Gold Reversal from 2022 Yearly Pivot

The Federal Reserve Bank of the United States will announce interest rates today. Fed Chair Powell indicated a few weeks ago that rates would be raised by 0.25%. While Powell has removed the mystery, the market will be closely watching today’s statement on the need for future rate hikes. Since this could be one of the most important FOMC statements in years, there will almost certainly be significant volatility before and after the FOMC release today. With current US inflation rates above 7% and the Ukrainian war likely to limit future economic growth while driving up energy – and overall costs – the prospect of future Fed rate hikes could not have come at a worse time. The University of Michigan Consumer Sentiment Index showed the lowest reading since 2011. The realities of brewing stagflation are already reflected in US stock indexes. The Dow Jones has fallen for the fifth week in a row. Mega-cap stocks (such as AAPL and MSFT) have been largely immune to the recent stock market rout. On the other hand, Precious metals reached the most significant number of $2,075 last week, as discussed in the weekly letter. The $2,075 yearly pivot was significant for the gold market to begin the next major rally or reverse from the yearly pivot. Prices quickly fell to $1,920, which served as the first significant support.

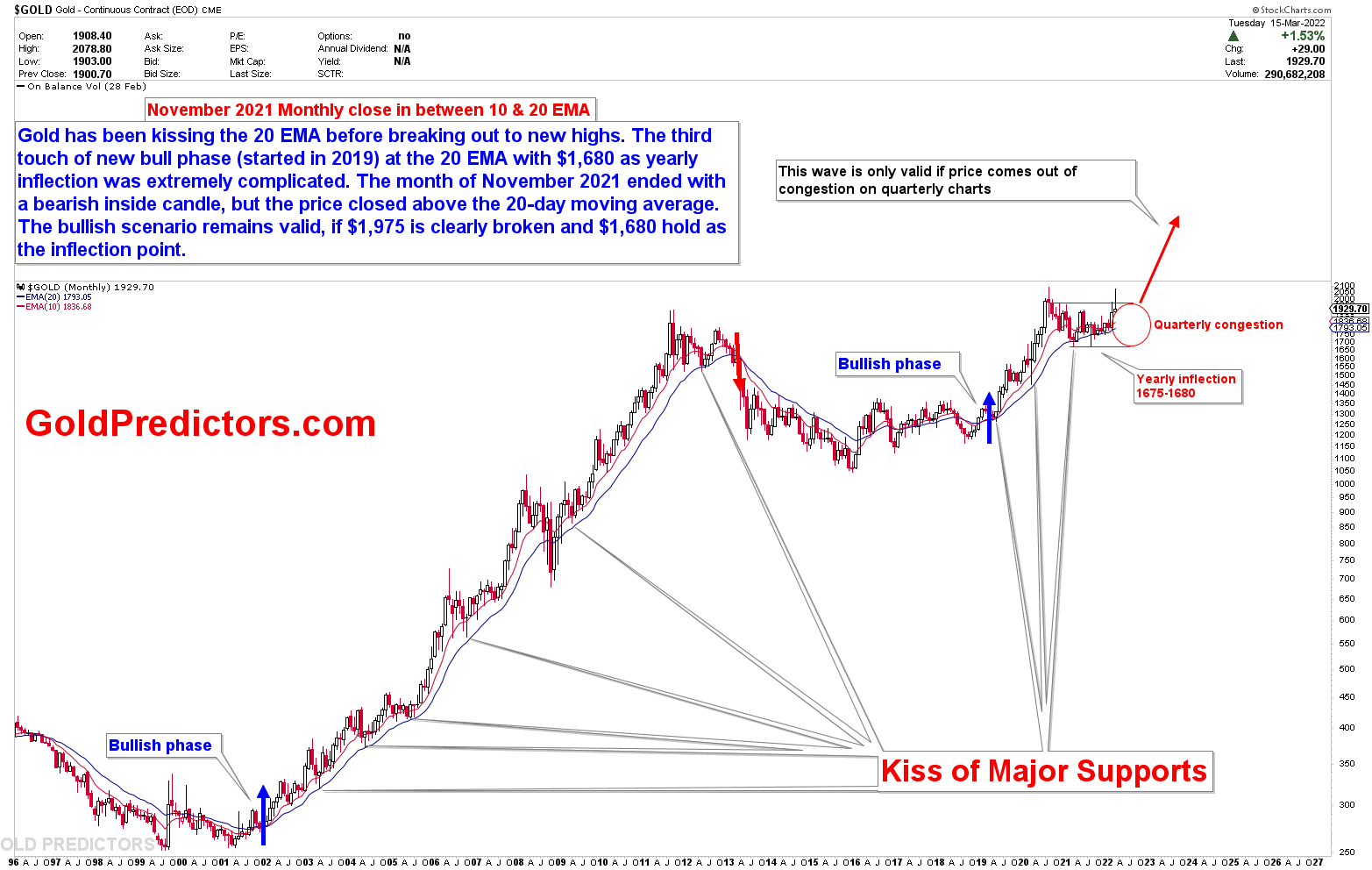

The chart below depicts the quarterly congestion that was broken last week, but gold must maintain $1,970 levels on a monthly basis. As shown in the chart below, prices have once again entered the quarterly congestion zone, where consolidations are due. Heavy volatility as a result of Ukraine-Russia conflicts and their impact on the global economy raises the risk in the precious metals market, making trading gold and silver extremely risky these days.

Since gold trading has been extremely difficult during these crises, this environment also generates good trading opportunities, if gold trading entry and exit are fully controlled by controlled risks. We entered a gold market trade, which was delivered to WhatsApp members. The trade was entered in $1,972, and the target was $2,069. After the entry of trade and price shot to hit the target, the inverted head and shoulder formed. However, we closed the trade early to book +69/ounce profits in one day. Due to the high volatility, trades must be entered at the bottom or top of the range. The 200 dollar range in the gold market will be normal in the coming months, and thus, looking at the chart in a larger context will make the gold market an excellent trading market during this crisis.

Please login to read full article!

Please subscribe to the link below to receive free updates.