Gold Current Situation and Future Implications

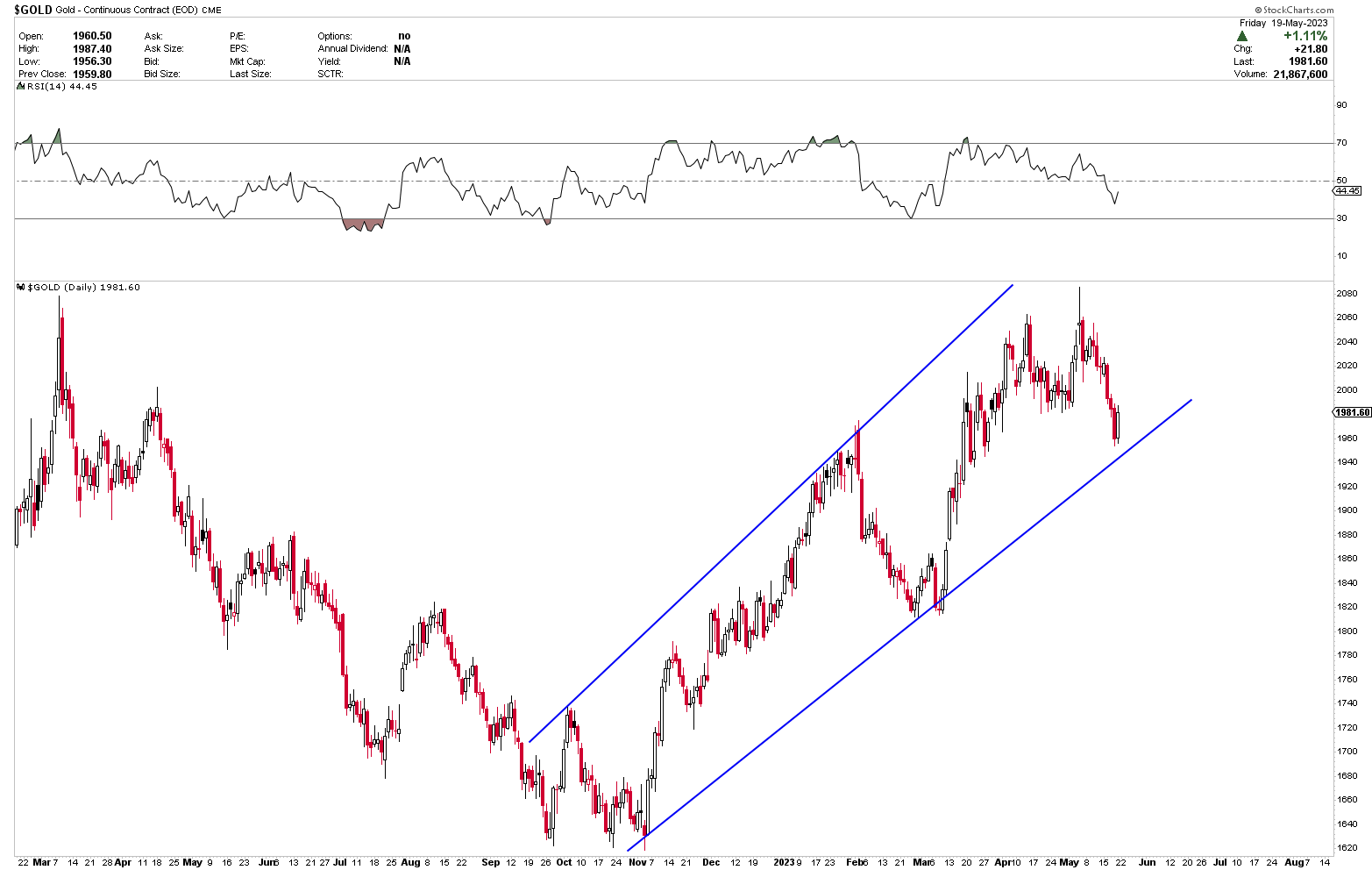

The gold market has recently witnessed a retreat from its highs, as forecasted in our previous articles. This predictable correction is taking place within a region we had anticipated, a region known to be favorable for buyers to step in. The trading channel, as demonstrated in the chart below, suggests that this area of support is crucial for any potential upside.

The gold market is presently facing a critical juncture, hinging at the price range of $1,900 to $1,950. If the market manages to establish support within this region, we can expect prices to rebound higher. The potential for this bullish movement is attributed to increasing inflationary pressure, as evident through wage inflation growth.

There is considerable evidence suggesting that inflation is in a slowing phase, largely due to plummeting energy prices. However, average hourly earnings growth provides a lens into the intrinsic inflationary pressures. Alarmingly, monthly data indicate that wage growth is in a rebound phase, marked by a significant 0.48% increase in average hourly earnings in April, which annualizes to 5.76%.

This recent correction in the gold market is widely believed to present a strong buying opportunity for both long-term and medium-term investors. However, the confirmation of this key support region is still lacking, mainly due to the heightened volatility in the market. This volatility and uncertainty, largely tied to emergent crises, is fuelling worries of a potential recession, as evidenced by a significantly negative Treasury yield curve.

Historically, a recession is signaled when the Treasury yield curve rebounds above zero after falling to lower levels. If a recession is indeed looming, gold will likely emerge as a safe haven for investors, further bolstering strong buying scenarios.

Conclusion and Implications for Investors

In conclusion, the gold market has descended as per our forecasts and is now approaching the first support region, where a potential bounce back is possible. However, the current market volatility and potential recession threats demand a cautious approach. Therefore, investors are advised to watch closely for the confirmation of the support region between 1900 to 1950 price levels, along with developments in wage inflation and the treasury yield curve, to guide their investment decisions in the gold market. The coming weeks will be crucial in determining whether gold retains its luster as a safe haven amidst these turbulent economic times.

For keeping abreast with the most recent gold and silver trading signals, we suggest you join Gold Predictors. Our platform is committed to delivering prompt and precise market insights, aiding you in making well-informed investment choices.