Gold Market Correction Reveals Investment Opportunities

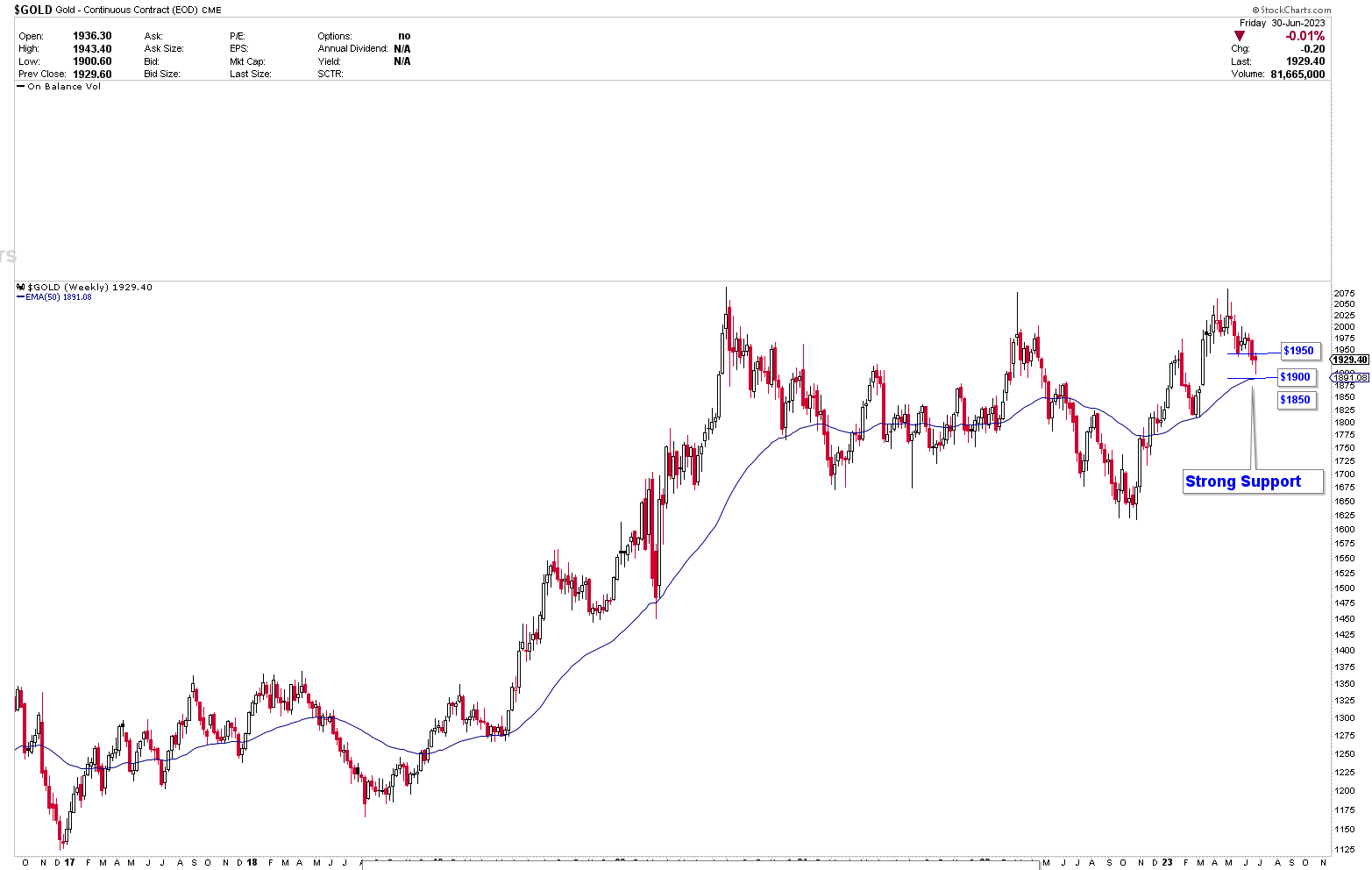

The gold market, a storied stalwart of the global economic system, has recently corrected from its all-time highs to touch its first robust support range between $1900 and $1950. This correction, rather than a cause for alarm, has instead brought forth an intriguing investment scenario, which if utilized strategically, could pave the way for significant profits.

Delving into the Dynamics of the Gold Market

In previous analyses, we have highlighted this price range as a solid support line. This prediction held firm as the gold market made a robust recovery after reaching these levels, signaling a robust resilience to downward pressures. However, in the ebbs and flows of financial markets, it is vital to understand that this support line could extend down to the $1850 region, a scenario that is not entirely unlikely.

On closer examination of the market dynamics, it is evident that any close below the $1900 threshold could potentially drive the gold price to hit $1850. This shift might initially appear concerning to the less seasoned investors, but in reality, it offers a strategic advantage. A move to this level is projected to set off a strong buy signal in the market, offering an invaluable opportunity for buyers waiting on the sidelines.

The current price movement has some exciting technical aspects as well. The past week saw gold prices touching the 50-week moving average, a historically significant milestone that invariably results in strong support. Consequently, gold prices have bounced back from the lows, reaffirming the strength of the underlying market sentiment.

This market dynamic has led to an intriguing event, the emergence of a wick on the weekly candle. In trading parlance, this is a phenomenon that points towards buying pressure in the market. The wick, in this case, symbolizes an intense drive amongst buyers to push the price upwards, which is a reassuring sign of gold’s value proposition amidst current market conditions.

The short-term cycle period, starting 3rd July brings another pivotal element into play. This time frame is significant as it indicates a potential turning point in the market. Historically, the start of this cycle often culminates in the creation of a market bottom. This change sets the stage for the gold price to push toward higher levels. Consequently, investors can look forward to the imminent formation of a strong foundation for a new bullish cycle.

Conclusion

Looking at these indicators, the current scenario in the gold market might appear as a confluence of corrective forces. Still, in reality, these factors are creating a harmonious symphony, potentially setting the stage for a rewarding journey upwards. Whether it’s the strong support levels, the anticipated buy signal at the $1850 mark, or the arrival of a new cycle period, each element points towards an exciting future for gold.

In conclusion, as the gold market enters this pivotal phase, investors have an invaluable opportunity to benefit from the intricate interplay of market dynamics. Observing the developments closely and acting decisively could lead to potentially profitable outcomes. After all, as the saying goes, not all that glitters is gold, but in this instance, it may indeed be a golden opportunity.

Sure, if you wish to stay abreast of the latest trends, movements, and trading signals for gold and silver, subscribing to our updates is an excellent way to achieve that. By doing so, you’ll get comprehensive insights and vital signals, delivered directly to your inbox. These updates can potentially make a significant difference to your trading strategies and outcomes. Please subscribe using the link provided below:

Remember, knowledge is power in the world of trading. Stay informed, stay ahead.