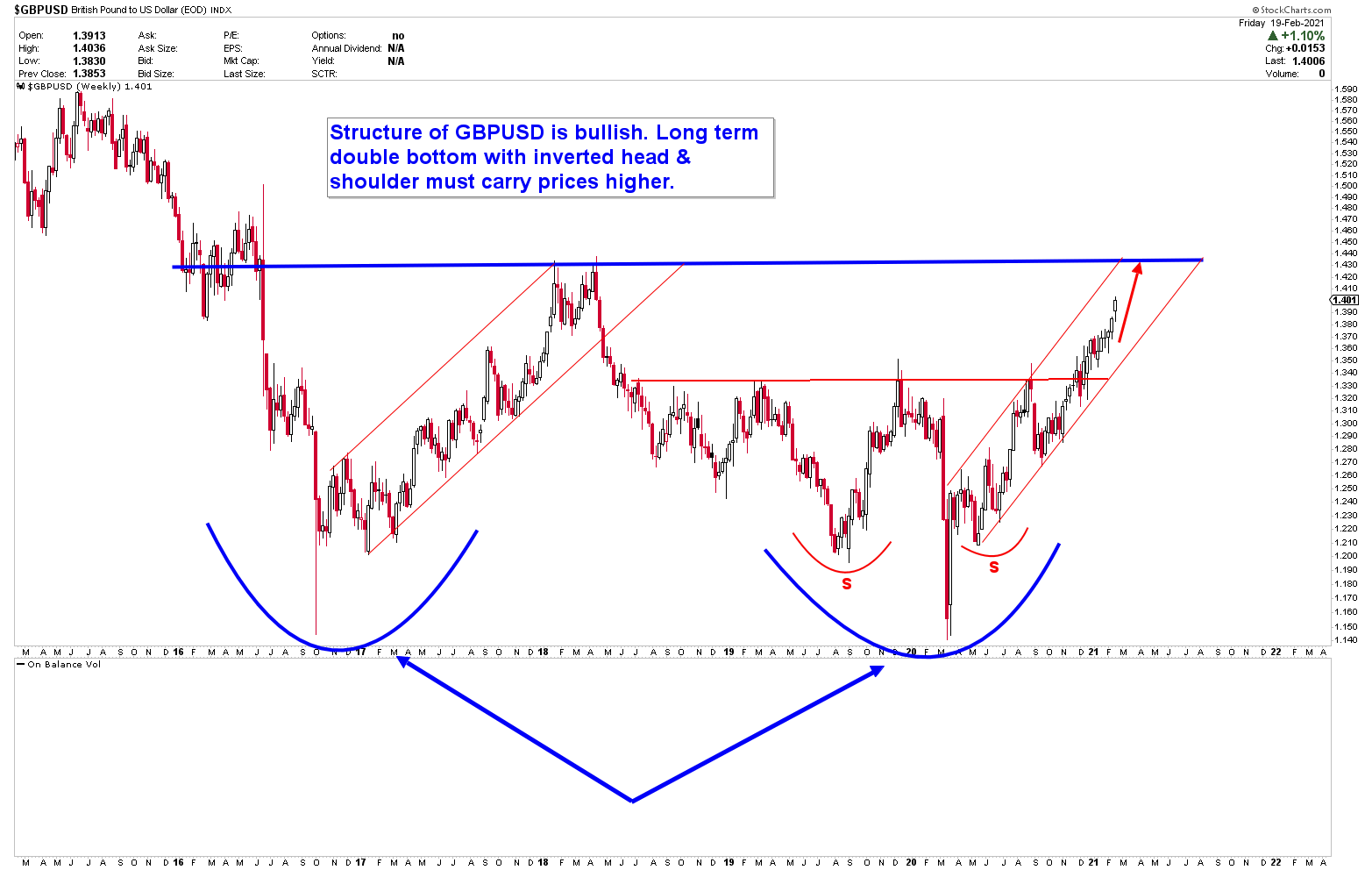

GBPUSD is emerging bullish patterns as discussed in last update, and all GBP pairs except GBPAUD could benefit from GBP strength. That’s because the Australian dollar is stronger as well. The updated chart shows that higher prices for GBPUSD are expected and prices will continue to rise in the coming weeks. This week, GBPJPY is strong as stated in last update.

The weekly chart indicates that the GBPUSD long term target is also bullish. Any pullback must be a buying opportunity.

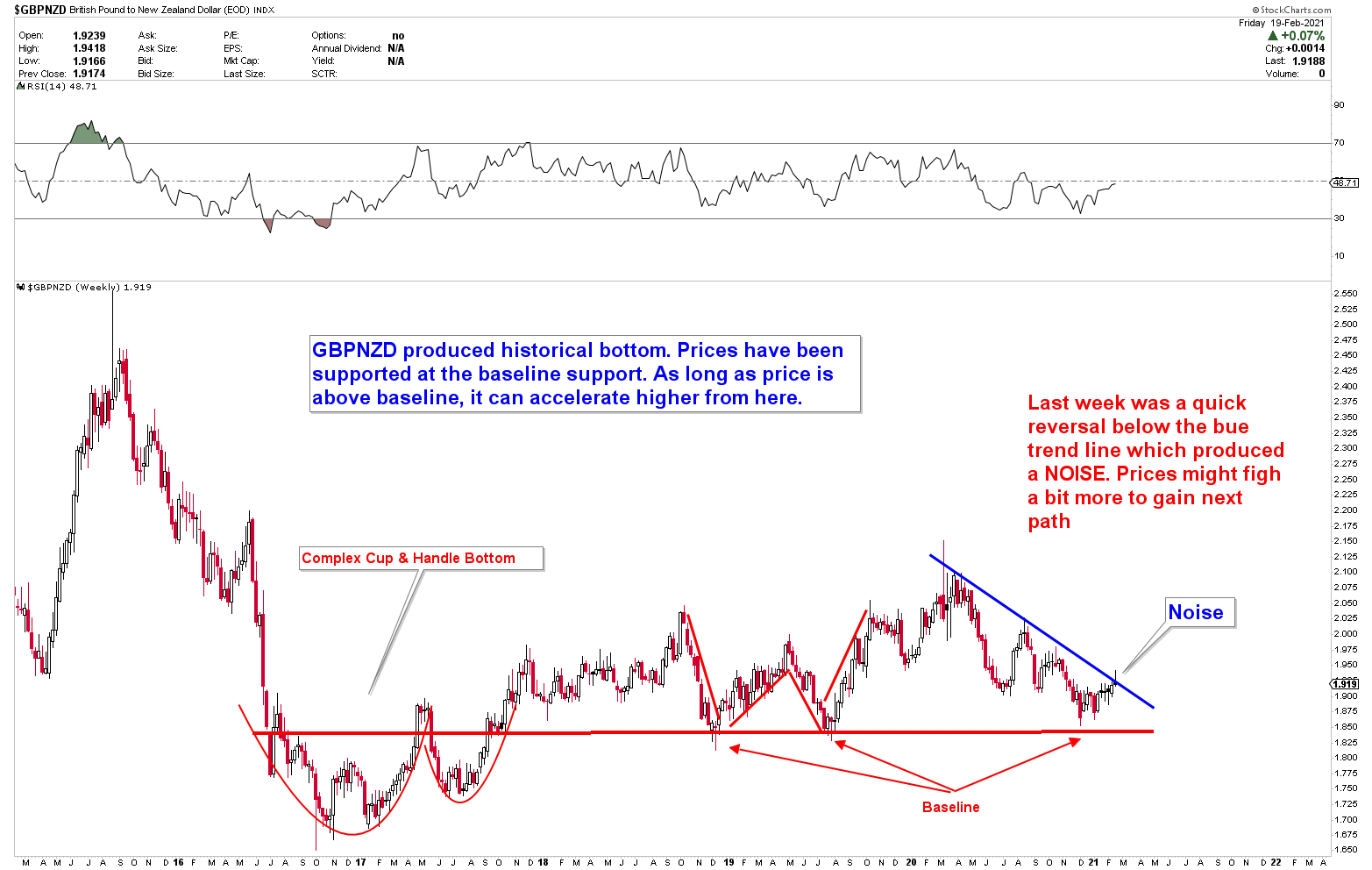

We introduced the GBPNZD chart last week. As per our expectations, prices went higher, but failed to close the week above the blue trend line. Maybe it’s not the start of the bullish movement. But as long as long-term baseline support holds, it could be higher. Dual scenarios are emerging in this pair. There are certain implications that indicate bearishness to come. It is good for the moment to avoid this instrument.

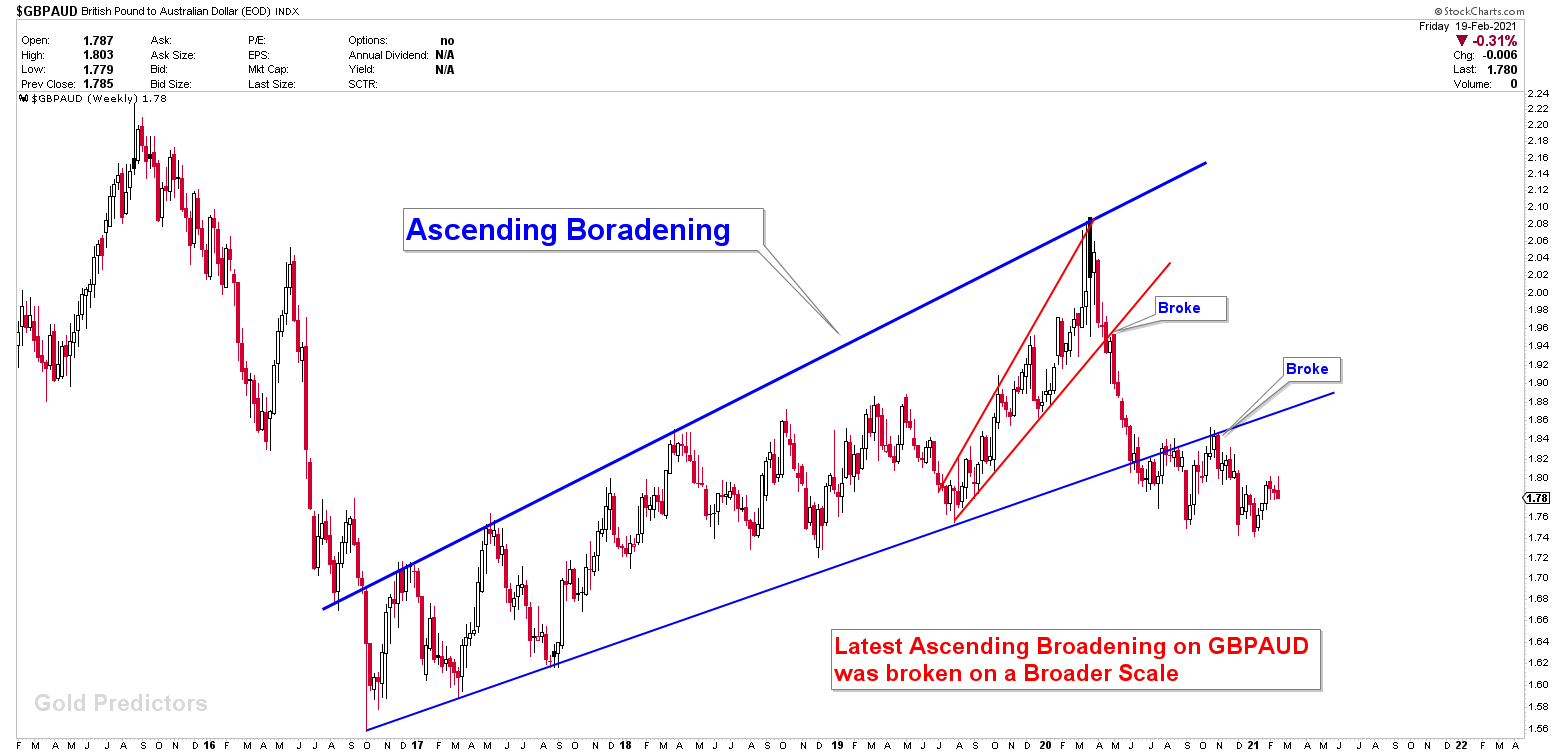

Let’s have a look at the chart for GBPAUD. On a wider scale, GBPAUD broke the BLUE long-term Ascending broadening wedge, which was the cause of a fall down. Also, broken prices declined in the red ascending broadening patterns. As the AUD remains so strong and the GBP is also strong, the pair could be risky for short-term trading. In this pair, there may be some developments for further directions.

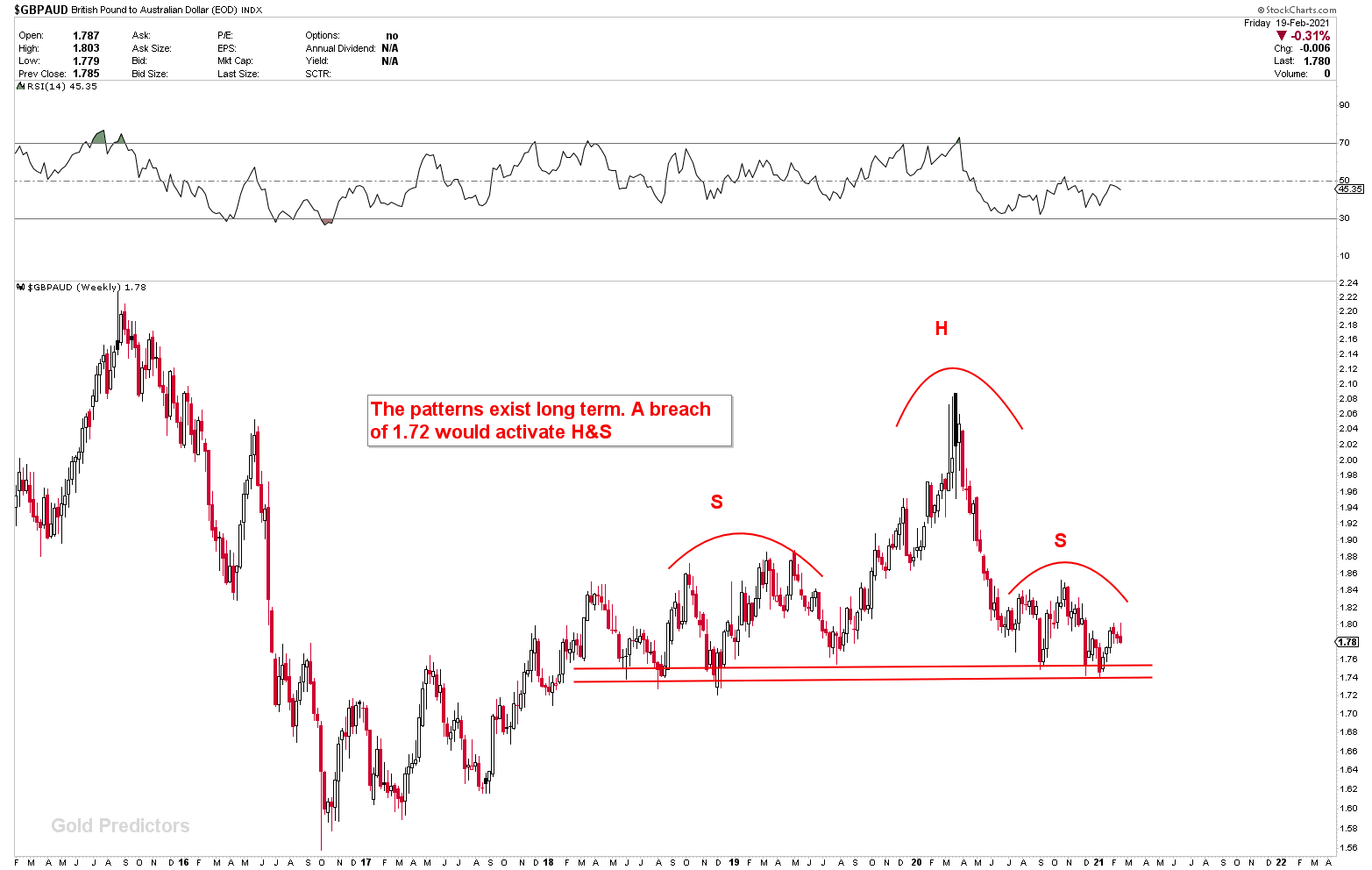

However, by looking at another chart, it is clear that if prices breached 1.72 GBPAUD, head and shoulder development would be confirmed. After that, prices would sink much lower. The possibility of this case occurring is much greater at the moment as AUD shows strength. It is just the matter of time and patience. Always follow the prices. Sometime prices reverses quickly and develop opposite patterns.

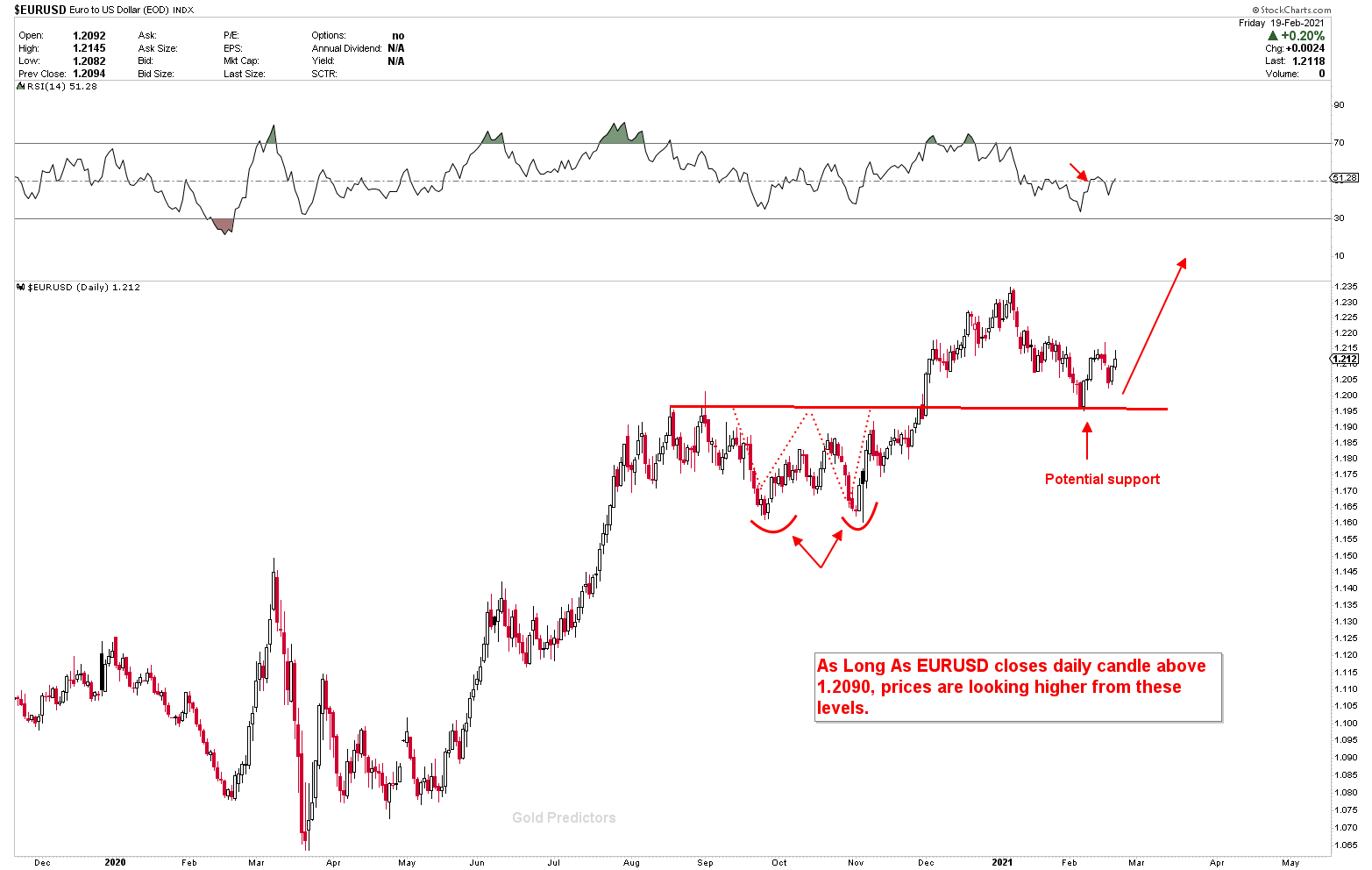

The EURUSD is bullish still. The pullback was above the RED line last week. Prices are expected to accelerate higher as long as EURUSD remains above the red line. And if the USD remains under pressure, then EURUSD will do well.

The dollar is ready to exert pressure again. While the AUD will shoot higher still further. Also, CHF is bearish. A few months ago, a long-term buy signal was produced by AUDCHF and is still valid. Bullish patterns have emerged for all AUD pairs: AUDJPY, AUDCHF, AUDCAD.

To receive the free trading alerts, signals and articles please subscribe as a Free member to the link below.