Rising Unemployment Claims Impact Dollar Index and Boost Gold Prices

The United States has seen a significant uptick in initial claims for unemployment, which has resulted in substantial effects on the Dollar Index and gold prices. For the week ending June 3, initial unemployment claims climbed to 261,000, marking an increase from the 233,000 claims from the preceding week. This surge represents the highest level since October 2021, thereby raising concerns among investors and policymakers alike.

In response to this rise in unemployment claims, the Dollar Index has started to decline from its resistance level. The economic logic behind this trend is the reduced pressure on the Federal Reserve to continue hiking interest rates due to increased unemployment claims. With fewer jobs available, there is less incentive for the central bank to keep inflation in check by increasing rates, leading to lower interest rate expectations. As these expectations soften, it causes a relative weakness in the dollar.

A breach of the Dollar Index’s support at 101 could serve as an ominous sign, warning of a strong decline. Such a decline would likely have multiple knock-on effects on the financial markets. Most prominently, this would lead to a bolstering of gold prices, an asset class often inversely correlated with the dollar.

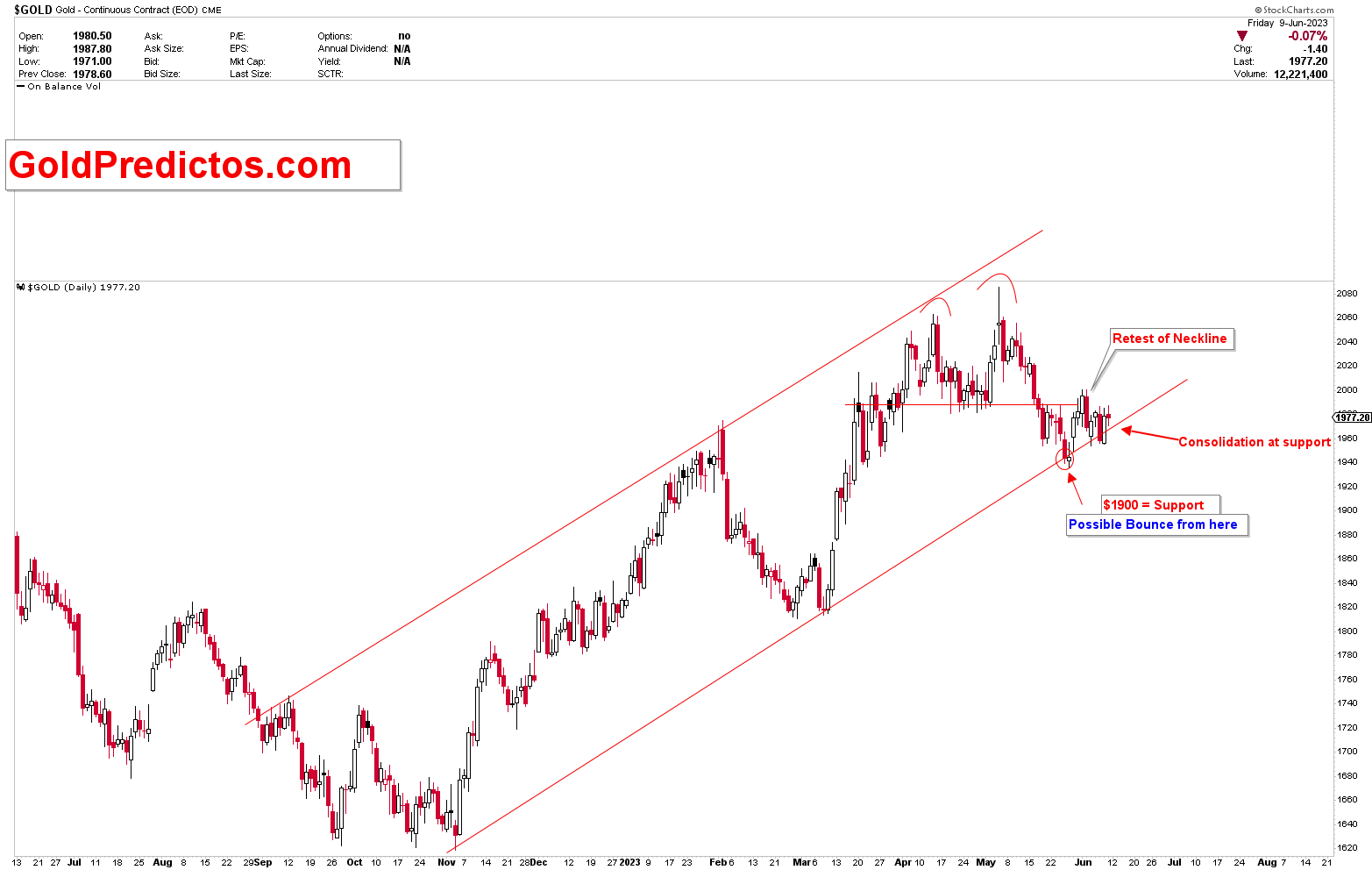

As the dollar weakens, gold prices start to bounce from a strong support region, and they have already begun to show signs of this anticipated behavior. Historically, gold has served as a safe haven for investors during times of economic uncertainty, which includes periods of dollar weakness. As investors anticipate a weaker dollar, gold starts to look increasingly attractive as an investment option. the gold chart below is taken from the previous article. The chart depicts the current situation in the gold market, which is bouncing from the strong support of the channel. Gold prices have found support in the $1900 to $1950 region and are beginning to rise from these low levels.

This shifting landscape presents an opportunity for investors to potentially capitalize on the situation. Buying the dips in the gold market, in anticipation of another shoot higher, could prove beneficial as the expected economic conditions unfold. However, investors should exercise due diligence and consider their risk tolerance before making any investment decisions.

Conclusion

In conclusion, the recent rise in unemployment claims has set off a cascade of events, leading to a weakening dollar and a strengthening of gold prices. This presents a compelling investment opportunity in the gold market for the cautious yet opportunistic investor. As always, the dynamics of the financial markets can shift rapidly, and what appears to be a sure thing today may change tomorrow. Therefore, it’s crucial for investors to stay informed and adaptable.

For those interested in further capitalizing on these market shifts, consider subscribing to our gold and silver trading signal service. By subscribing, you’ll receive real-time updates and strategic advice catered specifically to the precious metals market, allowing you to make informed decisions with confidence. You can subscribe and gain access to this valuable information by following the link below.