Gold Under Pressure

Last week, the gold market remained under pressure as the significant inflection level of 1680 was breached. The gold market’s weakness could be credited to the strength of the US dollar, but the US dollar index is currently trading at strong resistance, as indicated by the broadening wedge discussed earlier. On the other hand, there is concern about the Federal Open Market Committee (FOMC) meeting and the employment report. These events will be highlighted and regarded as major events, causing the markets to experience some volatility. Another reason for the gold market’s decline could be the Fed’s PCE inflation gauge, which was released on Friday. Nonetheless, Goldman Sachs analysts raised their Fed rate forecast to 5% in March. Gold prices are likely to remain under pressure, and any market rebound should be viewed as a strong opportunity to sell the market.

Technical Outlook for Gold Market

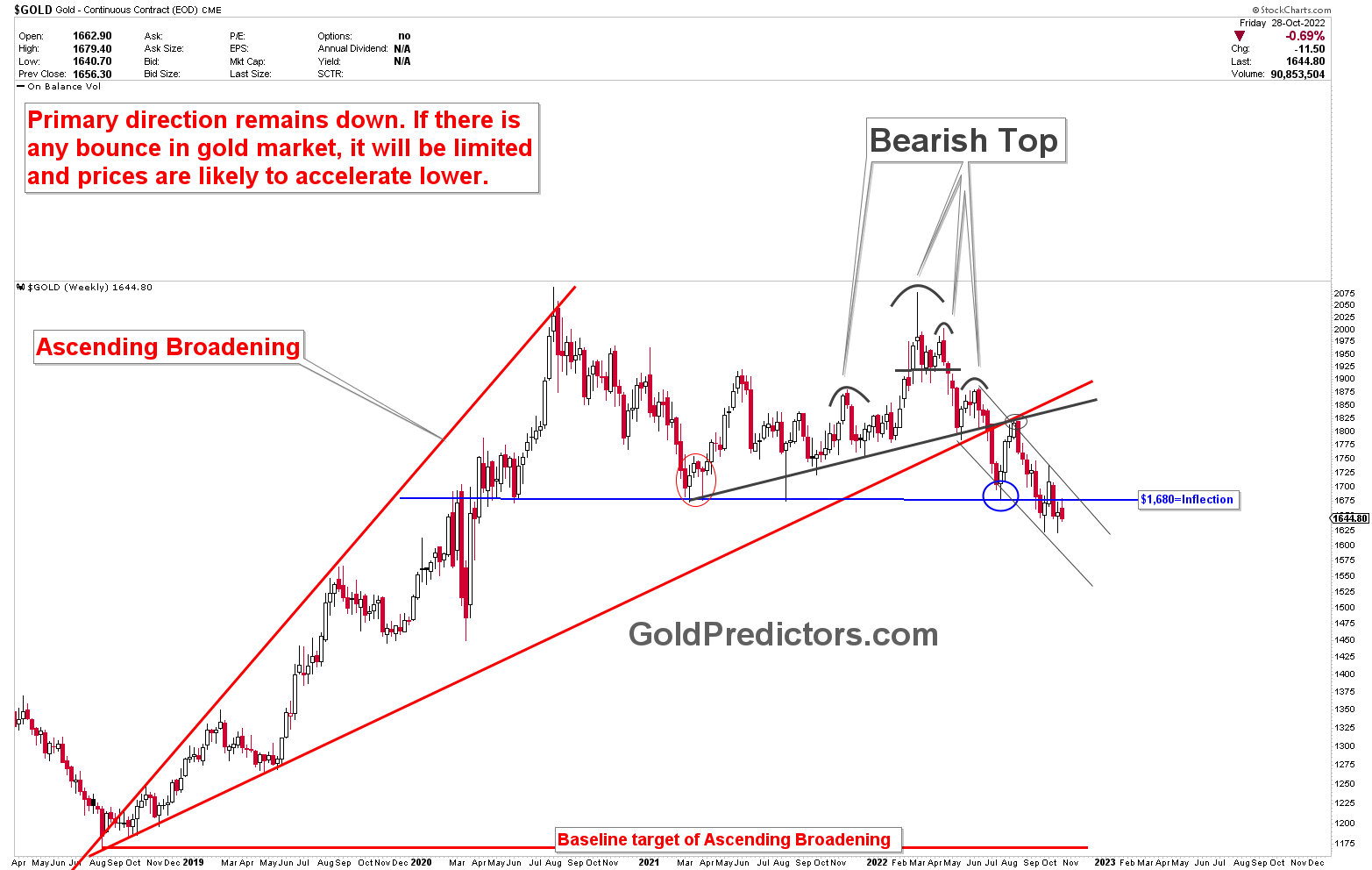

The chart below depicts the technical outlook for gold. The ascending broadening chart has been discussed and updated from last two years. Prices have been breaking these bearish patterns since the ascending broadening patterns were discovered in late 2020. We expected a drop to 1680 after ascending broadening patterns were broken, followed by a bounce back to the breakout region. Gold followed the expectations and broke the inflection point of 1680. This level has been discussed for the past two years and is very significant. The inflection points of 1680 were broken a few weeks ago, and gold prices are currently trading in a bearish formation. There is currently no energy available on the market. The formation of a bearish head and shoulder pattern with a double top suggests that prices are likely to fall further.

How to Trade the Current Gold Situation?

The gold market is currently very volatile. Traders and investors find it difficult to trade in such a volatile market. The events of this week, particularly the jobs report and the FOMC meeting, will cause a volatile shift in the market. Few weeks ago, we expected a bounce from 1680 to 1760 when the gold market broke the ascending broadening patterns. As shown in the chart below, gold produced the bounce, and we executed a sell trade in the 1760 region. The trade’s target was much lower, but due to market sentiments, we booked profits of $112/ounce. Trading is all about making money, not holding trades. We are currently looking for our next trade entry for members. The FOMC meetings and US job data will be used to evaluate trading gold and silver this week.

Please login to read full article!

Please subscribe to the link below to receive free updates.