Evaluating The Next Move In Gold Prices

Gold prices drift lower on Monday and managed to recover on Tuesday but the recent price action doesn’t indicate a bullish development based on the drop from the yearly pivot of $2,075. However, the immediate support of $1,835 remains intact, causing sellers to remain on the sidelines. In contrast, the yield on the benchmark 10-year US Treasury note increased on Monday, hitting the key 3% threshold. The solid US jobs report permitted yields to continue to rise in the absence of important macroeconomic data releases. According to the CME Group FedWatch Tool, the probability that the Federal Reserve would raise its policy rate by a total of 125 basis points over the next two sessions has grown from 4% last week to 15% this week.

According to data released by the US Census Bureau on Tuesday, the US goods and services deficit shrank by $20.6 billion to $87.1 billion. Exports increased by $8.5 billion to $252.6 billion during that time period, while imports decreased by $12.1 billion to $339.7 billion. The market had little reaction to these figures, and gold continued to fluctuate within its daily range. According to a monthly report released earlier in the day by the People’s Bank of China, China’s gold reserves remained stable at 62.64 million fine troy ounces at the end of May. The value of China’s gold reserves, on the other hand, fell from $119.73 billion at the end of April to $115.18 billion at the end of May. According to Bloomberg, India’s gold holdings increased 9.4% YoY to 760.4 ounces at the end of March.

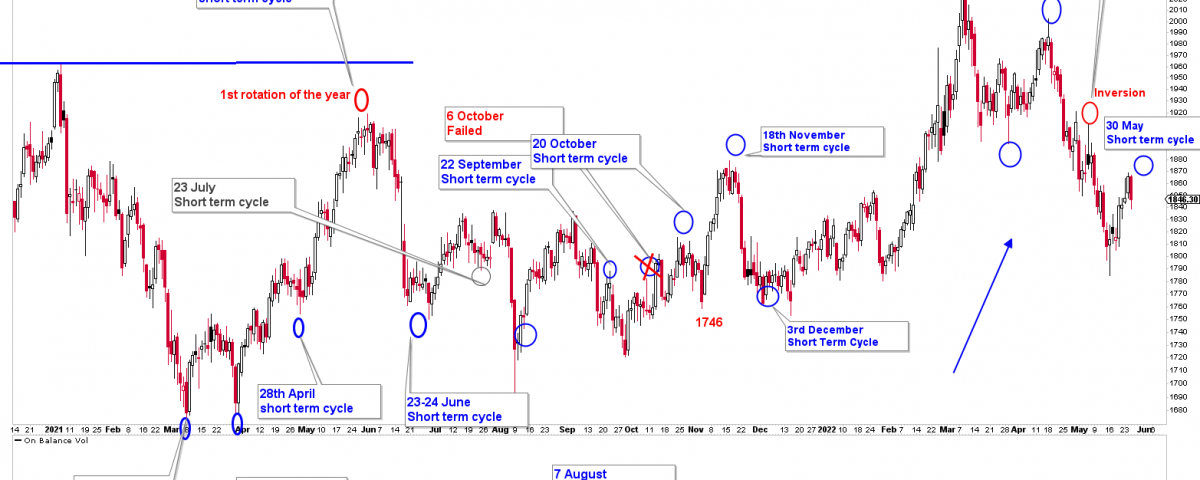

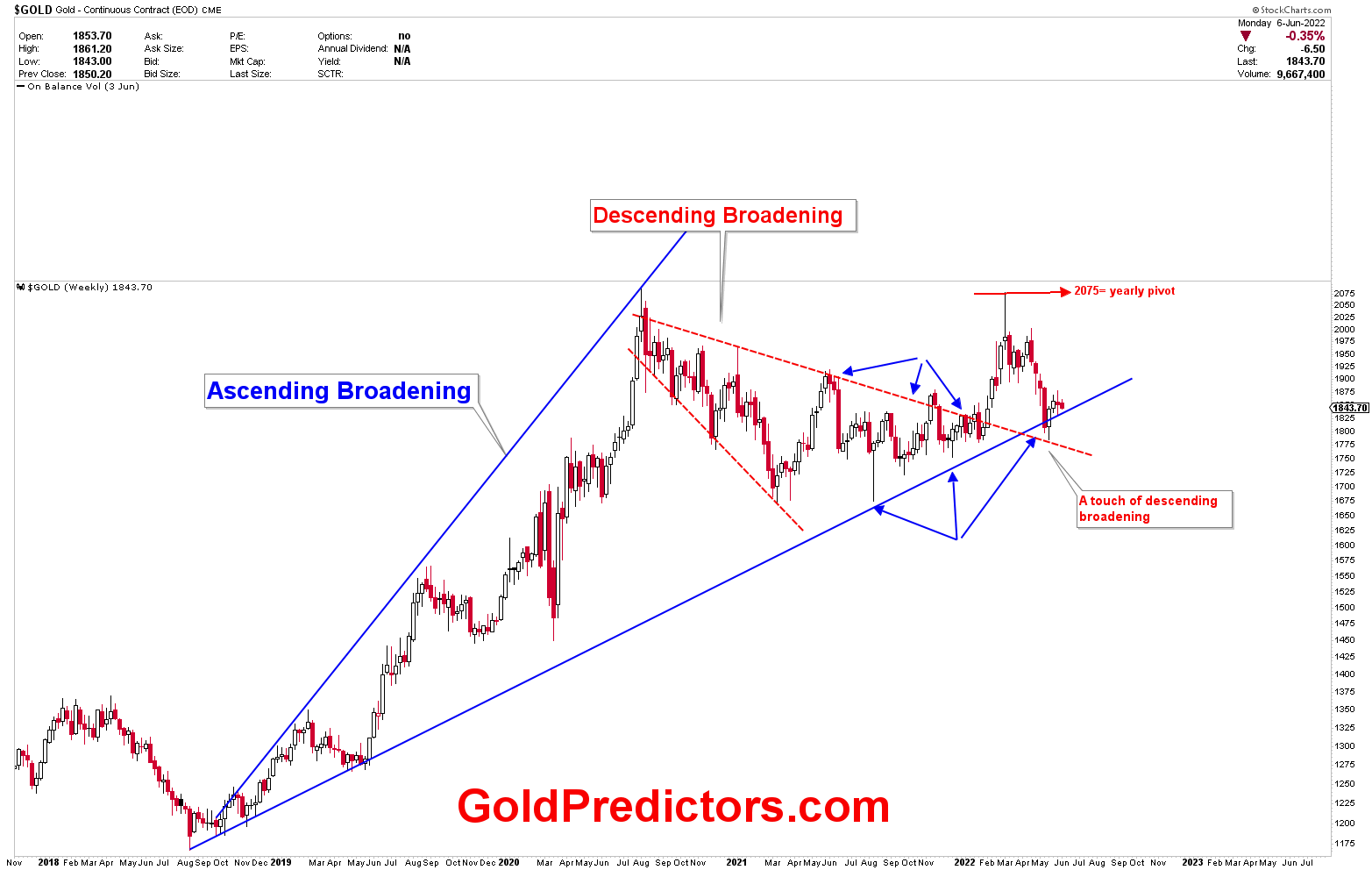

The gold weekly chart, shown below, explains the technical outlook for gold prices. The graph depicts the progression of Ascending Broadening and the formation of Descending Broadening. Gold is clearly stuck within the ascending broadening patterns of the last 12 months, with the price fluctuating in wide ranges. Gold prices formed descending broadening patterns in February 2022, which were broken to hit the strong yearly resistance areas. We’ve talked about the significance of $2,075 as the yearly pivot for 2022, and prices hit it exactly before reversing lower. The recent drop from the yearly pivot met strong support at $1,790, which was mentioned as an important inflection point for bears to control the gold price. Because of the significance of the $1,790 levels, gold is currently consolidating and stabilizing the recent drop. This article will focus the next upcoming short term gold move.

Gold Predictors Celebrates 6th Anniversary! Huge Discount on Yearly Memberships

Please login to read full article!

Please subscribe to the link below to receive free updates.