Emergence of Next Gold Move in June

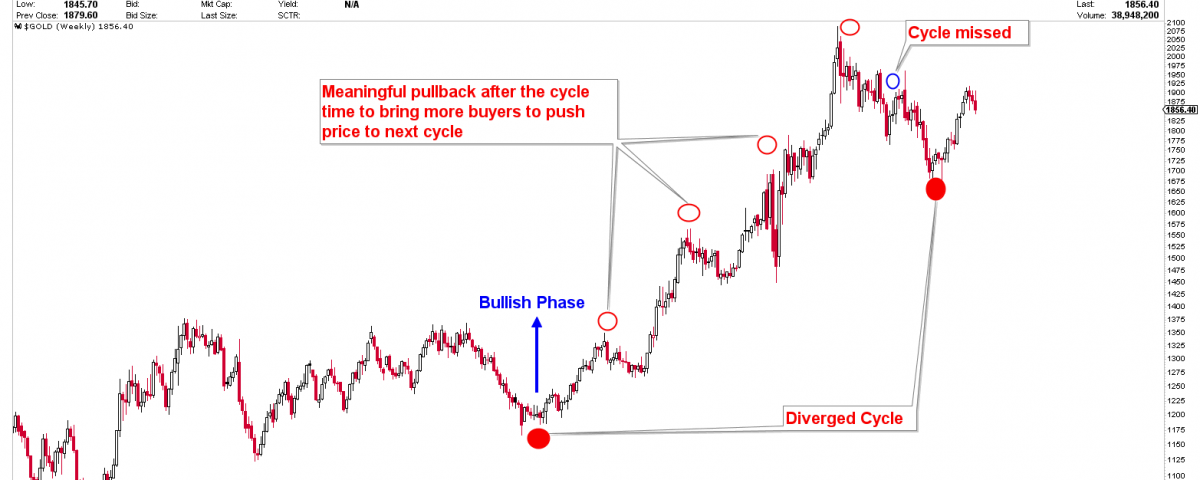

We’ve been discussing the possibility of a pullback from the 1925 region for the past 3-4 weeks. The concerns were demonstrated using monthly charts, in which gold prices failed to close the month of May above 1923. The monthly ascending broadening chart showed the same trend, with a pullback to an ideal number in the 1820 area. However, the markets are too elastic and, therefore, ideal numbers do not exist. Because of the high volatility, the support and resistance levels have large deviations on both sides of market. Since the new all-time highs were posted above the 2000 region, the gold markets have been extremely volatile. Our divergent cycle of 10th march on the yearly inflection of 1675-1780, completed the pullback from the highs. Gold prices emerged a cycle rotation and produced a short-term top on 26-27 May 2021. The expected pullback in gold has been emerged and the next gold move will be evaluated based on technical and cyclical analysis.

In today’s report, we’ll look at the technical reasons for potential bottoms or highs that could emerge at any time. We’ll discuss the short-term cycles that were rotated on May 27th and produced a high. Based on time measurement and number calculation techniques, we will discuss the possible time and numbers for the next gold turn.