Gold – A Recession Warning

The financial markets, including stocks, precious metals, and foreign exchange, are impacted by the economic downturn. Economic imbalances emerged after the Covid-19 pandemic as a result of rising inflation. The inflation reaches a 40-year record high, and the Federal Reserve raises interest rates in multiple steps, taking above 4%. The higher interest rates exacerbated systemic issues, and inflation was out of control. The high inflation and interest rates are possible to remain for long term and indicate a recession. The upcoming recession will probably take gold prices higher.

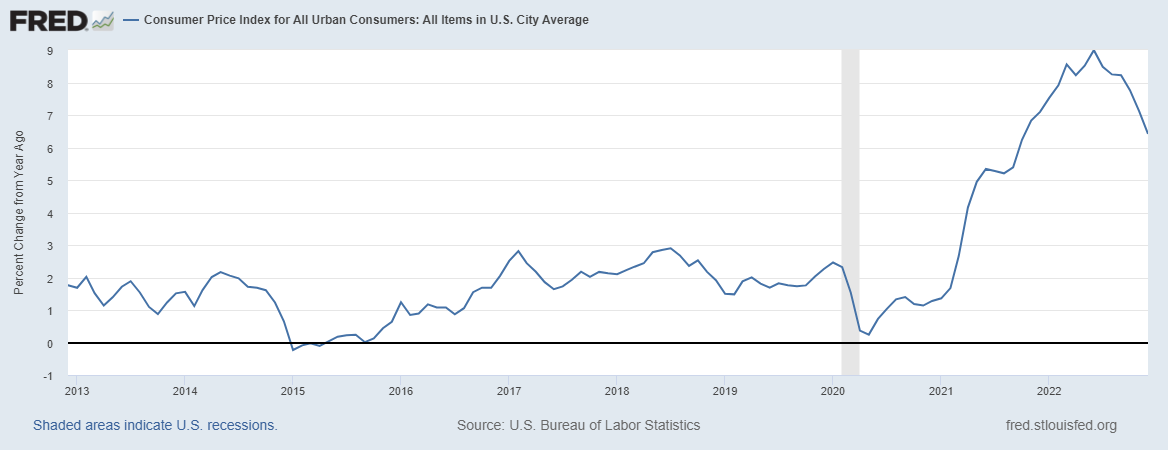

The Consumer Price Index (CPI) can be used to measure inflation, as shown in the chart below. The chart indicates that CPI is currently declining from its recent peaks. The 12-month CPI values for December have decreased to 6.42% from 7.11% in November, but are still considered high.

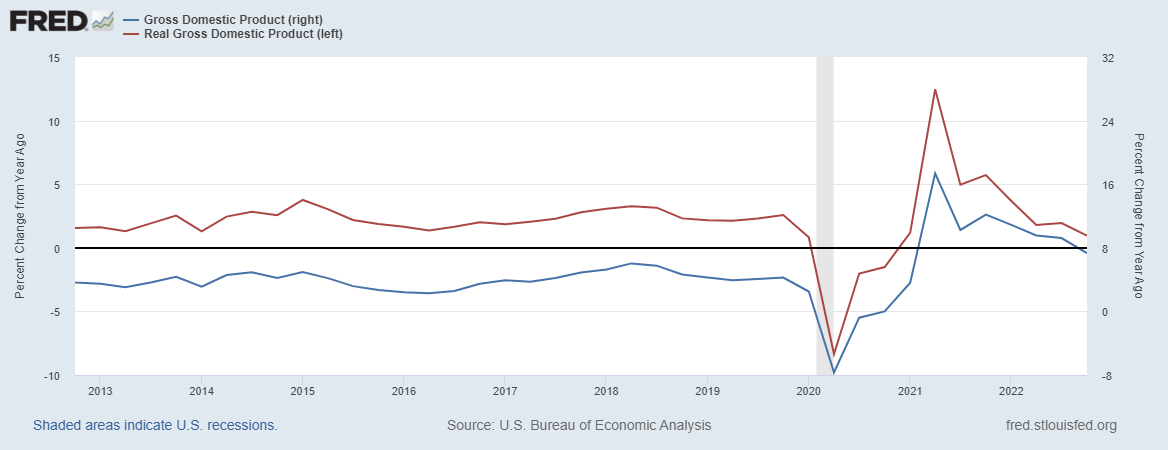

In contrast, real GDP growth slowed to 0.96% in 2022, the lowest rate since the pandemic of 2020. However, nominal GDP, unadjusted for inflation, slowed to 7.32% as a result of a 6.28% rise in prices. This decline in GDP was due to the base effect, with quarterly GDP remaining relatively stable at 0.72%.

Recession in Imminent

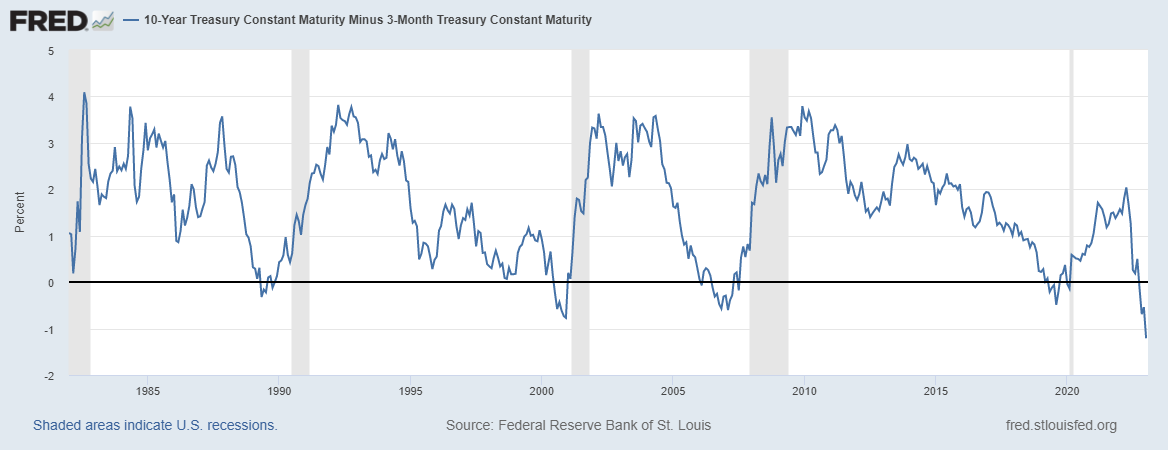

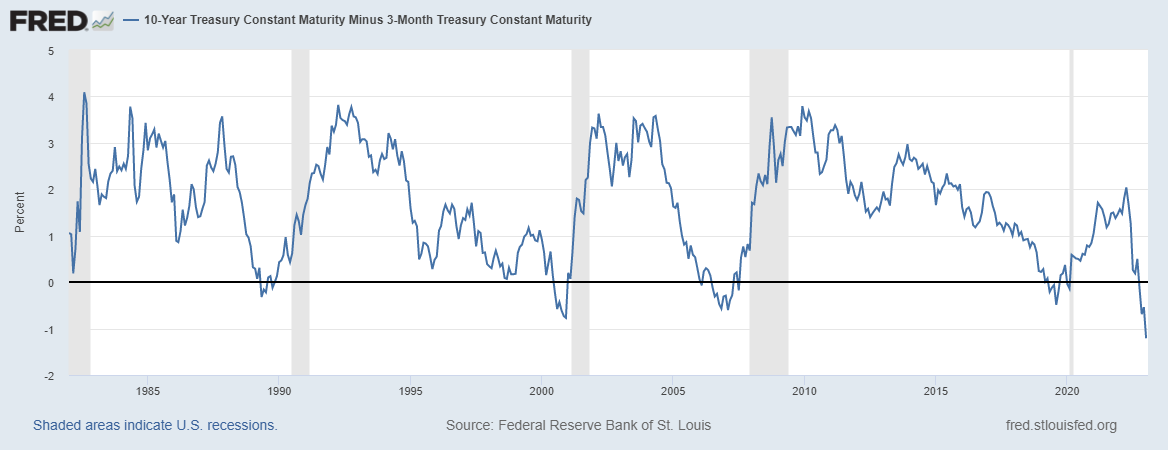

Recession and high inflation can occur concurrently because both are caused by economic imbalances. High inflation causes a recession because it indicates that the economy is overheating and that the demand for goods and services is excessive. This resulted in businesses increasing prices to offset rising costs, which decreased consumer spending as goods and services became more costly. In addition, high inflation has caused interest rates to rise above 4%, making borrowing more expensive and deterring investment. This eventually led to a decline in economic growth and a recession. Therefore, persistently high inflation is an indicator that a recession is imminent, and it can also contribute to its development. The possibility of a recession is indicated by the negative yield curve, which indicates an imminent recession. This curve is proved to be the most trustworthy indicator. The recession examples are shown in blue circles on the chart below.

During economic downturns, the price of gold rises as investors seek safe-haven assets that maintain value. Because gold is regarded as a store of value and a hedge against inflation and currency devaluation. It is important to note, however, that the relationship between gold prices and recessions is not always straightforward. The relationship varies based on the specifics of the recession. Currently, higher interest rates are having a negative impact on the US dollar index. The US dollar has already reached its long-term resistance in 2022 and will continue to decline in 2023. The negative US dollar will increase gold demand further in 2023.

Gold Technical Evaluation

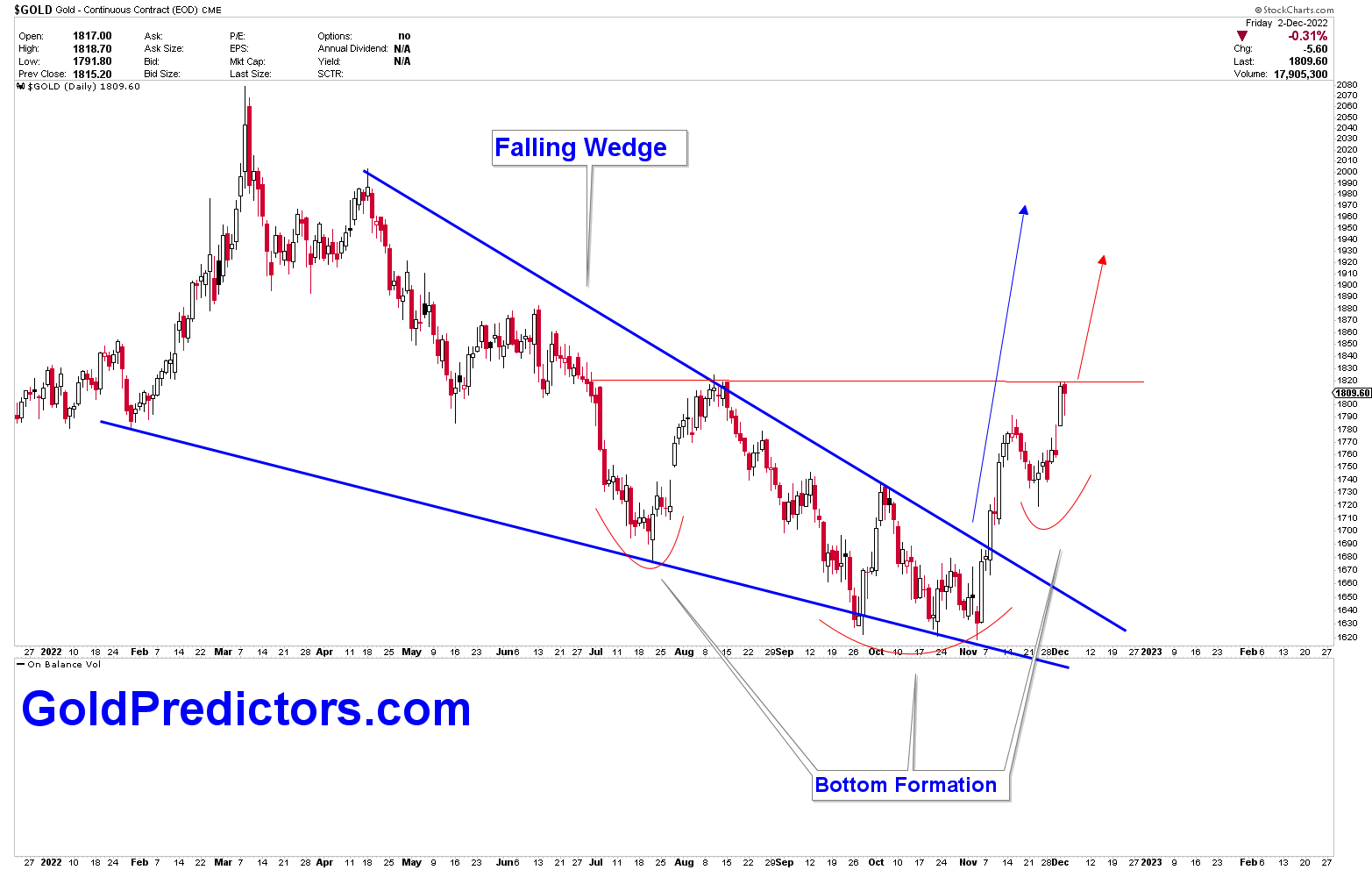

A few weeks ago, the gold chart was presented with a strong bullish outlook. The chart below depicts the formation of a falling wedge, a strong bullish pattern. The bullish pattern aimed for levels between $1,975 and $2,000 in a matter of weeks. At $1,820, where we also executed a long trade in the market, the red neckline was broken. The gold price shot higher toward the target of the falling wedge after the breakout of neckline.

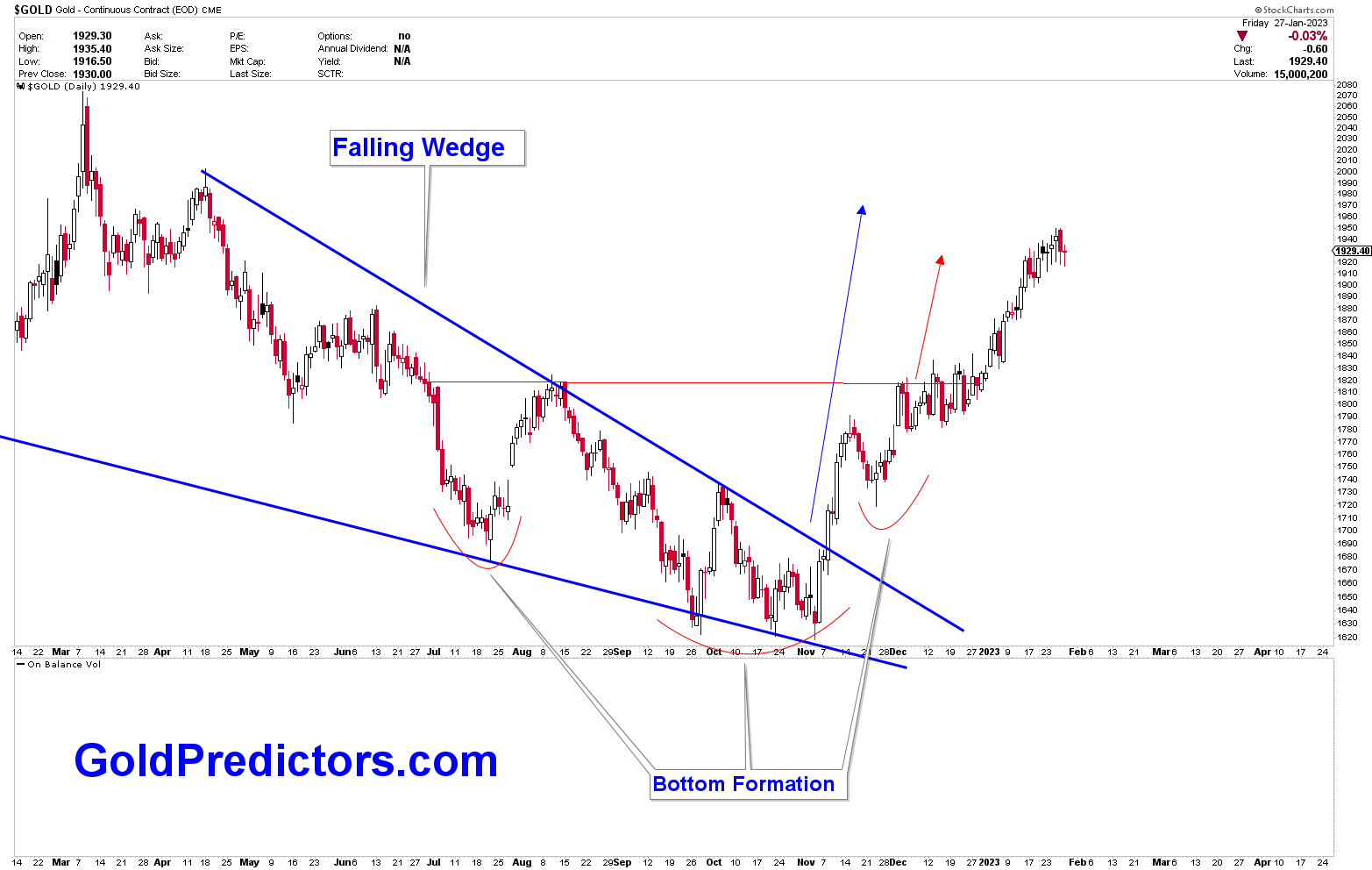

The updated chart below demonstrates that the price is already trading near the target and has the potential to reach the target region between $1,975 and $2,000. Given the economic outlook and the dollar index’s weakness, it is likely that gold prices will increase further. However, the long-term price congestion between $1,680 and $2,075 will only be broken if the gold market breaks above the $2,075 pivot.

Conclusion

The fourth quarter GDP grew at an annualized rate of 2.9%, indicating a slowing economy. The negative yield curve indicates the imminence of a recession. The high interest rates are causing a decline in CPI values, but inflation is not yet under control; therefore, additional rate hikes are expected in 2023. The reaction of gold prices to rising inflation and interest rates is real, and it is probable that the gold market will soon break higher. During the upcoming pullback in the gold market, investors will likely enter new positions.

To receive free and premium updates and trading signals, please subscribe to the link below.