A Significant Liquidation Event in Gold

The Fed plans another interest rate increase on Wednesday. The impact of statements such as the Fed might increase interest rates by 0.75% instead of 0.5% on the markets resulting in a sharp decline in the prices of stocks and precious metals. The situation will be extremely intriguing during the Fed’s announcement, and a rate hike of more than 0.5% would be sufficient to send a message to the market regarding their inflationary and political intentions. Whether or not it occurs, it will be sufficient to shake the stock and precious metals markets.

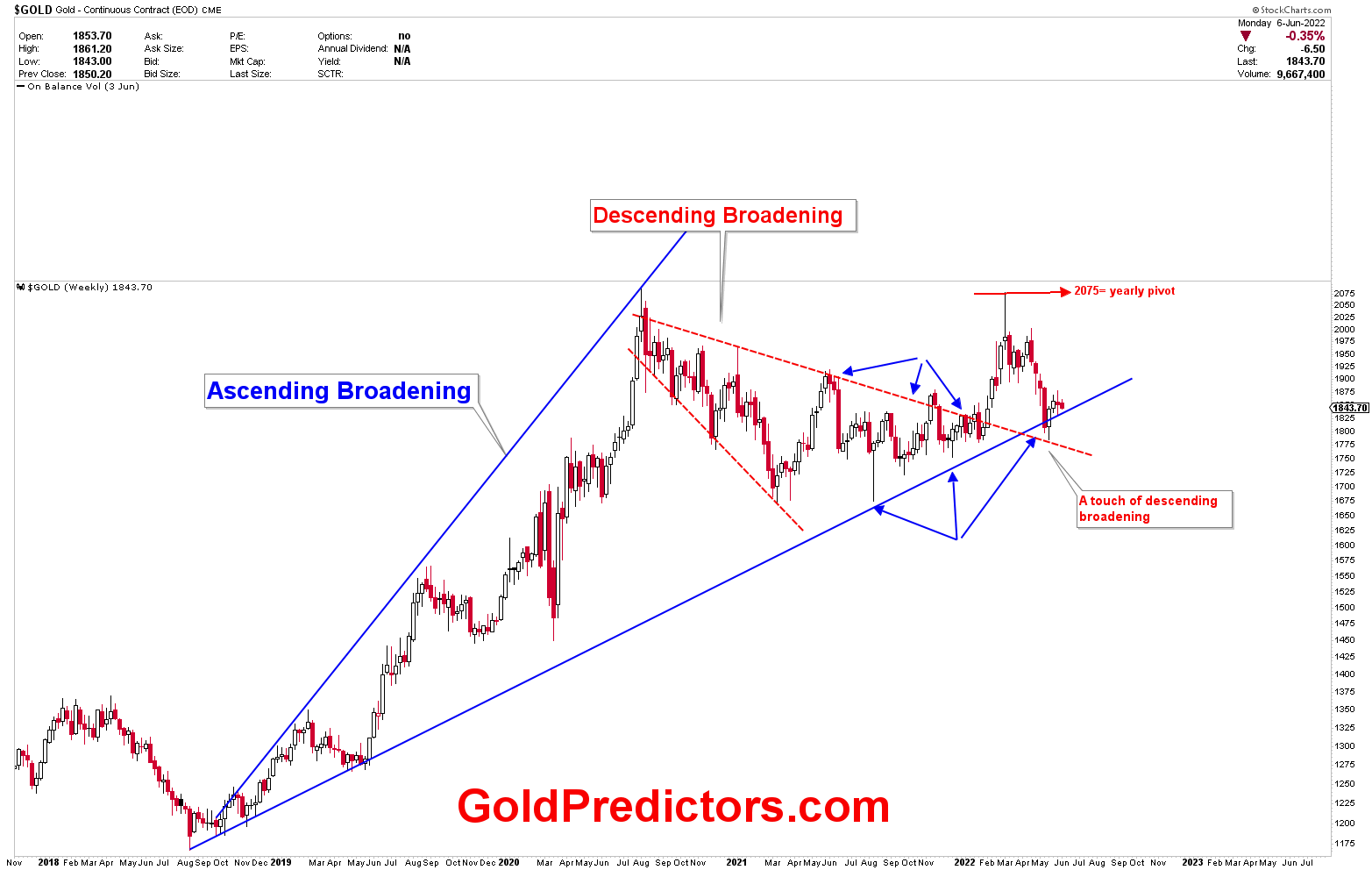

In last week’s article, it was stated that we anticipate a sideways gold market between $1,830 and $1,875. The peak was reached in $1,875, and gold fell below $1,830. We mentioned in our most recent weekly letter that $1,880 is the pivot for this week if gold is to advance. It was determined that a BUY STOP at $1,880 will be beneficial for a price increase. The peak was reached in $1,879, and the price dropped approximately 80 dollars, as expected.

We conclude with a straightforward statement.

We expected a drop from $1,975 to the inflection of $1,790, and the low was developed in $1,786. Then we expected a bounce from $1,790 to $1,875, and the high was $1,875. We anticipated that $1,880 would be the pivot for this week, & $1,879 was the week’s high, and the price has dropped 80 dollars from the pivot as of the time of writing.

What is Next?

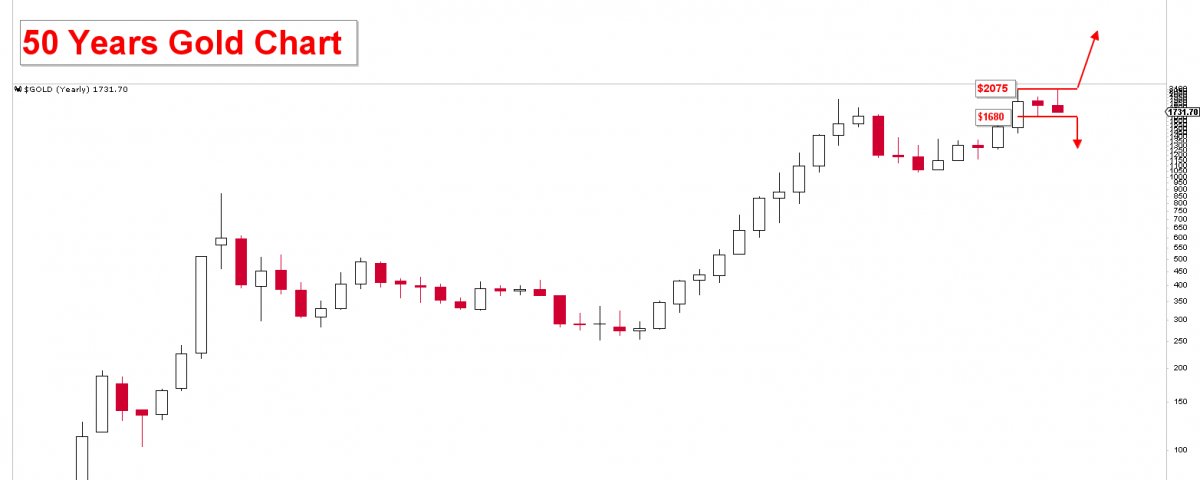

Gold remains bearish and is trading at a highly significant area where the price has a high probability of breaking down to significantly lower levels. This week’s Fed announcement will prompt the next action. A move above at least 1880 is necessary to consider higher levels. Nonetheless, a further decline towards 1760 is conceivable. The preceding chart illustrates the significance of the inflection, whereby a price breakdown will activate much lower ascending broadening targets. On the other hand, the US dollar index is breaking away from significant resistance levels, and a breakout will further propel the dollar higher. Silver is also bearish, with 20.80 or 18.75 as the two primary key targets for the next significant bullish rally.

Please login to read full article!

Please subscribe to the link below to receive free updates.