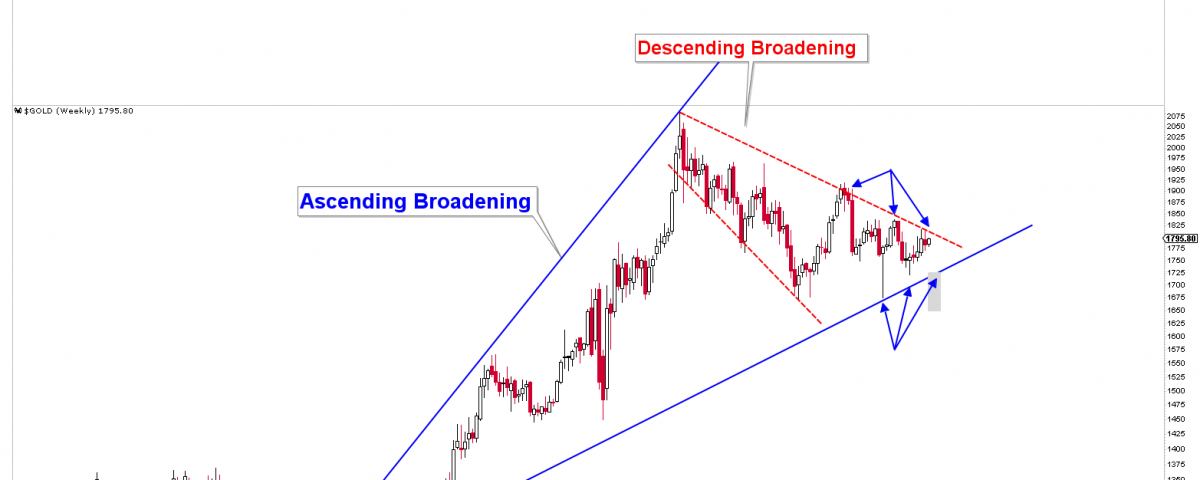

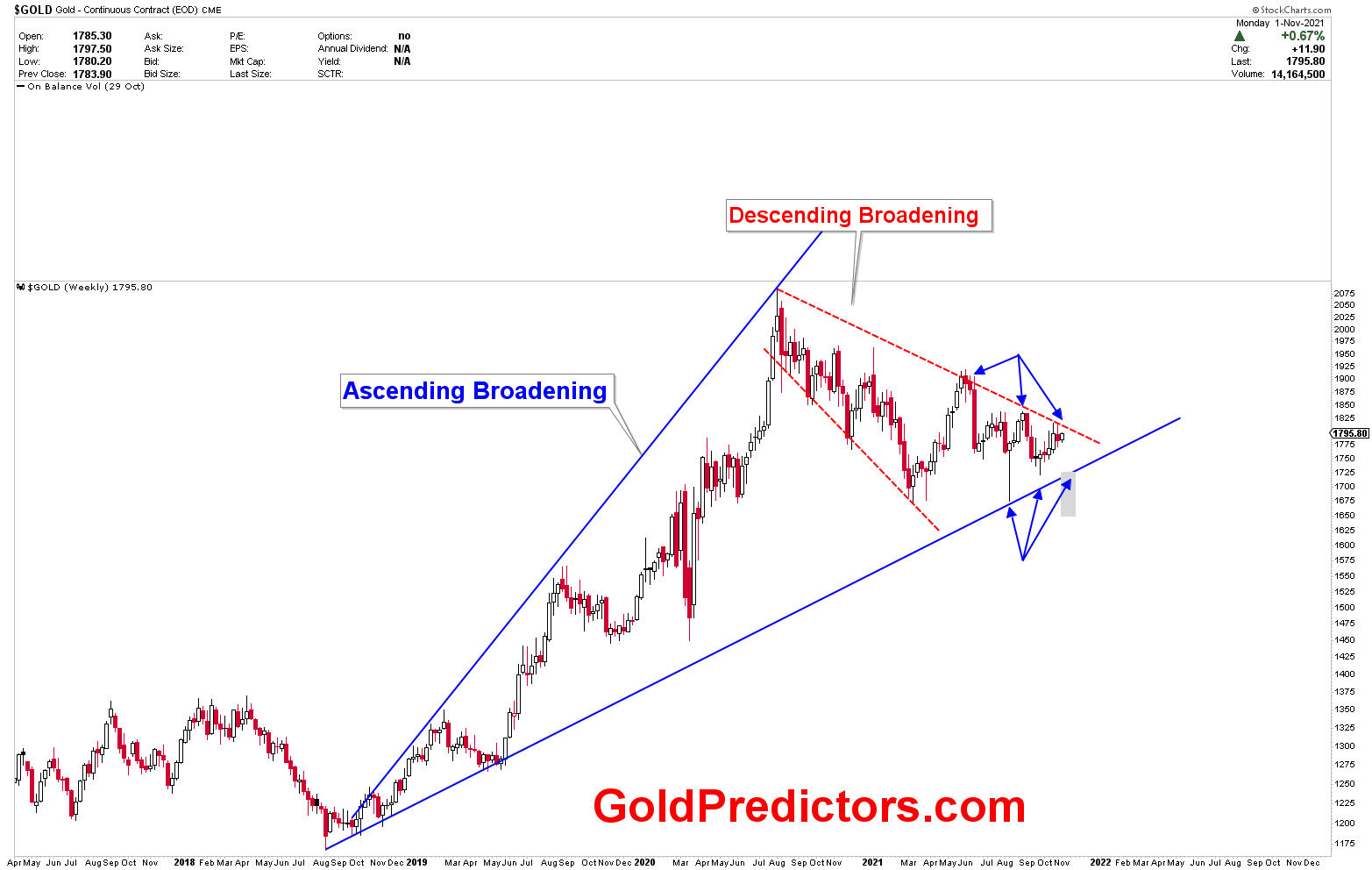

Gold Pullback from Descending Broadening

The major pending decision in gold prices was halted at the neckline of the descending broadening triangle last week as shown in the chart below. Gold prices took a significant hit at $1,815 and returned to the main support area after hitting the significant resistance. It was stated several times, that prices are not in a bullish mode and that a decline is still possible. Today’s article will go over the specifics of the upcoming move and discuss the potential next move in gold and silver prices. The major events of this week are FOMC meetings and NFP report.

Last week’s premium article mentioned $1,810 and $1,815 as the first weekly resistance levels, and the high was formed in the region of $1,813 last week. Our sell position, which was delivered to premium members last week, is still open, and the trade’s management will be discussed with premium members later. Silver prices have also hit strong resistance and are now retracing. The 20th of October, which has been as an important short term cycle day, appears to have formed a short term cycle top, with prices now pulling back to form the next short term cycle bottom. The specifics will be covered in the article. According to the price action of gold and silver, it appears that the prices are in a big decision mode, and the risk remains high. The possible spikes might become fake moves.

On a grand scale, the chart below depicts the formation of ascending broadening formation. When gold was trading at $1,900-$2,000 levels, the chart was created with the anticipation $1,700-$1,725 as the mega level for support. Prices precisely pulled back to the support level of $1,680 during the diverged cycle in March 2020, and this critical level has now become the inflection point for the next move. The chart below also depicts the formation of a descending broadening triangle with three touches at the upper level. Prices are now simply fluctuating between these patterns, and any breakout from this formation would be a significant move in the coming months. This article will go over the specifics of the upcoming moves.

To Receive The Trading Articles, Trading Signals and Premium Content, Please subscribe using the link below.