Gold Bottom At Inflection Point

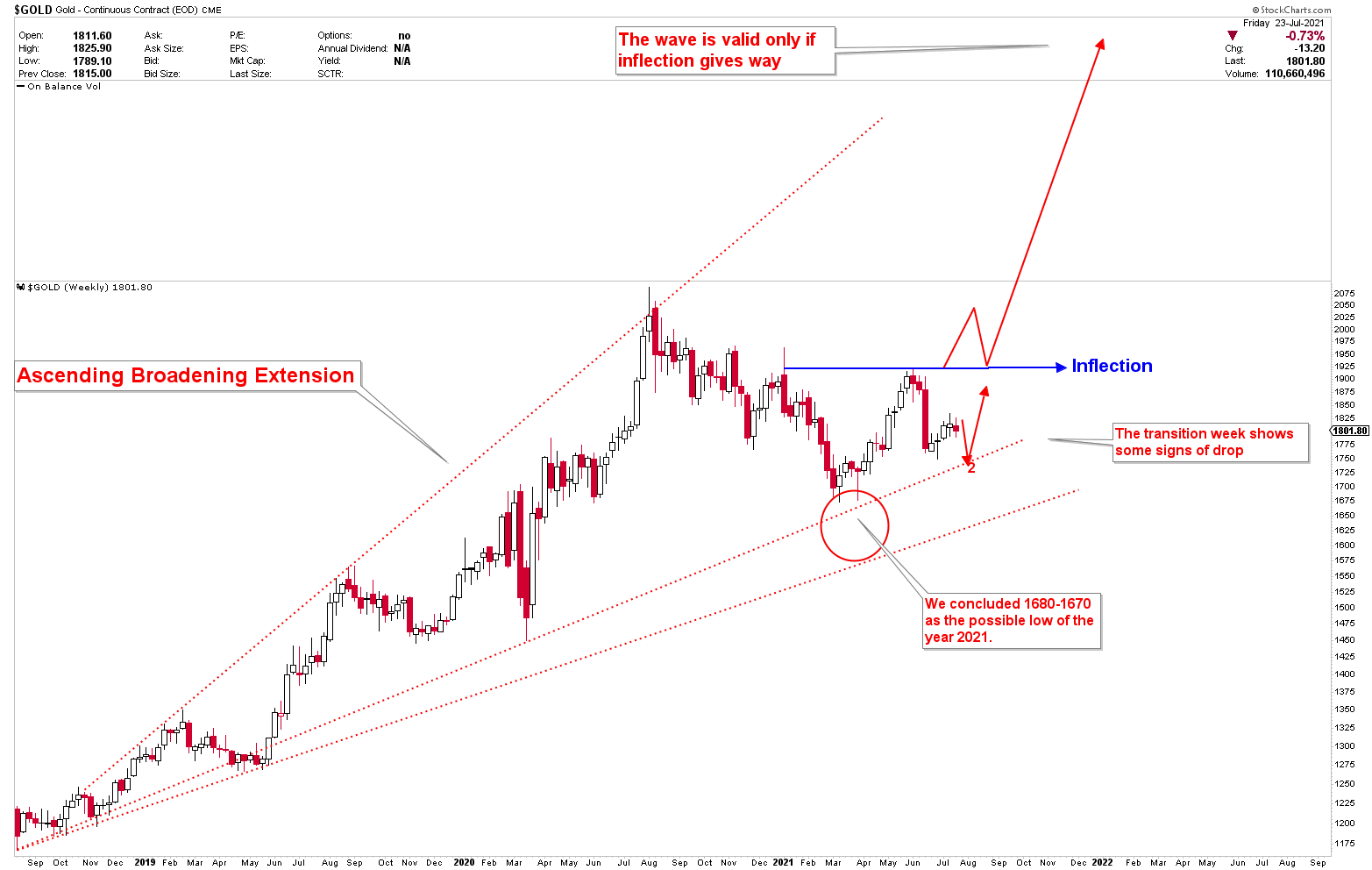

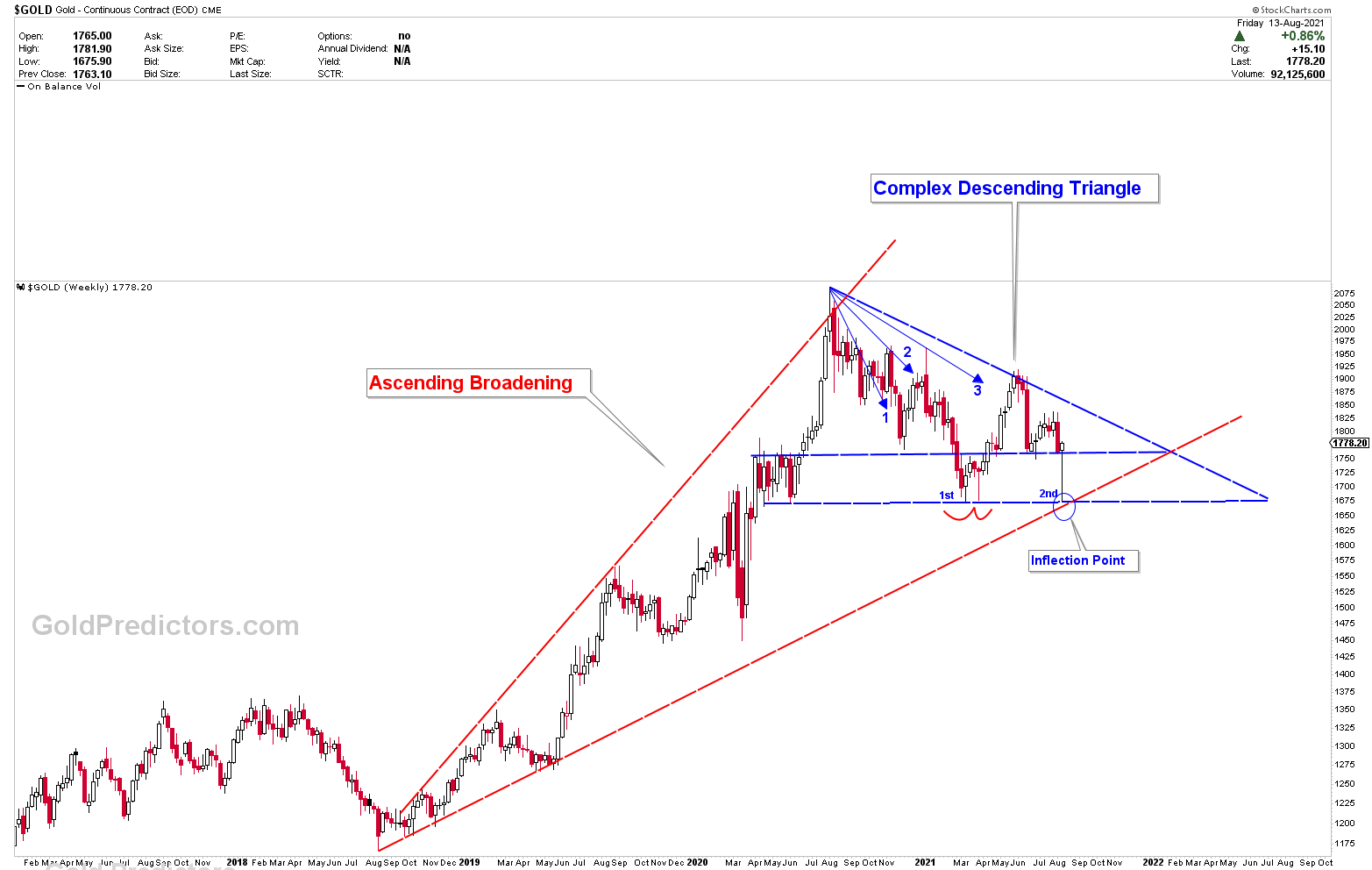

Last week, gold bottom at inflection point of 1680, resulting in a strong reversal weekly candle. Whatever the circumstances, we made it clear to premium members that we expect higher gold and silver prices. It was mentioned that the price drop on Monday was merely a bear trap. We stated clearly three weeks ago that gold prices are likely to fall from 1835 before rising significantly. Prices began to fall exactly in 1835. When prices were trading at 1680, we publicly stated that gold is unlikely to breach 1680. And how important is 1680 number in terms of our historical chart analysis.

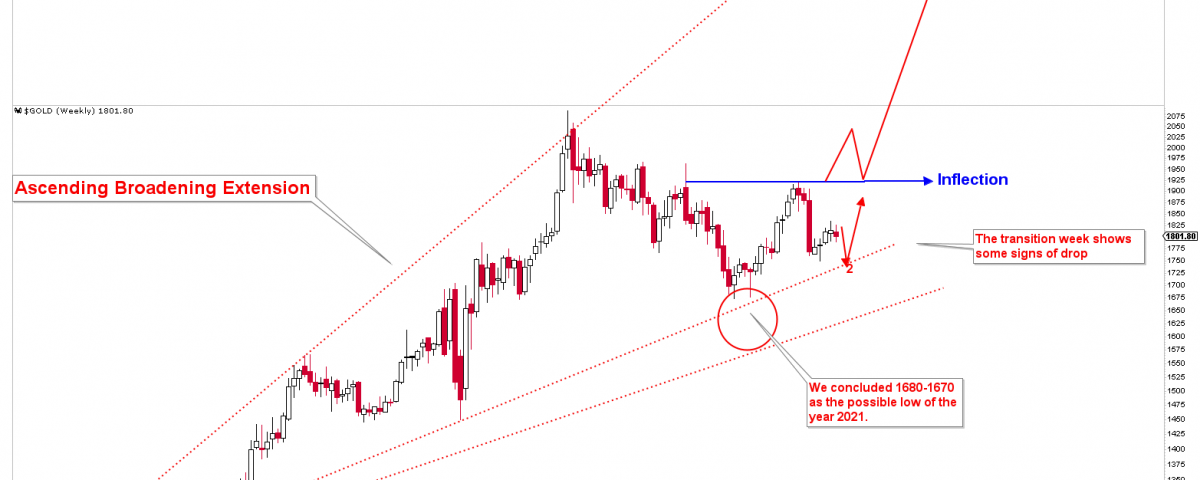

The chart shows how we presented a leg down in gold from 1835 to lower levels, followed by higher prices. The chart was developed on 23rd July 2021.

Gold price is operating in line with our expectations. Since prices closed above 1760, prices are likely to trade sideways to higher in the coming days. Since the volatility is extremely high at the moment, only a few of the levels indicate that the bounce could be a dead cat bounce. These levels and scenarios will be discussed in detail in the premium article tomorrow. A gold bear trap produced one of the biggest historical weekly candles in gold weekly charts.

Did Gold Really Bottom?

There are two possible scenarios for understanding this type of heavy move that happened last week. Prices fell in a matter of minutes and recovered 100% of the drop by the end of the week. These details will be discussed in premium article tomorrow.

Silver has two levels of support, as previously stated on twitter. The first is 23.01, and the second is 20.80 for silver to bottom on a long-term basis. Silver dropped to 22.98 on Friday, just 3 cents below our target, and then shot higher after forming an inverted head and shoulder bottom on hourly charts. This type of development also indicates two possible scenarios in terms of long term development. These scenarios will be discussed in detail in a premium article tomorrow.

Gold Trade Entry

Our trade entry for premium members which went long at 1741 by following the CUP type of bottom on short term charts. The trading positions will be kept open since gold has to decide this week for the possible targets.

To Receive Free Updates Please Register As A Free Member