Gold Prices with Omicron Fears

A potentially vaccine-resistant Covid-19 variant was discovered in South Africa and few other countries, causing concern in precious metal markets. Global economies are already experiencing high inflation, and economic conditions are still in recovery mode. With the Thanksgiving holiday week, gold prices traded into a non-liquidity environment, ending the week at the pivot of $1,793, where prices were expected to remain bullish. The market opened on Monday with uncertainty due to Thanksgiving holiday, resulting in short-term ranges below $1,800 as markets are trying to digest the new variant of Covid-19. However, dollar remains strong, limiting gold’s gains below $1,800. Global equities recovered some ground today after falling last week on fears that the new variant would impose new restrictions. The first covid-19 was discovered in China in December 2019, and it quickly spread throughout the world, becoming a global ongoing pandemic. The virus has been arriving with new variants, and the disease has so far remained uncontrollable. The second dangerous variant, known as the Delta variant, was reported in November 2020, exactly one year after the discovery of Covid-19, imposing new lockdowns around the world as the disease became more easily spread and uncontrollable. Now, exactly one year later, in November 2021, a third variant with the same type of health risk has been discovered and is currently uncontrollable and vaccine-resistant.

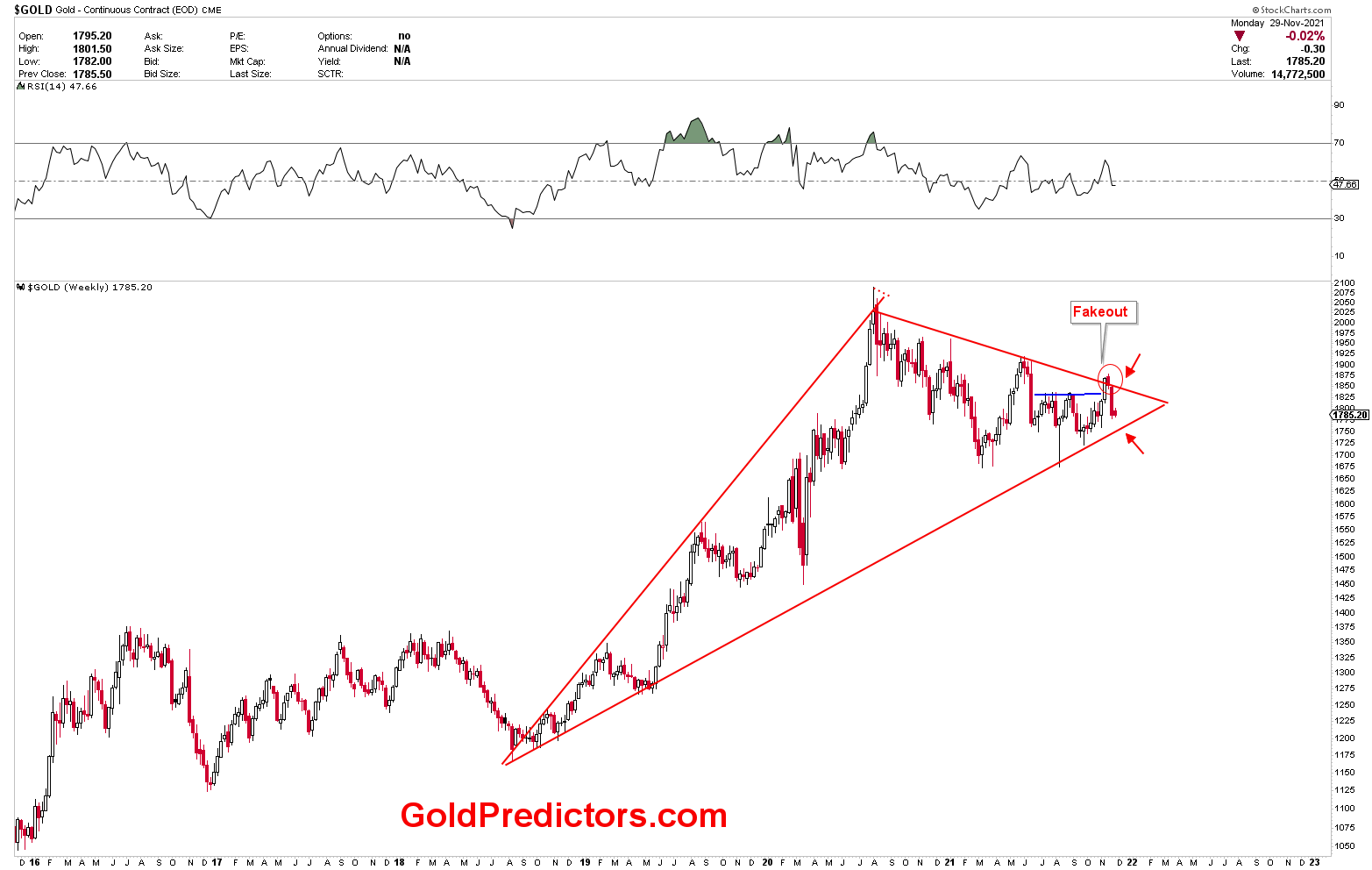

The chart below was discussed several weeks ago, where $1,835 was identified as a strong barrier. The level of $1,835 was expected to break, so we entered a Long Trade before the breakout at $1,822 with a target price of $1,875.50. However, after we closed the trade with profits at $1,860, gold reached the trade’s target of $1,876 and then reversed lower exactly from the targeted number. The fallout from $1,875 below $1,800 deceived many analysts, and the price is now back below $1,800, waiting for markets to digest the new variant “Omicron“.

Gold trading environment has been uncertain from last year, and this type of trading environment is expected to end in a few weeks, and a very healthy environment is likely to develop. It is also clear from the chart below, that gold is on the verge of breaking out, and any clear breakout from this triangle would result in the next massive move. According to calculations from machine learning model, $1,931 has been the inflection point for many months, and prices will continue to fluctuate in wide ranges until this level is breached clearly. At the time of writing, the lower arrow at the red line of the triangle is a massive support region. This article will discuss further specifics of these analysis.

Similarly, silver has returned to the critical level of $23.01. According to the analysis, silver is neutral until $25.75 is clearly breached. Currently, silver prices have retreated from the 200-day moving average, trading below pivotal levels. Gold and silver traders will be looking for clues as Fed Chair Jerome Powell and New York Fed President John Williams speak later today at a virtual event. Later this week, the Fed chairman will also testify before the US Senate. The market will continue to trade with uncertainty until we learn more about the omicron and its potential. This will have an impact not only on gold and silver markets, but also other demand-driven markets such as energy, metals and stock markets.

Thoughts and Analysis expressed by an independent investment analyst and an active investor who has researched for more than 20 years. Plan your own investment strategy which is most suitable for your investments. The author’s primary objective is to describe his thoughts and opinions that may be used as the tool for the reader.

The premium article is updated for premium members. Please subscribe to the link below to receive updates.