Gold Reaction at $1875

Last week, gold prices rose from $1,780 support and broke through the $1,810–$1,813 resistance to reach the pivot of $1,875. Prices reached the $1,875 level before falling back below the $1,850. This phenomenon has been occurring for a year, and it will not take long before gold generates a congestion region between inflection points. The time for a decision is approaching soon.

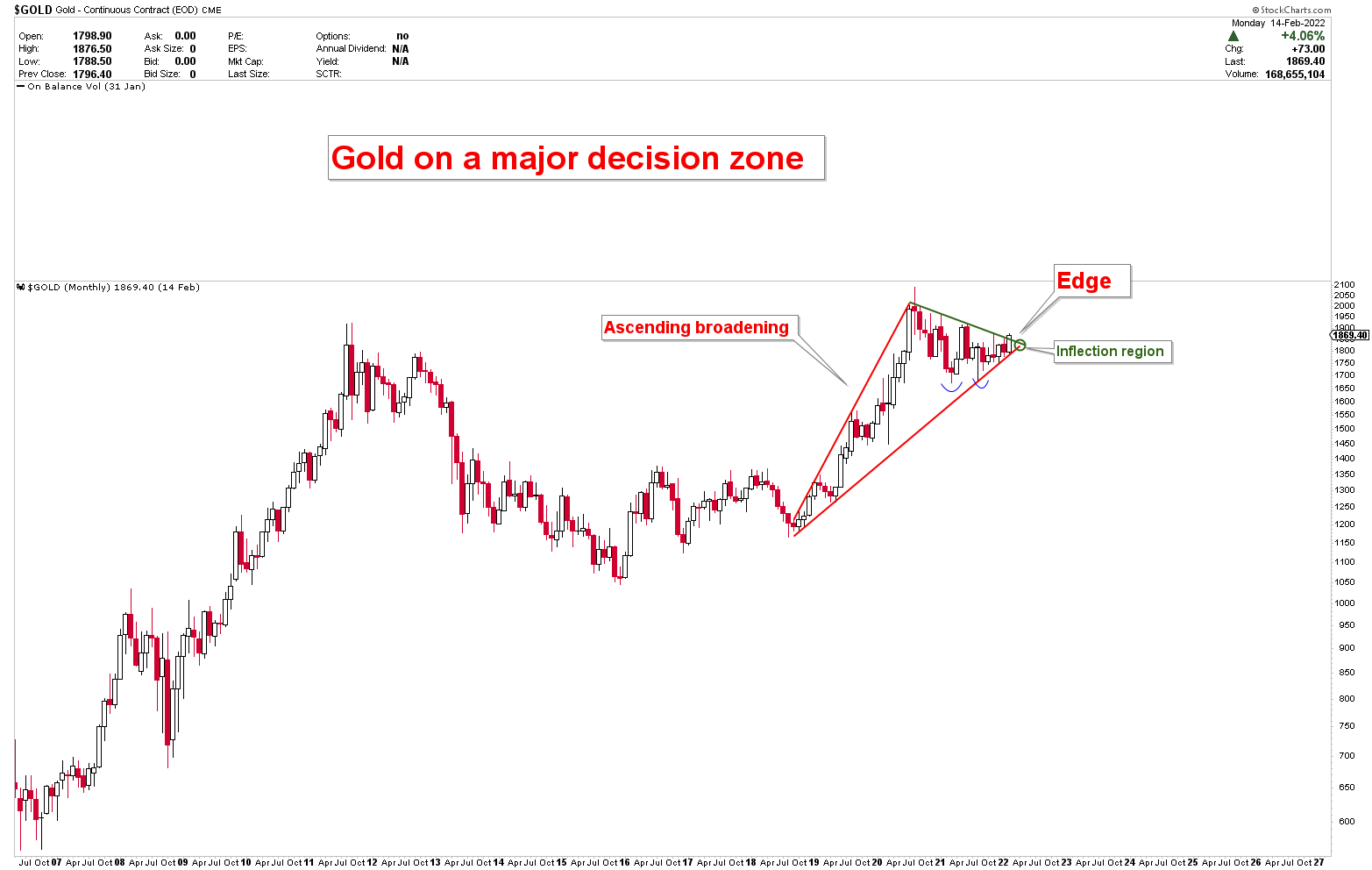

On a bigger scale, the gold monthly chart depicts the development of ascending broadening patterns. Last year, gold prices held the inflection point of $1,680, consolidated with a double bottom formation, and then formed a triangle. Last week, prices attempted to break through triangle, but failed to the green line. Gold is currently trading at the apex of the triangle, with $1,875 serving as the first immediate resistance and $1,920 serving as the inflection point. Any confirmation above $1,920 would trigger a new gold rally to new highs.

When profits of $55 were booked at $1,683 last week, prices rebounded hard back above $1,813 and closed the week above the $1,850 region. In the weekly report on Monday, it was stated that gold must be bullish in the short term until $1,875, and then there is a possibility of a drop from $1,875 region. As a result, we advised traders to avoid trading in the $1,875 region. Prices fell precipitously from 1875 to the $1,850s as expected. Patterns are not clear yet, huge volatility is expected in precious metals market.

Silver prices also trade in big range, in between $21 and $30 regions. Due to wide ranges in silver markets, both metals are vulnerable to significant risks. It has been discussed numerous times, February and March (2022) are big months for big decisions in precious metals, and it appears that the time for a big decision is approaching soon.

Please login to read full article!

Please subscribe to the link below to receive free updates.