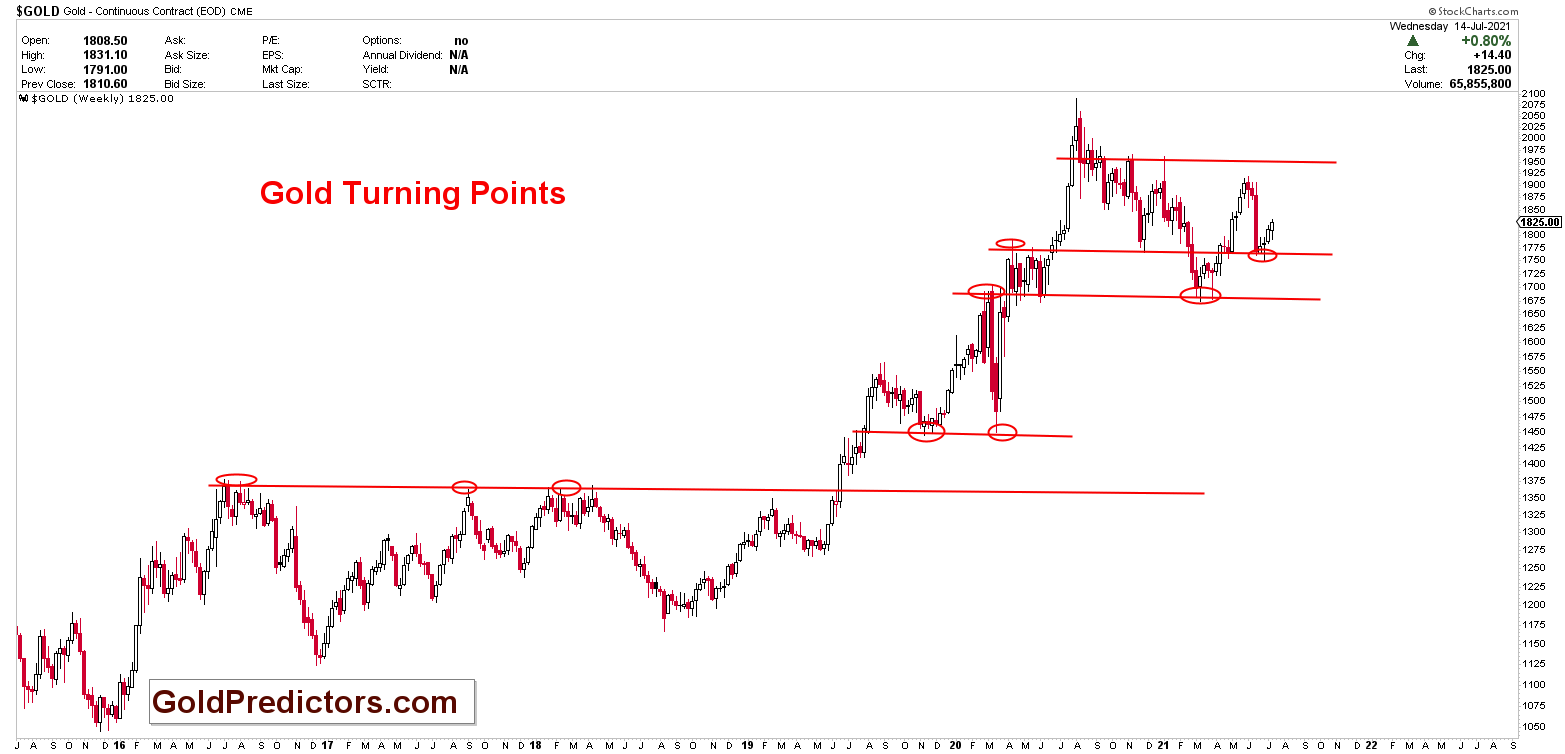

Turning Points in Gold

A turning point emerge when a significant shift in any asset takes place that has an impact on an asset’s future trajectory. This happens due to variety of factors. These factors include as venture requests, the value of the US dollar, and central bank savings. Turning points usually occur at a consistent interval of time, for as every X days. In any event, as with the timing, it’s unclear whether the price will reach a top or a bottom.

Turning Points in Daily Life

Turning Point is something that may be noticed in daily life. Consider an unwelcome diagnosis, an accident or a sudden phone call from your dream company offering you appointment letter. Having a baby in a family or a new campaign against smoking by a company can also be a turning point. Every turning points can bring a sudden change in life creating a positive or a negative change towards the future.

Turning Points in Business Market

When an asset’s price direction shifts, this is referred to as a turning point in finance and trading. Therefore, if any asset reaches a turning point in five days, that doesn’t indicate whether the price will rise or fall, as we need to see patterns before the turning point. The consequences will be gloomy if it is followed by a surge. If, on the other hand, gold’s turning point is missed due to a decline, the signals will be bullish. Changing time intervals are captured by turning point. That is, most studies of stock price behavior use fixed time intervals within the data, such as daily, monthly, or yearly returns.

There’s no “guarantee” that the following turning point will be the one which will turn the assets direction, not at all like a cycle that highlights a settled course of action of tops and bottoms in an exact and rehashing design. We believe the price will most probably shift direction based on many other factors.

Turning points in Gold Market

Due to gold’s worldwide commercial use and consumption, it became a good and secure investment opportunity for the investors. However, there are also turning points in the price of gold occurring from different variables. What’s crucial to note is that the price of gold was matched by a price extreme at each turning point. Gold peaked out at times and dipped out at other times, without technical pattern. This may happen as a result of monetary policy/Fed talk, supply and demand, Covid-19 crisis, currency fluctuations, ETFs, and other unknown uncertainties.

Practically in each case, the turning point flips the direction of gold. As it can be seen by the cycles and series of turning points, if gold is on the verge of a recovery, it will most likely fail at the turning point. However, on the other hand, if recovery is over, it will certainly rally after the turning point.

Sign up for Gold Predictors