The Next Cryptocurrency To Explode

Despite a lot of things that would normally make investors unwilling, including tensions between the US and China, Brexit, and of course a global pandemic, Bitcoin achieved a remarkable increase in 2020. Bitcoin prices touch the $4000 levels in March 2020 before the real pandemic started, and now rose to above $35,000 at the time of writing. Since then, the price of other cryptocurrencies has been rising at the same time. Here we will discuss about the next cryptocurrency which are about to explode.

One reason for the massive price growth is due to the investors from large institutions such as the pension scheme, college endowment funds and investment trusts. This scenario was not there in 2017 when prices of cryptocurrencies gain more than 1000% in many crypto assets. In 2017 individual retail investors dominated the crypto-currency ecosystem, many of them attracted by the shortage of Bitcoin and its absence from the global financial system. The bull market in 2017 had all the signs of a traditional financial bubble and investors who purchased ‘fear of missing out’ (FOMO). In 2020, COVID-19 pandemic led to huge stimulus package from governments around the globe and many central banks printing more money. This phenomenon would drive the inflation UP and lowers the people’s purchasing power. The US Federal Reserve last year signaled it would be slightly more tolerant of rising prices when it relaxed its 2% inflation target. Due to this threat, investments like bitcoins are being consider as a store of value for many.

Even central banks started to work on cryptocurrencies. Russia, Canada, the EU and others already working on Central bank digital currencies (CBDCs) which signals that powers that remain in the old financial systems are seeing cryptocurrencies as the future.

How Bitcoin Explodes

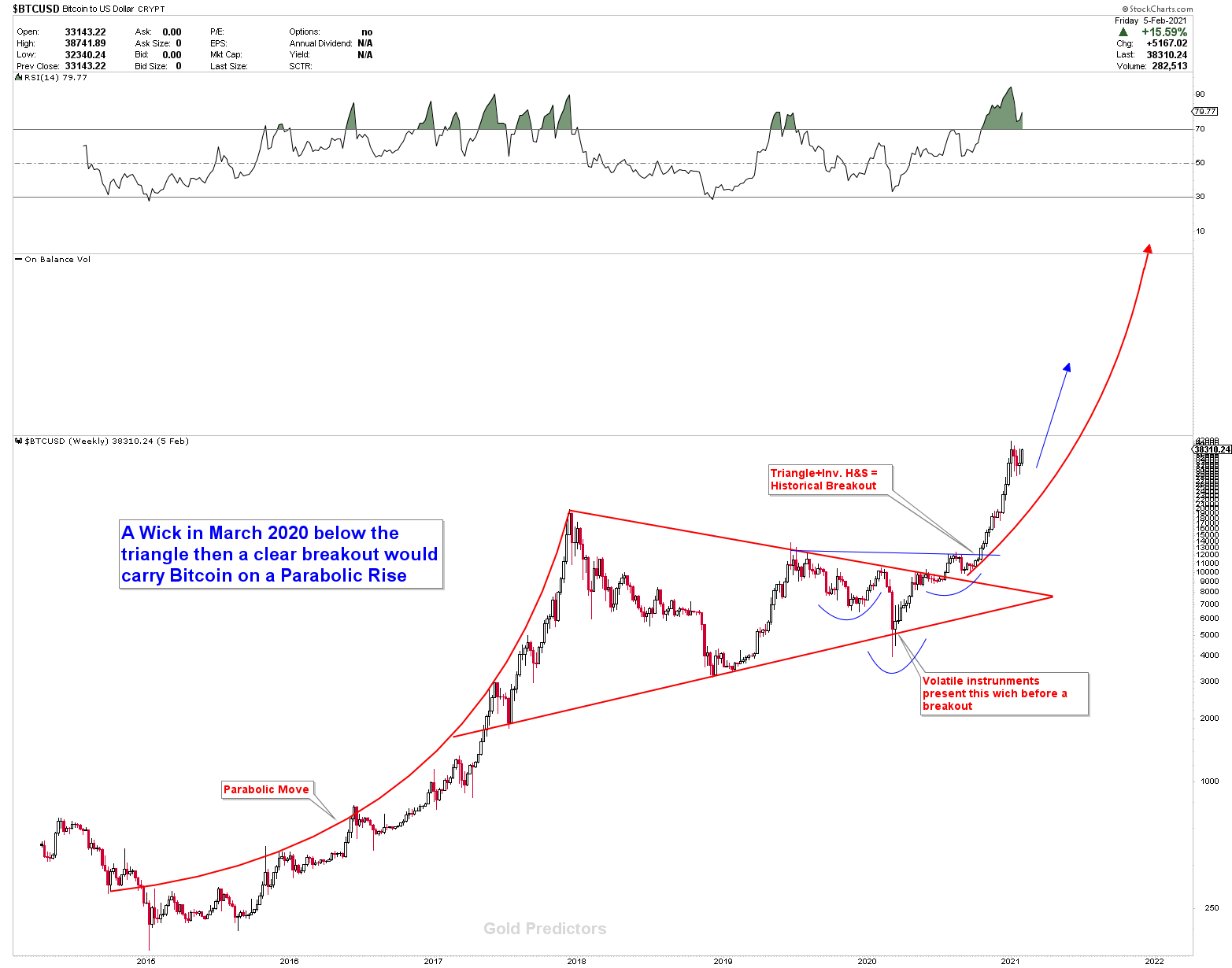

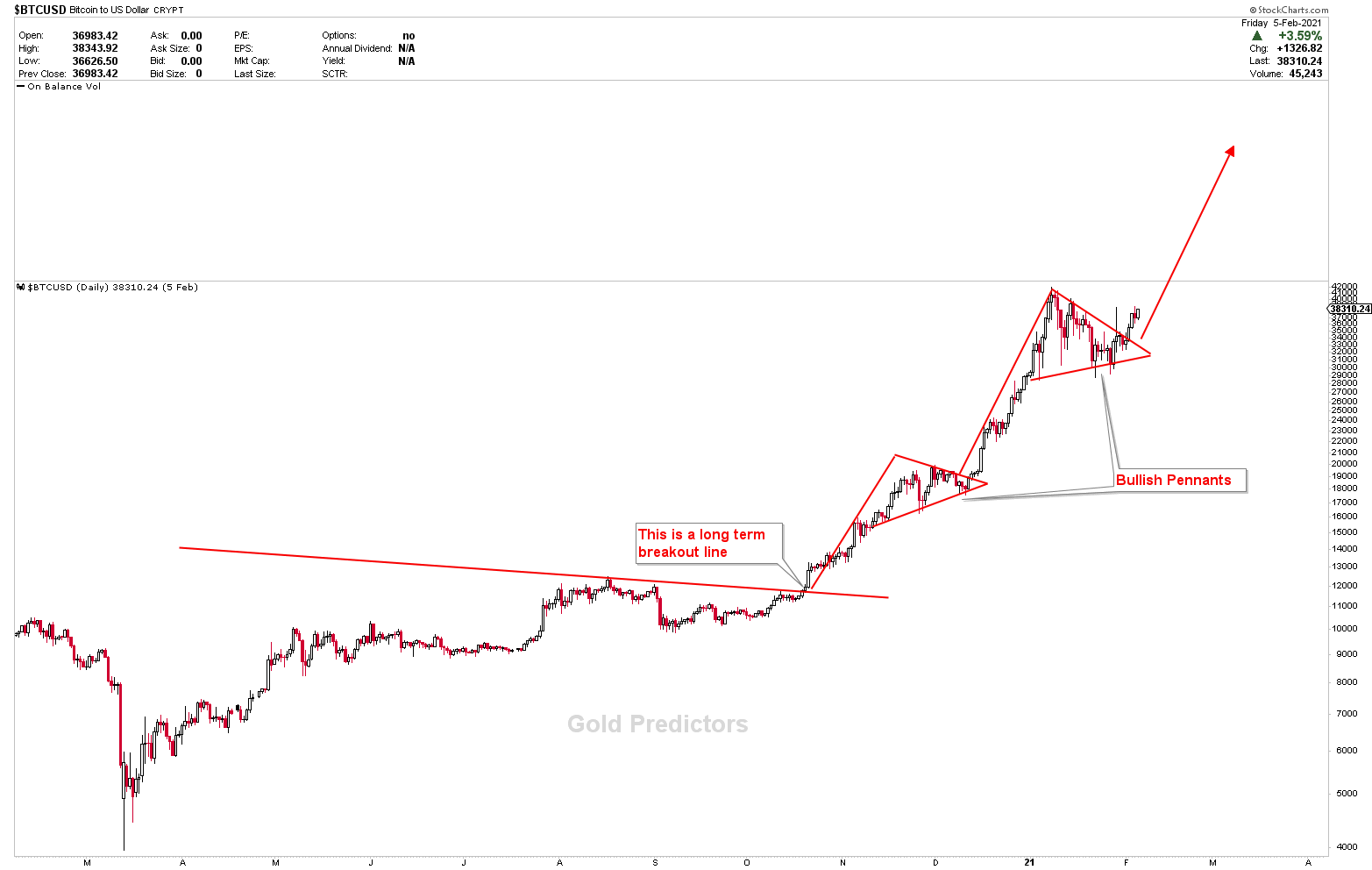

Looking at the weekly Bitcoin chart, it is very clear that prices are on a parabolic rise. The top of the move is very difficult to see when any instrument initiates parabolic movements, as most of the times, the top is terminated with a type of bubble. In the chart below, it is very evident how the weekly bitcoin generated its pattern. Bitcoin was the perfect entry in March 2020 when it hit the bottom of the triangle by producing a Wick (quick reversal). An inverted head and shoulder, which was another bullish indication, produced a perfect reversal and hammer. Another entry in Bitcoin was a breakout at the neckline of inverted head and shoulder at $12000. Prices are now moving with a parabolic rise and no sign of a pullback. Monday could be a strong day, as on daily charts, the bullish Pennant was broken and retested.

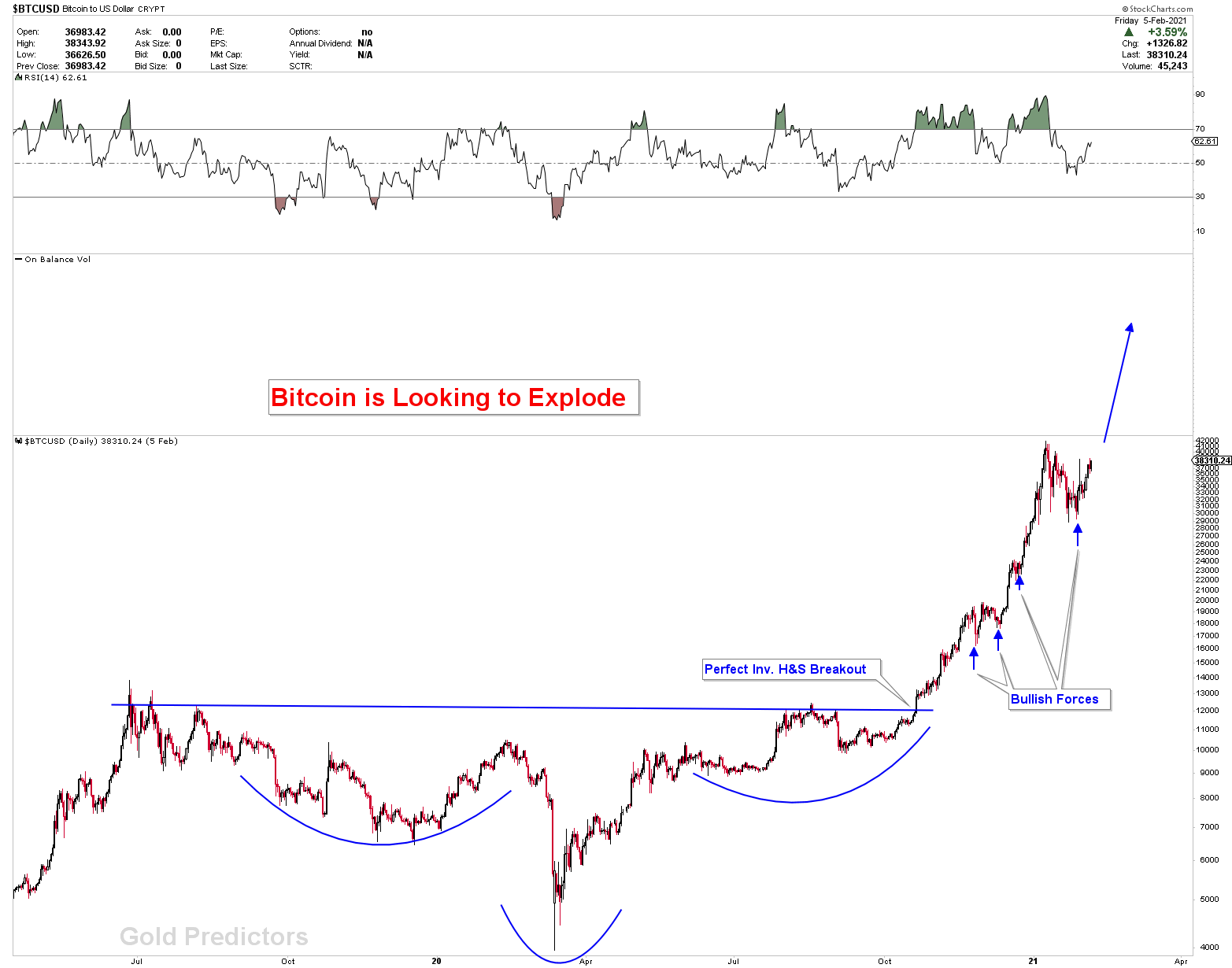

Just to observe the blue inverted head and shoulder, zoom out the bitcoin chart on a daily timeframe. It is very clear that the perfect breakout at levels of $12,000 will take prices to much higher levels above $40k. The rapid reversal on the chart identifies bullish forces that demonstrate some power and the price shift is far from over.

After a breakout, bullish pennants are observed, when we zoom out the daily chart, which looks to be forming bullish flags. Each pennant’s break and rapid reversals show some strength which is indication of much higher levels coming. Following the COVID pandemic, these pennants emerged in Gold when Gold shot in days from $1500/ounce to $2070/ounce.

Next Cryptocurrency To Explode

Ethereum was next, while Bitcoin was the leader of all the coins. In addition, there are many coins that have attracted market attention, but the price of these coins is still much lower to buy. There are some of them listed below.

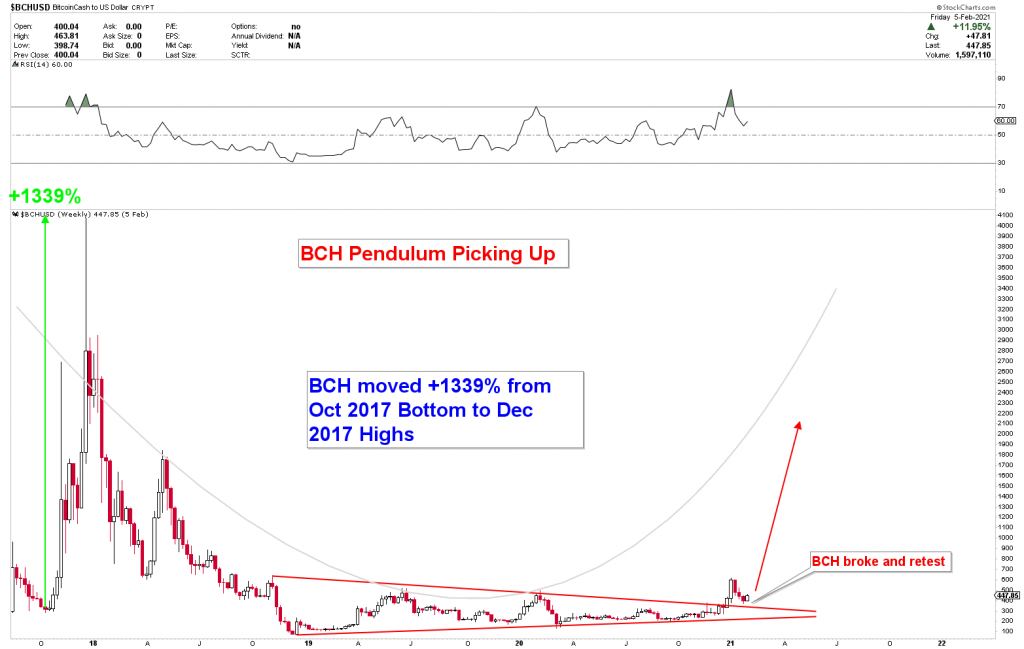

Let’s take a look at Bitcoin Cash (BCH), which has a market cap $9,352,705,729. The price is moving in the Pendulum type structure. Remember, BCH moved 1339% in less than 2 months timeframes before crashing to grounds, during a 2017 cryptocurrencies bubble. As said earlier, current moves in cryptocurrencies are because of enormous interests and demands from investors, therefore prices might shoot higher for some longer time and might become stable longer term. While Bitcoin and Ethereum have already left the train, BCH is looking as good option to invest as prices are much lower. The triangle (RED) is already broken and a buying opportunity is usually a re-test of the triangle.

Litecoin (LTC) is the next crypto asset that currently has a low value but enormous demand. The current price is $150 with a market cap of $11,454,333,411. When Blue Triangle was broken, that was the big buying opportunity in Litecoin. But a lot of investors and traders missed out on that. The price structure looks heavily bullish. In particular, the double bottom formations indicate that during the third spike, this pair could break the recent highs of 2017, keeping in mind the inflation adjusted peak. In terms of price gains, it is also a possibility that Litecoin is next to Ethereum.

Let’s have a look at Dogecoin (DOGE). How beautifully has the coin developed its market and prices. The main thing that separates Dogecoin from most other cryptocurrencies is that it is a cryptocurrency that is inflationary rather than deflationary. When a cryptocurrency is inflationary, like Dogecoin, it means that the number of coins in circulation is not limited to the maximum. Bitcoin and many other cryptocurrencies are designed with a hard coin supply cap. The potential issue with this is that it may no longer be profitable for miners to continue to maintain the system once the cap is reached. This would either lead to unacceptably high fees to encourage miners or very long transaction times as there would be no incentive to process transactions from the network. This coin’s structure is parabolic and suggests much higher movements ahead. Because of its recent developments, this coin might be an attraction for many. When price produced a spike last week on fear to lose the opportunity to enter at lower value, Doge produced another signal to go long at 0.026 when tested the 61.8% of retracement on a log chart.

On the basis of the above debate, as soon as the market opens on Monday, we would love to enter these markets. These signals are considered to be bought at the level when market opens on Monday. At these levels, you can immediately consider Buy Now (if you are allowed to during weekends). When Monday opens, we will consider the entry price (Asian trading hours)

1. Bought Bitcoin (BTCSUD) $38100 (3 Positions)

Stop Loss: $28300

Target: Close 1 @ $64150 (remaining 2 would be open)

Target for remaining 2 would be posted

2. Bought Litecoin (LTCUSD) @ $149 (3 Positions)

Stop Loss: $60

Target: Will Update

3. Bought Dogecoin (DOGEUSD) $0.056 (3 Positions)

Stop Loss: Will Track

Target: Will Update

4. Bought Bitcoin cash (BCHUSD) @ $444 (3 Positions)

Stop Loss: $195

Target: Will Update

Note: Different platforms have rules that differ. All signals can be applied on all platforms, with different attitudes depending on the availability of resources on each platform. The idea is to simultaneously execute three positions. At the nearest exit point, we will close one position and hold the remaining positions for the longer term. You can play these possibilities with some other options available in your platform/exchange.

In 2017, cryptocurrency markets saw a bubble, but the movements are real at the moment, which can shoot the particular crypto value to unexpected figures. The overall market cap for cryptocurrencies has breached USD1150B and is expected to increase next week. Although the market is volatile, it is highly recommended not to jump with blind eyes. With enormous volatility, Financial instruments are easy to retrace up to 61.8 % quickly before any significant bottom. If crypto becomes the next digital currency really, then heavy volatility will bring big moves in both directions, that would be time for you to jump in. What would make you in trouble if you buy Bitcoin at 40k and price crash to 15k. Next week could be the big week , Bitcoin could shoot to new highs, Litecoin would try to break the Redline very quickly.

Invest smartly and play safely.